- All templates

- Class diagram templates

- Class diagram bank loan

About this class diagram for bank loan

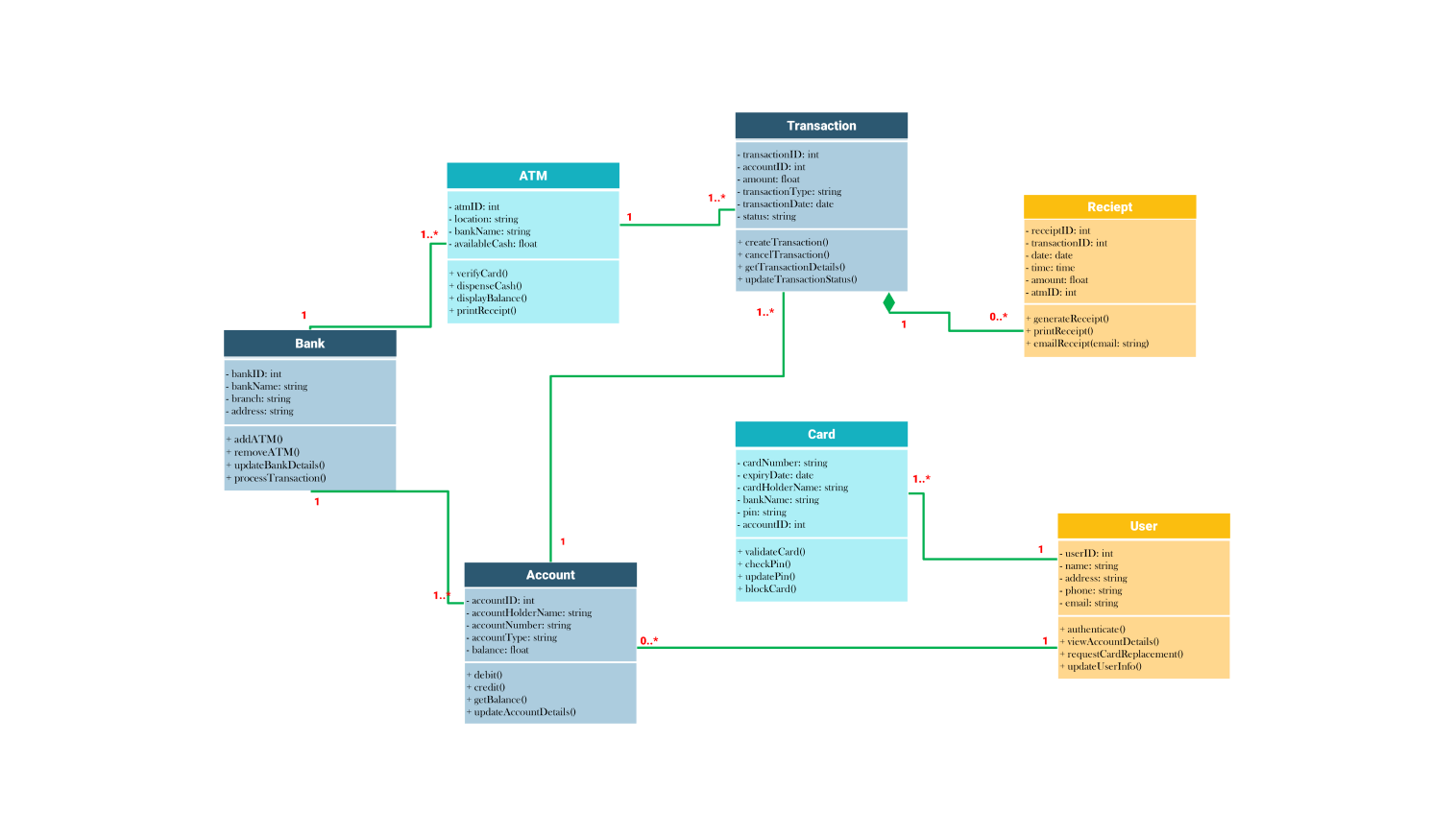

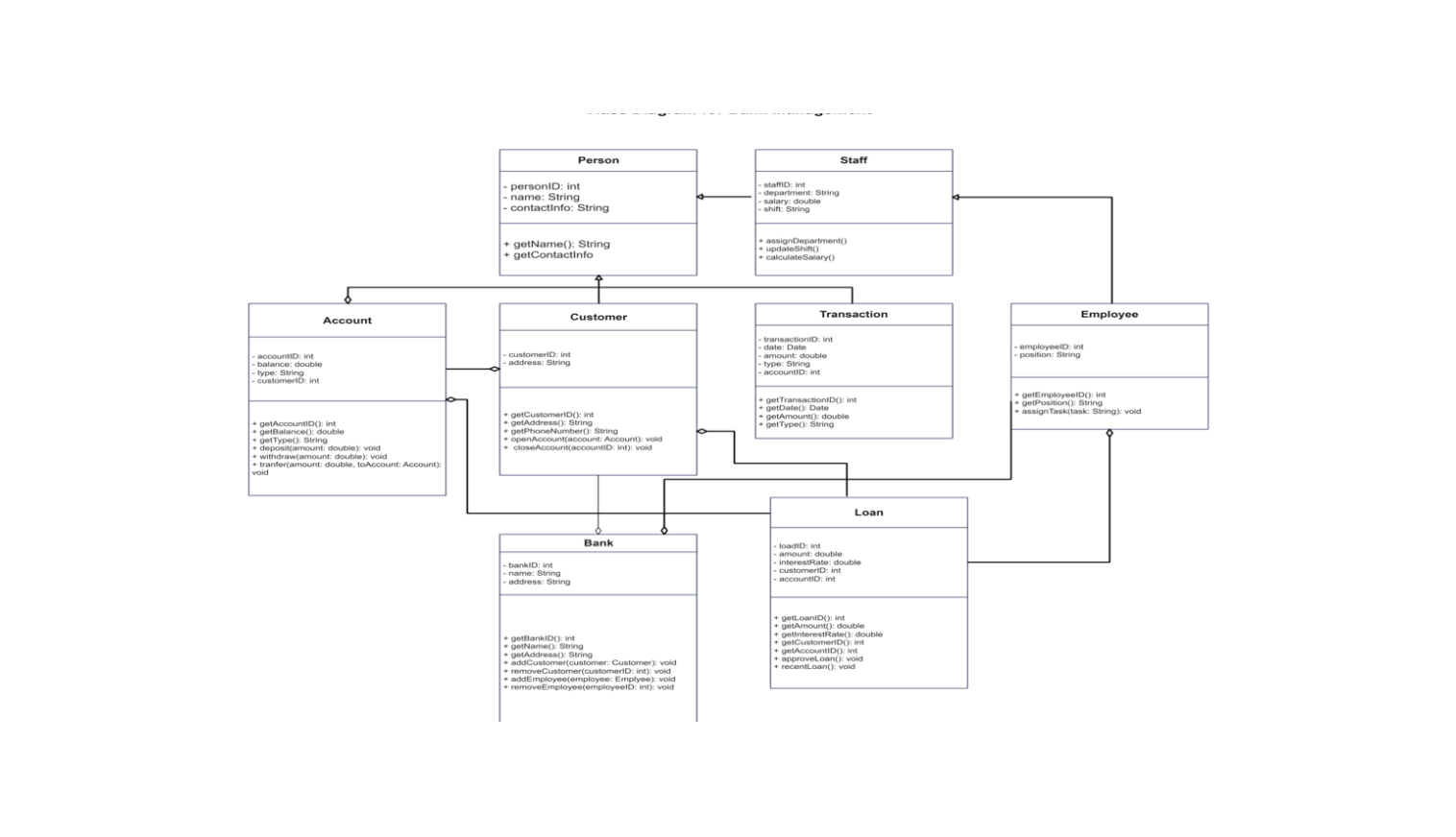

This class diagram illustrates the entire structure and relationships of a bank loan management system. It gives an overview of how various entities such as customers, loans, banks, loan officers, accounts, payments, credit scores, and collaterals are interdependent.

Their interaction with one another describes major functionalities like loan processing, approval, and management in a banking environment. The customer class is crucial to the system because this is the key class around which the system revolves.

It represents people who apply for loans. Customers can have many accounts and apply for various loans. This shows the customer's interaction with these classes. Each customer has contact information, such as name, address, and email that is used to manage their relationship with the bank.

The loan class represents the loans made by the bank. It contains information relevant to loans such as the loan amount, start date and finish date, interest rate, and status. The bank class also issues loans.

These loans may need several payments over time due to their communication with the payment class. The loan class is also capable of calculating EMIs and accessing loan information and details.

The bank class is responsible for providing loans to customers. It is linked to several loans and includes ways for approving or rejecting loans. It also gets the bank details for the processing of loans. The loan approval is related to the loan officer class.

The loan officer class examines loan applications and makes selections based on the data supplied. Individuals in the loan officer class are accountable for loan assessment and approval. They assess loan applications and can approve or reject them to ensure that those who meet certain criteria are accepted.

The account class represents the financial accounts handled by customers. These accounts held by the customers are used to deposit or withdraw funds. Accounts are required for handling loan-related financial transactions such as disbursements and repayments.

The credit score class measures a customer's creditworthiness. It generates a credit score, which is an important aspect of the loan approval method. The credit score class is associated with clients and gives information about their financial stability.

The collateral is responsible for providing security and ensuring that loans are backed by valuable assets by using information such as type, value, and evaluation techniques.

Related templates

Get started with EdrawMax today

Create 210 types of diagrams online for free.

Draw a diagram free Draw a diagram free Draw a diagram free Draw a diagram free Draw a diagram free