- All templates

- Use case diagrams

- Use case diagram bank security

About this use case diagram for the bank security system

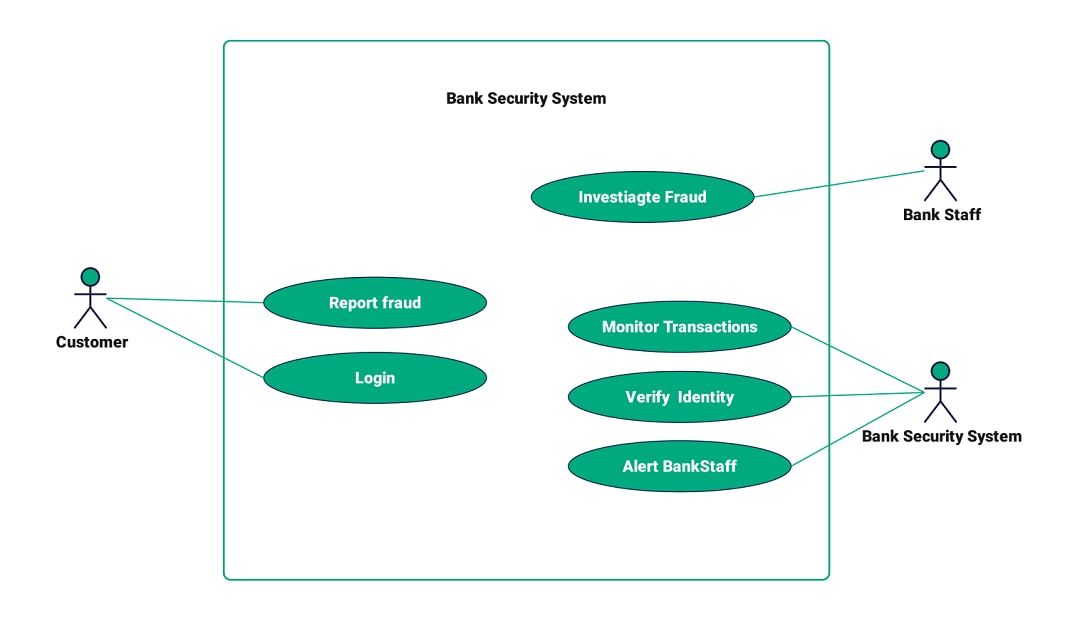

This UML use case diagram for the bank security system involves three main parties: customer, bank staff, and bank security system. Each actor can use some system functions to resolve or prevent security incidents.

The customer has the 'login' function. It restricts access to their accounts and triggers the bank's security system. Second, the customer can 'report fraud.' It informs the bank of unrecognized or unauthorized activity in their account.

The bank security system has several major activities as well to maintain security and safety during banking activities. It ‘monitors transactions to look for any patterns of behavior that might be abnormal or questionable. A warning to 'alert bank staff' may be generated for suspicious activity.

In addition to self-surveillance, the bank security system verifies identities. This layer of security makes sure that anyone using the interface is who they claim to be. If the identity is unverified or there are doubts, the system can notify bank staff within seconds.

A second area central to the system is represented by the bank staff. If the system finds a problem, bank staff can use the "investigate fraud" feature. It can explain the issue and the steps to fix it. This may involve calling the client, holding certain accounts, or other measures to protect the client and the bank.

This UML use case diagram for the bank security system shows interactions between customers and bank staff. It aims to prevent, detect, and respond to security threats. The system monitors transactions, verifies identities, and alerts staff to unusual behavior. Customers can also report any fraud they notice.

Related templates

Get started with EdrawMax today

Create 210 types of diagrams online for free.

Draw a diagram free Draw a diagram free Draw a diagram free Draw a diagram free Draw a diagram free