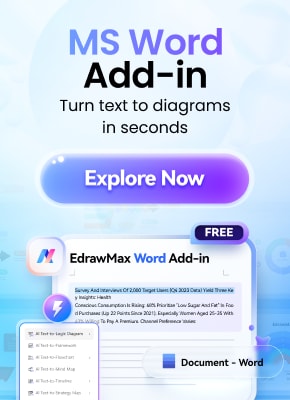

Risk management in financial institutions is like a safety net for your money. It's all about making smart choices to protect against unexpected problems. From handling changes in the market to dealing with loans, it's a crucial part of keeping things running smoothly.

In this article, we'll break down the basics of how it works and why it's so important for the success of financial institutions.

Got risks? Every business does. Risk management is how smart leaders tackle those worries. They scan the scene to spot potential problems headed their way. They come up with clever solutions to steer clear of hazards or handle them smoothly if they hit. Risk managers keep companies safe without making work boring. Their job is to stay upbeat while looking out for what could go wrong. That way workers can keep the fun while risks run for the exit.

In this article

Part 1. Overview of Risk Management in Financial Institutions

Financial institutions like banks and insurance companies face many risks that can impact profitability and stability. Effective risk management is essential to their success. It involves identifying key risks like credit, market, liquidity, and operational risks. The goal is to monitor these risks, minimize exposure through diversification and limits, and ensure enough capital is available to absorb potential losses.

Proactive risk management promotes public confidence in financial institutions by showing they can manage risk responsibly.

Part 2. Types of Risks Faced By Financial Institutions

Financial institutions juggle many complex risks. Key risks include:

- Credit risk - The risk that borrowers will default on their loans or other obligations.

- Market risk - The risk of investment losses from changes in market prices.

- Liquidity risk - The risk that insufficient cash flow will prevent meeting financial obligations.

- Operational risk - The risk of losses from inadequate processes, systems, or human error.

- Reputational risk - The risk that negative publicity will damage the institution’s reputation.

Proactively managing these risks is crucial for the safety and soundness of financial institutions.

Part 3. Best Risk Management Strategies for Financial Institutions

In the dynamic realm of finance, a solid risk management strategy is crucial for financial institutions. Here are key strategies:

- Diversification of Investments: Spreading investments across different assets reduces risk.

- Stress Testing: Simulating adverse scenarios helps assess resilience.

- Comprehensive Due Diligence: Thoroughly vetting potential investments minimizes risks.

- Regulatory Compliance: Staying updated ensures legal adherence.

- Data Security Measures: Robust cybersecurity safeguards sensitive information.

- Scenario Analysis: Evaluating future scenarios aids in preparation.

- Continuous Monitoring: Regular assessments allow timely interventions.

- Liquidity Management: Maintaining ample liquidity ensures stability.

These strategies fortify financial institutions, ensuring stability and growth.

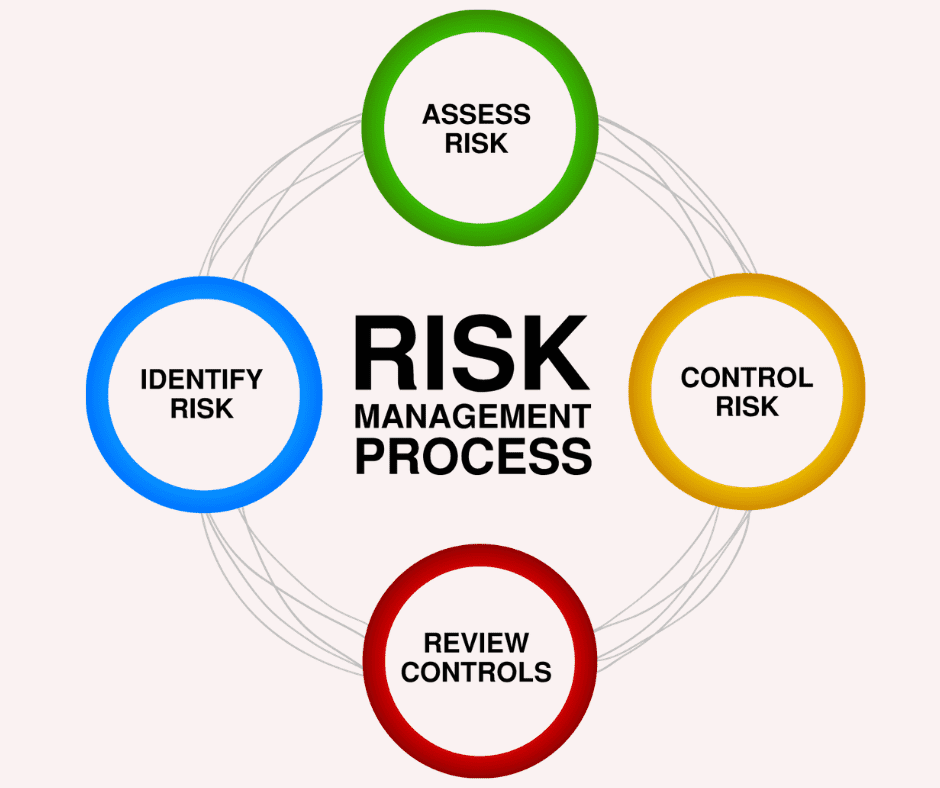

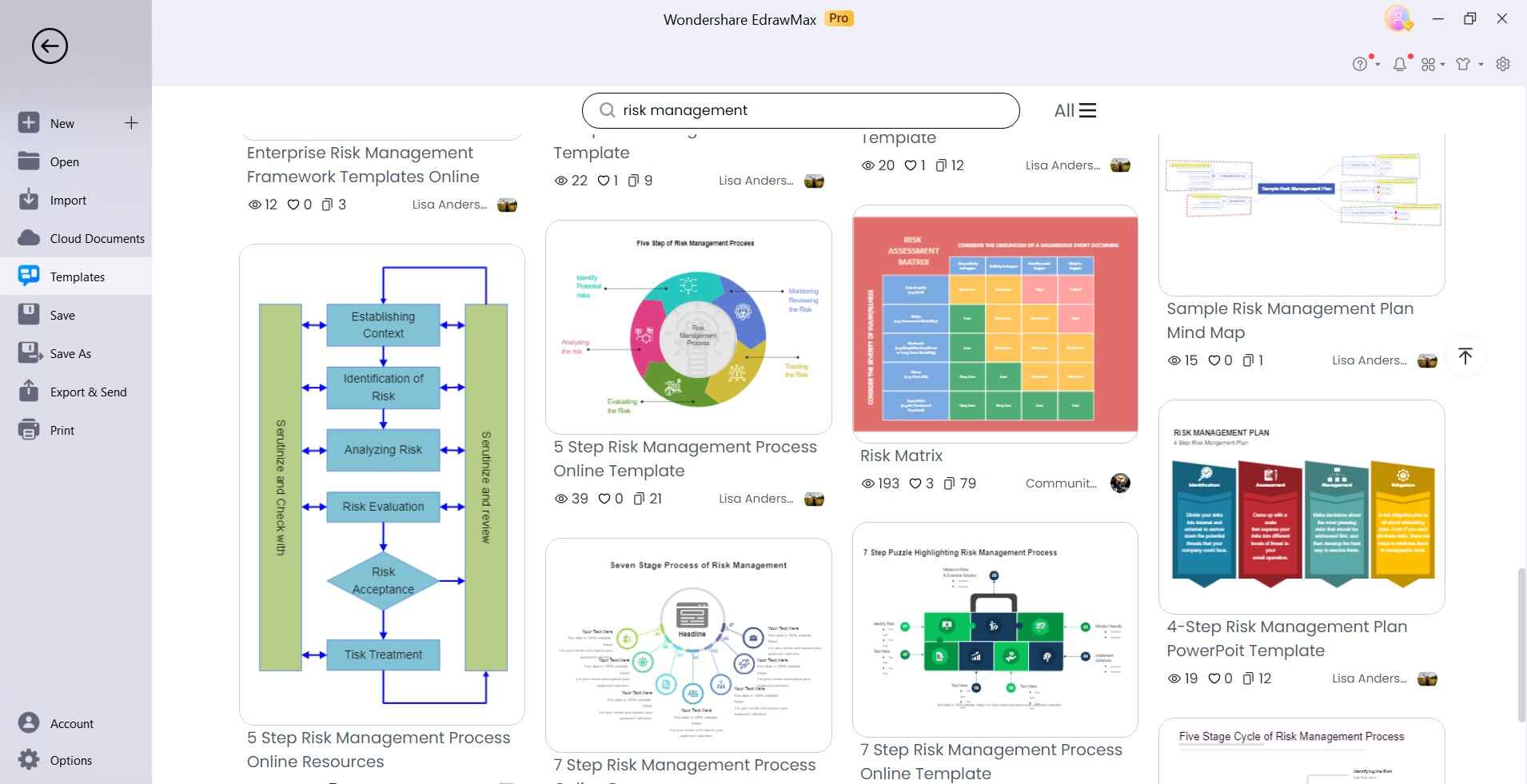

Part 4. Creating a Risk Management Diagram Using EdrawMax

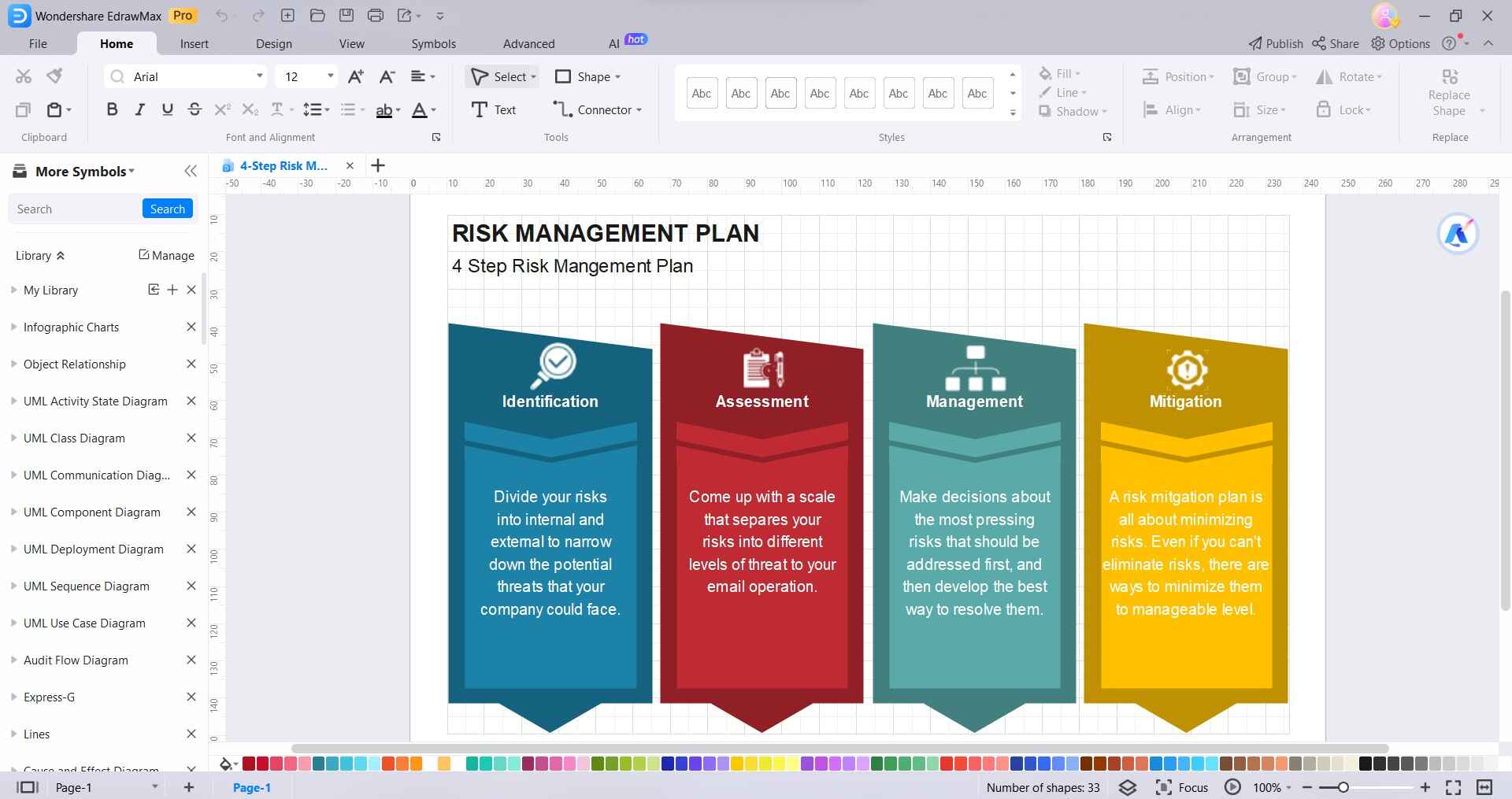

Visualizing risk is key for financial institutions to prepare for the unknown. EdrawMax is a powerful tool to create risk management diagrams. Its simple design makes it easy to map out risk scenarios and plans.

With EdrawMax, financial institutions can turn complex risks into clear insights. This allows smart decision-making to strengthen defenses. By making risk visible, EdrawMax gives institutions the vision to see threats coming. Its extensive features simplify risk planning so protection is in place before storms hit. Financial institutions can leverage EdrawMax to build sturdy risk management strategies.

EdrawMax's key features significantly enhance the effectiveness of risk management diagrams. Firstly, its extensive library of pre-designed templates expedites the creation process, offering a range of customizable options tailored to specific risk profiles.

Secondly, the ability to integrate data seamlessly allows for dynamic, real-time updates to the diagram, ensuring that it remains a relevant and reliable tool.

Here are the steps to create a simple risk management diagram using EdrawMax:

Step 1: Open the EdrawMax application on your computer. Click on the "Template Gallery" or "New" button to start a new project. In the search bar, type "Risk Management" and press Enter. This will filter the templates specifically related to risk management.

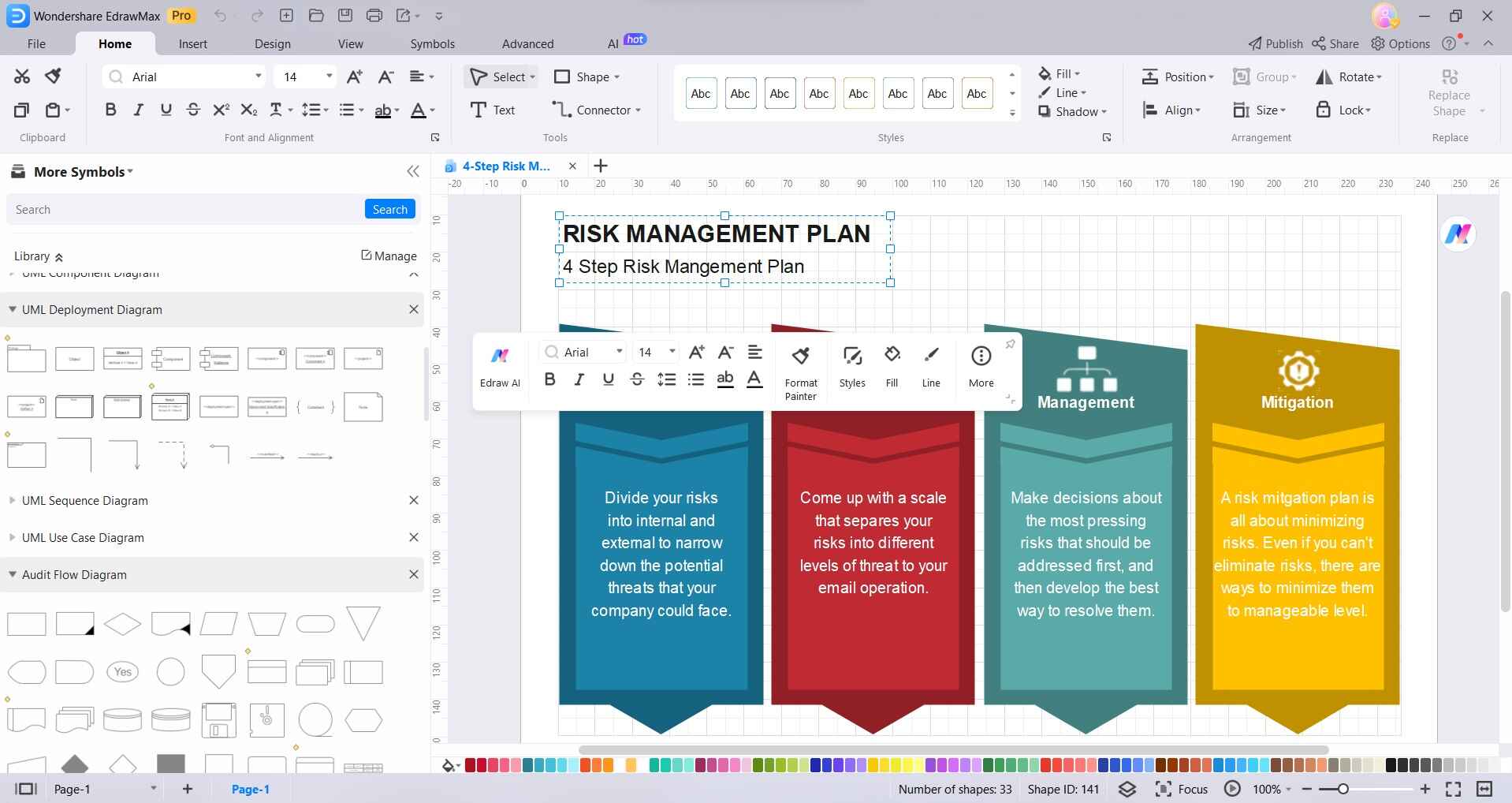

Step 2: Once the template is open, you can customize it by adding, removing, or editing elements. This includes text boxes, shapes, icons, and connectors.

Step 3: From the left sidebar, use connectors to link the risks to their respective categories. This visual representation helps in understanding the relationships.

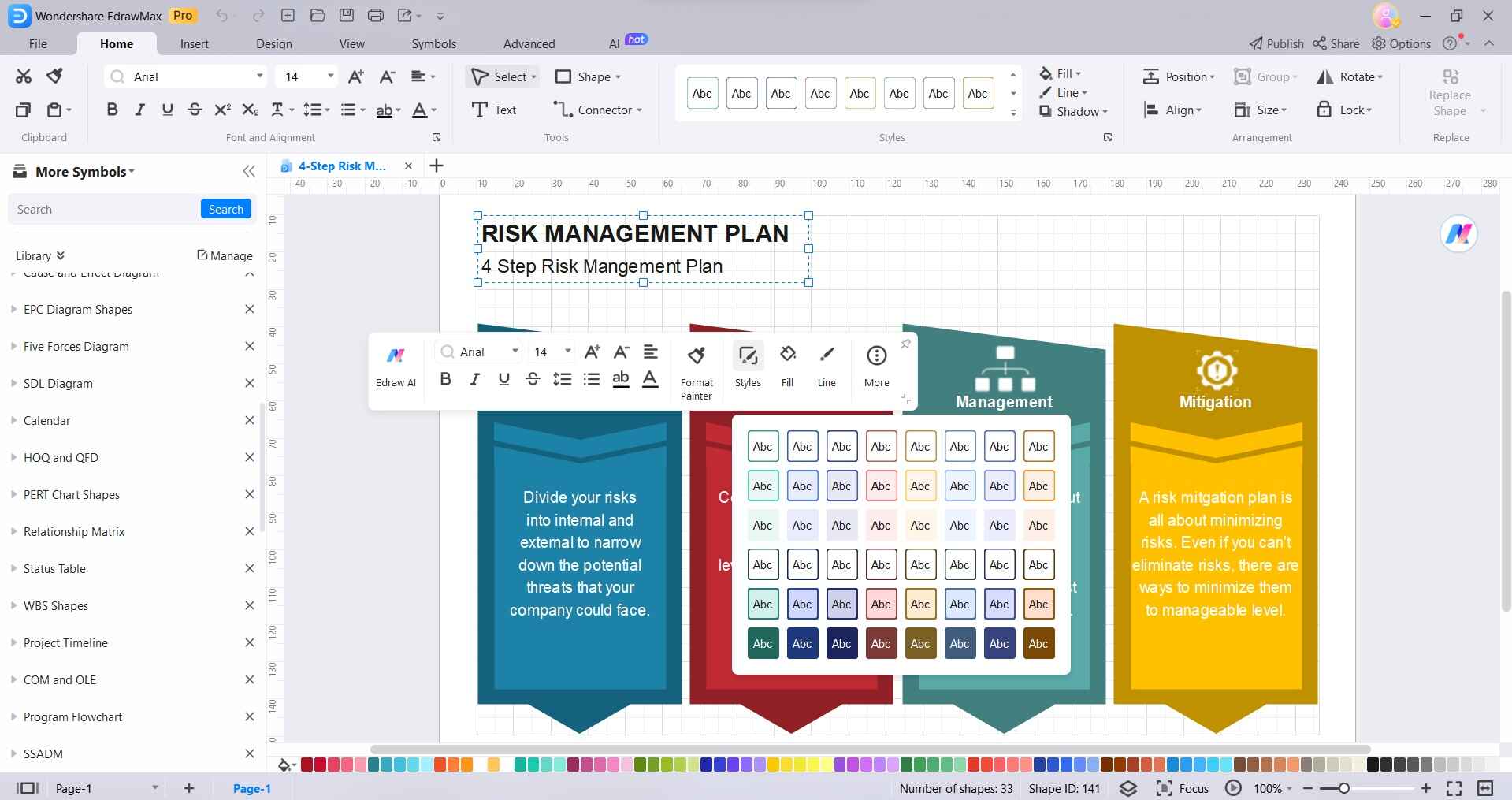

Step 4: Click on any entity and select “Styles” to customize font, color, and style. Enhance the visual appeal and clarity of your diagram by incorporating relevant icons or symbols. EdrawMax provides an extensive library of these.

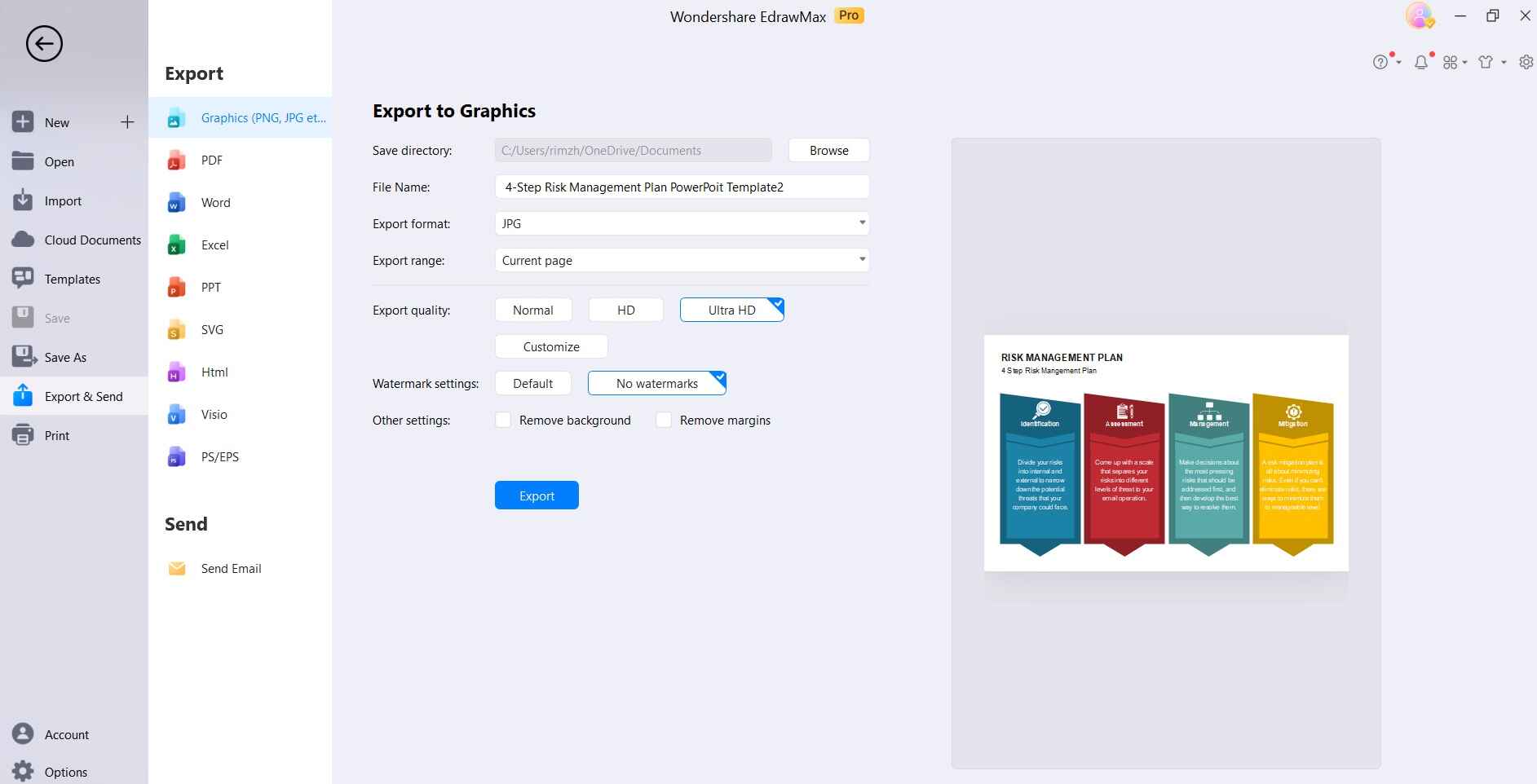

Step 5: Click on the "Save" button to save your risk management diagram. Choose a location on your computer and give it a descriptive name.

Following these steps, you'll have a well-structured and visually clear risk management diagram created using EdrawMax templates. Remember to save your work regularly to ensure you don't lose any progress!

Conclusion

In summary, risk management in financial institutions helps identify and deal with potential threats. EdrawMax simplifies this process with easy-to-use diagrams. By combining smart strategies and user-friendly tools, financial institutions can face uncertainties with confidence.

In addition, a well-executed risk management strategy ensures that financial institutions can weather unexpected challenges and adapt to evolving market conditions. EdrawMax, with its intuitive interface and extensive template library, streamlines the creation of effective risk management diagrams.