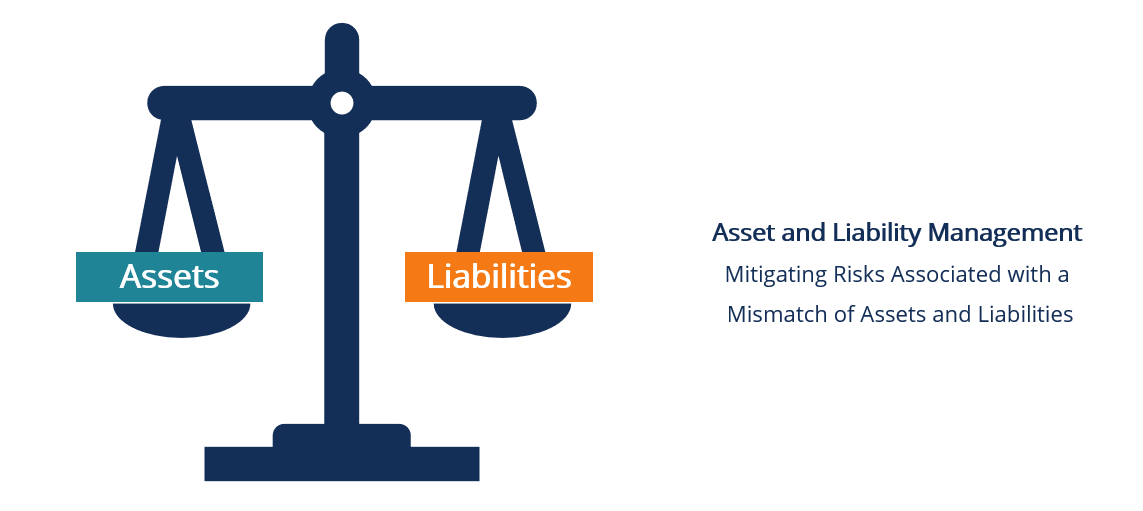

Asset and Liability Management (ALM) is a critical practice for financial institutions to mitigate financial risks resulting from a mismatch of assets and liabilities. In this blog post, we will explore the concept of Asset liability management risk and its importance in managing long-term risks that can arise due to changing circumstances. We will also discuss the various strategies employed by organizations to manage these asset risks, including strategic allocation of assets, risk mitigation, and adjustment of regulatory and capital frameworks.

When financial institutions match their assets against liabilities, they are left with a surplus that can be managed to maximize their investment returns and increase profitability.

In this article

Part 1: What is Asset Risk?

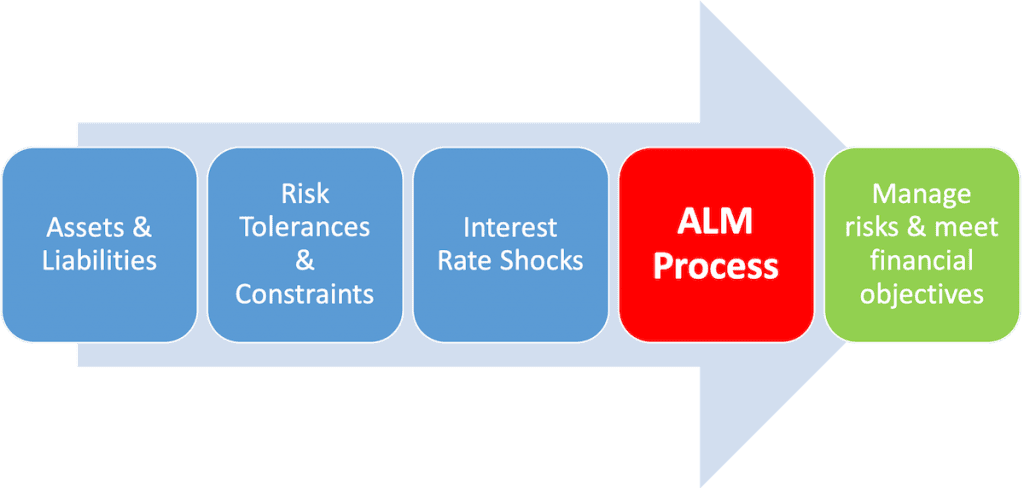

Asset risk refers to the possibility of losing money due to fluctuations in the value of an asset. An asset is anything that has value and can be traded, such as stocks, bonds, or real estate. Asset risk can arise due to various factors, including changes in interest rates, credit quality, repayment risk, and other factors. Financial institutions use asset and liability management (ALM) strategies to mitigate financial risks resulting from a mismatch of assets and liabilities. ALM strategies employ a combination of risk management and financial planning to manage long-term risks that can arise due to changing circumstances.

Part 2: What Does Asset Risk Management Look Like in Action?

Asset liability management is the process of making sure investments are handled carefully. This means recognizing possible risks and finding ways to reduce them. Managers use different methods like spreading investments, using financial tools to offset losses, and dividing investments wisely. These strategies help managers handle risks and make the most out of their investments.

By using these strategies, asset managers can navigate uncertain financial situations with confidence. This careful approach not only safeguards investments but also boosts the chances of making profitable returns in the long run.

Part 3: 5 Biggest Risks to Effective Asset Management

Effective asset management is crucial for financial success, yet it comes with several potential pitfalls. Here are the five biggest risks to consider:

- Inadequate Data Quality: Inaccurate or poor-quality data hampers decision-making, leading to incorrect valuations and misguided strategies.

- Compliance and Regulatory Changes: Evolving regulations demand constant adaptation; non-compliance risks financial penalties and reputational damage.

- Technological Obsolescence: Outdated systems struggle with modern asset complexities, hindering automation, efficiency, and robust analysis.

- Market Volatility: Fluctuating markets impact asset values and returns, and without proper risk mitigation, it can lead to significant losses.

- Lack of Strategic Planning: Absence of a clear asset management strategy results in aimless decision-making, failing to align assets with organizational goals, and impacting long-term growth.

Part 4: The Importance of Effective Asset Risk Management

In the dynamic world of finance, mastering effective asset risk management is akin to steering a ship through stormy waters. It's not merely about avoiding hazards; it's about harnessing the power of uncertainty for greater gains. A robust risk management strategy safeguards investments, ensuring they thrive even in turbulent times. It empowers decision-makers with foresight, allowing them to seize opportunities others might overlook. Ultimately, it's the difference between merely sailing and truly conquering the vast expanse of the financial seas.

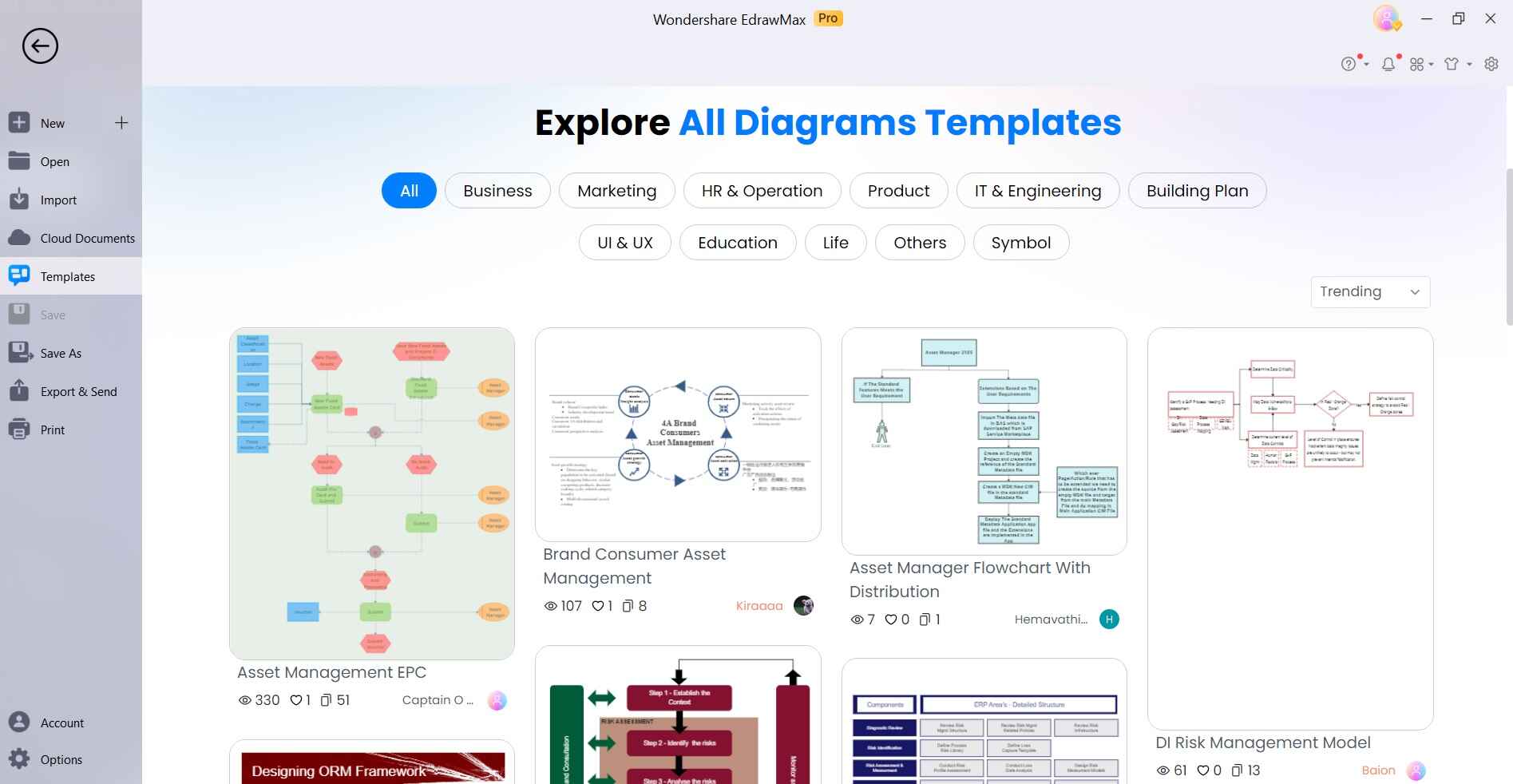

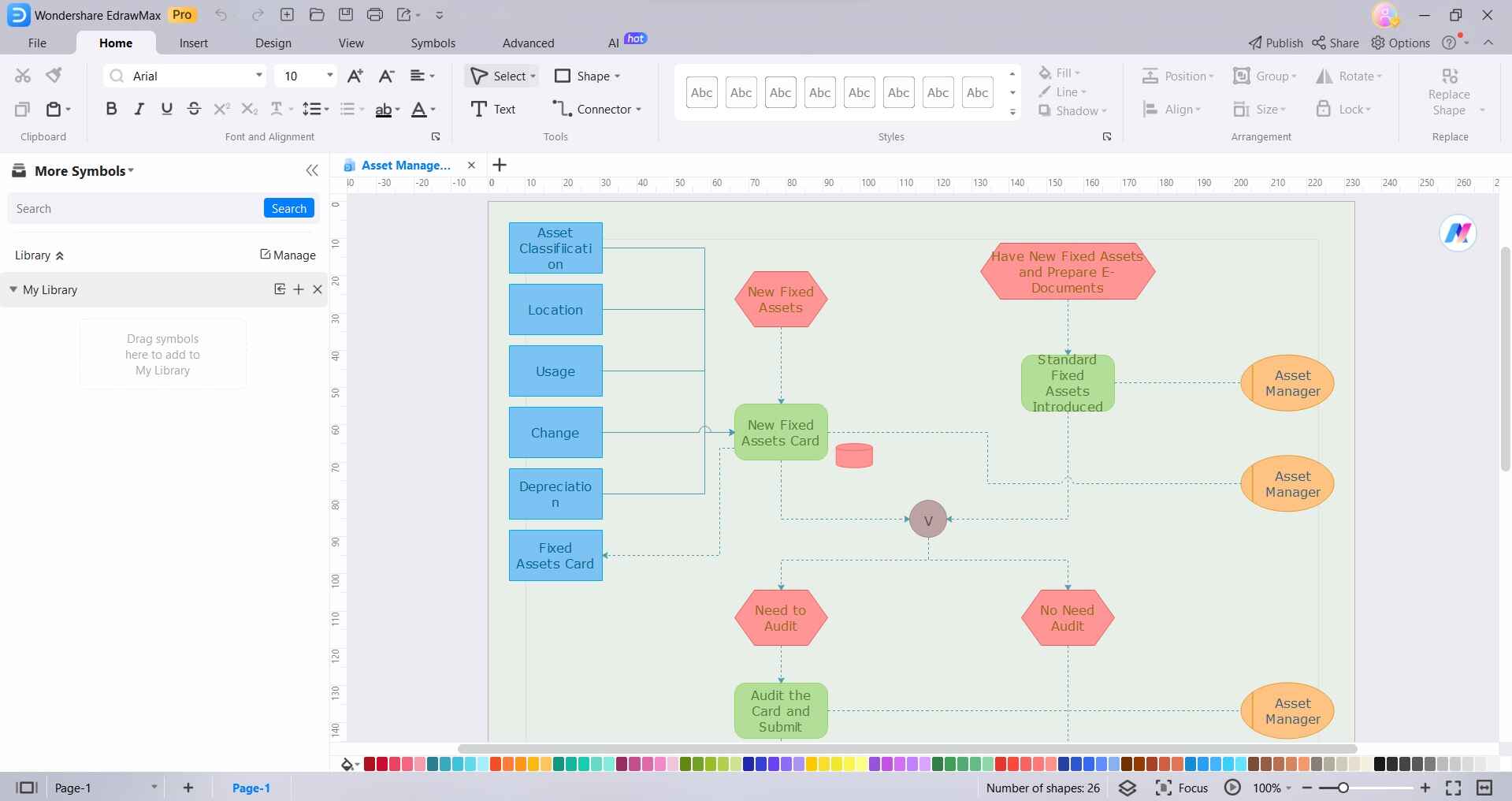

Part 5: Create an Asset Risk Management Process Chart Using EdrawMax

Using Wondershare EdrawMax to create an Asset Risk Management Process Chart is like making a clear map for keeping our investments safe. It shows step-by-step how to spot risks, evaluate them, and plan what to do. This picture helps everyone understand their part in keeping our money secure. Plus, if new risks come up, we can easily update our plan. It's like having a simple, effective guide to protect our assets in the world of finance.

With EdrawMax, even if we're not experts, we can easily make this visual guide. It simplifies complex concepts and ensures everyone is on the same page. This tool empowers us to take charge of our financial security with confidence.

Here are the steps to create a risk management process chart using EdrawMax:

Step1

Open the EdrawMax application on your computer. In EdrawMax, choose a suitable template for a risk management process chart. You can find various templates under the "Risk management” category.

Step2

Drag and drop shapes onto the canvas to represent different stages of the risk management process. These can include ovals for start and end points, rectangles for process steps, diamonds for decision points, and arrows to connect them.

Step3

Use lines or arrows to connect the shapes, indicating the flow of the risk management process. Ensure the connections are clear and follow a logical sequence.

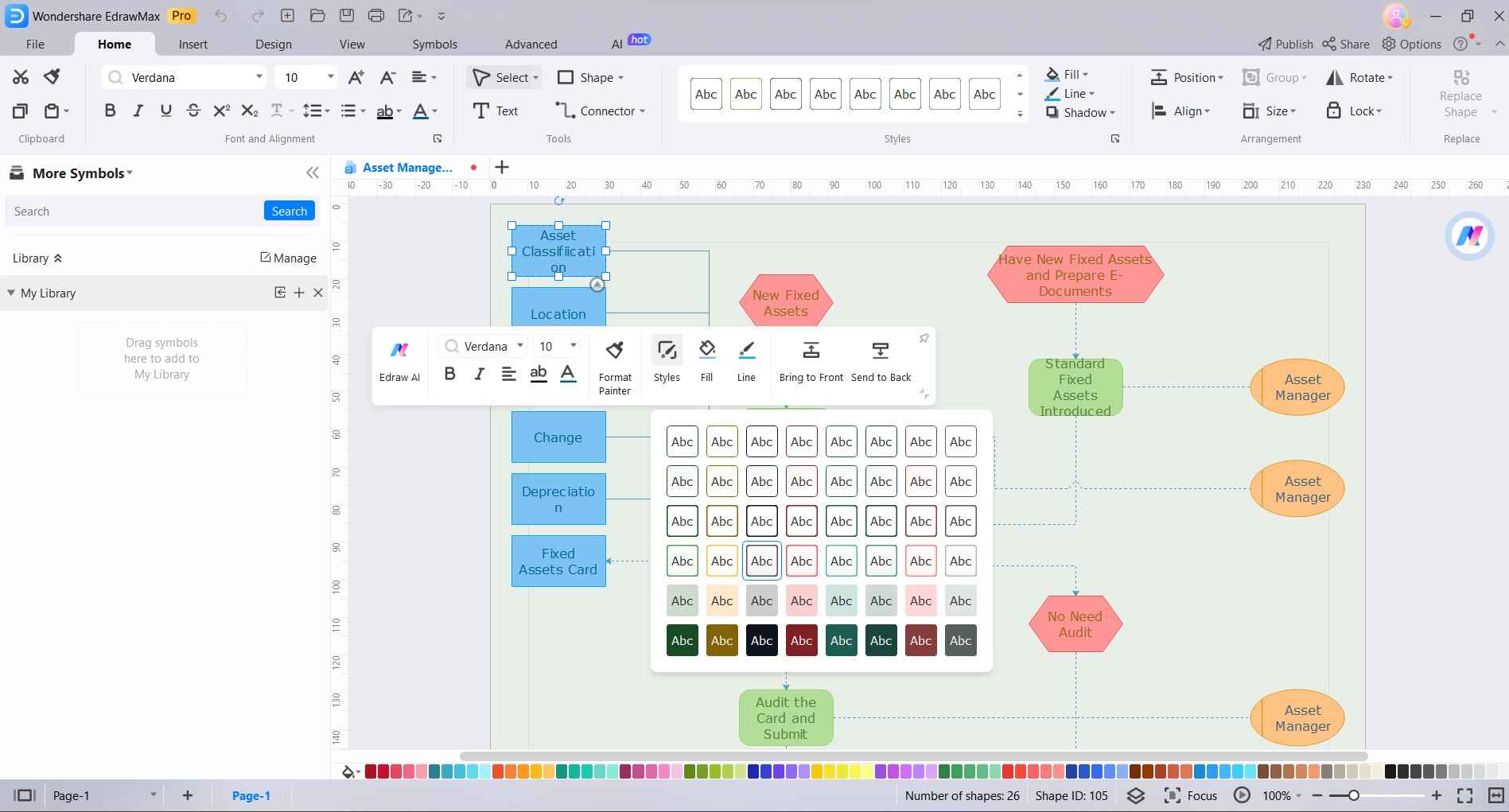

Step4

If needed, insert relevant icons or images to further illustrate each stage of the process. Click on each entity and select “Styles” to change the color and formatting style.

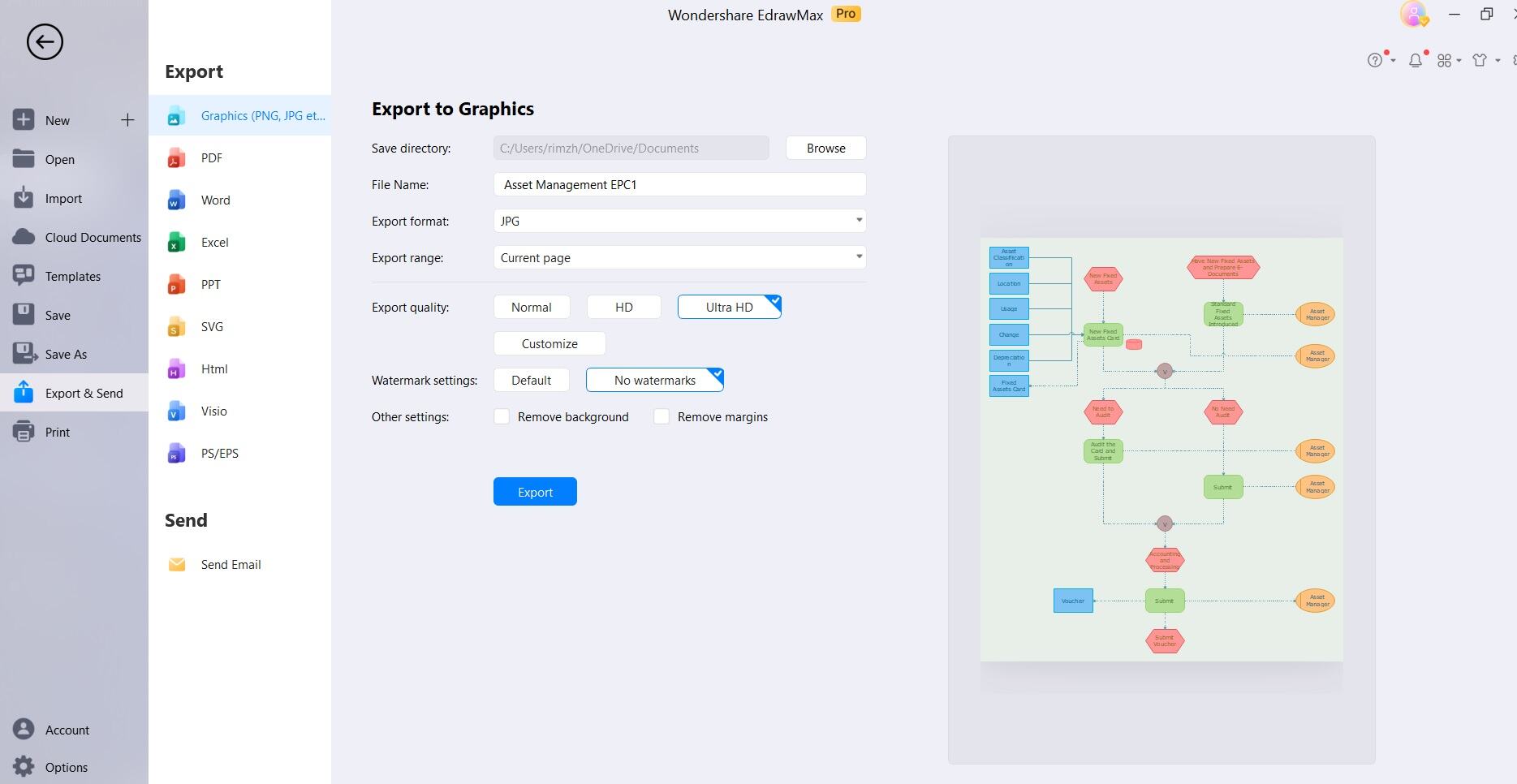

Step5

Save the file to your desired location on your computer, ensuring you choose a format compatible with your needs (e.g., .pdf, .png, .jpeg).

Following these steps in EdrawMax will help you create a clear and effective risk management process chart.

Part 6: Tips to Prevent Asset Risks in Cyber Security

In the ever-evolving landscape of cybersecurity, safeguarding assets is paramount. Here are essential tips to prevent risk associated with asset in cybersecurity:

- Regular Software Updates and Patch Management: Promptly apply security patches to fix vulnerabilities.

- Firewall Implementation: Establish strong barriers to monitor and filter incoming and outgoing traffic.

- Employee Training and Awareness: Educate staff about phishing, social engineering, and best security practices.

- Access Control and Authentication: Employ strong passwords, and multi-factor authentication, and limit access based on roles.

- Data Encryption: Safeguard sensitive information with encryption protocols.

- Regular Security Audits and Assessments: Conduct routine evaluations to identify and rectify potential vulnerabilities.

Conclusion

In an era dominated by technological advancements, safeguarding asset risks from cyber threats is imperative. Implementing robust cybersecurity measures, from regular updates and firewalls to employee training and incident response plans, forms the bedrock of a resilient defense. Through these proactive steps, organizations fortify their digital fortresses, ensuring the protection of critical assets.

By staying vigilant and adaptive, businesses not only mitigate risks but also demonstrate a commitment to maintaining trust and integrity in an increasingly interconnected world.

[没有发现file]