Risk management strategies are crucial components for organizations to navigate the uncertainties and potential threats that may hinder their operations and goals. By adopting a systematic approach, organizations can identify, assess, and mitigate potential risks.

In this article

Part 1. Why Is Having a Risk Management Strategy Important?

Risk management strategy refers to the systematic approach adopted by organizations to identify, assess, and mitigate potential risks that may negatively impact their operations or goals. Risk management strategies in project management involve the development of proactive measures and contingency plans to minimize the likelihood of risk occurrences and mitigate their potential consequences.

Having a risk management strategy is vital for organizations. It helps them in managing risks that can hamper them significantly.

1. Operational Efficiency: A risk management strategy plays a vital role in enhancing operational efficiency within an organization.

2. Protect Company's Assets: A robust risk management strategy helps identify vulnerabilities and implement appropriate safeguards to protect these assets from potential threats or losses.

3. Customer Satisfaction: A risk management strategy facilitates the identification and mitigation of risks that could potentially compromise customer experience.

4. Achieving Business Goals: A risk management strategy allows businesses to make informed decisions, allocate resources effectively, and pursue growth opportunities with minimized uncertainty.

Part 2. What Are 5 Risk Management Strategies?

Developing a risk management strategy is a collaborative effort that involves various stakeholders within an organization. While the ultimate responsibility for risk management may lie with upper-level management or the board of directors, effective strategies are developed through the involvement of different departments and employees at all levels.

5 risk management strategies are step-by-step processes that organizations should follow to manage risk adeptly. Following these strategies helps organizations to systemically manage risks.

1. Avoidance: Avoiding risks involves taking proactive measures to prevent exposure to potential threats.

2. Retention: Risk retention involves consciously accepting certain risks and retaining them within the organization.

3. Spreading: By spreading or diversifying, organizations reduce their dependency on a single point of failure and minimize the likelihood of a significant impact from a single risk event.

4. Loss Prevention and Reduction: Loss prevention and reduction strategies focus on implementing measures to minimize the occurrence or severity of potential risks.

5. Transfer:Organizations can transfer risks by purchasing insurance policies or outsourcing certain activities to third parties who have specialized expertise in managing those specific risks.

Part 3. Types of Risk Management Strategies

In the context of forex trading, 2% risk management refers to a strategy wherein traders limit their exposure to potential losses by risking only 2% of their trading capital on any single trade. Forex risk management strategies aim to protect traders from significant losses that could otherwise harm their overall account balance.

Organizations can face many different types of risks. There are various types of risk management strategies depending on the type of risk.

1. Business Risk: Risk management strategies in business focus on identifying and mitigating potential risks that could hinder the overall performance and profitability of the organization.

2. Strategic Risk: Strategic risk management strategies involve assessing potential risks to the organization's strategic objectives and developing appropriate measures to address them.

3. Hazard Risk: Hazard risk management strategies focus on identifying vulnerabilities, implementing preventive measures, and developing contingency plans to minimize the impact of these risks on the organization's operations and assets.

Part 4. Make a Risk Management Strategy Flowchart with Edrawmax

A risk management strategies flowchart can help you create a visual map of your risk management process. Creating a risk management flowchart with a Wondershare EdrawMax template is a simple and efficient way to organize your risk management strategy. The following steps will guide you on how to create a risk management flowchart with the tool:

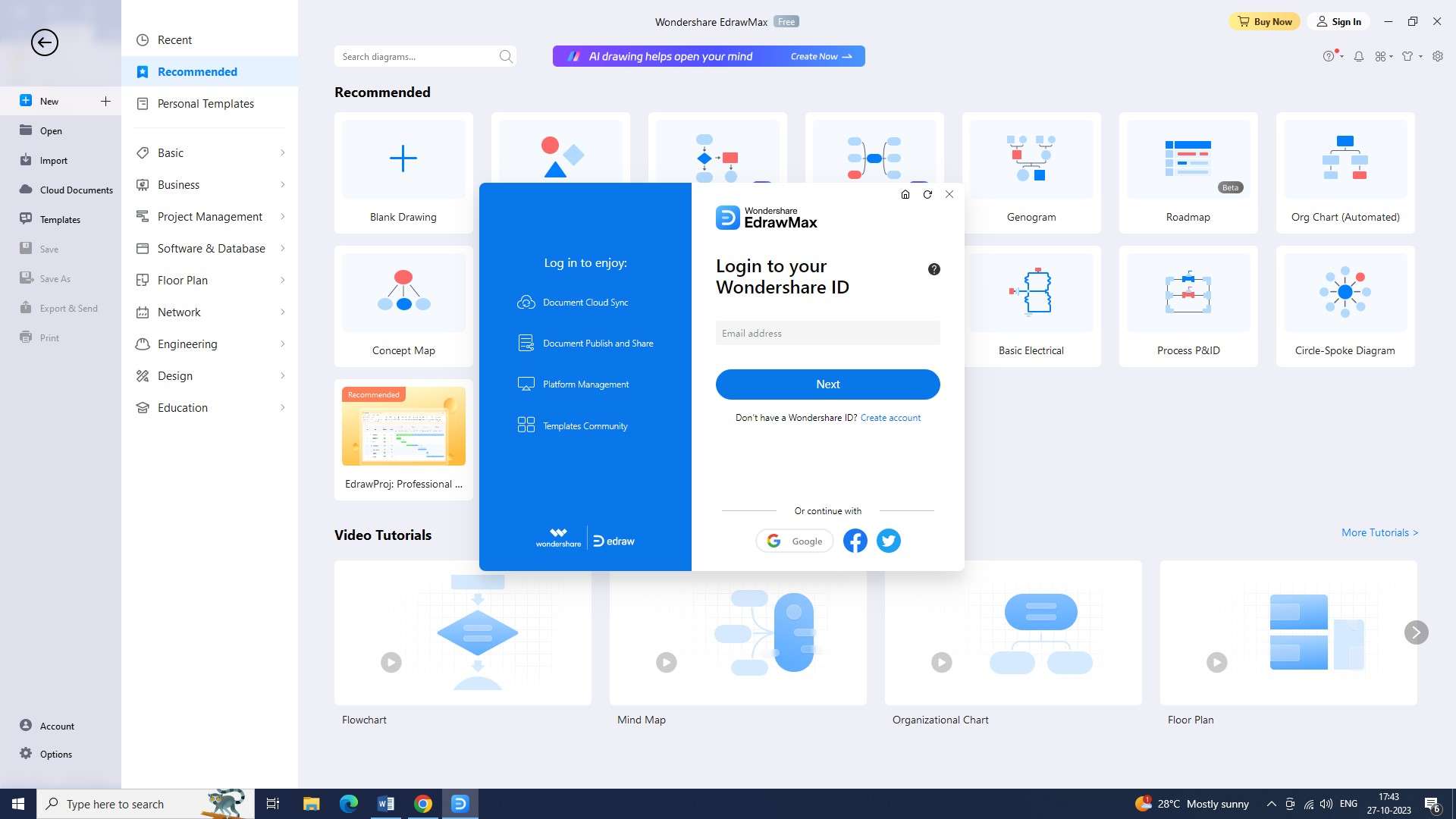

Step 1: The first step is to log in to Wondershare Edrawmax. Once you have logged in, you will be directed to the Edrawmax homepage.

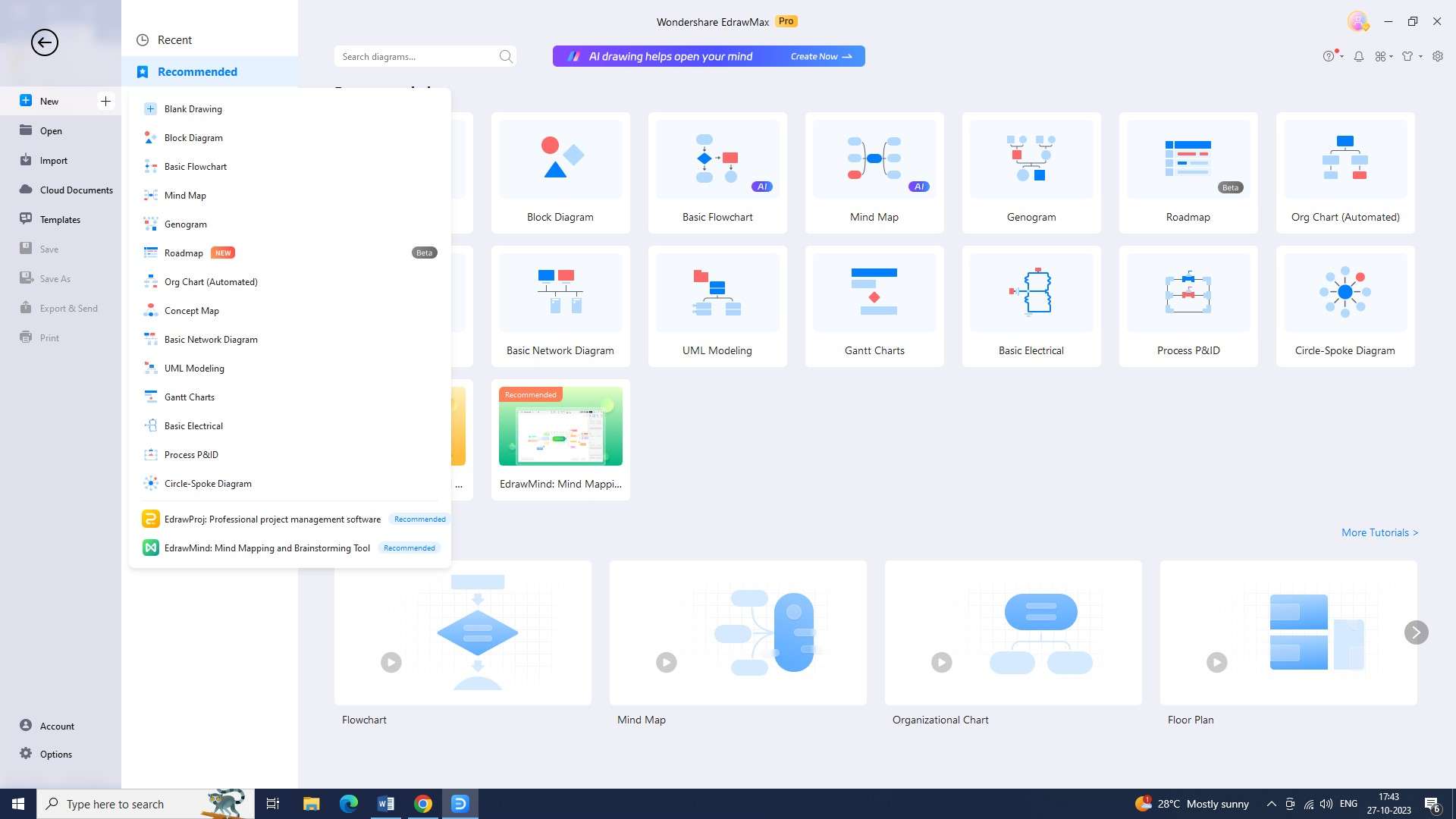

Step 2: You now have to open a new document in the tool. Click on the “+” sign beside the “New” button to open a new document.

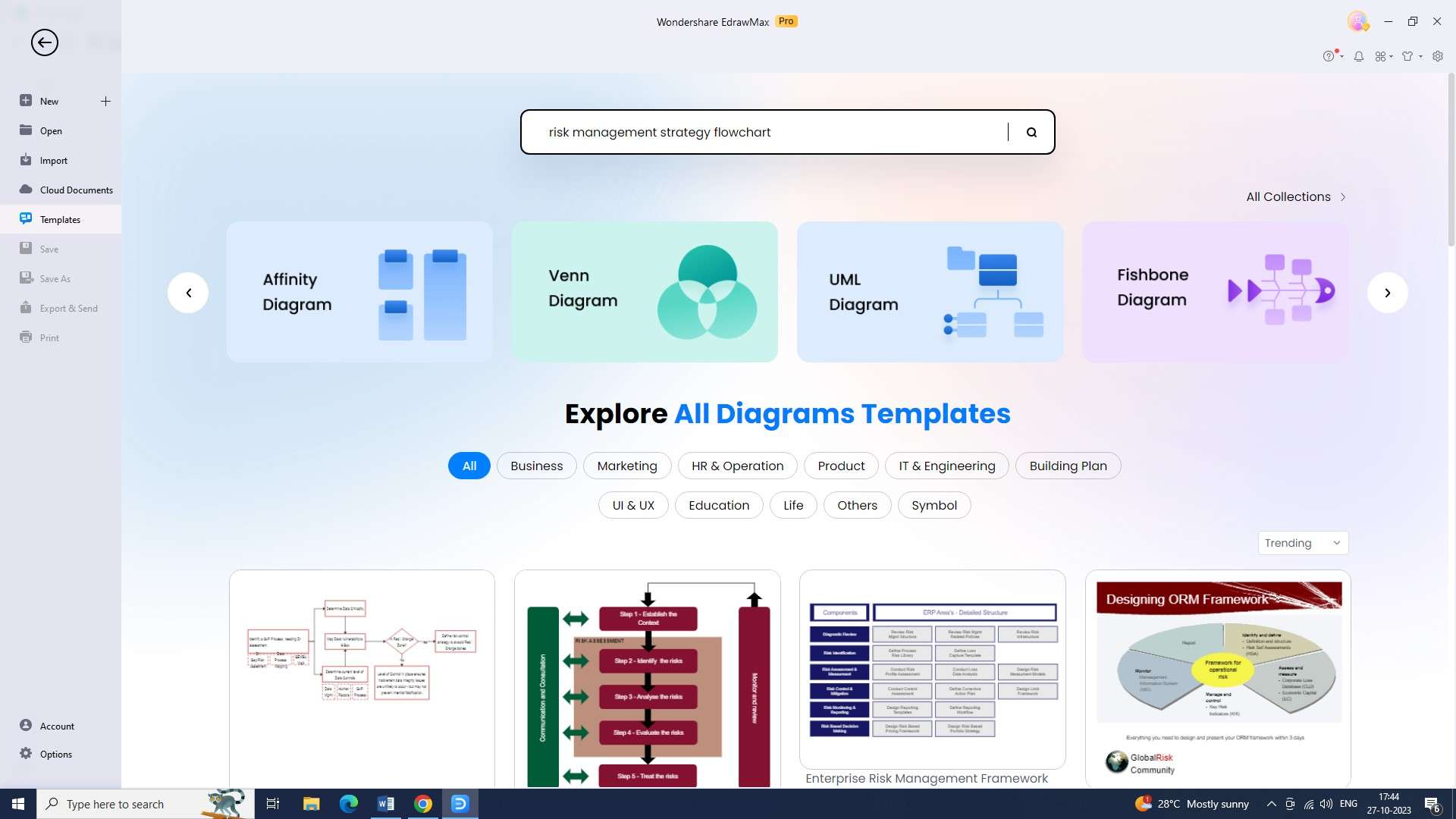

Step 3: Now, you will need to select a template that best meets your needs. Go to the “Templates” section, search for a “risk management strategy flowchart,” and choose one list of available templates.

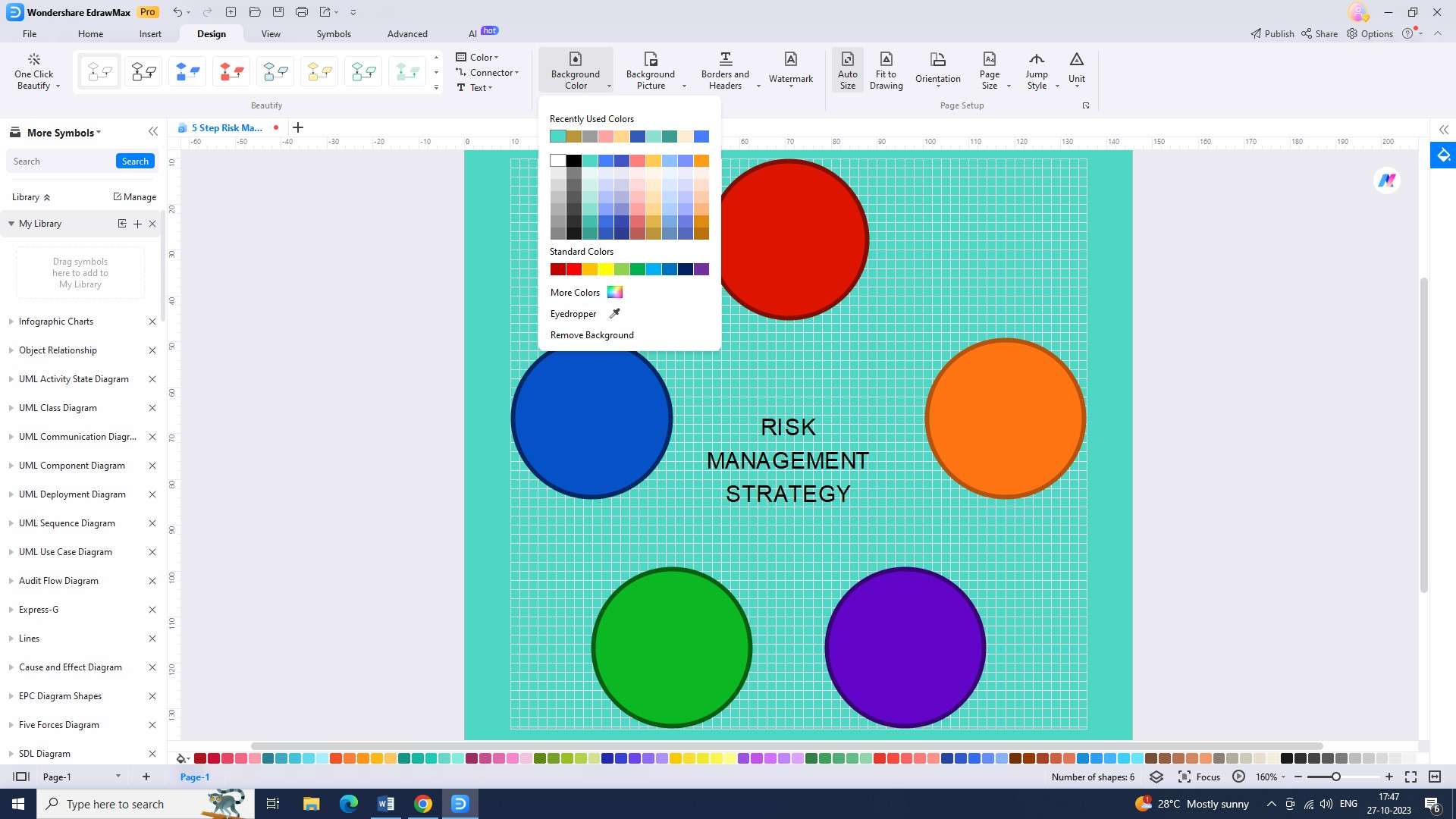

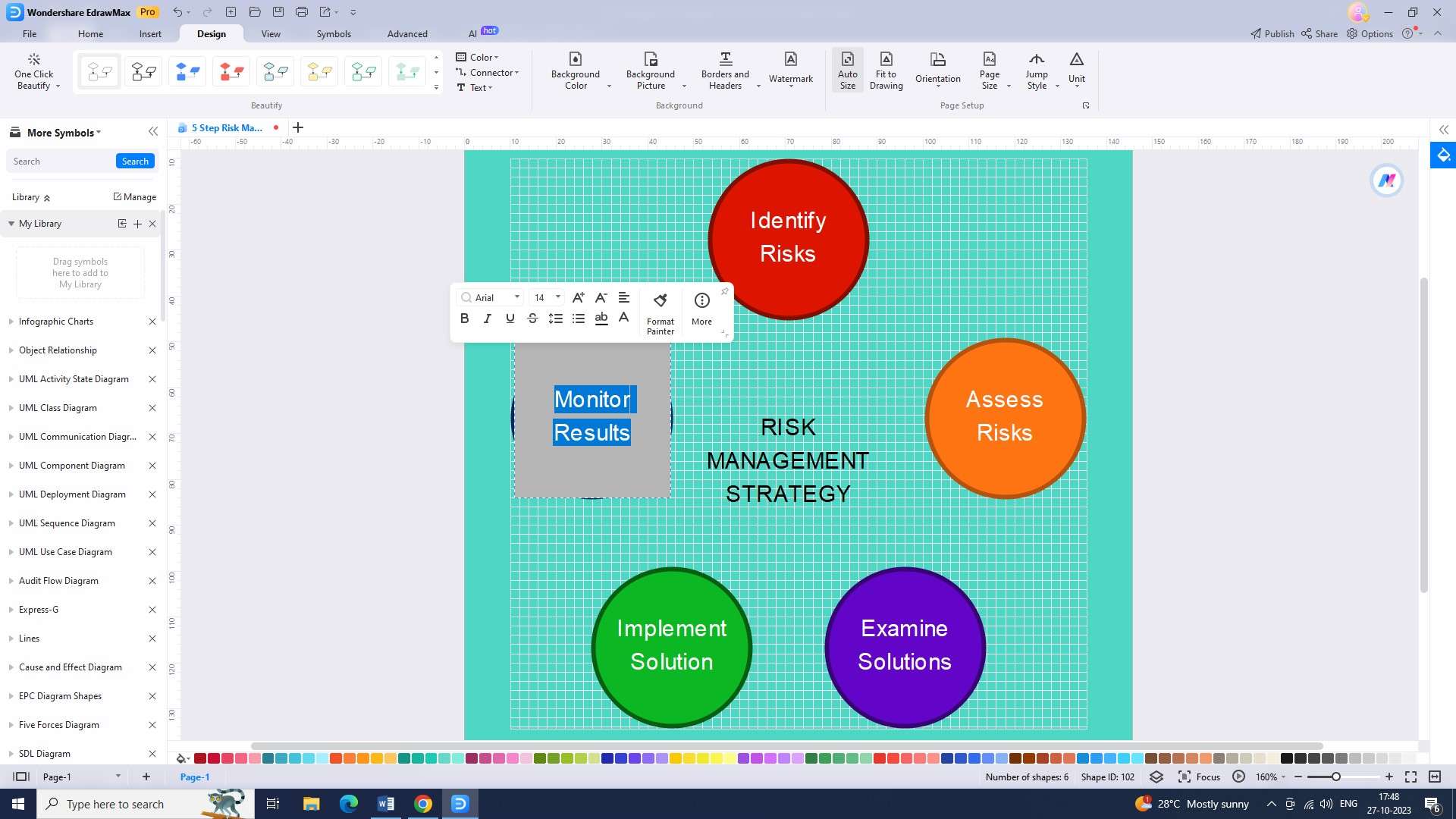

Step 4: Once you have selected the template, you will need to customize it. You can customize the chart according to your preference to create the flowchart you need.

Step 5: The next step is to insert risk elements into the flowchart. Add risk elements such as risk identification and risk assessment, among others.

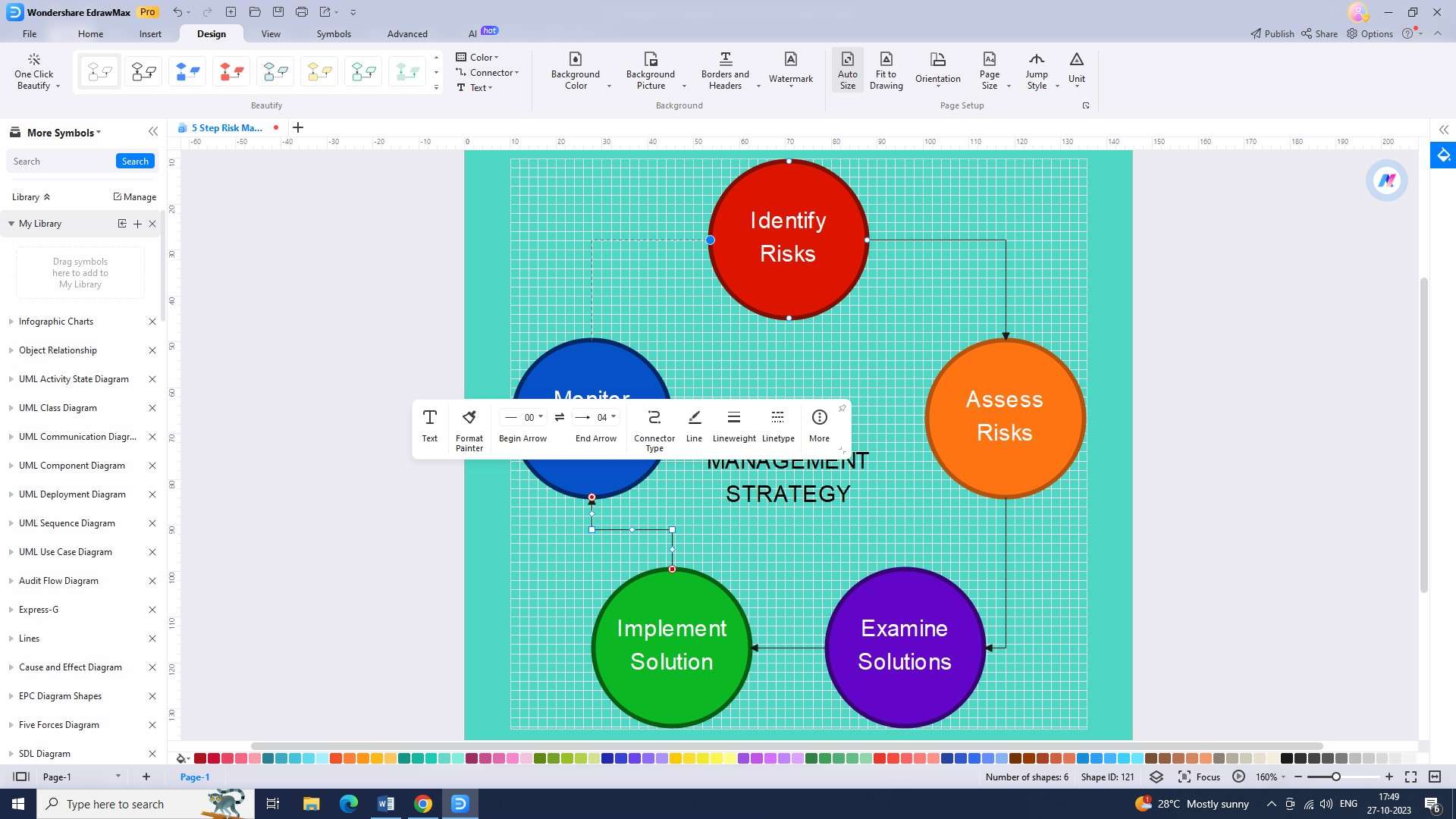

Step 6: Once you have inserted the risk elements, you will need to link them together. You will then be able to draw lines between the elements to create the flowchart.

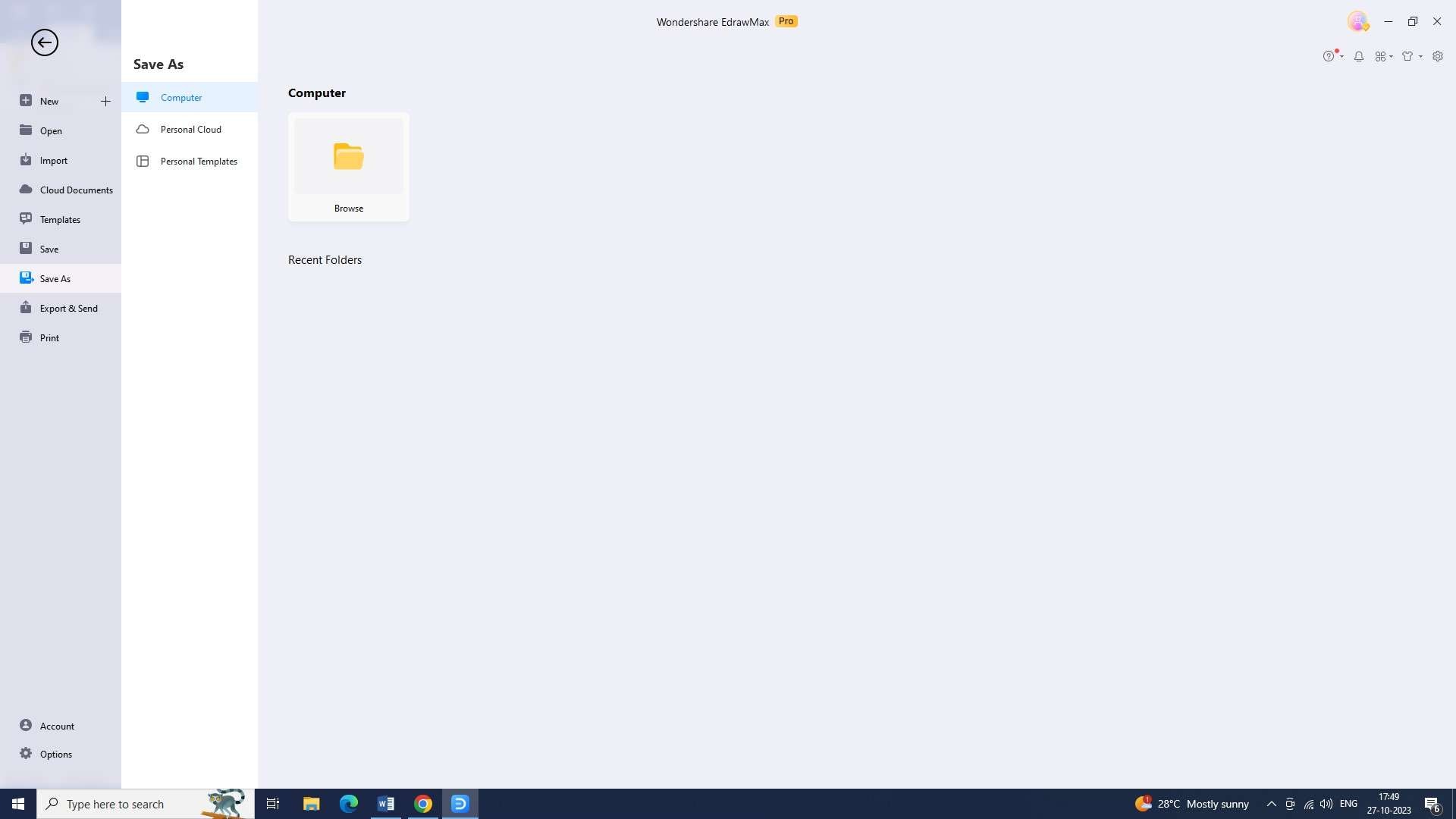

Step 7: Once you have finished creating the flowchart, you can save it. Save the chart by going to “File” and then clicking on the “Save” option.

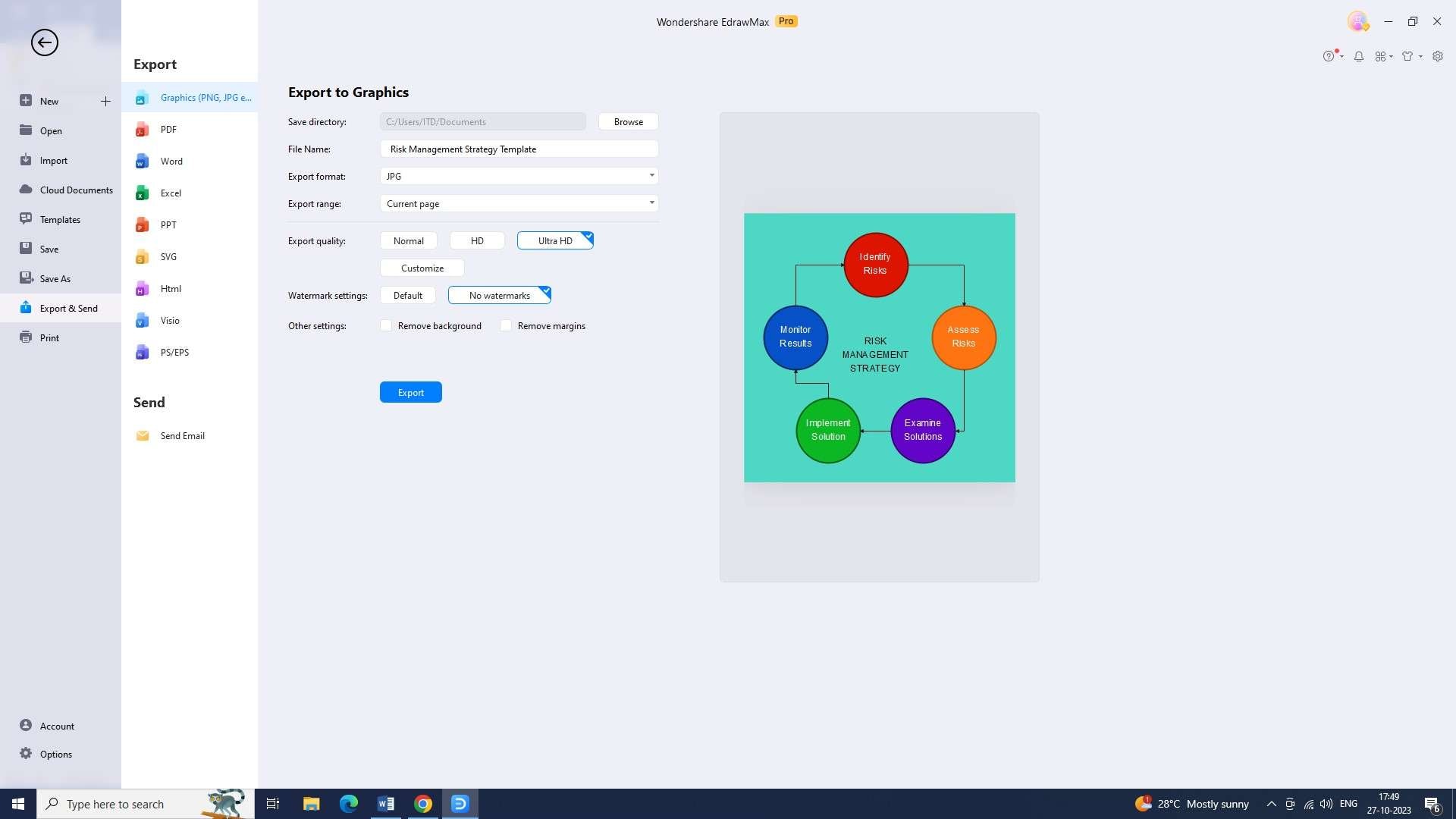

Step 8: The final step is to export the flowchart. This can be done by going to “File” and clicking on the “Export” option.

Conclusion

In today's unpredictable business environment, having robust risk management strategies is imperative for organizations to thrive. By proactively identifying and addressing potential risks, organizations can effectively manage uncertainties.