Capital Risk Management is all about safeguarding your investments. It helps you understand and minimize potential financial risks. This guide provides practical tips and expert advice to navigate this important aspect of finance. Whether you're new to investing or experienced, mastering Capital Risk Management is essential for long-term success and stability.

Part 1: What is Capital Risk Management

Capital Risk Management is the practice of safeguarding your investments from potential financial setbacks. It involves identifying and assessing risks that could affect your capital, and taking steps to minimize them. By understanding and planning for these uncertainties, you can make more informed decisions about where to allocate your resources. This ensures a more secure and stable financial future.

Part 2: Understanding Capital Risk

Capital risk refers to the potential loss of investment value due to various factors like market fluctuations, economic downturns, or unforeseen events. It's crucial to assess and mitigate these risks to protect your capital. Human Capital Risk involves strategies like diversification and careful financial planning. By understanding and managing capital risk, you can make more informed investment decisions, ultimately safeguarding your financial well-being.

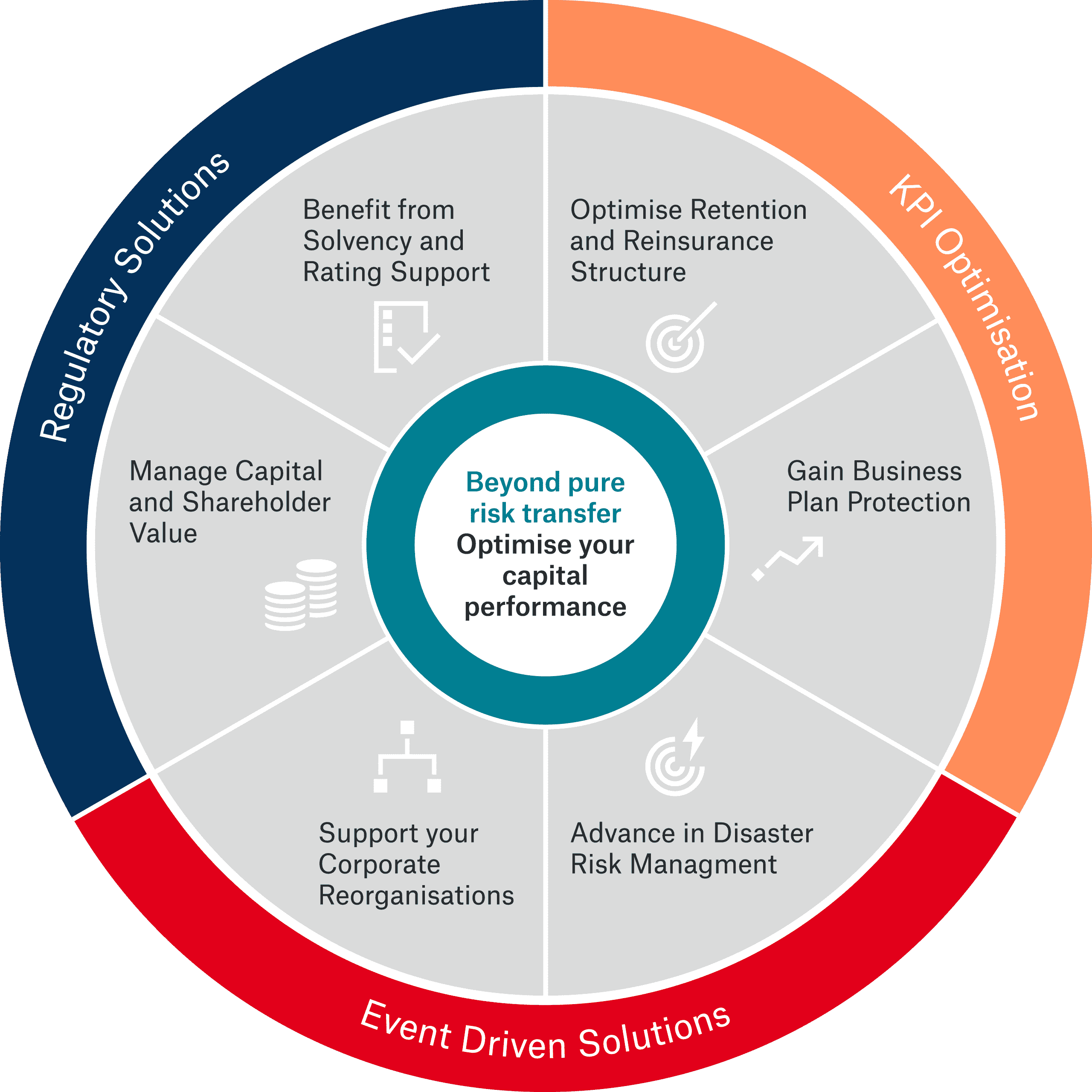

Part 3: Components of Capital Risk Management

Effective Capital Risk Management involves several key components to safeguard investments and ensure financial stability:

- Risk Identification: Identifying potential threats to capital through market trends, economic indicators, and external factors.

- Risk Assessment: Evaluating the impact and probability of identified risks on investments and financial stability.

- Risk Mitigation Strategies: Implementing measures like diversification, hedging, and asset allocation to minimize potential losses.

- Monitoring and Review: Continuously tracking the performance of investments and adjusting strategies in response to changing market conditions.

- Contingency Planning: Preparing for unexpected events with contingency plans to mitigate their impact on capital.

Part 4: How to Create a Capital Risk Management Framework Using EdrawMax

Creating a Capital Risk Management Framework with EdrawMax is like making a clear plan to protect your money. EdrawMax makes it easy with its user-friendly tools. This framework helps you identify and deal with possible risks when you invest. It's like having a map that guides you to make smart decisions about where to put your money. This way, you can aim for good returns while keeping risks low. It also makes sure everyone in your team understands and follows the plan, making your financial journey safer and more successful.

Overall, utilizing EdrawMax to create a Capital Risk Management Framework streamlines the risk management process, ultimately contributing to a more secure and profitable financial landscape.

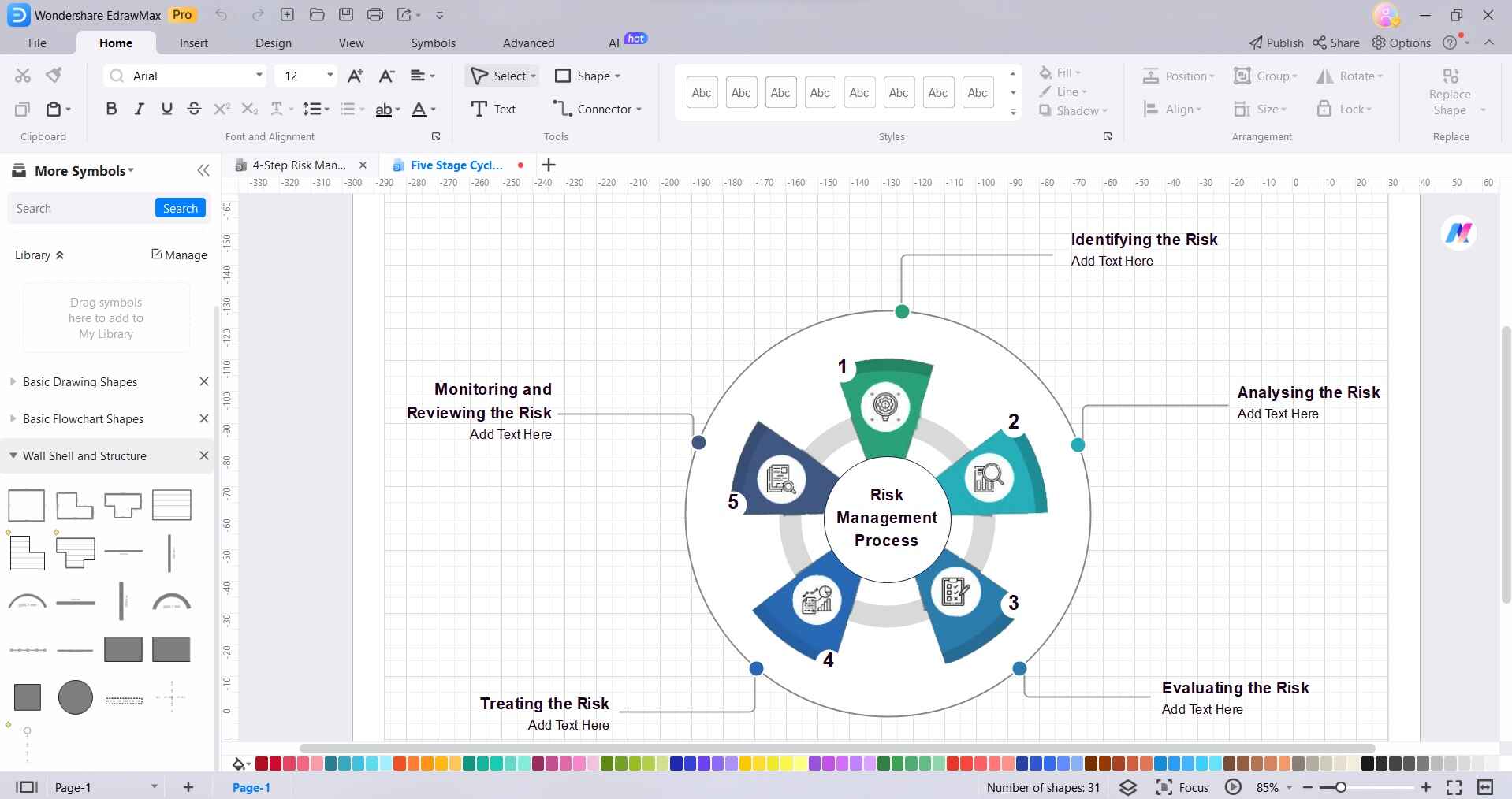

Here are the steps to create a capital risk management diagram using EdrawMax:

Step1

Launch the EdrawMax application on your computer. Browse through the available templates and select one that best fits your Capital Risk Management needs. Look for templates related to risk assessment or financial management.

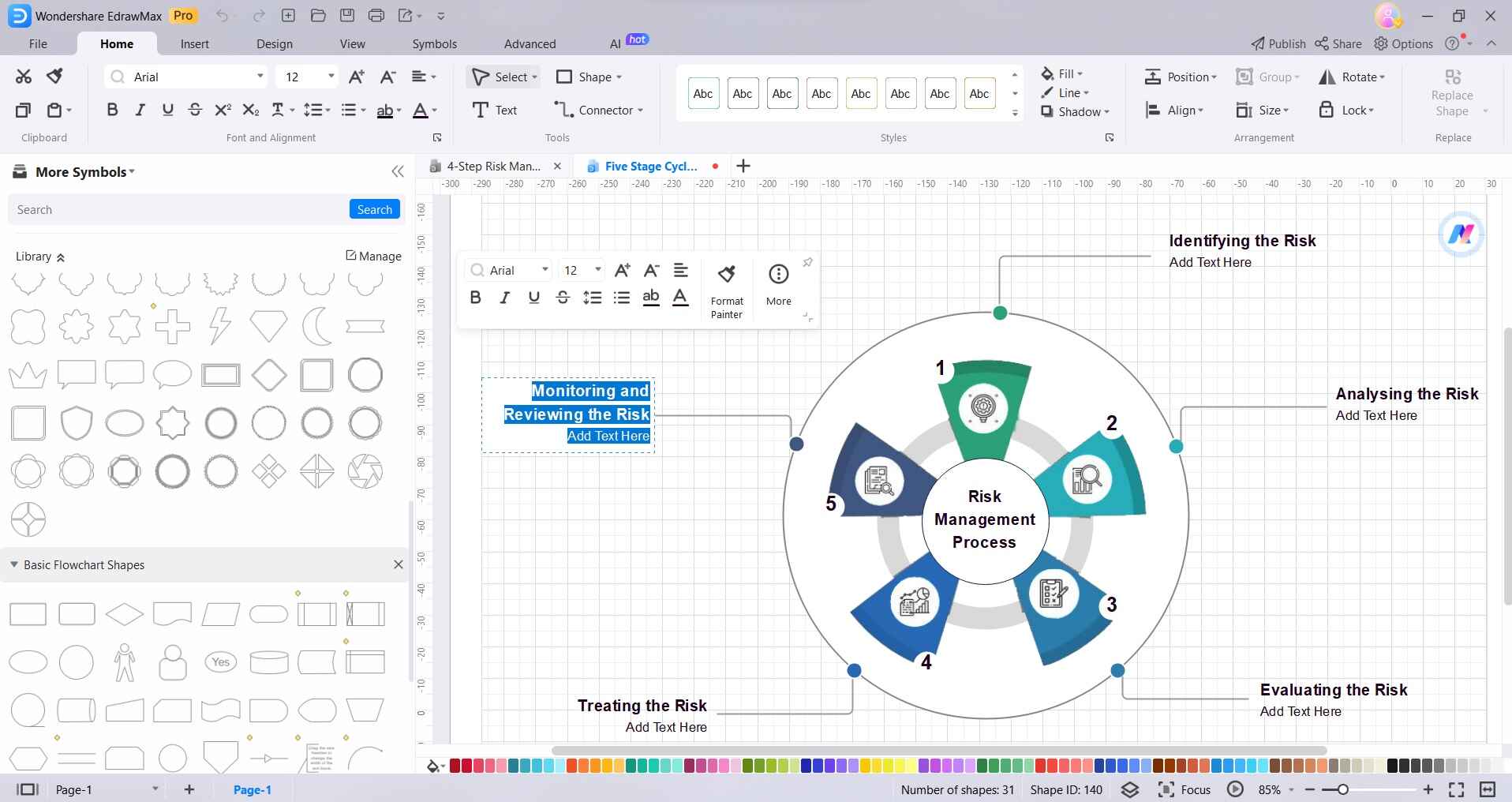

Step2

Drag and drop shapes, symbols, and text boxes onto the canvas to represent different elements of your Capital Risk Management framework. You can add labels, arrows, and other visual elements to clarify the process.

Step3

Double-click on shapes or text boxes to add specific information. Include details about risk identification, assessment, mitigation strategies, monitoring, and contingency planning.

Step4

Customize the colors, fonts, and styles to make the diagram visually appealing and easy to understand. Use consistent formatting to maintain clarity.

Step5

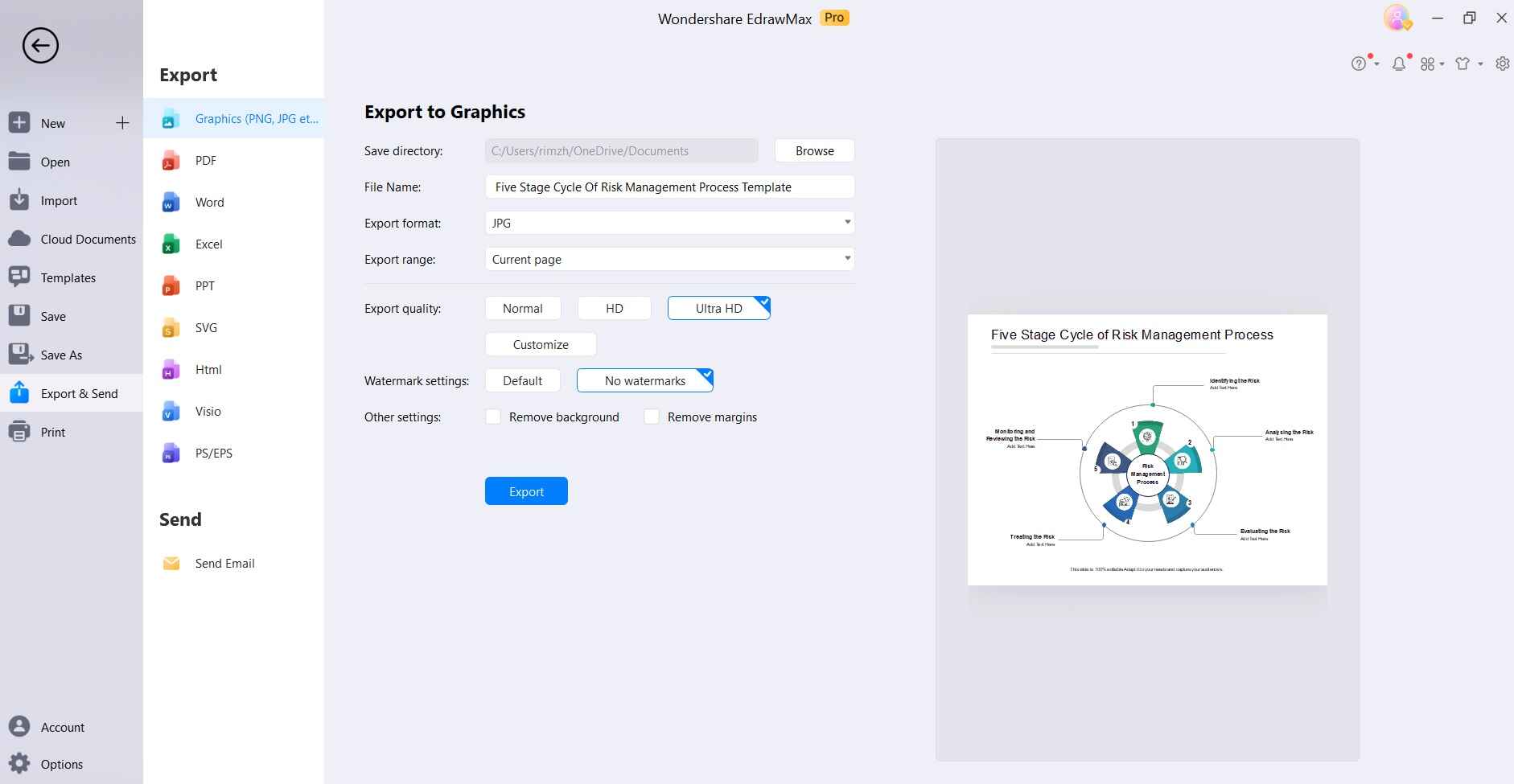

Click on File> Save to save your Capital Risk Management diagram. Choose a location on your computer to store the file. If needed, you can export the diagram in different formats such as PDF, PNG, or JPEG. You can also directly share it with your team members or stakeholders from within the EdrawMax application.

By following these steps, you'll be able to create a clear and concise Capital Risk Management diagram using EdrawMax.

Part 5: Challenges in Capital Risk Management

Effectively managing capital risk is crucial for financial stability, but it comes with its fair share of challenges. Here are some key hurdles to consider:

- Market Volatility: Sudden and unpredictable shifts in market conditions can lead to unexpected losses.

- Economic Uncertainty: Fluctuating economic factors can impact the value of investments and capital allocation decisions.

- Regulatory Changes: Evolving financial regulations may require adjustments to risk management strategies.

- Lack of Data Accuracy: Inaccurate or incomplete data can lead to flawed risk assessments and poor decision-making.

- Emerging Risks: New, unforeseen risks may arise, necessitating adaptive risk management approaches.

- Human Error: Mistakes in risk assessment or implementation of risk mitigation strategies can have significant consequences.

Conclusion

In managing capital risk, it's clear that being prepared and flexible is key. Market changes, economic uncertainties, and rules shifts are tough, but accurate data and watching for new risks help. Remember, people can make mistakes, so staying vigilant and trained is crucial. By facing these challenges and using smart risk strategies, you can protect your finances and set yourself up for success in the future.

In this journey, tools like EdrawMax simplify the process, offering user-friendly solutions for creating clear and effective risk management frameworks.