Trading risk management has emerged as a crucial discipline for traders and investors. Effective trading risk management, including energy trading and risk management, is vital for mitigating potential losses and ensuring long-term success in the market.

Trading risk management encompasses the processes, tools, and strategies employed to identify, assess, and mitigate risks associated with trading activities. It aims to protect traders' investments by preparing them for potential adverse market movements and minimizing the likelihood of substantial losses.

In this article

Part 1. Why is Trading Risk Management Important?

Ensuring efficient trading risk management is vital for organizations. Trading risk management is of paramount importance due to a lot of reasons.

- Preservation of Capital: Effective trading risk management ensures capital preservation by preventing excessive losses in volatile markets.

- Consistency and Long-term Success: Adhering to trading risk management techniques helps maintain consistency and increases the probability of long-term success.

- Emotional Control: Trading risk management helps maintain emotional control during uncertain market situations, preventing impulsive decisions driven by fear and greed.

- Regulatory Compliance: Trading risk management practices ensure compliance with financial authorities' requirements.

Commodity trading risk management involves identifying, analyzing, and mitigating risks associated with commodity markets. With commodities being subject to price volatility due to supply and demand dynamics, geopolitical events, and weather conditions, effective risk management is essential for commodity-based businesses to protect profits, manage cash flows, and ensure operational resilience.

Part 2. Managing Risk in Trading: Top Tips and Strategies

Trading risk management requires a well-planned approach. Successful trading risk management involves implementing effective strategies.

- Determine Risk/Exposure Upfront: Analyze and assess potential risks before entering a trade. Consider factors like market trends, volatility, and liquidity.

- Optimal Stop Loss Level: Set predefined stop-loss orders to limit potential losses. Adjust them based on market conditions for an appropriate risk-reward ratio.

- Diversify Your Portfolio: Spread investments across different assets, industries, or regions to reduce the impact of adverse events.

- Consistent Risk Management: Determine a risk percentage per trade or portfolio and stick to it. Manage emotions to make rational decisions based on trading plans.

- Positive Risk-to-Reward Ratio: Aim for greater potential rewards compared to the risk in each trade to generate profit, even with a relatively low success rate.

The 1% rule in day trading risk management refers to limiting the risk exposure of a single trade to a maximum of 1% of the trader's total account capital. This rule aims to prevent substantial losses that could cripple a trader's account if a trade goes against their expectations. Adhering to the 1% rule ensures that no single trade has an overly detrimental impact on a trader's overall portfolio.

Part 3. Benefits And Future of Energy Trading

Energy trading offers several benefits. Energy trading risk management is also of utmost importance to organizations.

- Profit Potential: Energy markets often exhibit substantial price volatility, creating opportunities for traders to profit from short-term price fluctuations or long-term trends.

- Portfolio Diversification: Including energy assets in an investment portfolio enhances diversification, as energy prices are generally influenced by different factors compared to other asset classes.

- Hedging Risks: Energy trading enables market participants to hedge against potential risks arising from fluctuating energy prices and geopolitical events, ensuring stability in energy-related investments.

The Energy Trading and Risk Management (ETRM) industry is poised for growth and innovation. Technological advancements, such as Artificial Intelligence and Blockchain, are

expected to revolutionize the industry by streamlining trading operations, enhancing risk management practices, and facilitating greater transparency.

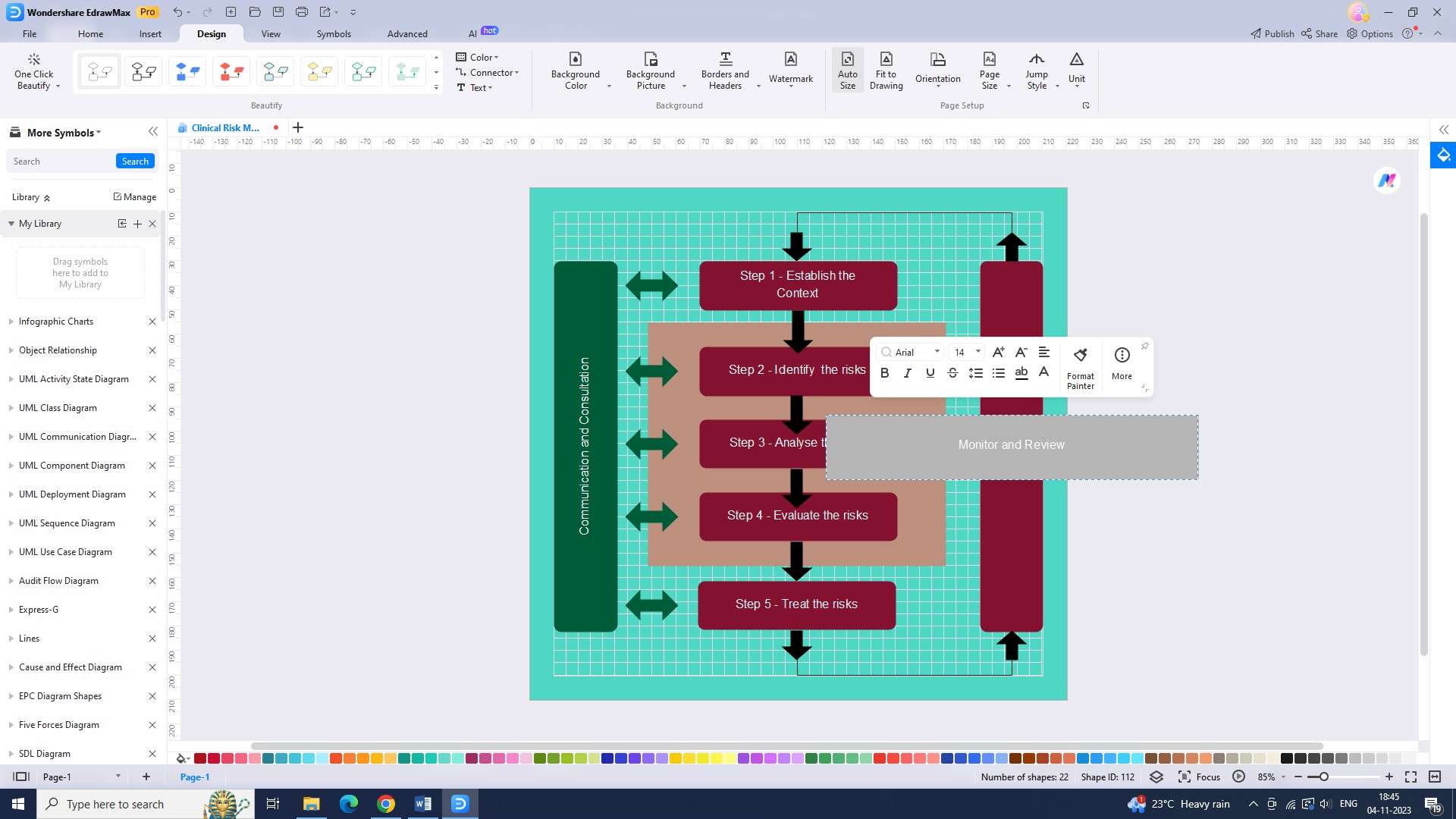

Part 4. Make a Trading Risk Management Chart with EdrawMax

Risk management charts are important tools for making informed trading decisions. Wondershare EdrawMax makes creating these charts quick and easy with its template feature. Here are the steps for creating a trading risk management chart with the tool:

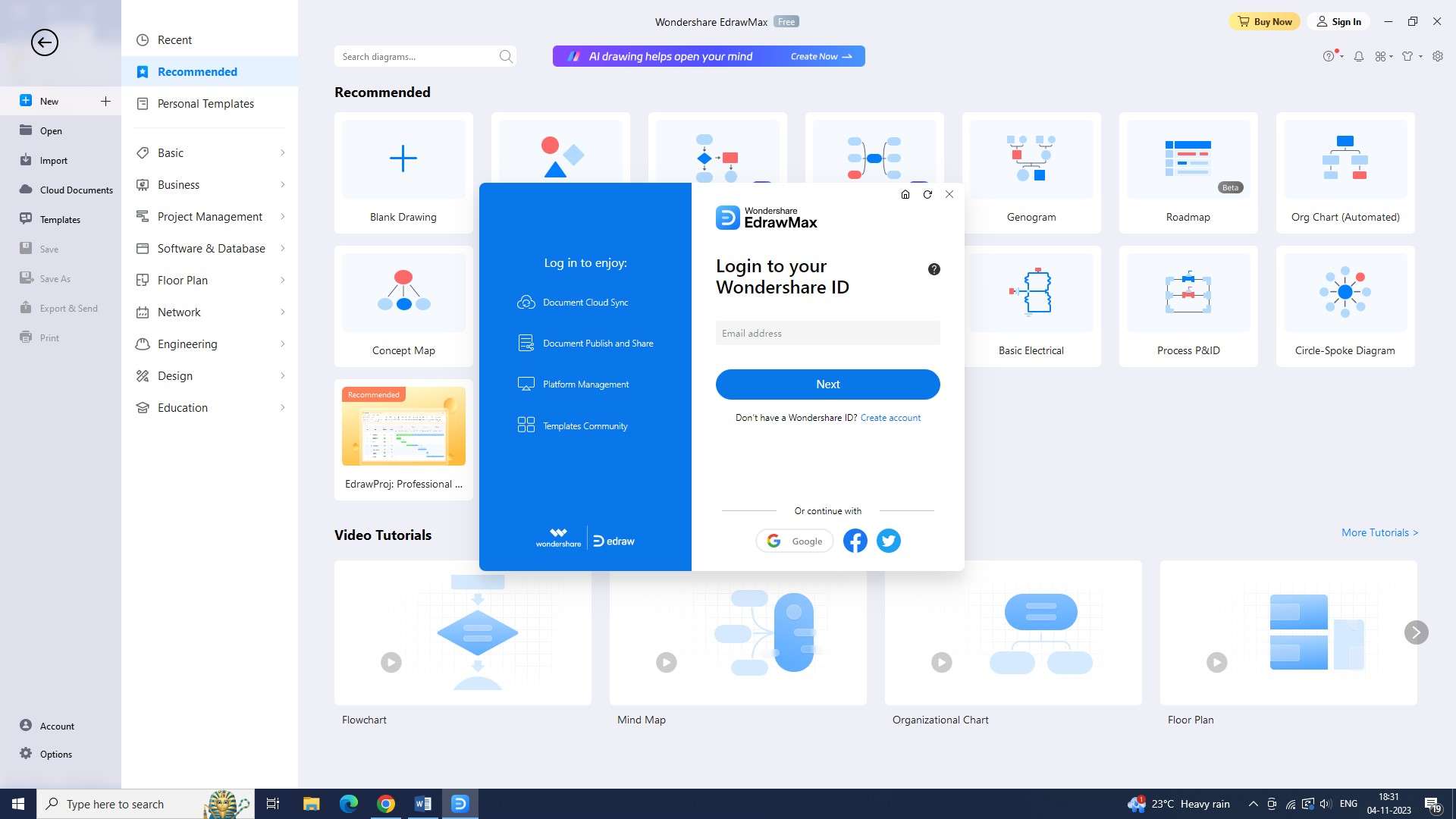

Step 1: Before you can begin using Edrawmax, you will need to log in to your account. Once you’re in, you can move ahead in the chart-making process.

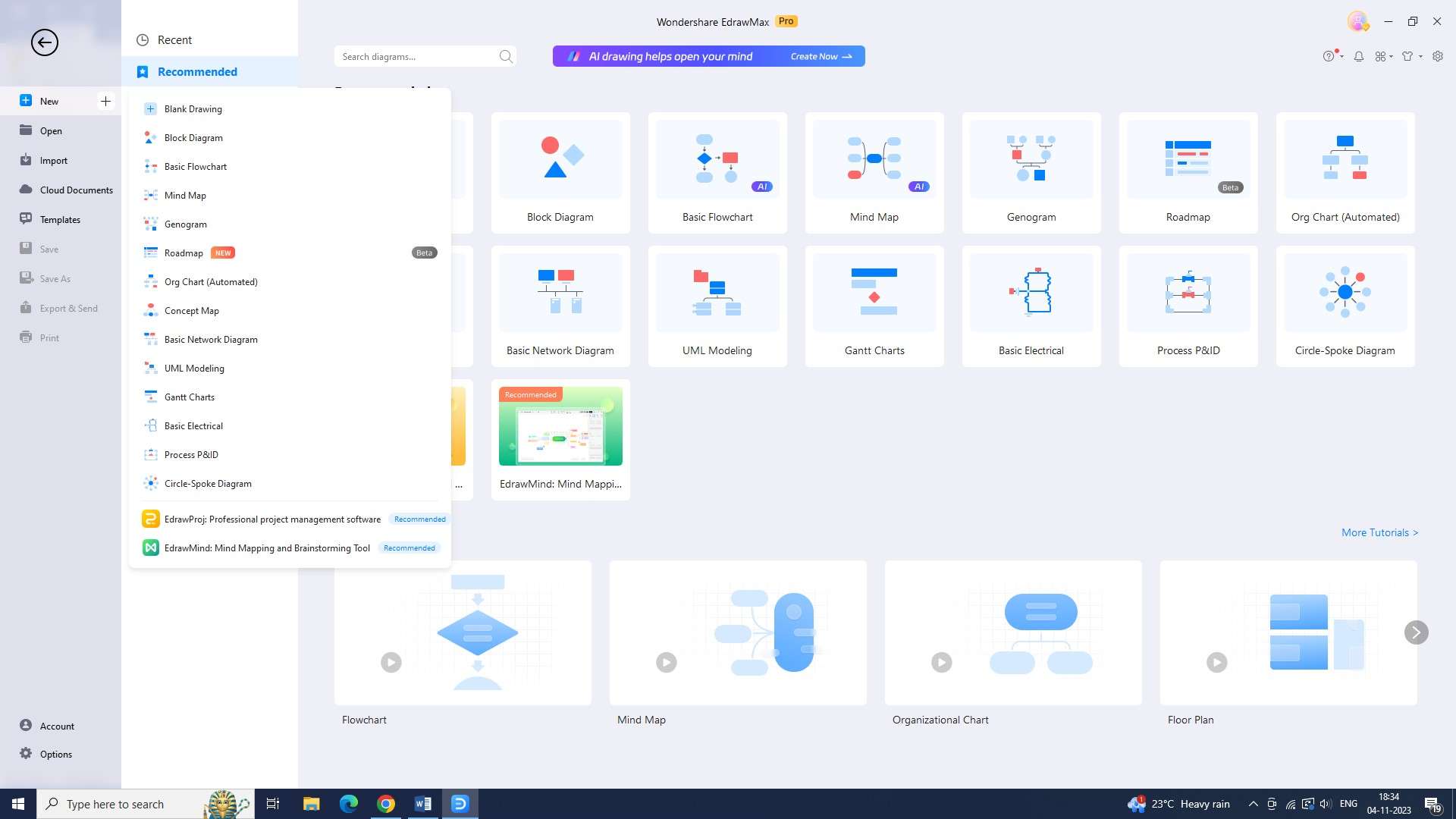

Step 2: In order to create a trading risk management chart, you will need to open a new document. This can be done by clicking on the plus symbol beside the “New” button.

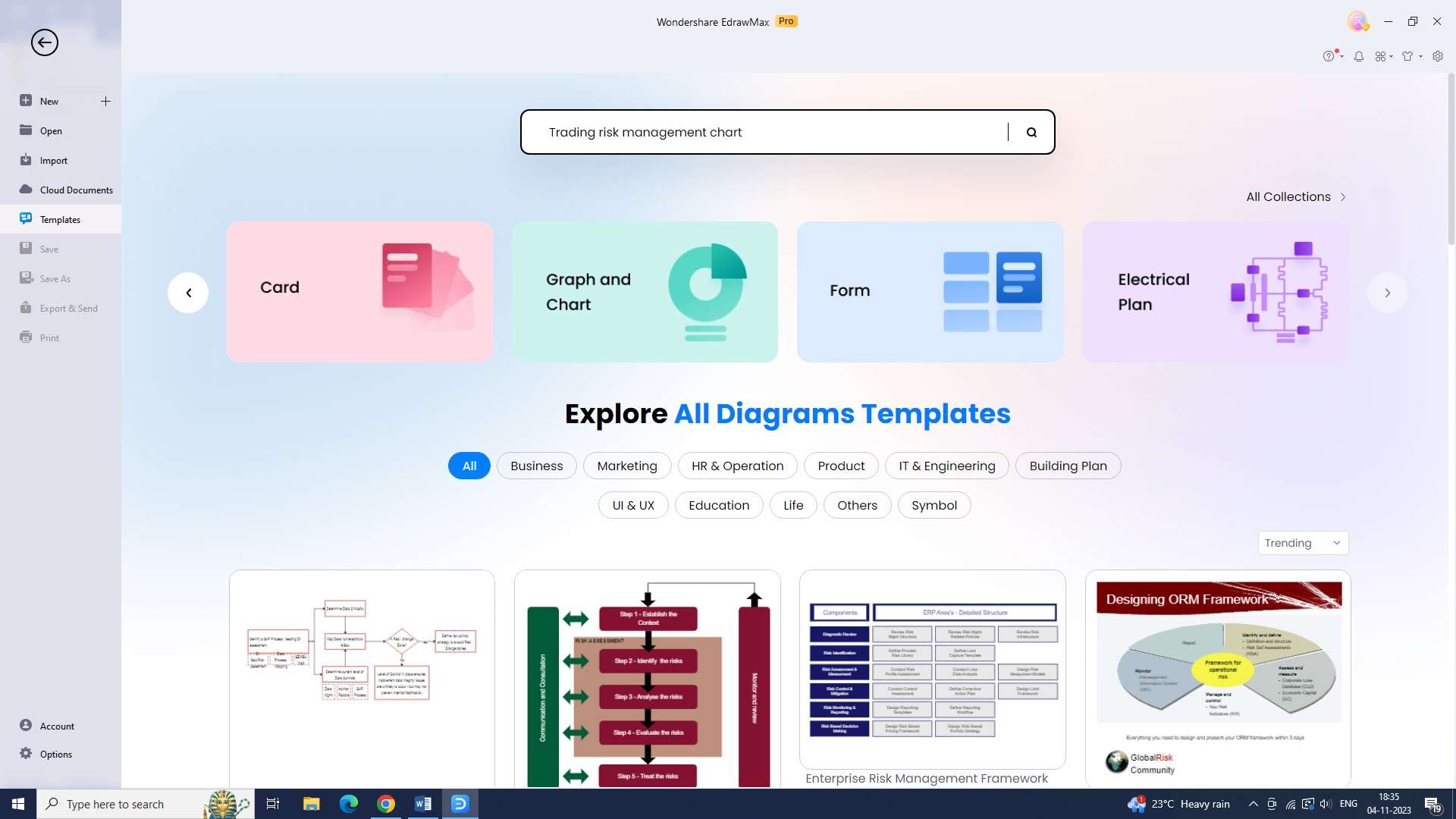

Step 3: Edrawmax provides several templates to choose from. Select a trading risk management chart template from the list of options.

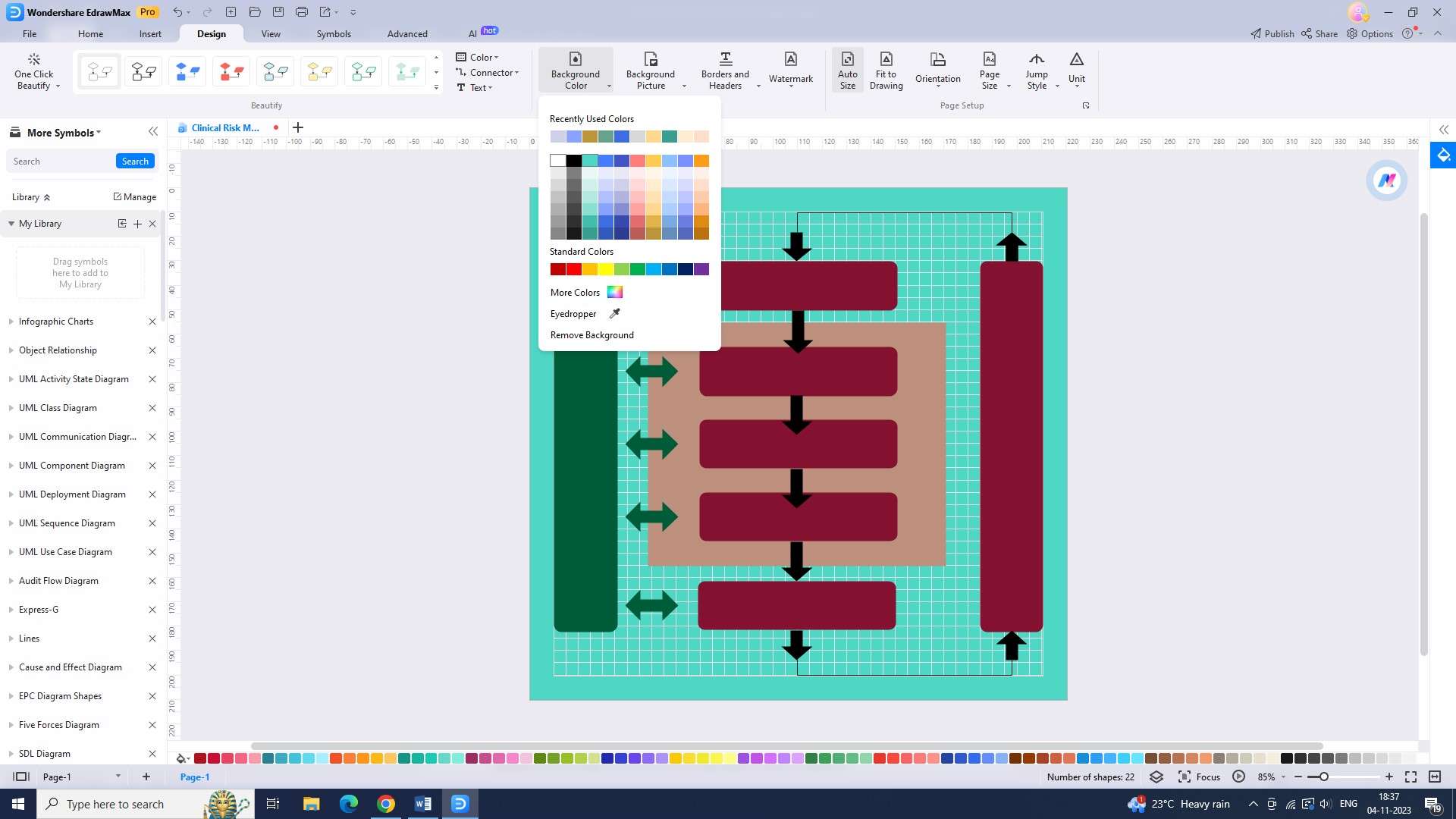

Step 4: The template will provide you with a basic structure, which you can customize according to your needs. You can change the color scheme layout, add or remove elements, and more.

Step 5: When you are happy with your chart design, you can start entering data into it. You can enter the information you want in the chart.

Step 6: After entering data, you can save the chart. This is done by selecting the ‘Save As’ option after going to “File.”

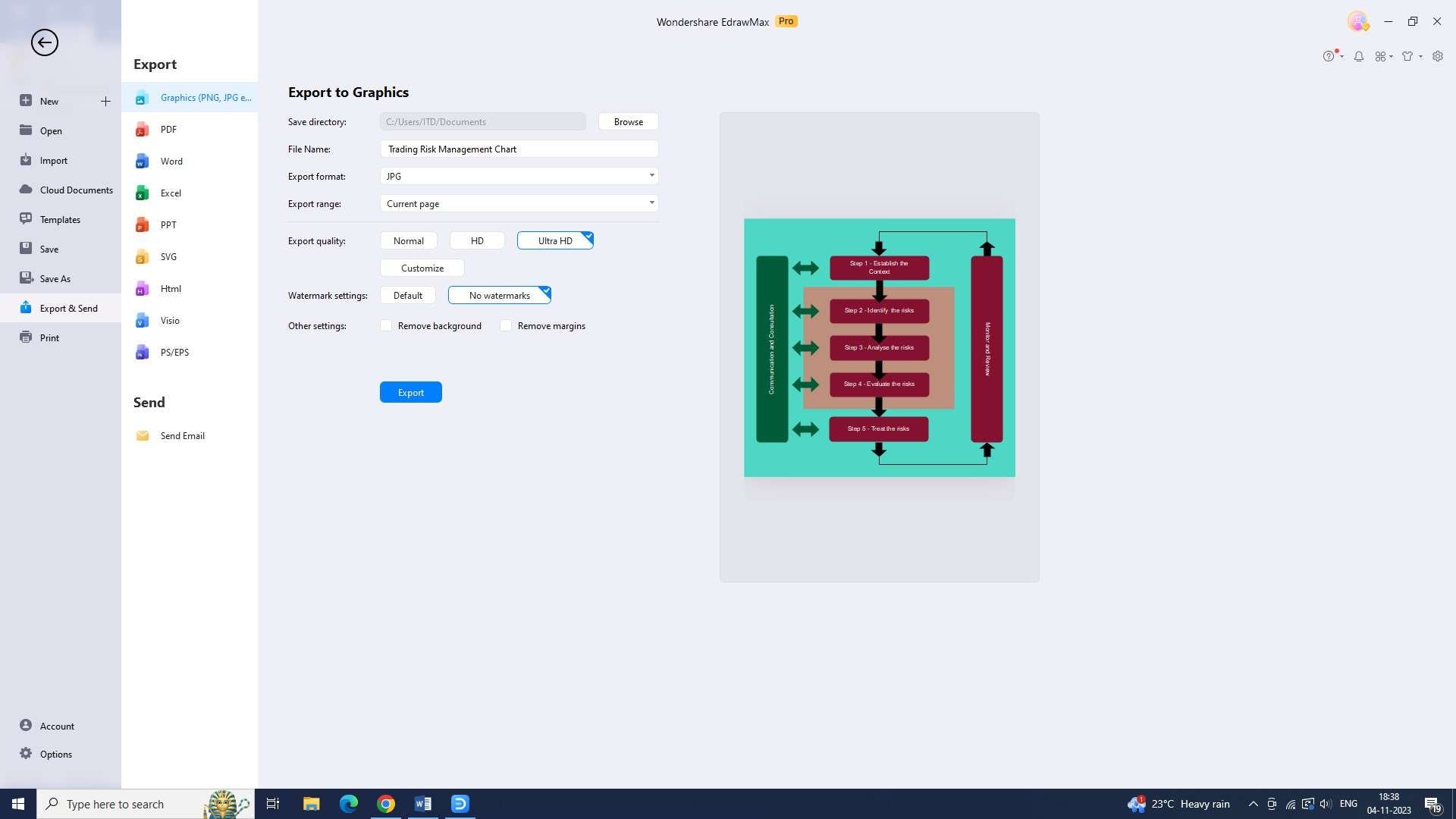

Step 7: Once you have saved the chart, you can export it for use in other applications. You can export the chart as a .pdf file or an image in popular formats like PNG and JPEG.

Final Thought

Trading risk management serves as a cornerstone for traders and investors seeking consistent profitability in an unpredictable market. By understanding the principles and strategies of risk management, traders can protect their capital, maintain emotional control, and make informed trading decisions.