Staying proactive in interest rate risk management is essential for organizations. By considering factors such as economic conditions, central bank policies, market expectations, and creditworthiness and utilizing techniques like duration analysis, yield curve analysis, scenario analysis, and stress testing, companies can successfully manage and reduce risk rates. Implementing strategies such as interest rate hedging and asset-liability management is crucial for protecting against potential risks.

In this article

Part 1. Overview of Risk Rate Management

Risk rate management refers to identifying, assessing, and mitigating the potential risks associated with changes in interest rates.

Interest rate risk management involves understanding the impact of interest rate fluctuations on financial instruments, such as loans, bonds, or investments, and implementing strategies to effectively manage and reduce these risks.

Part 2. Factors Influencing Risk Rates

Interest risk rates are affected by various factors. Those in charge of handling these factors must have in-depth knowledge about them. Eliminating these factors is essential for the smooth progress of an organization.

1. Economic conditions:Changes in economic indicators, such as inflation, GDP growth, or unemployment, can influence interest rates and subsequently impact risk rates.

2. Central bank policies:Monetary policy decisions by central banks can affect interest rates, leading to changes in risk rates and the need for interest rate risk management in banks.

3. Market expectations:Market sentiment and expectations about future interest rate movements can influence risk rates.

4. Creditworthiness:The creditworthiness of borrowers or issuers can impact the risk rates associated with interest-bearing instruments.

Part 3. Techniques for Assessing and Calculating Risk Rates

Assessing and calculating interest risk rates need techniques that are distinctive for the purpose. All major organizations use these techniques. They help in ensuring that risk rates are analyzed adeptly without any hindrances.

1. Duration analysis: Assessing bond or fixed-income investments’ sensitivity to interest rate changes.

2. Yield curve analysis: Analyzing the shape and movement of the yield curve to assess interest rate risks.

3. Scenario analysis: Evaluating the impact of different interest rate scenarios on financial instruments.

4. Stress testing: Assessing portfolios or investments’ resilience to extreme interest rate scenarios.

Part4. Strategies for Managing and Reducing Risk Rates

Any company’s top priorities are interest and exchange rate risk management and reduction. To ensure that interest risk rates are managed and lessened, some specific strategies should be implemented.

1. Interest rate hedging:Using derivatives to manage interest rate risks.

2. Asset-liability management:Matching assets and liabilities to reduce interest rate mismatches.

3. Diversification:Spreading investments to reduce concentration risk.

4. Regular monitoring and adjustment:Continuously monitoring and adjusting investment strategies.

5. Risk communication:Effectively communicating interest rate risks to stakeholders.

Part 5. Making a Risk Management Flowchart With EdrawMax

Using an online tool to create a rate risk management chart can help businesses analyze and mitigate financial risks, make informed decisions, track market trends, and effectively manage their exposure to interest rate fluctuation. These tools allow for easy customization and collaboration, making them a convenient and efficient solution for businesses of all sizes to effectively manage rate risk.

1) Wondershare EdrawMax

Wondershare EdrawMax is an advanced yet easy-to-use chart creation tool that provides comprehensive features to help you create and manage risk charts and diagrams. It offers a smart user interface and a wide range of templates and elements to customize your charts. With EdrawMax, you can customize your risk charts to be interactive, create data-driven visualizations, and even collaborate with colleagues in real time.

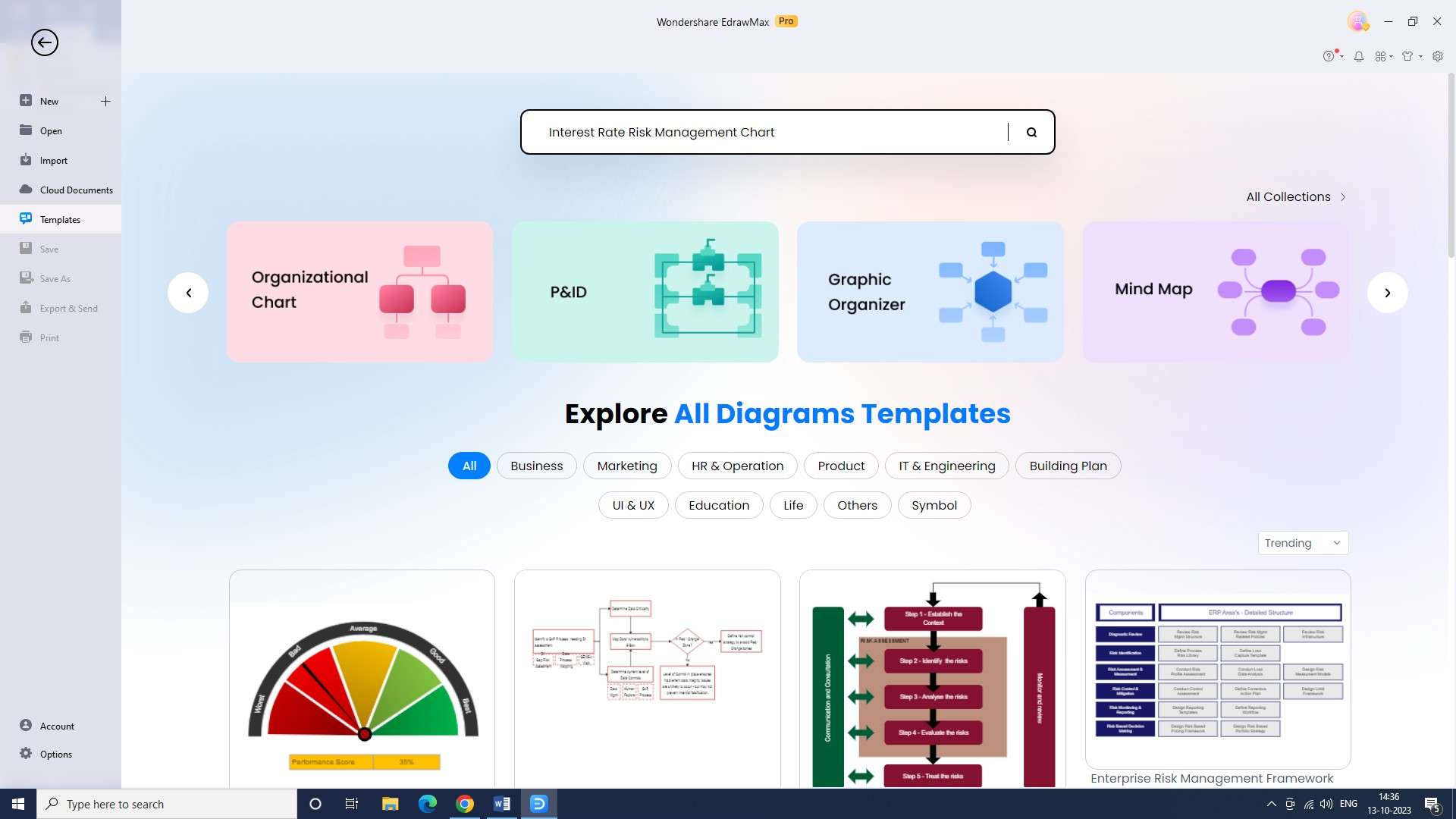

Step 1: Search for a template

After starting the program, search for an “Interest Rate Risk Management Chart” template from the template library. The long list of templates in EdrawMax is sure to amaze you.

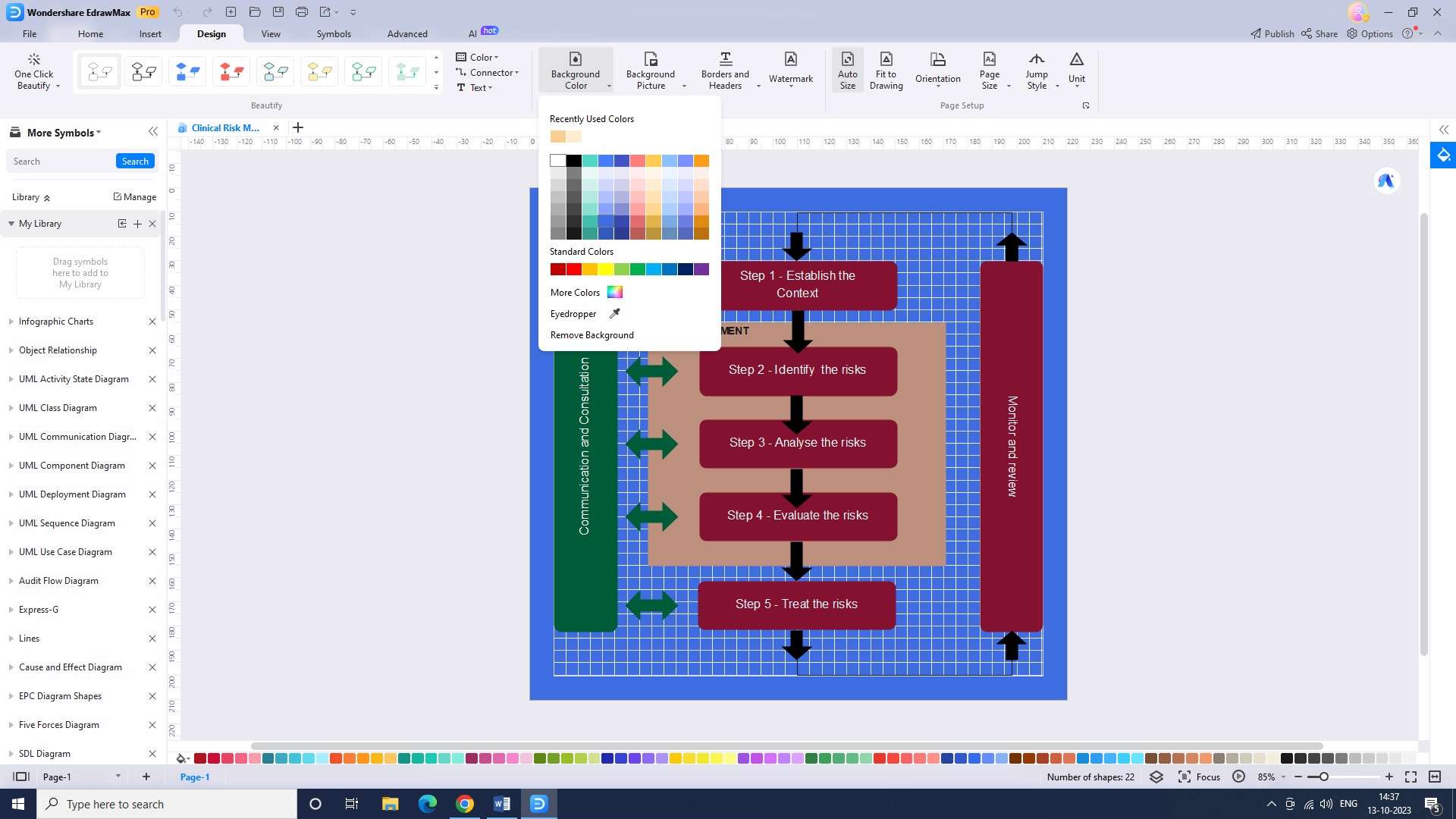

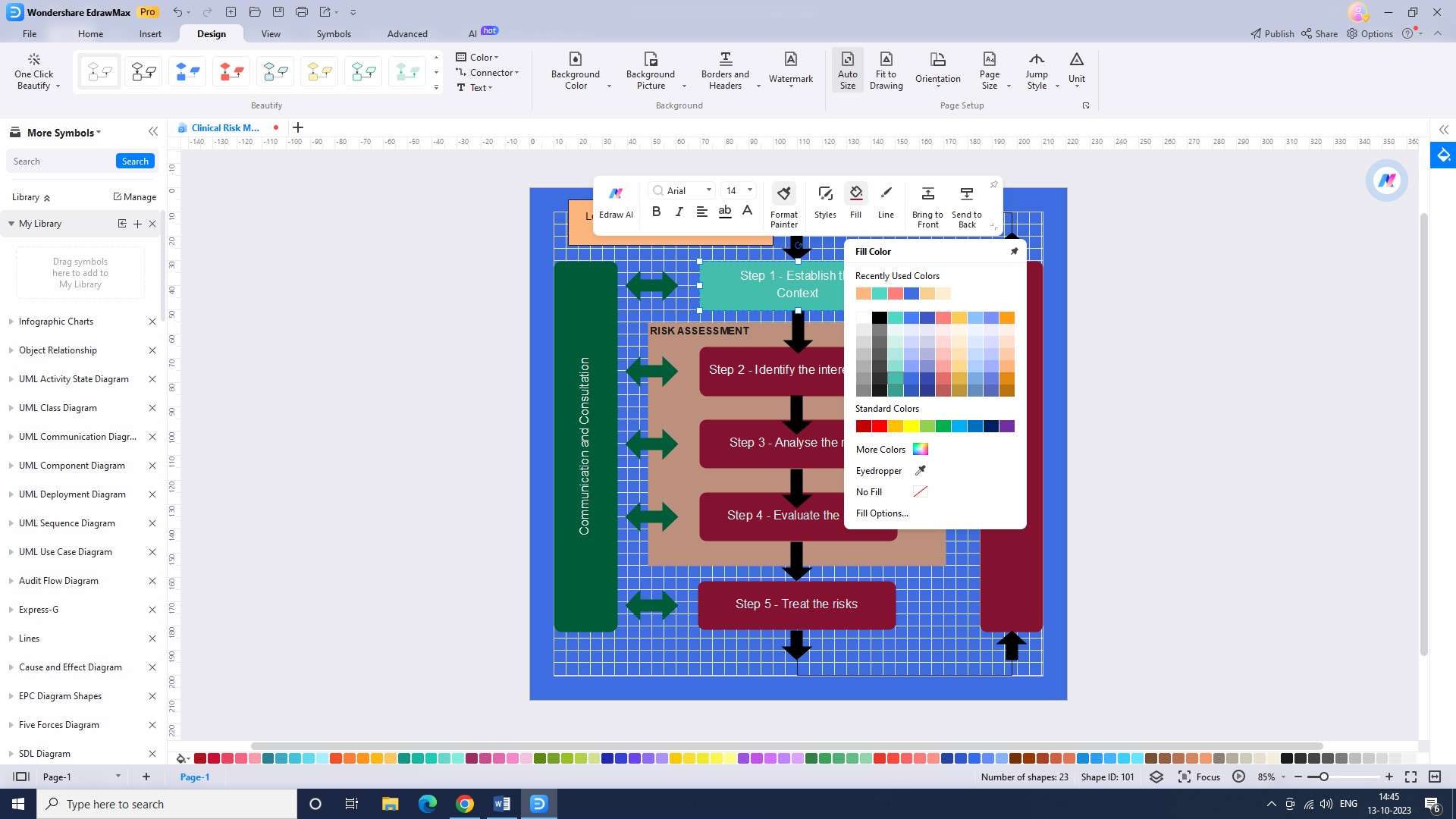

Step 2: Customize the template

Customize the template to fit your needs. You can change the template’s colors, fonts, size, and layout to make it fit your specific requirements.

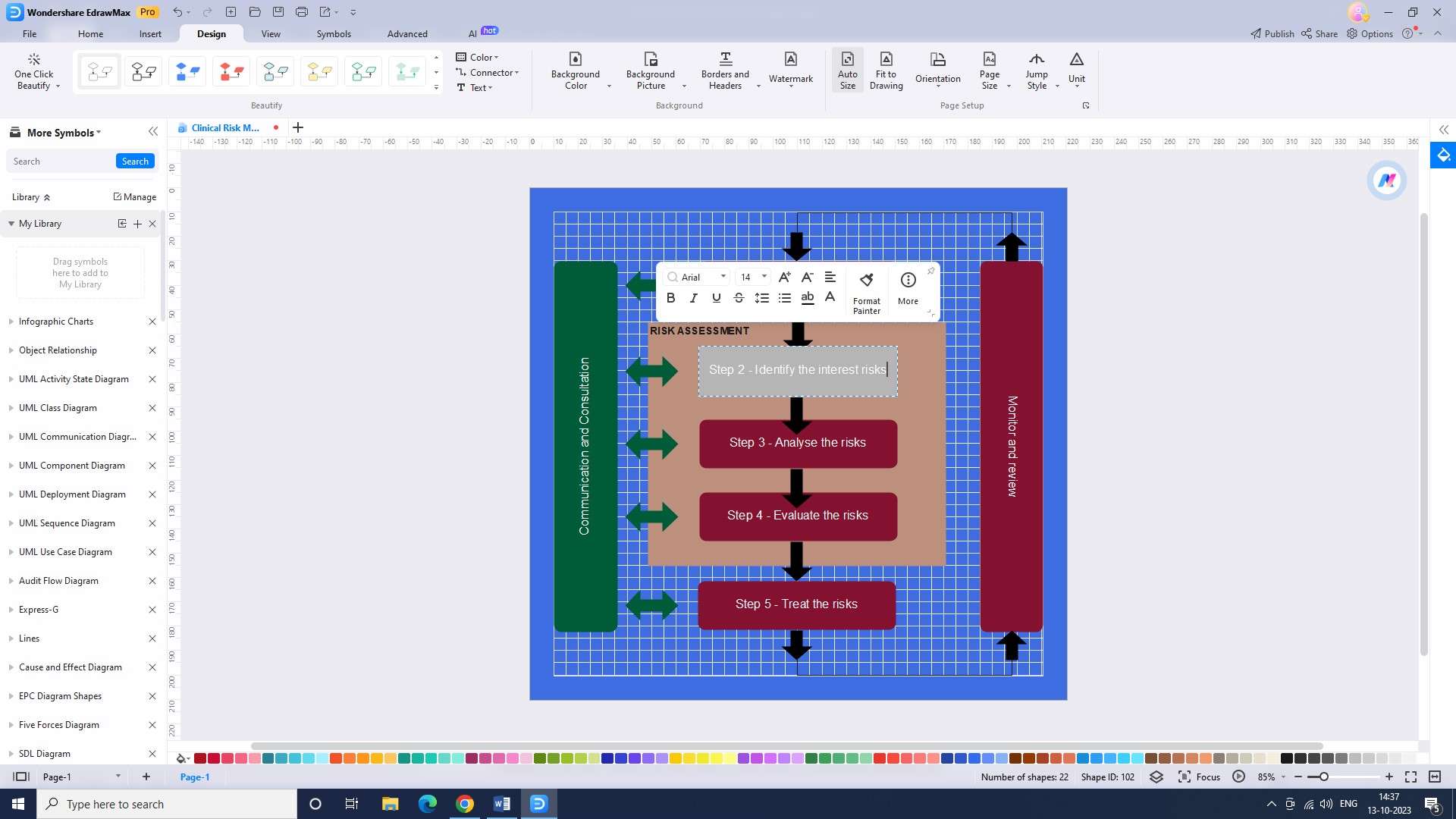

Step 3: Add in your own data

Add your own data to the chart. You can input any information or data you want to include in the chart, such as risk ratings, mitigation strategies, or historical data.

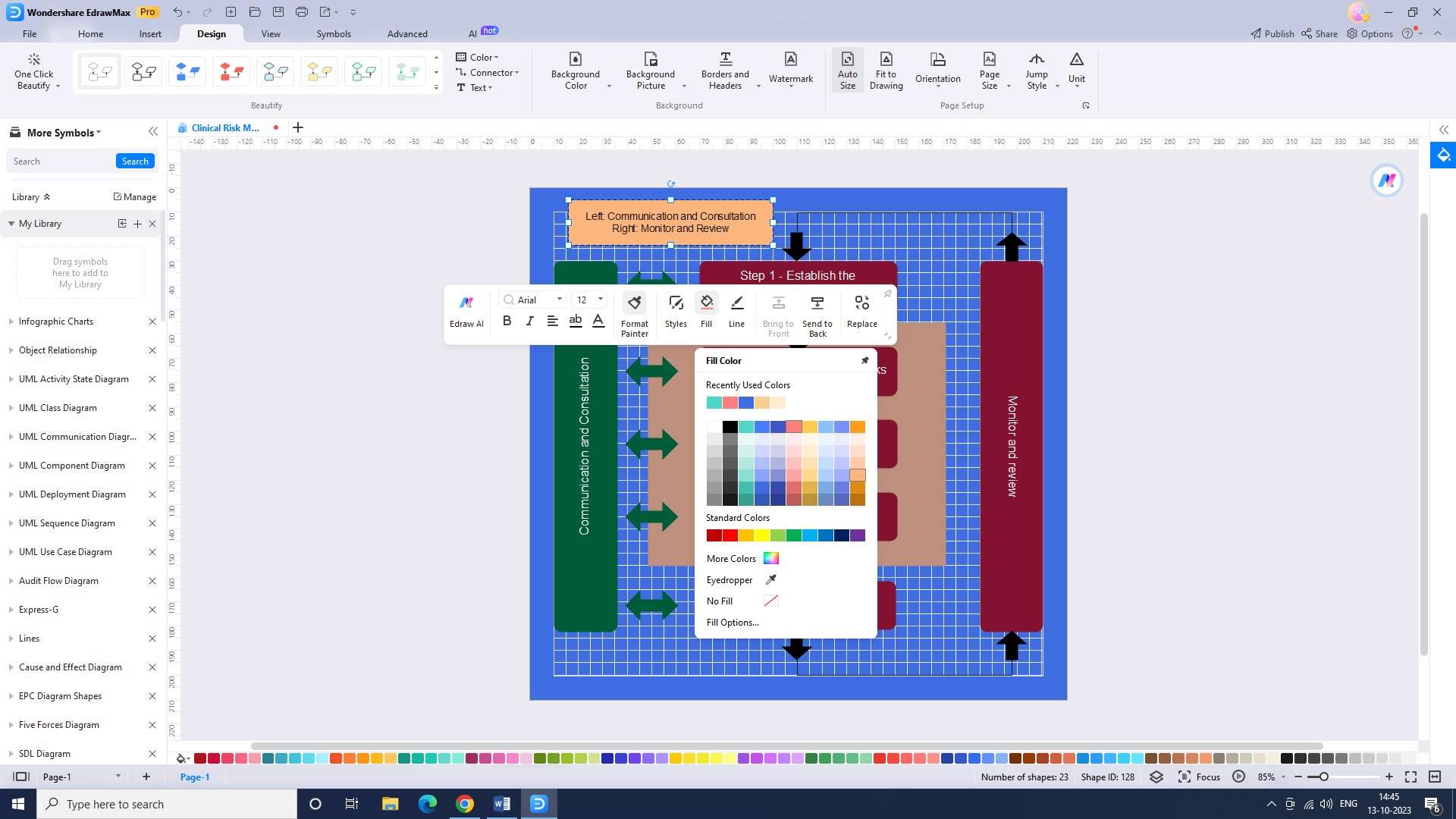

Step 4: Create a legend

The next step involves creating a legend. This is a key to help you identify different parts of the chart. Label each element or category in the chart and provide a clear explanation in the legend.

Step 5: Add additional elements

Add in any additional elements that you would like. This could include arrows, illustrations, or other visual elements to enhance the clarity and understanding of the chart.

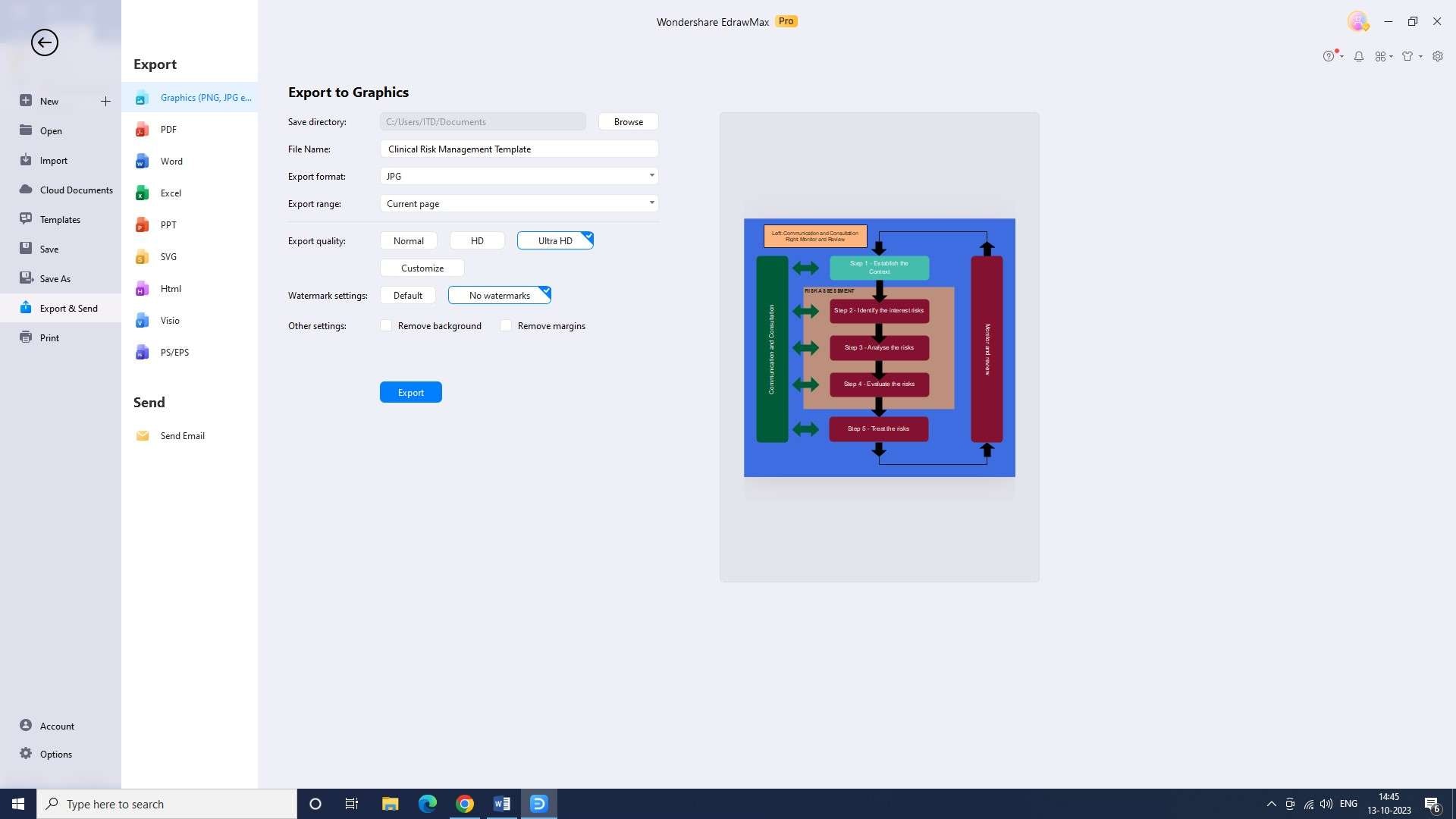

Step 6: Export the chart

Export the chart as an image, PDF file, or any other format you like. Save the chart in a format that is easily shareable or can be embedded in presentations or reports.

2) Creately

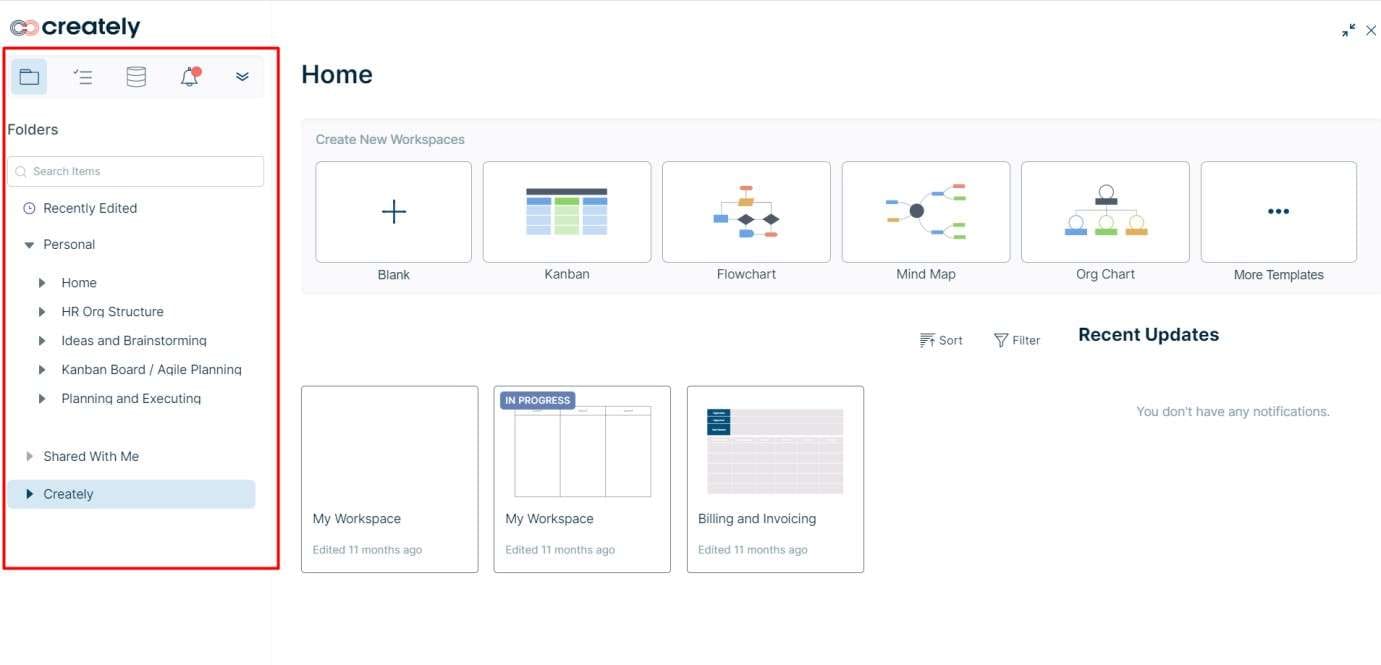

Creately is a risk chart creation tool that offers a wide range of customizable templates and elements to help you create professional risk charts and diagrams. It also provides powerful collaboration tools, allowing you to share your risk charts with colleagues and clients in real time.

Features:

- Pre-built risk assessment templates for interest rate management.

- Interactive simulations for modeling interest rate scenarios.

- Advanced data visualization capabilities with real-time interest rate data.

Pros:

- Side-by-side comparison of multiple interest rate scenarios for comprehensive analysis.

- Intelligent algorithms that suggest risk mitigation strategies.

- Seamless integration with popular risk management platforms.

Cons:

- Limited integration with financial data providers, requiring manual data input.

- Lack of advanced statistical analysis tools for interest rate management.

3) Miro

Miro is a risk chart creation tool that allows you to quickly and easily build interactive risk charts and diagrams. With Miro, you can collaborate with your team in real time, making it easy to gather input and make informed decisions.

Features:

- Risk heat map capabilities for visually representing interest rate risks.

- Integration with real-time market data sources.

- Automated risk alert functionalities.

Pros:

- Interactive virtual workshops for collaborative risk assessment.

- Extensive customization options for visualizing interest rate risks.

- AI-powered risk analytics for predictive insights.

Cons:

- Challenges in managing large data sets within the tool.

- Limited customization options for defining and configuring risk alerts.

Conclusion

Interest and exchange rate risk management plays a vital role in the financial industry by identifying, assessing, and mitigating potential risks associated with interest rate fluctuations. This overview explores the factors influencing risk rates, techniques for assessing and calculating them, and strategies for effectively managing and reducing these risks.