Liquidity is the lifeblood of any bank or financial institution. Having robust liquidity risk management frameworks in place is crucial for navigating the ups and downs of financial markets. This article will provide a comprehensive overview of liquidity risk management, its key components, and how banks can build effective frameworks to safeguard their financial health.

We will also explore liquidity risk solutions and diagramming tools to communicate risk frameworks. Read on to understand the vital role of proper liquidity risk management in banking.

Part 1: What is Liquidity Risk Management?

Liquidity risk management refers to the set of policies, controls, and processes used to ensure a bank has adequate liquidity to fund operations and meet obligations. This involves managing both daily liquidity needs and liquidity under potential stress events. Core liquidity risk management components include:

- Identification and measurement of liquidity risks

- Setting liquidity risk tolerance levels

- Monitoring liquidity exposures and metrics

- Managing and maintaining liquidity reserves

- Contingency planning for stressed liquidity events

- Reporting on liquidity risk to senior management and the board

Robust liquidity risk management is essential for any depository institution to thrive.

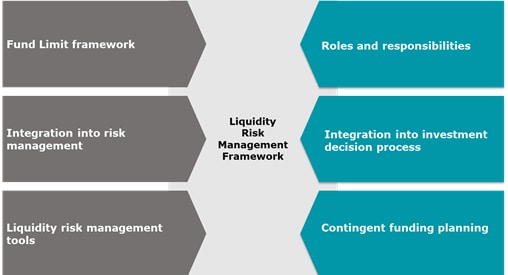

Part 2: Key Components in a Liquidity Risk Management Framework

An effective liquidity risk management framework contains several core elements:

- Policies and governance - Set liquidity risk management strategy, define metrics, and establish responsibilities.

- Risk identification - Identify sources of liquidity risk like funding mismatches, credit commitments, etc.

- Risk measurement and modeling - Quantify liquidity risks using metrics, ratios, stress testing, and scenario analysis.

- Risk monitoring - Track liquidity exposures through reports, analysis of key risk indicators, and early warning signals.

- Risk control and mitigation - Maintain liquidity buffers, diversify funding sources, and set limits.

- Reporting and communication - Timely reporting to managers, board members, and regulators on liquidity risk.

- Contingency planning - Develop playbooks for responding to liquidity crises.

- Independent oversight - Internal/external audits and reviews.

These components provide structure, transparency, and accountability in liquidity risk management.

Part 3: Overview of Liquidity Risk Management in Banks

Banks have unique liquidity risk profiles due to their role in maturity transformation - using short-term deposits to fund long-term loans. This creates a mismatch between short-term liabilities and long-term, less liquid assets. Banks are also vulnerable to large unexpected depositor withdrawals.

The global financial crisis highlighted the imperative for more rigorous liquidity risk management in banks. While regulation has increased, the ultimate responsibility for sound liquidity risk management remains with a bank's board and management.

Part 4: Understanding Funding and Liquidity Risk Management

Funding liquidity risk management focuses specifically on managing the risk that a bank cannot meet its current and future cash flow obligations. This requires diversifying funding sources, monitoring dependency on volatile funds, and maintaining contingency funding plans.

Banks fund their balance sheets from various short and long-term funding sources:

- Retail deposits (stable core source but interest rate somewhere)

- Wholesale funding markets (higher risk)

- Long-term debt issuance

- Equity capital

Banks aim for stable, diversified funding structures. Overreliance on short-term wholesale funding can quickly evaporate in a crisis. A best practice is to regularly stress test funding needs under various scenarios. Constructing a funds transfer pricing system can also optimize funding costs across the organization.

Part 5: Best Liquidity Risk Management Solutions for Banks

Advanced analytics and technology solutions can greatly enhance liquidity risk management. Leading options include:

- Liquidity forecasting models for dynamic projections of cash inflows/outflows.

- Liquidity buffers and ratios optimization models.

- Risk dashboard technology for monitoring exposures.

- Automation of regulatory reporting.

- Trading book risk and collateral management systems.

- AI and machine learning applications for predictive analytics and insights.

Dedicated liquidity risk management systems centralize all processes into a streamlined architecture. This improves risk transparency, agility in responding to market fluctuations, and governance.

- You may need: AI for risk identification

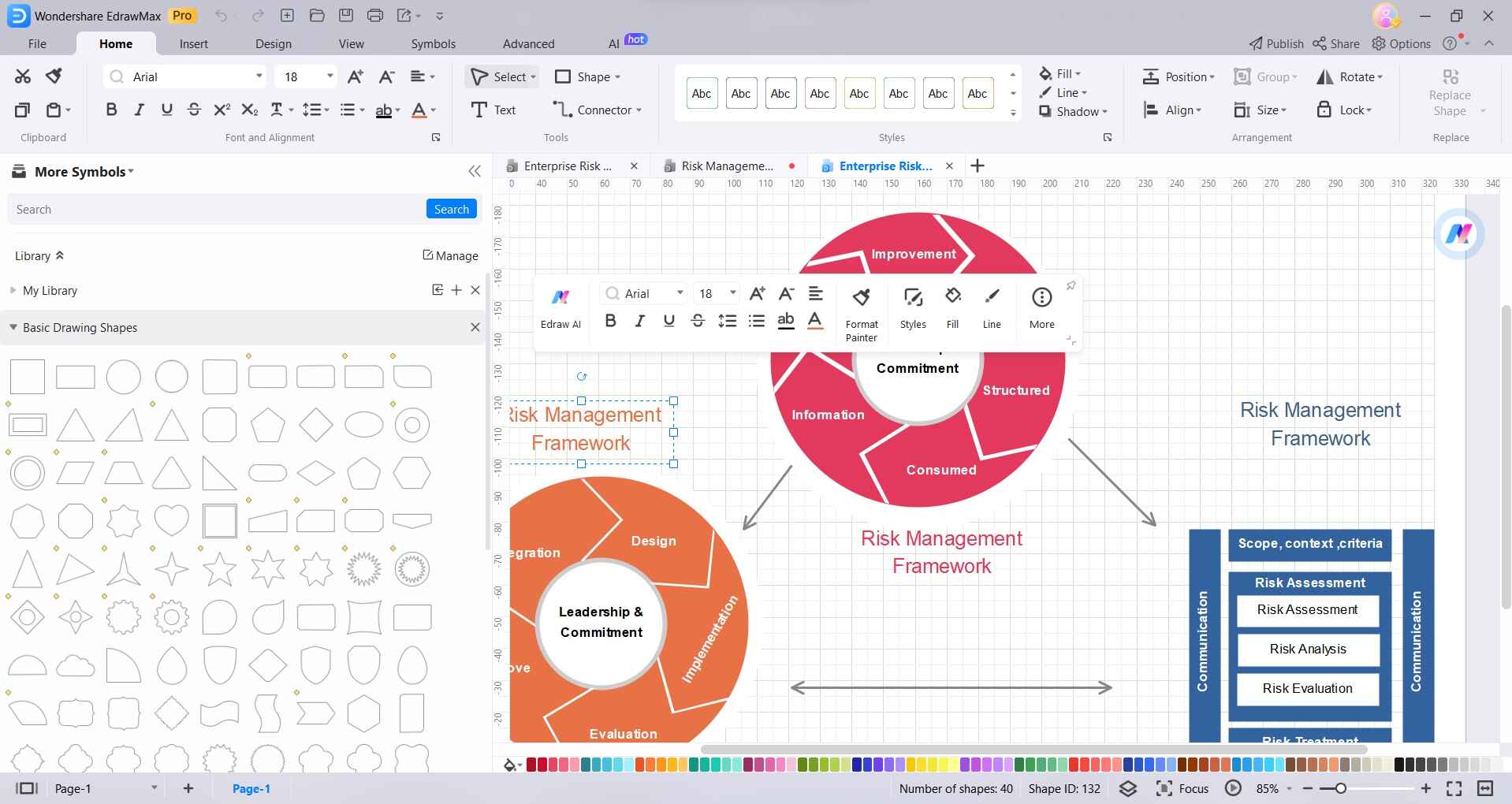

Part 6: Creating a Liquidity Risk Management Diagram with EdrawMax

Edrawmax is a versatile diagramming and visualization software that allows banks to map out liquidity risk frameworks. Key features:

- Intuitive drag-and-drop interface.

- Numerous risk management templates.

- Real-time collaboration.

- Customizable styling and formatting.

- Icons, images, hyperlinks.

- Export diagrams into various formats.

Steps to create a liquidity risk management diagram:

Step 1:

Launch the EdrawMax software on your computer. In EdrawMax, navigate to the template gallery and search for "Risk Management" in the search bar. Choose a template that suits your specific needs and click on it to open.

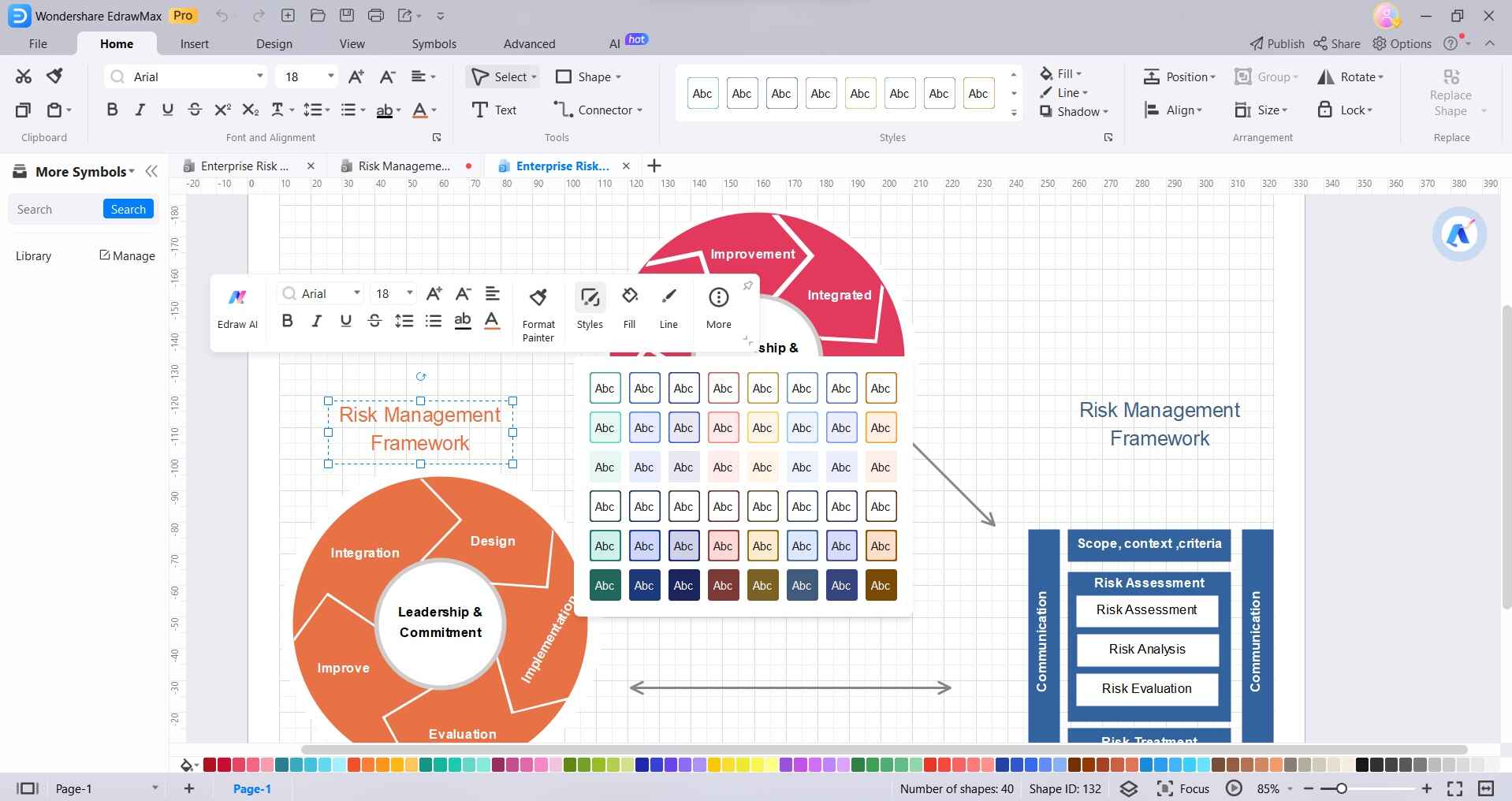

Step 2:

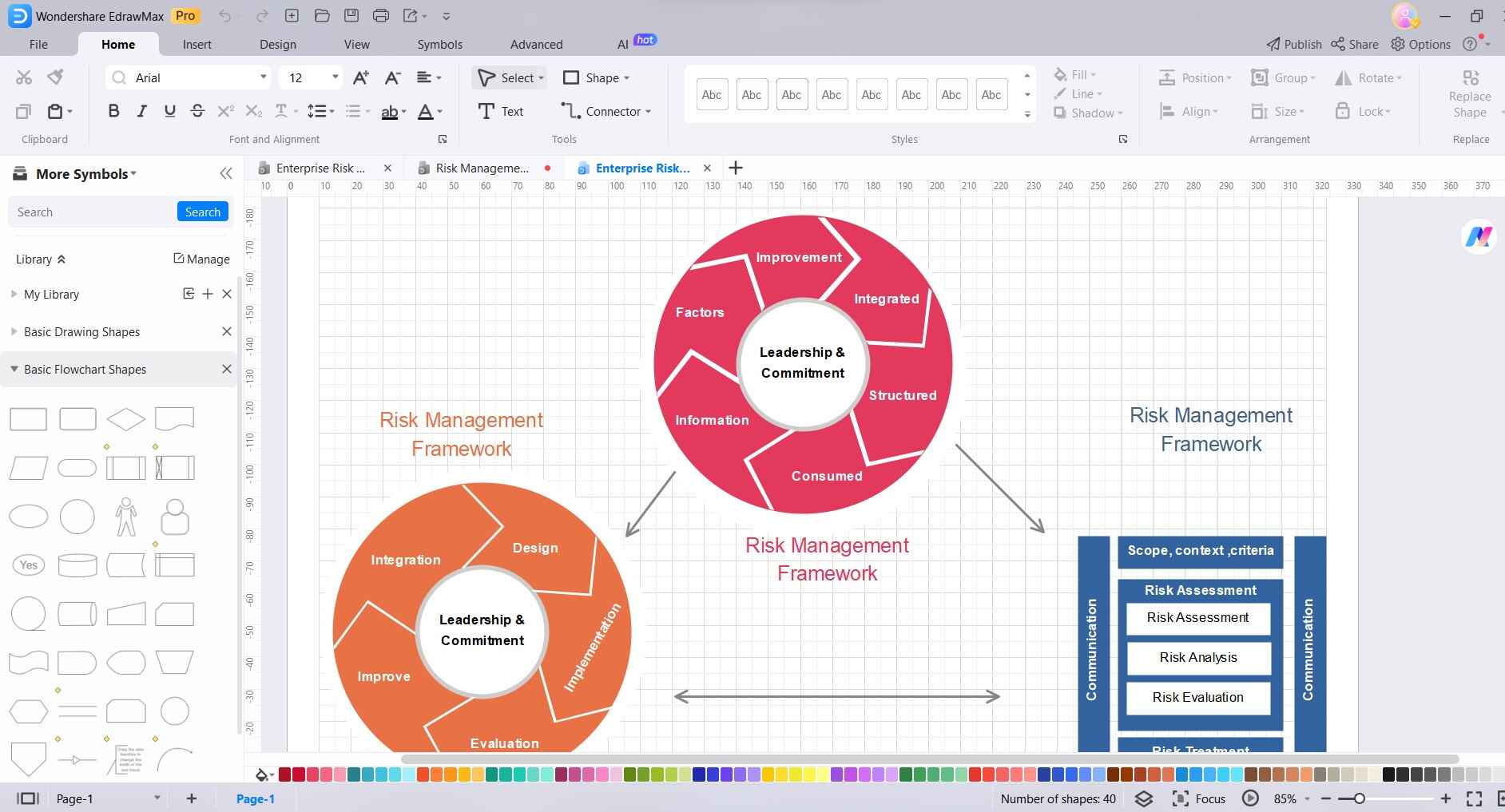

Once the template is open, you can customize it to fit your specific risk management scenario. This may include adding or removing elements, changing colors, and modifying text.

Step 3:

Use the shapes and tools provided in EdrawMax to add the various components of your risk management framework.

Step 4:

Click on the element (shape, text box, etc.) you want to format and select “Styles”. Click on the respective color boxes to choose a new color from the color palette.

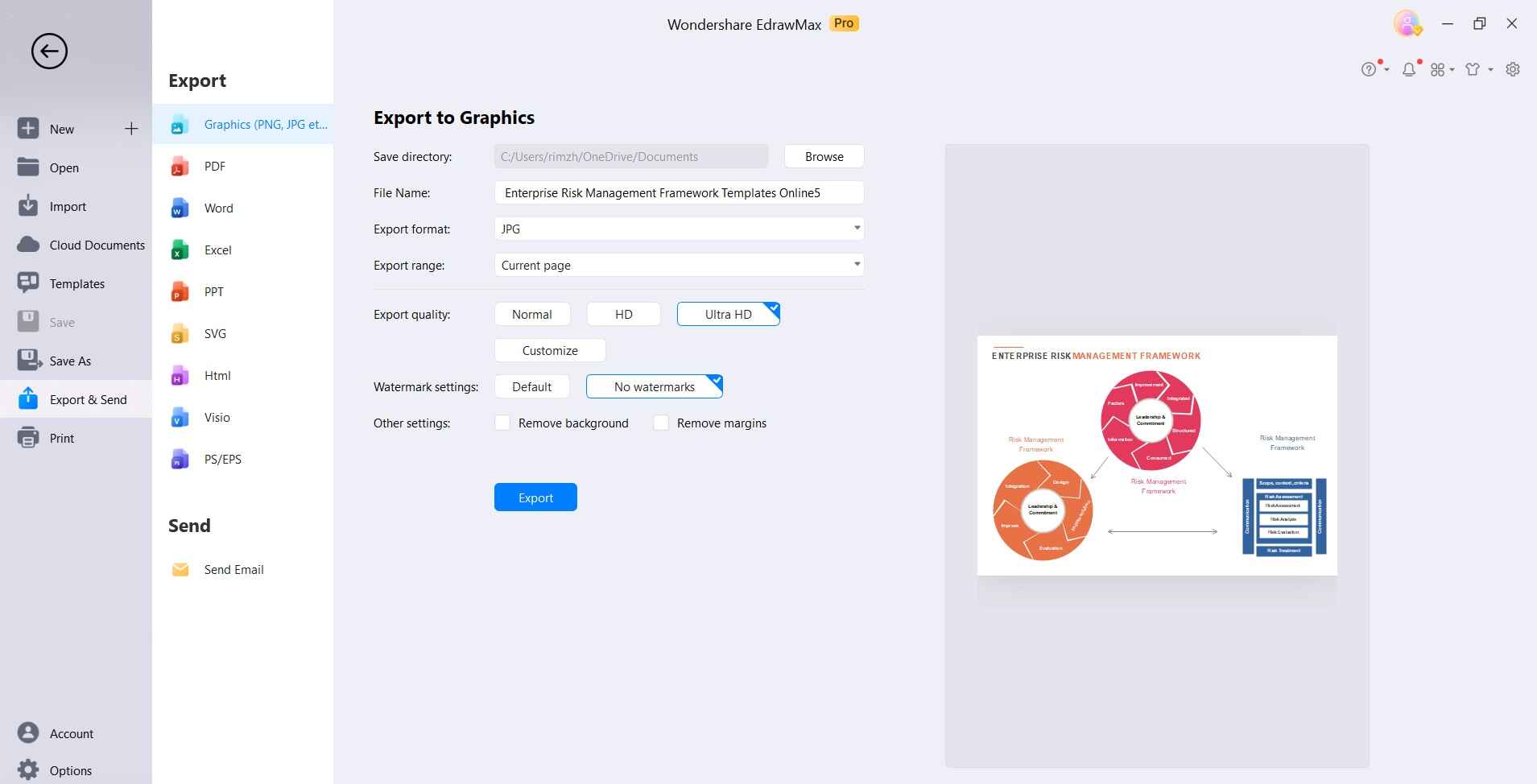

Step 5:

Once you're satisfied with the diagram, save your work to your computer.

Conclusion

Constructing robust liquidity risk management frameworks enables banks to successfully ride the fluctuating tides of business cycles and economic conditions. The key foundations include effective policies, analytics, technology solutions, and responsive controls.

Diagramming tools like EdrawMax facilitate clear communication of risk management programs to all stakeholders. Keeping sight of the lighthouse ultimately leads organizations safely along their journey toward sustained financial viability and success.