Liquidity risk management is a critical function for banks and financial institutions. Maintaining adequate liquidity ensures a bank can meet its financial obligations, fund operations, and provide credit to customers.

This article provides a comprehensive guide to understanding and managing liquidity risk in the banking sector. Proper liquidity risk management is key to ensuring the safety and soundness of banks.

In this article

Part 1: What is Liquidity Risk?

Liquidity risk refers to the risk that a bank may not be able to meet short-term financial demands. This occurs when the bank cannot easily convert assets into cash or access funding to meet obligations. Liquidity risk arises from mismatches in the timing of cash inflows and outflows. Banks make long-term loans but also need to honor short-term deposits and withdrawals. If unusually high withdrawals occur, the bank may struggle to fund operations and payments. Liquidity risk can spiral into solvency issues if a bank cannot access sufficient funding.

Effective liquidity risk management ensures financial institutions have adequate liquid assets and funding sources to cover near-term obligations. This provides resilience under stress and prevents disruptions to operations.

Part 2: Types of Liquidity Risks

There are two main types of liquidity risks that banks face:

Funding Liquidity Risk:

This occurs when banks cannot easily access funding to operate and meet obligations. It entails the risk of higher funding costs and being unable to raise funds on short notice. Funding liquidity risks arise from overreliance on short-term wholesale funding sources.

Market Liquidity Risk:

This arises when banks have trouble selling assets quickly without a large loss in value. Assets become illiquid when trading activity declines dramatically in stressed markets. Banks may be forced to sell assets below fair value which can weaken their balance sheet.

Part 3: Overview of Liquidity Risk in Banks

Banks are inherently vulnerable to liquidity risk due to the maturity mismatch between short-term liabilities and long-term assets. Deposits from customers are payable on demand or at short notice. However, banks use these funds to make long-term loans to individuals and businesses. Other sources of liquidity risk include draws on credit commitments, derivatives exposures requiring collateral, and unexpected customer deposit withdrawals.

- Related reading: Risk Management in Banking: Risks and Strategies

Liquidity issues were a major contributor to bank failures during the global financial crisis. Many banks lacked sufficient high-quality liquid assets, diversified funding sources, and robust risk management. This underscored the need for improved regulatory oversight and bank risk management evolution. Basel III introduced key reforms including the Liquidity Coverage Ratio and Net Stable Funding Ratio. Banks now face more rigorous regulatory liquidity requirements.

Part 4: Best Practices for Managing Funding Liquidity Risks

Banks utilize various approaches to effectively manage funding liquidity risk, including:

- Diversifying funding sources - Banks avoid overreliance on any one type of funding by maintaining a stable mix of core deposits, long-term debt, equity, and wholesale funding sources.

- Carrying a liquidity buffer - Holding a portfolio of high-quality liquid assets allows banks to readily meet spikes in funding needs. Assets like cash and government bonds can quickly be sold or used as collateral.

- Monitoring early warning indicators - Track metrics like deposit outflows, funding concentrations, and asset quality changes to get early warning of liquidity issues.

- Performing liquidity stress tests - Model potential stressed liquidity scenarios and assess whether current liquidity is adequate. Tests help identify vulnerabilities.

- Having a contingency funding plan - Document how the bank will access backup liquidity options in a crisis. Sources can include asset sales, lines of credit, Federal Reserve funding, etc.

Part 5: Creating a Risk Management Diagram Using EdrawMax

EdrawMax is a versatile diagramming software tool that can help banks map out and visualize their liquidity risk management frameworks.

- Intuitive drag-and-drop interface to easily create over 210 types of diagrams like flowcharts, mind maps, org charts, and more

- Numerous premade risk management template examples to use as a starting point

- Ability to collaborate with team members by sharing created diagrams in real-time

- Customizable formatting, styling, colors, and fonts to tailor diagrams

- Tools to add icons, images, hyperlinks, and multimedia content

- Support for exporting and sharing files in various formats like PDF, JPG, HTML, etc.

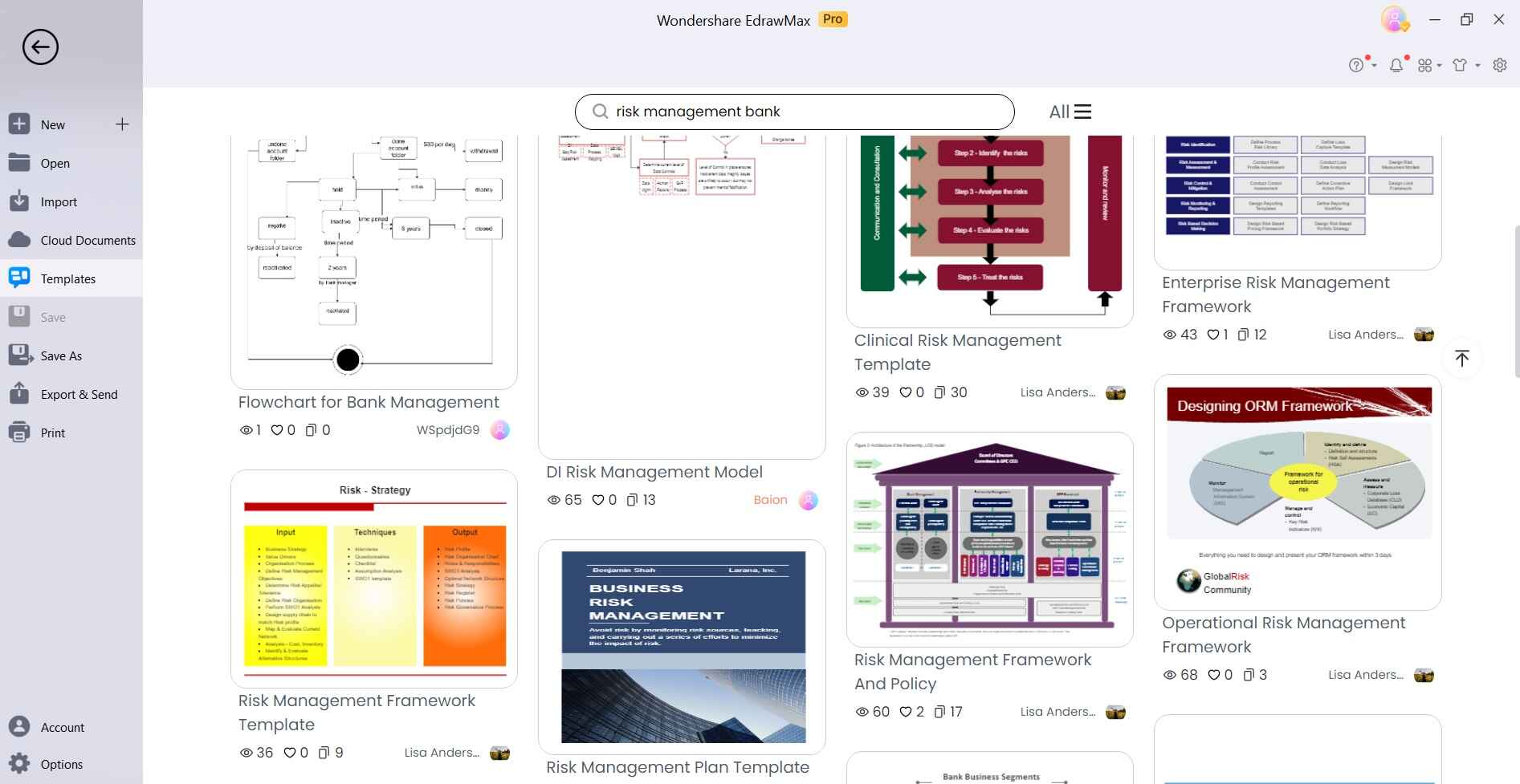

Below are some key steps to create a liquidity risk management diagram in EdrawMax:

Step 1:

Open a new EdrawMax software and switch to the “Template” category. Search for a suitable “Risk Management” template to get started.

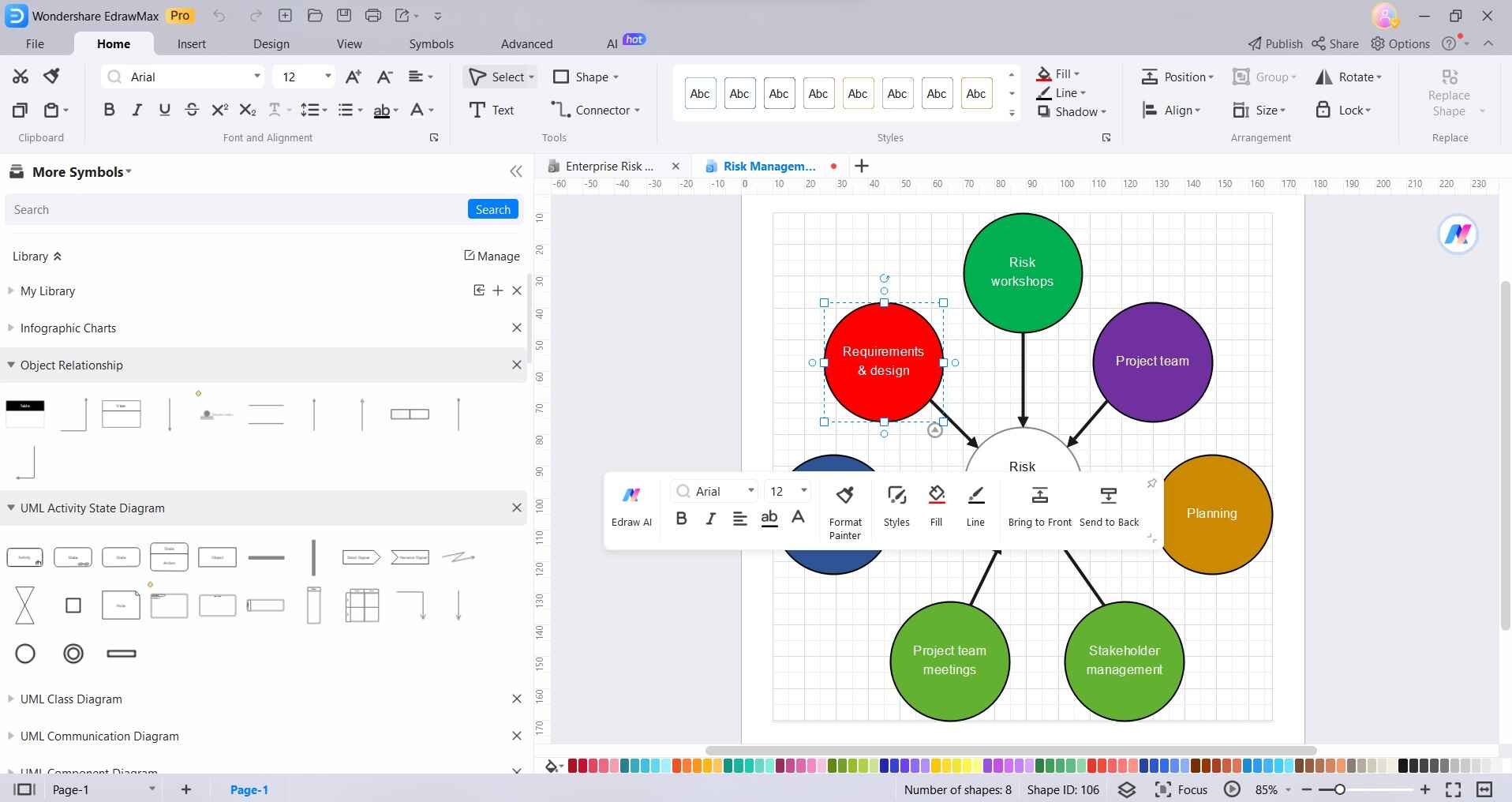

Step 2:

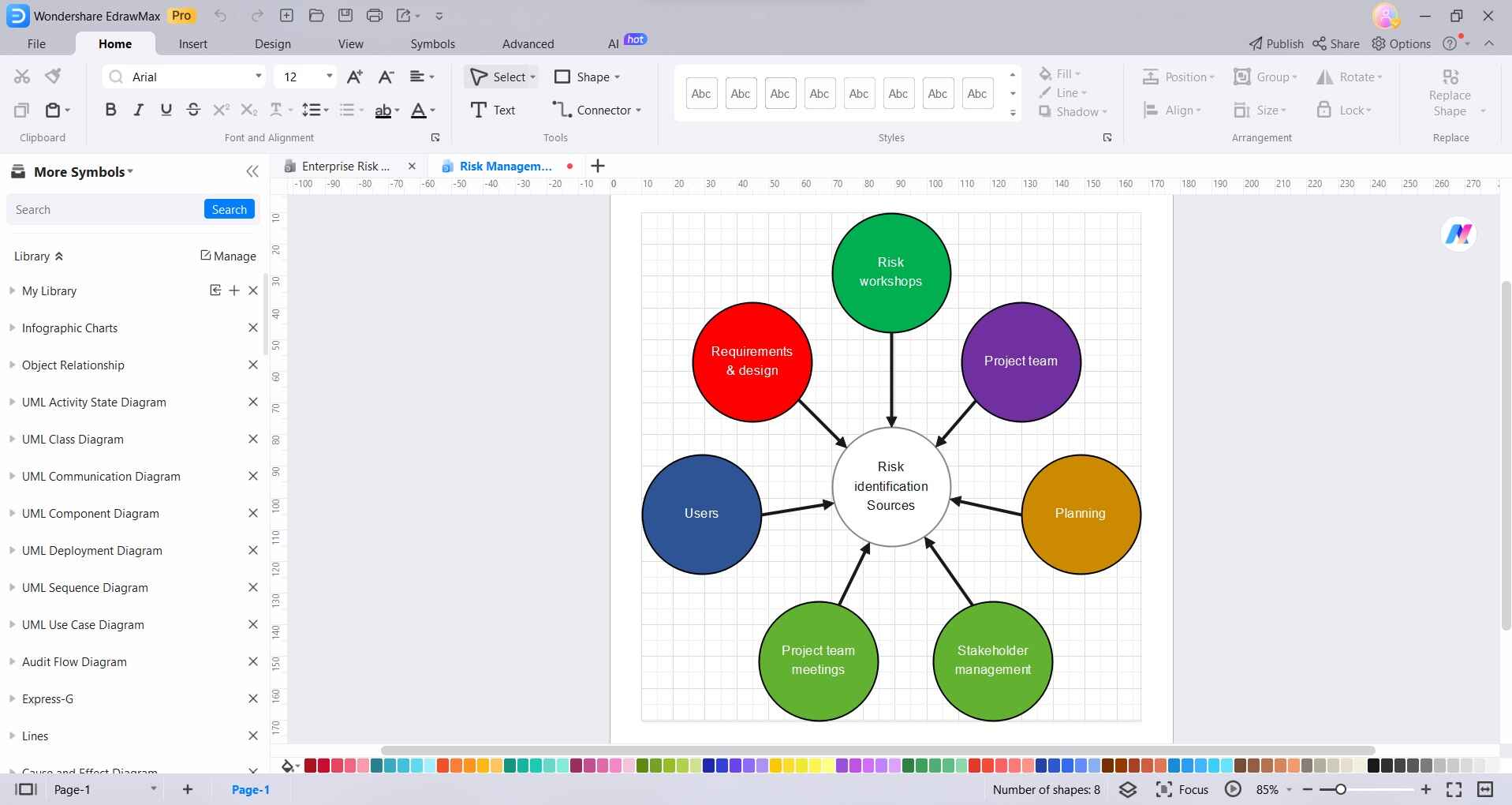

Drag and drop symbols onto the canvas to represent processes like risk identification, measurement, monitoring, controls, and reporting.

Step 3:

Use connecting lines and arrows to show the relationships and flow between symbols.

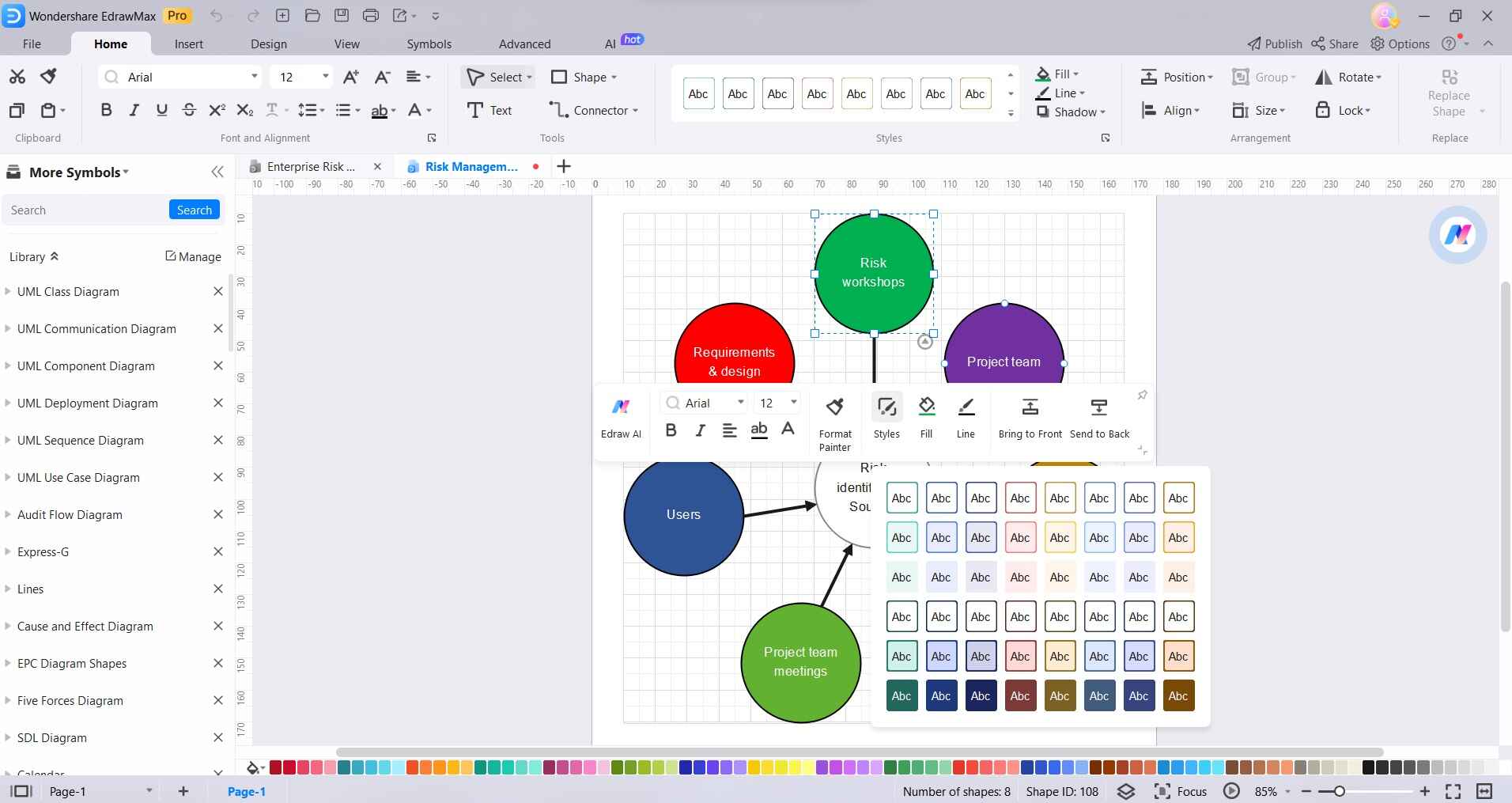

Step 4:

Customize the visual style, colors, fonts, etc. to match the bank's branding. Add text and labels to explain the processes and procedures.

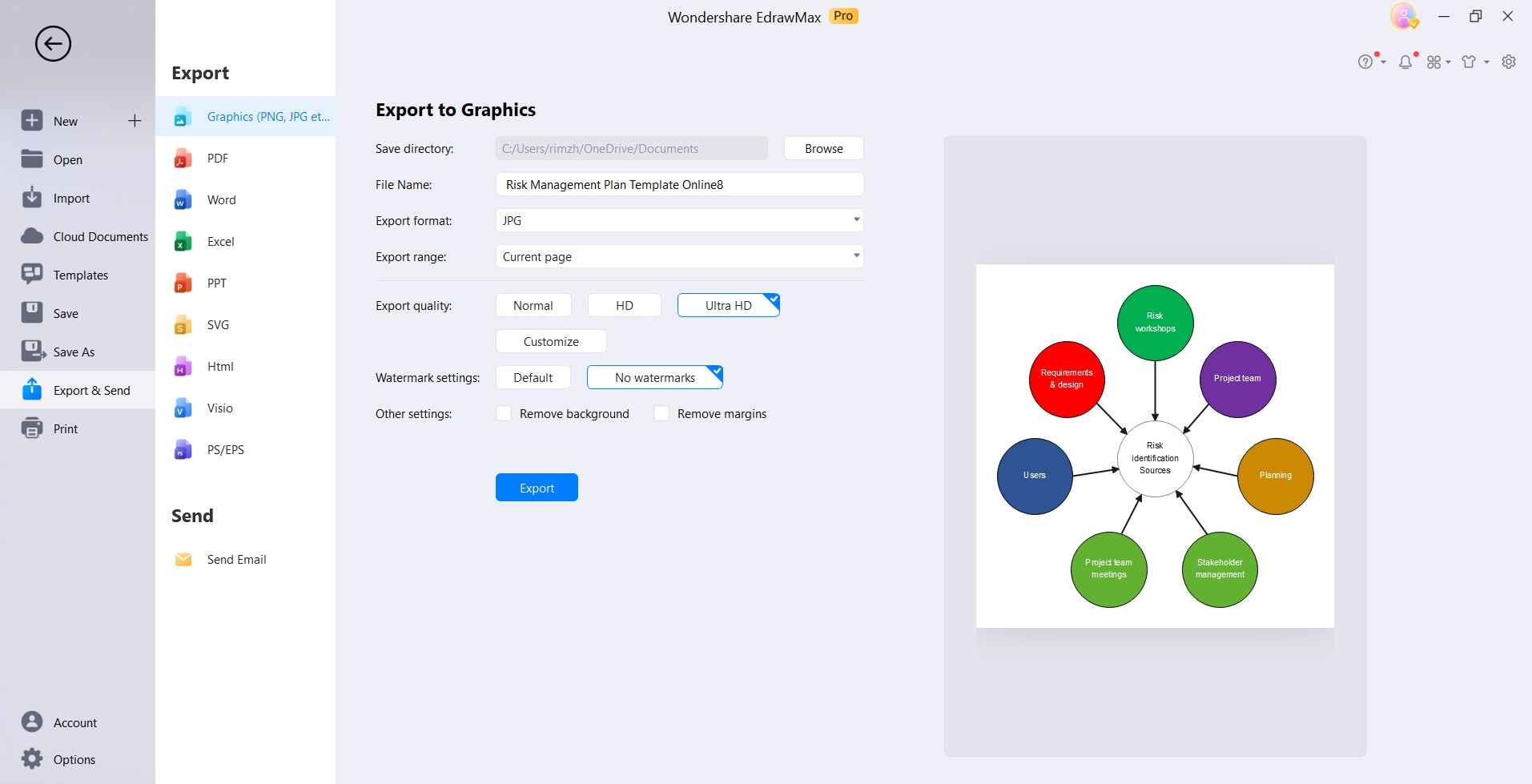

Step 5:

Export the completed diagram into image or PDF formats to share with stakeholders.

Conclusion

Effective liquidity risk management is crucial for the viability of banks and the stability of the broader financial system. Banks must actively monitor their liquidity exposures and implement robust frameworks to handle both day-to-day and stressed liquidity needs.

Utilizing prudent risk management strategies enables banks to successfully navigate changing economic landscapes and fluctuating funding markets. By committing to comprehensive liquidity risk management, banks can thrive and fuel economic growth in a sustainable manner.