In an increasingly complex and uncertain world, effective risk and security management has never been more vital for businesses. Amidst growing threats, vulnerabilities, and ever-evolving risks, organizations must implement robust frameworks to protect value and ensure resilience.

This article provides an overview of risk and security management, explores key risks across different financial sectors, and highlights the importance of crisis preparedness and vendor oversight. We also discuss how EdrawMax can help create risk management visualizations. Discover why vigilant risk management is indispensable in navigating today's turbulent landscape.

Part 1: What is Risk and Security Management?

Risk management involves identifying, assessing, and controlling threats that could adversely impact key business objectives and performance. It covers risks stemming from operations, systems, regulations, strategy, finance, and beyond.

Security management focuses on protecting the organization's assets - physical, informational, and human.

Together, robust risk and security management provides an integrated approach to monitoring the threat landscape, evaluating exposure, implementing controls, and building organizational resilience.

Part 2: Overview of Forex Risk Management

Foreign exchange (forex) risk management is crucial for companies involved in international trade and finance. Exchange rate fluctuations can significantly impact profit margins. Key forex risks include:

- Transaction risk - FX rate movements affecting transaction cash flows.

- Translation risk - Currency volatility affecting consolidated financial statements.

- Economic risk - FX shifts reducing global competitiveness.

Part 3: 5 Major Risks in Pension Fund Management

Pension funds face multifaceted risks requiring prudent management:

- Investment risk - Market declines reducing asset values. Diversification across asset classes is key.

- Interest rate risk - Rate changes affecting liabilities and funding. Liability-driven investment strategies help manage this risk.

- Longevity risk - Members living longer than expected increasing liabilities. Hedging instruments like longevity swaps can mitigate this.

- Regulatory risk - Policy shifts impacting investments or increasing costs. Engaging policymakers helps address this risk.

- Operational risk - Process failures causing losses. Strong controls and risk culture are preventative.

Part 4: Implementing Risk and Crisis Management

Risk management and crisis preparedness go hand-in-hand. Key steps in developing a resilient crisis management framework include:

- Conducting thorough risk assessments covering operational risks, cyber threats, geopolitical issues, brand reputation, and more.

- Identifying early warning indicators that may signal potential crises.

- Creating a crisis management plan detailing response strategies, communications protocols, leadership roles, and responsibilities.

- Training employees through simulated crisis scenario exercises.

- Establishing crisis communication guidelines to manage media interactions.

- Establishing protocols for business continuity and disaster recovery.

- Monitoring emerging risks and updating plans accordingly.

Part 5: The Role of 3rd-Party Vendor Management

Third-party vendors like suppliers, service providers, and partners can introduce significant risks requiring careful oversight:

- Cybersecurity risks - Vendors may lack adequate data security controls.

- Operational risks - Poor vendor performance disrupts operations.

- Compliance risks - Vendors may violate laws and regulations.

- Reputational risks - Vendor actions may damage brand reputation.

Robust vendor risk management entails assessing risks, enforceable contracts, ongoing monitoring of compliance and performance, and contingency plans. Audits provide oversight and accountability.

Part 6: Creating a Risk Management Diagram with EdrawMax

EdrawMax stands out as the premier choice for creating risk diagrams due to its unmatched versatility and user-friendly interface. With a comprehensive library of pre-designed templates and a wide range of customizable elements, it streamlines the process of visualizing complex risk scenarios.

Whether you're a seasoned risk management professional or a newcomer to the field, EdrawMax's intuitive features empower you to efficiently communicate and mitigate risks, making it an indispensable tool for any organization striving for robust risk management practices.

Key features:

- Intuitive drag-and-drop interface.

- Numerous templates like flowcharts, mind maps, and network diagrams.

- Real-time collaboration for teams.

- Customizable styles, fonts, and color themes.

- Export options to share diagrams in multiple formats.

With EdrawMax, businesses can diagram risk processes like identification, analysis, monitoring, mitigation, and reporting to memorialize their risk management system. Visuals help communicate complex frameworks in a clear, easily understood format.

Steps to Create a Risk Management Diagram with EdrawMax

Here are the steps to Create a Risk Management Diagram using EdrawMax:

Step 1:

Launch the EdrawMax application on your computer. Or visit EdrawMax Online to diagram online.

Navigate to the "Template Gallery" and choose a suitable risk management template from the available options. These templates are specifically designed to assist in creating risk management diagrams.

Step 2:

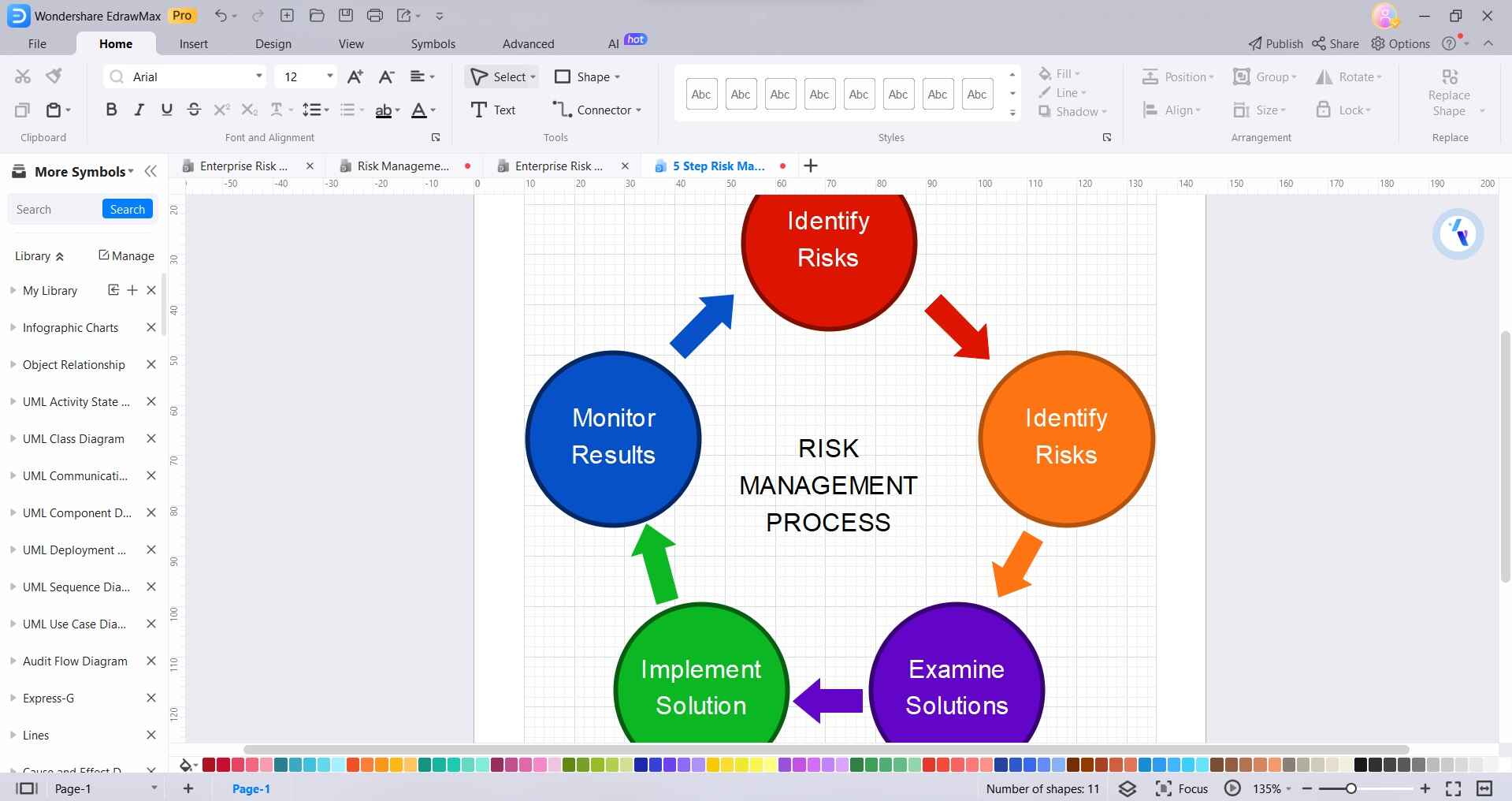

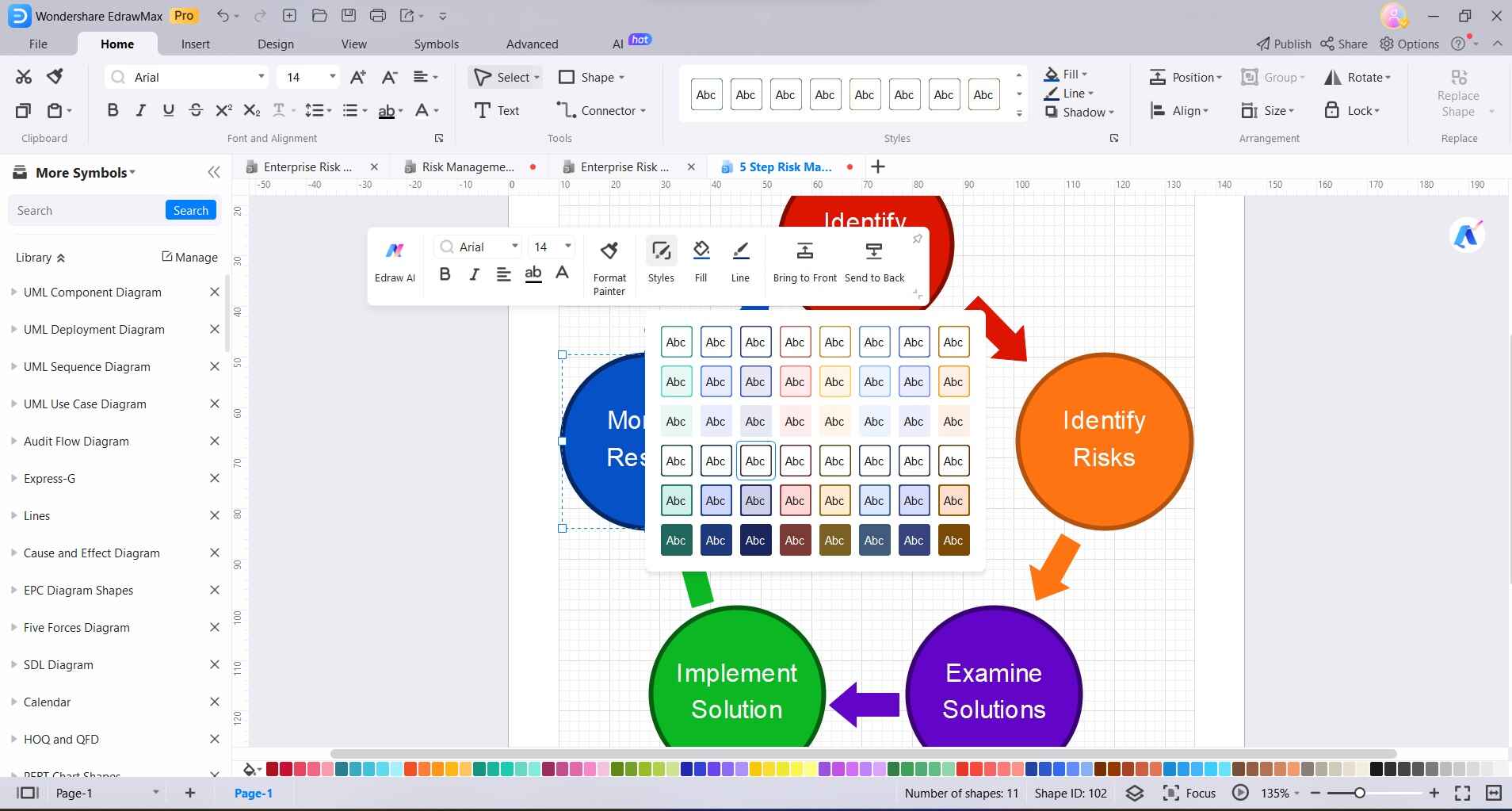

Once you've selected a template, you can start customizing it to suit your specific needs.

Step 3:

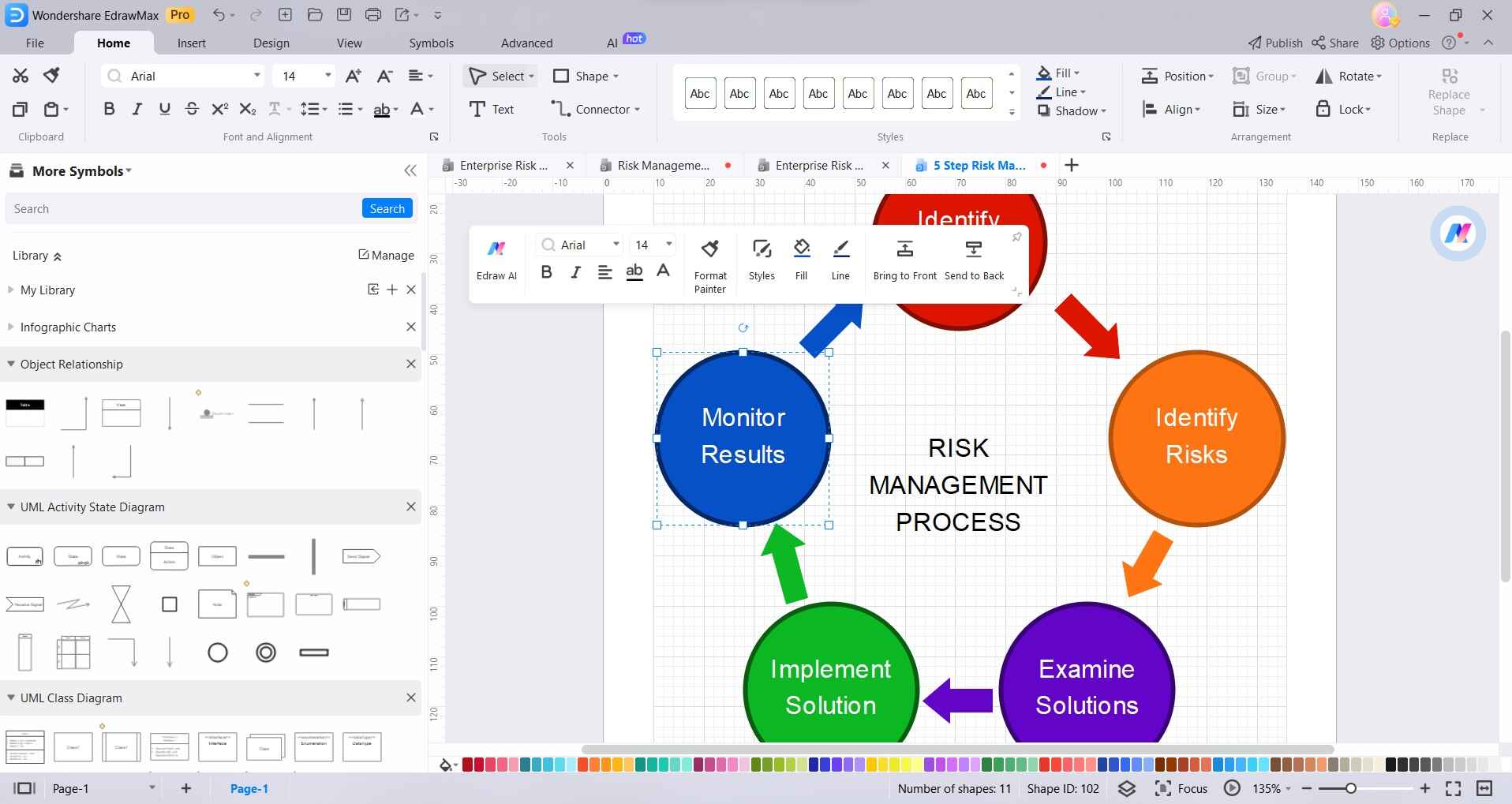

Once you've selected a template, you can start customizing it to suit your specific needs. Click on elements in the template to edit text, adjust shapes, or add additional components like icons, symbols, or images.

Step 4:

Select any entity, then choose "Styles" to modify colors, fonts, and other attributes.

Step 5:

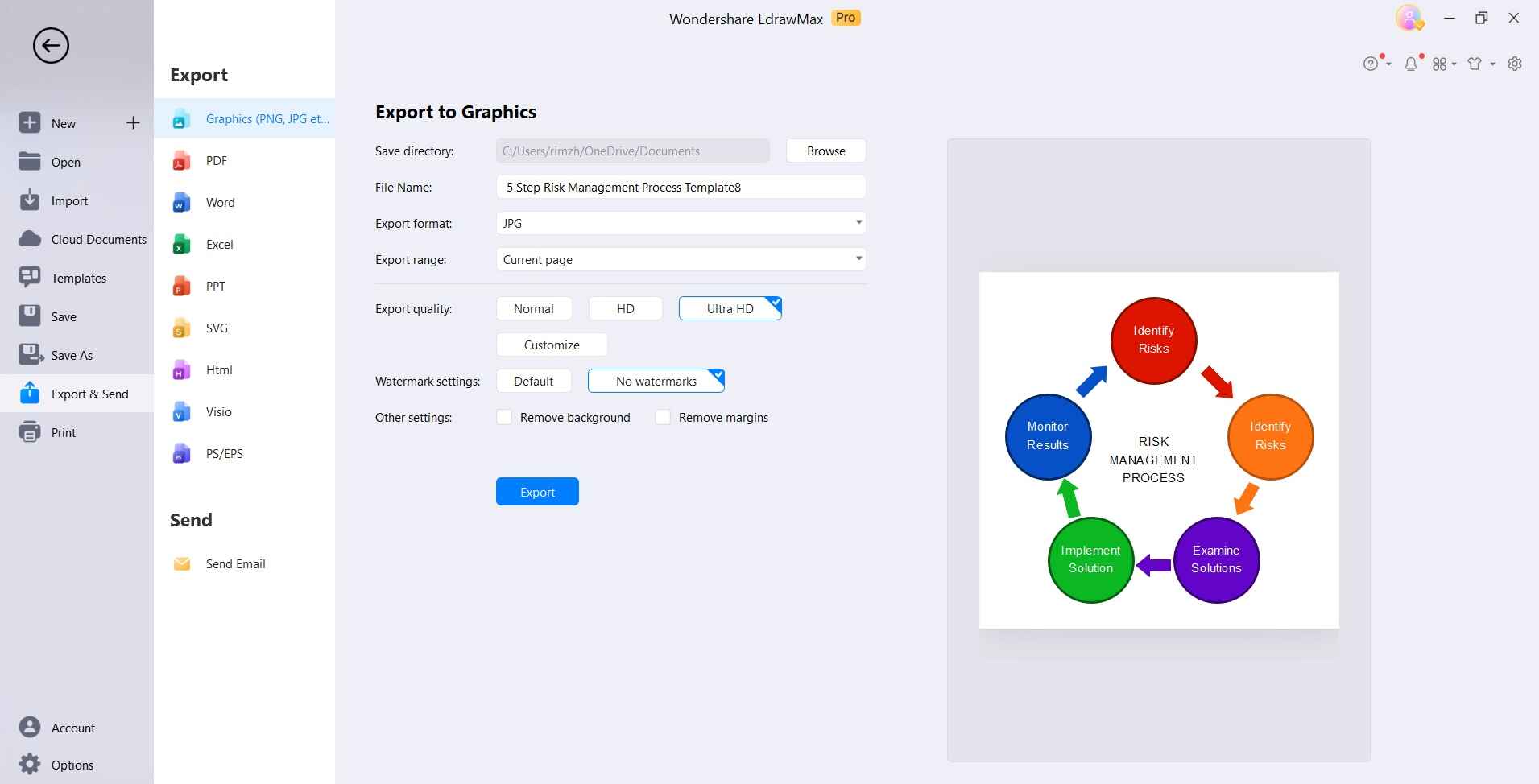

Once you're satisfied with your risk management diagram, save your work. EdrawMax allows you to save in various formats, including Edraw file formats, PDFs, image files, and more.

By following these steps, you can efficiently create a comprehensive risk management diagram using EdrawMax Templates, helping you visualize and manage risks effectively within your organization.

Conclusion

In today's uncertain world, risk management has become an indispensable discipline enabling organizations to survive and thrive amidst growing threats and volatility. By implementing robust risk identification, assessment, mitigation, and preparedness capabilities, companies can strategically manage uncertainties rather than be paralyzed by them.