A due diligence checklist is a critical tool in assessing many business transactions. Conducting due diligence is always an indispensable element in decision-making processes. The page below discusses its specific types for you to gain insights. It tackles different types, such as legal, vendor, and even HR due diligence checklists.

The article highlights their role in mitigating potential pitfalls and ensuring informed decision-making. Read on below and explore the key components of each checklist. Learn and realize their relevance in different business contexts.

In this article

Part I: What Is a Due Diligence Checklist?

A due diligence checklist is a structured document utilized in various businesses. They are also used in financial and legal scenarios. It assesses and confirms critical aspects of a transaction, investment, or business opportunity. A due diligence checklist serves as a comprehensive framework for conducting an examination.

A thorough due diligence encompasses financial records and legal and compliance documents. It also considers the operational details and other essential data of an entity. It enables stakeholders to test the viability of a business deal or investment. It also takes into account the potential challenges associated with it as well.

Part II: What Is the Importance of Due Diligence?

The importance of due diligence cannot be overstated. It serves as a critical process ensuring informed decision-making. The process minimizes surprises, enhances negotiation power, and safeguards investments. It contributes to the success and sustainability of a business. Here are several detailed reasons why due diligence is important:

- Risk mitigation. Risk mitigation Identifies potential risks and liabilities associated with a deal. It allows stakeholders to install risk-mitigation strategies and safeguards.

- Informed decision-making. It provides a comprehensive understanding of the opportunities and challenges involved. It also enables well-informed decisions during the whole process.

- Financial health assessment. Through financial records and analysis, it assesses the target's financial stability and performance. It helps investors gauge profitability and sustainability.

- Legal compliance. It ensures adherence to legal and regulatory requirements. Legal compliance also minimizes the likelihood of legal disputes and associated costs.

- Operational efficiency. It evaluates the target's operating structure, processes, and contracts. It allows for the identification of areas for improvement and operational synergies.

Part III: Types of Due Diligence

There are several types of due diligence. Each is tailored to specific aspects of a business or investment. Here are some common types, along with their relative descriptions.

Legal Due Diligence Checklist

Legal due diligence involves examining a business or transaction's legal aspects and compliance. It includes reviewing contracts, licenses, permits, litigation history, and intellectual property rights. It ensures the target entity is complying with all applicable laws and regulations. Conducting your legal due diligence also reduces legal risks and liabilities.

Vendor Due Diligence Checklist

Vendor due diligence is essential when evaluating potential suppliers or service providers. It focuses on assessing the credibility of vendors by reviewing their financial stability. It also considers operational capabilities, quality control processes, and reputation. This due diligence helps when selecting vendors and managing supply chain risks.

HR Due Diligence Checklist

HR due diligence concentrates on human resources. It also includes the personnel aspects of a business. An HR due diligence examines contracts, benefits, and retention rates. It also reviews any potential HR challenges that might arise during assessment. It's crucial during M&A deals to ensure a smooth human capital transition. It helps identify any workforce-related issues that might affect the deal's success.

Financial Due Diligence

Financial due diligence involves thoroughly analyzing the target company's financial statements. It examines income statements, balance sheets, cash flow, and financial forecasts. It aims to check the business's financial health, profitability, and sustainability. Financial due diligence assists investors in understanding the viability of the investment.

Operational Due Diligence

Operational due diligence focuses on the operational aspects of a business. It examines processes, workflows, supply chains, and customer and supplier contracts. It helps identify opportunities for operational improvements. It also checks potential challenges that could impact the success of the transaction.

Creating these types of due diligence checklists can be time-consuming. Having a dedicated tool can certainly help you save time and effort. The next section demonstrates creating a due diligence checklist using a specialized diagramming tool like EdrawMax.

Part IV: Creating an Effective Due Diligence Checklist

Creating an effective due diligence checklist is straightforward with the right tool. Here's a step-by-step guide using EdrawMax to create an effective checklist.

Step 1: Download and install EdrawMax on your computer. Afterward, launch the app.

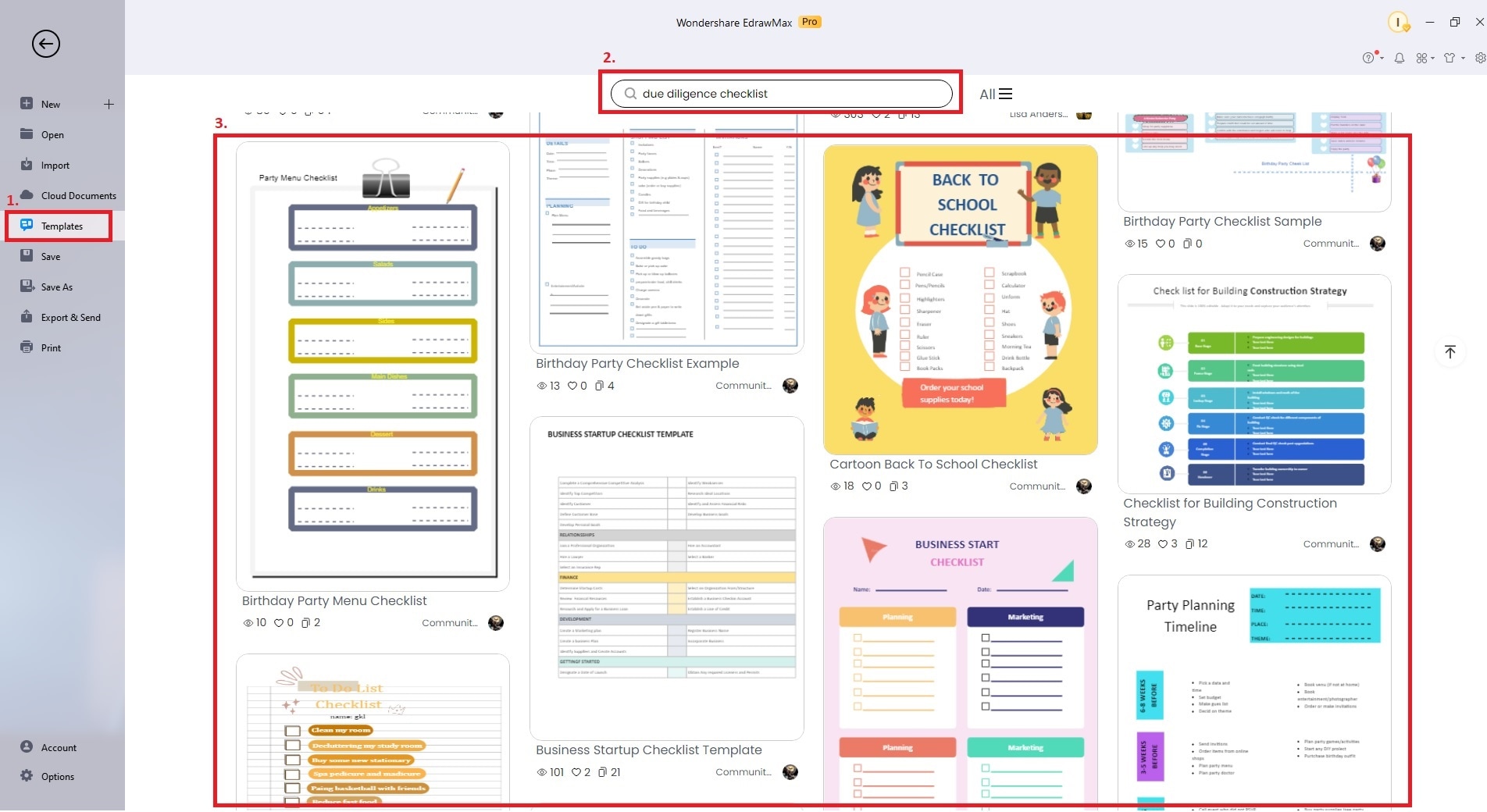

Step 2: Start from a blank canvas or choose from the checklist templates to save time. Click on Templates and use the Search box. Look for a pre-designed due diligence checklist that you like. The sample below uses a due diligence checklist for a construction operation.

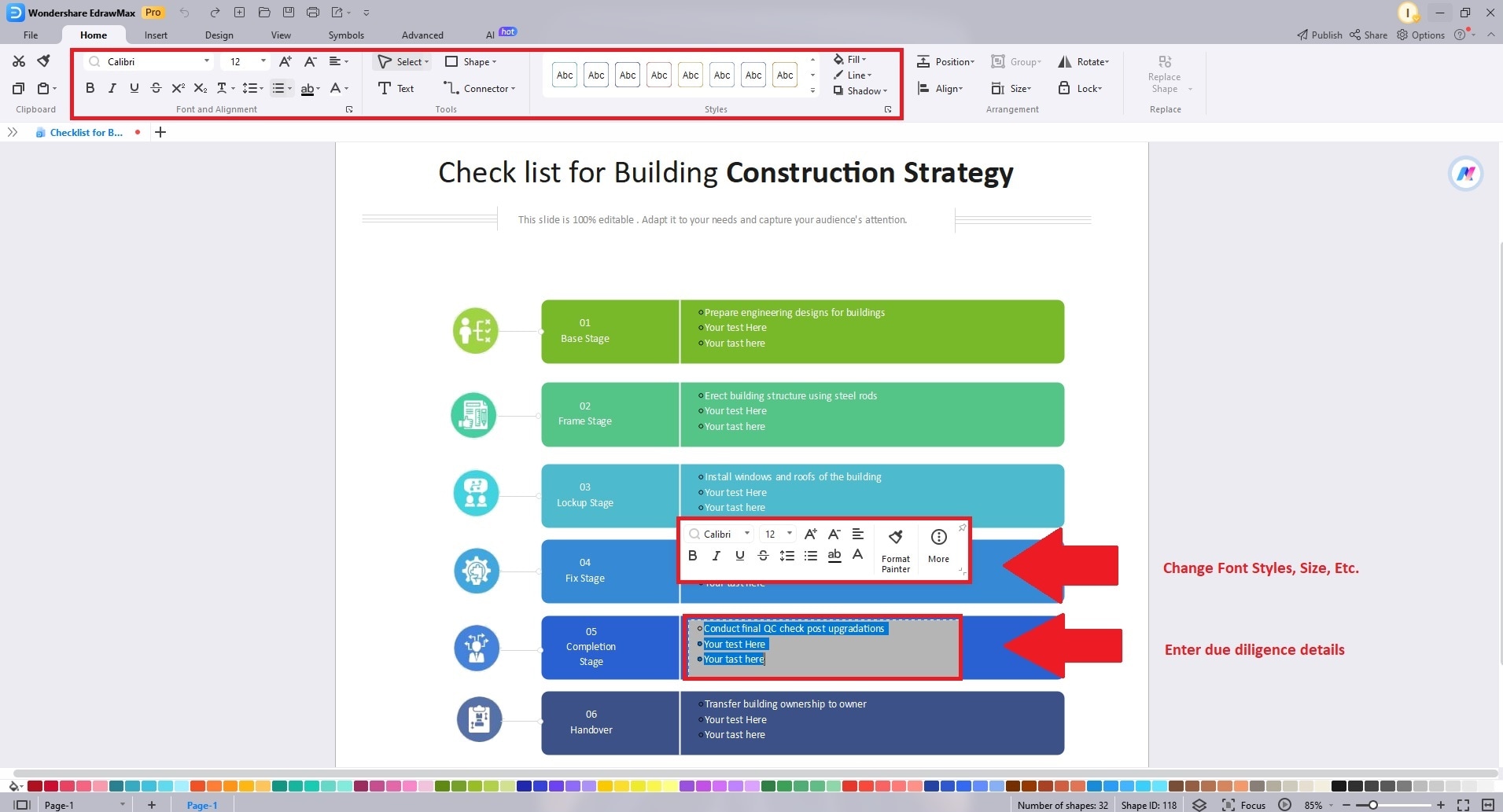

Step 3: Add the main title of your due diligence checklist. List the specific categories or sections you want to include in your checklist. Type in the necessary details as needed.

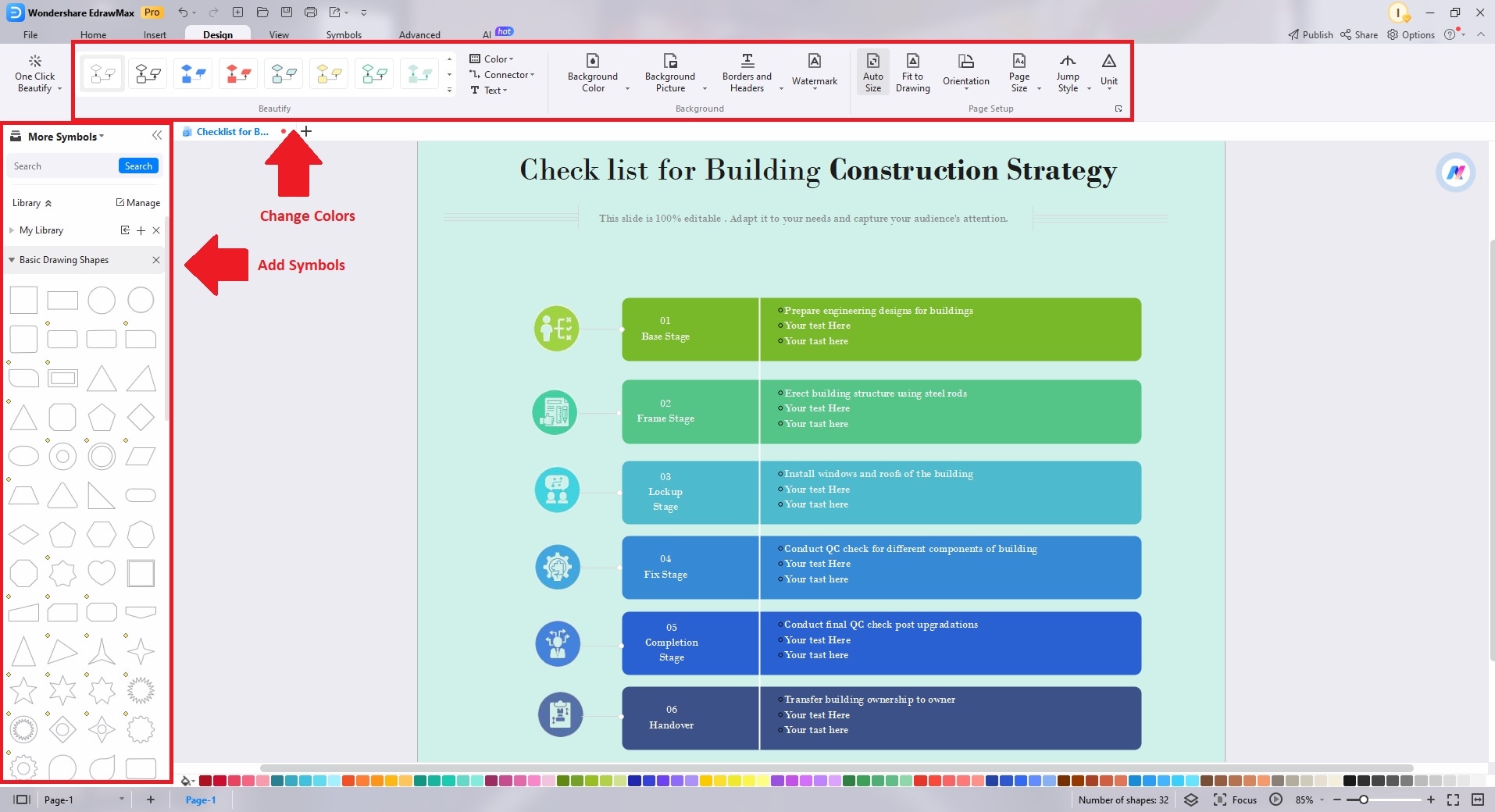

Step 4: Customize your checklist by adding checkboxes and text boxes. You can also add shapes for each item within the sections. Edit and adjust fonts, colors, and styles. You can include backgrounds, images, or logos to match your preferences or the organization's branding to enhance the checklist's visual appeal.

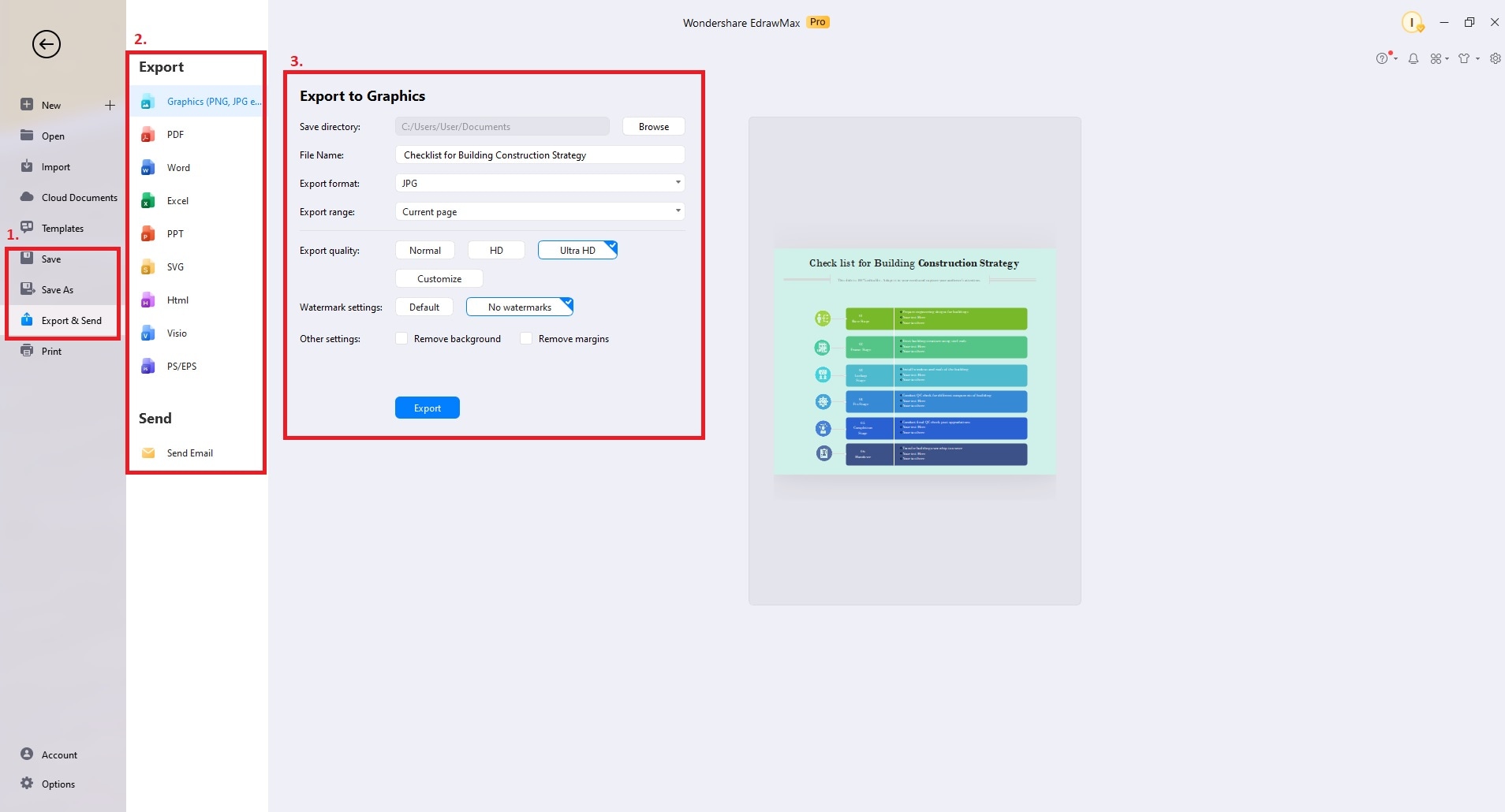

Step 5: Save your work once your due diligence checklist is complete. You can export it to a common file format like PDF or PNG. Also, you can share your checklist with team members or stakeholders.

Part V: Creating an Effective Due Diligence Checklist

An effective checklist should encompass the following elements for a comprehensive assessment:

Financial Documents

- Income statements

- Balance sheets

- Cash flow statements

- Tax records

- Audited financial reports

Legal and Compliance

- Contracts and agreements

- Licenses and permits

- Litigation history

- Intellectual property documentation

- Regulatory compliance records

Operational and Business

- Customer and supplier contracts

- Organizational structure

- Employee contracts and benefits

- Marketing and sales strategies

- Inventory management

HR and Personnel

- Employee records and turnover rates

- Compensation structures

- Training programs

- Health and safety compliance

- Employee satisfaction surveys

Technology and IT

- IT infrastructure and systems

- Data security measures

- Software licenses

- Technology roadmap

- Cybersecurity protocols

It would help if you created a tailored due diligence checklist for a particular transaction or business in question. A checklist will help you assess all crucial areas to steer the due diligence process. Performing due diligence guarantees you don't miss any major aspects during the assessment. Don't forget that a versatile tool like EdrawMax can help you get a better outcome!

Conclusion

Conducting your due diligence is an important process, especially in business. It involves meticulous assessment of various aspects of a transaction. They help businesses with possible investment or business opportunities. Creating a due diligence checklist is important in ensuring a thorough evaluation.

A checklist also provides a roadmap for stakeholders to uncover risks. To streamline the process, using tools like EdrawMax can help you get the job done. It offers customizable templates for creating and managing due diligence checklists efficiently.

FAQs

- What is the primary goal of due diligence?

The goal of due diligence is to assess and investigate a potential investment. Due diligence is also recommended for any business transaction. It helps identify and check risks, liabilities, and opportunities. It also assists in making decisions and ensures that the deal aligns with your objectives.

- How long does the due diligence process usually take?

Conducting due diligence and estimating the duration varies. It depends on the complexity of the transaction and the parties involved. A due diligence process can range from a few weeks to several months. Often, it even includes extensive M&A deals. Due diligence will take longer due to comprehensive evaluations.

- Can a due diligence checklist be used in mergers and acquisitions?

Yes, a due diligence checklist is a valuable tool in mergers and acquisitions. It serves as a structured guide to ensure you've examined all aspects of the target company. It helps streamline the process and improves consistency. A checklist also ensures you have assessed key information and all the risks. It's especially important before completing the transaction.