In today's fast-paced business world, adhering to governance compliance and managing regulatory risks are crucial for success. This guide on compliance management framework offers practical advice to strengthen your business. From understanding regulations to implementing best practices, we provide the knowledge to ensure compliance and minimize risks. Join us in creating a secure and resilient business foundation.

In this article

Part 1: What Is GRC Compliance?

GRC compliance, short for Governance, Risk, and Compliance, is a framework that helps organizations manage and align their operations with legal and regulatory requirements. It encompasses strategies and processes to ensure that a company operates ethically, legally, and in a way that mitigates risks. GRC compliance involves establishing clear policies, evaluating risks, and implementing controls to maintain adherence to these standards.

By adopting GRC compliance practices, businesses can navigate complex regulatory environments, build trust with stakeholders, and safeguard their reputation.

Part 2: Importance of GRC in Organizations

GRC (Governance, Risk, and Compliance) is vital for organizations. It helps follow rules and regulations, making operations smoother. By using GRC compliance, businesses make better decisions, reduce risks, and act ethically. This builds trust with stakeholders and protects the company's reputation. GRC is like a guide, helping companies navigate complex situations and grow responsibly.

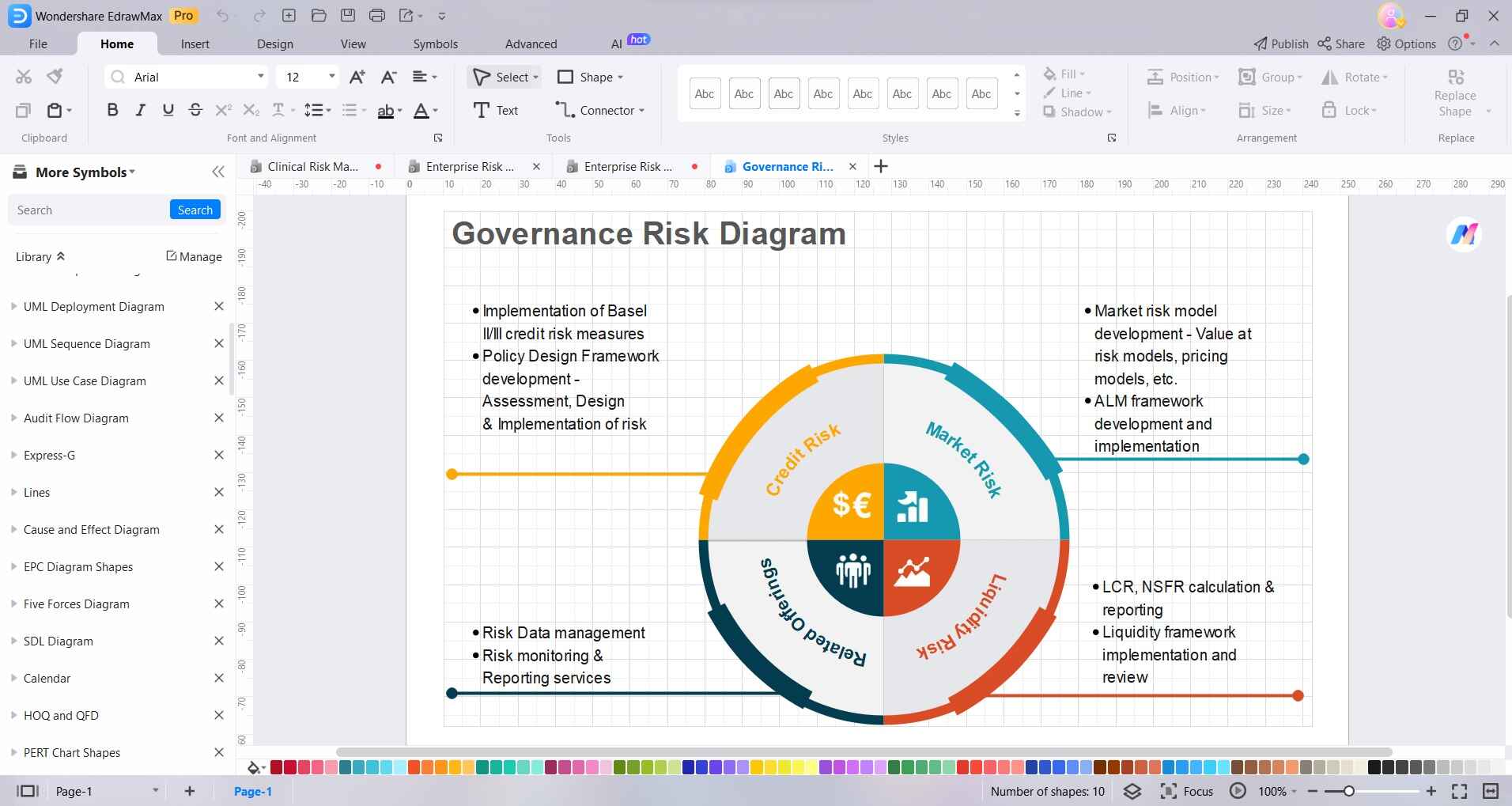

Part 3: Types of Risks

Business operations are subject to various types of risks. It's crucial to identify and manage them effectively to ensure the smooth functioning and long-term success of a company. Here are four key categories of risks to consider:

1. Financial Risks:

These involve potential losses from market changes or financial issues. Managing these risks is vital for a stable and profitable business.

2. Operational Risks:

These come from internal processes, like errors or supply chain problems. Identifying and dealing with them keeps business running smoothly.

3. Reputational Risks:

These affect how others see your business. They can come from customer issues or PR problems. Protecting your reputation is key for long-term success.

4. Regulatory Risks:

These stem from not following industry rules. It can lead to fines and damage your reputation. Being compliant is crucial for avoiding these risks.

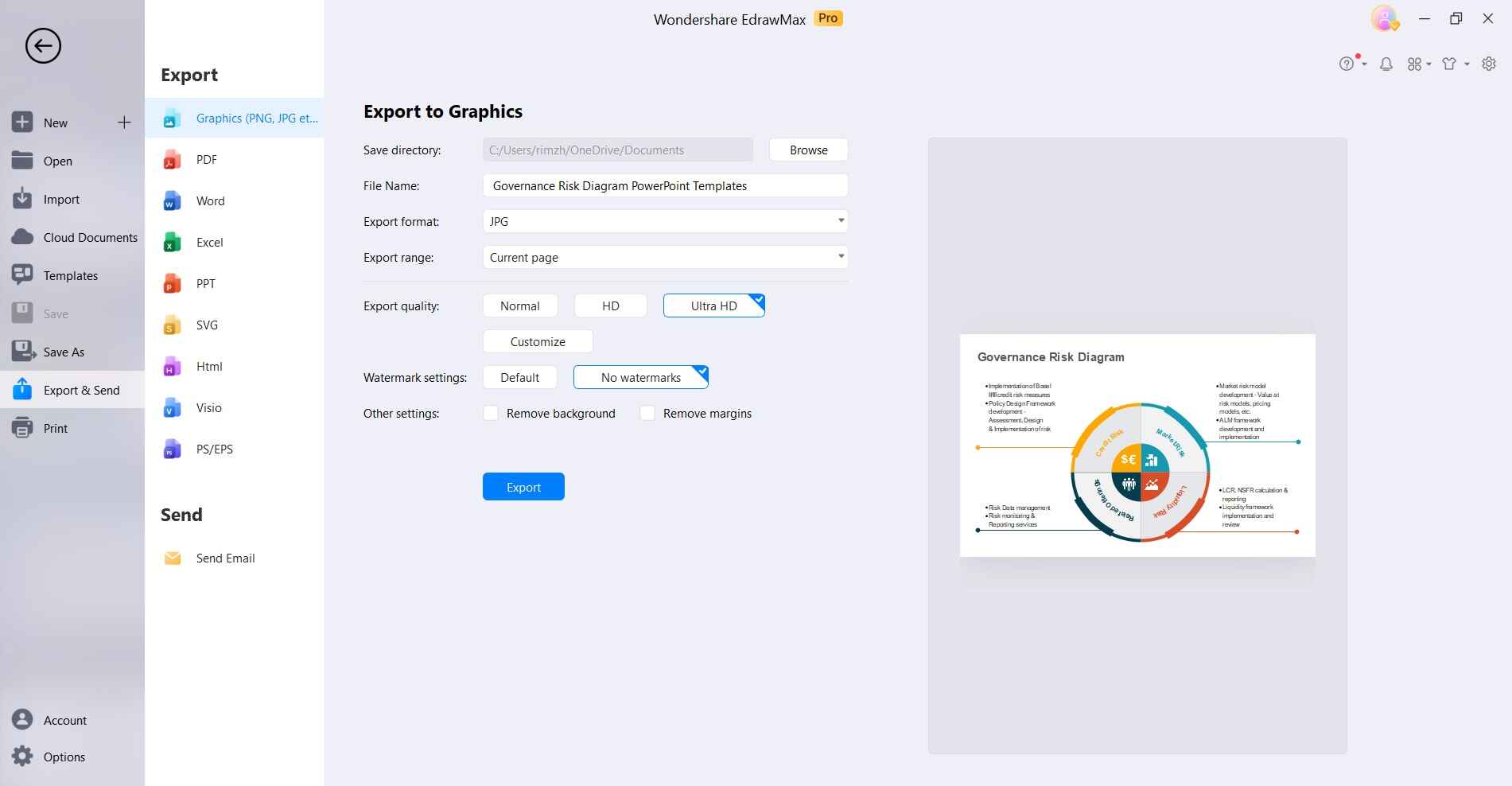

Part 4: Creating a Compliance Checklist for Auditing in EdrawMax

Creating a Compliance Checklist in EdrawMax ensures a structured approach to auditing, making it user-friendly and efficient. It helps organize tasks, track progress, and ensures no crucial compliance aspect is overlooked.

With its intuitive interface, users can easily customize and adapt the checklist to specific industry standards and regulatory requirements, ultimately streamlining the auditing process and promoting confidence in regulatory adherence.

Plus, EdrawMax allows for seamless team collaboration, real-time updates, and provides a clear visual overview of progress, enhancing transparency and accountability. It's accessible to users of all technical levels, making compliance auditing a breeze for teams of any size.

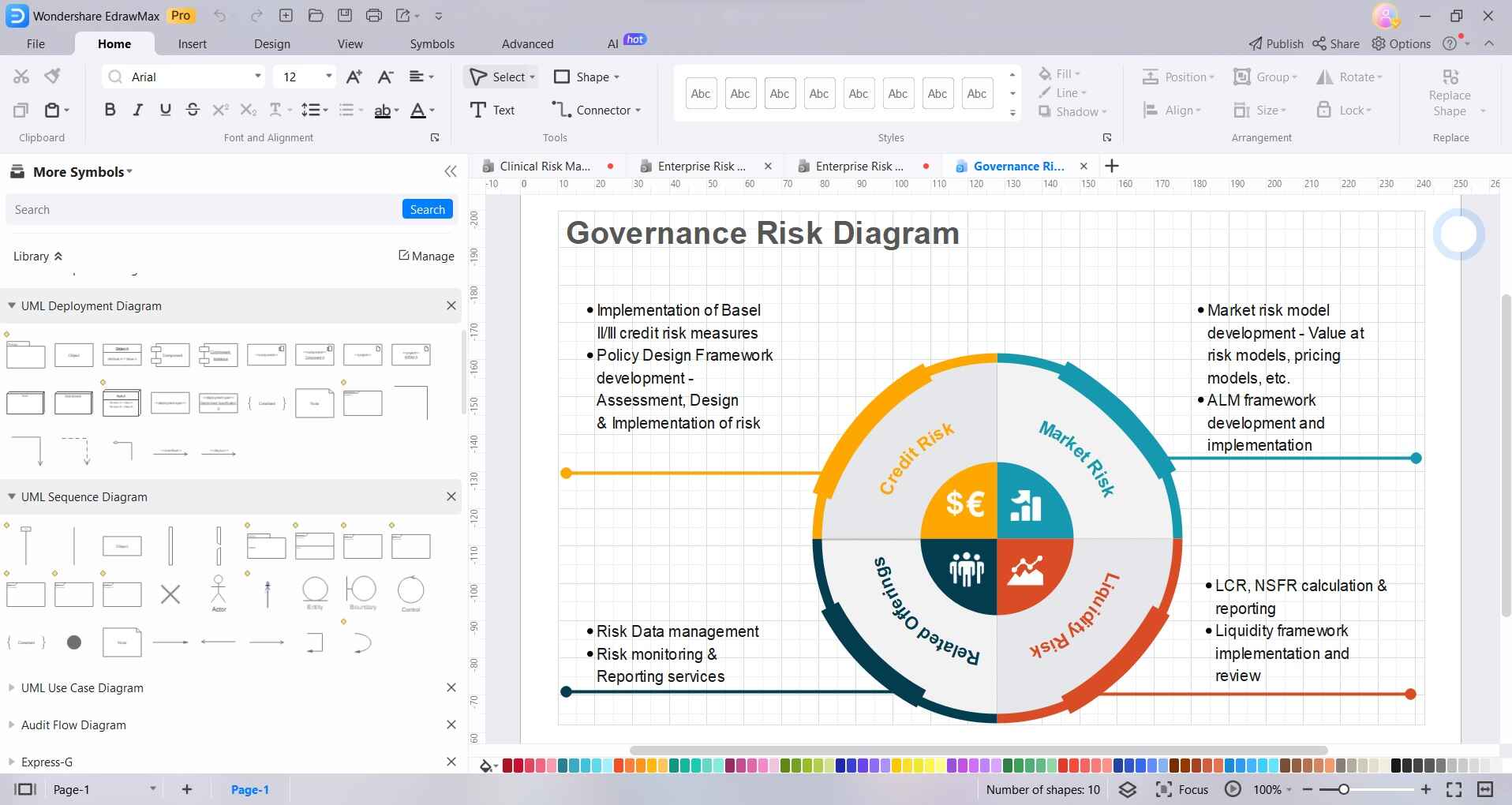

Here are the steps to create a compliance diagram using EdrawMax:

Step1

Launch the EdrawMax application on your computer. From the left menu pane switch to the template category that suits your compliance diagram. For example, you might select "Compliance Diagram" from the list.

Step2

In the canvas area, you'll find various shapes and symbols related to compliance. Drag and drop these onto the canvas to start building your diagram.

Step3

Use connectors (lines or arrows) to link different shapes and show relationships between compliance components.

Step4

Click on shapes to add text, change colors, or modify their appearance to represent specific compliance elements accurately.

Step5

Take a moment to review your compliance diagram for accuracy and completeness. Make any necessary adjustments. Click on the "File" menu and select "Save As" to save your compliance diagram to your desired location on your computer.

Remember, EdrawMax offers a range of tools and features to enhance your compliance diagram. Experiment and explore to create a clear and effective representation of compliance processes and components.

Part 5: Best Practices in GRC Implementation

Implementing Governance, Risk, and Compliance (GRC) effectively is essential for the success and stability of any organization. Here are three key strategies to ensure a seamless GRC framework:

A. Establishing a GRC Culture:

Fostering a GRC culture ensures that every member of the organization understands and values Governance, Risk, and Compliance. It involves integrating GRC principles into everyday operations, promoting accountability, and aligning business goals with regulatory requirements.

B. Clear Communication and Reporting:

Effective GRC implementation hinges on transparent communication channels and robust reporting mechanisms. This practice ensures that relevant stakeholders are informed of compliance efforts, risk assessments, and governance strategies, facilitating timely decision-making and risk mitigation.

C. Continuous Monitoring and Adaptation:

GRC implementation is an evolving process. Regularly monitoring compliance, risks, and governance activities allows organizations to adapt swiftly to changing regulatory landscapes and emerging threats. This practice ensures that GRC strategies remain effective and aligned with the organization's objectives.

Conclusion

Mastering Governance, Risk, and Compliance (GRC) is vital for modern businesses. By nurturing a GRC culture, ensuring clear communication, and vigilant monitoring, organizations can confidently handle regulatory challenges. These practices not only boost compliance but also lay a strong foundation for growth.

Embracing GRC isn't just a good idea; it's a smart move that empowers businesses to thrive. With a solid GRC framework, organizations are ready to face and conquer any challenge that comes their way.

[没有发现file]