By implementing risk management best practices, organizations can enhance risk perception, protect valuable assets, and ensure regulatory compliance. Examples from various industries demonstrate the effectiveness of practices such as data encryption, incident response plans, and agile methodologies. To achieve continuous improvement, organizations should focus on areas like risk identification, mitigation strategies, and effective communication.

In this article

Importance of Adopting Best Practices in Risk Management

Risk management serves as a vital tool for organizations across sectors, enabling them to identify, analyze, and address potential risks proactively. By adopting risk management best practices, businesses gain several advantages.

- Enhanced Risk Perception: Implementing exemplary risk management strategies such as credit risk management best practicessharpen an organization's ability to perceive potential risks comprehensively.

- Protection of Assets: Effective risk management practices safeguard an organization's valuable assets.

- Regulatory Compliance: Adopting best practices in risk management ensures adherence to applicable laws and regulations.

Examples of Successful Risk Management Best Practices

Key industries, such as finance, healthcare, and information technology, have witnessed several successful risk management initiatives. These examples serve as testaments for various kinds of risk management best practices.

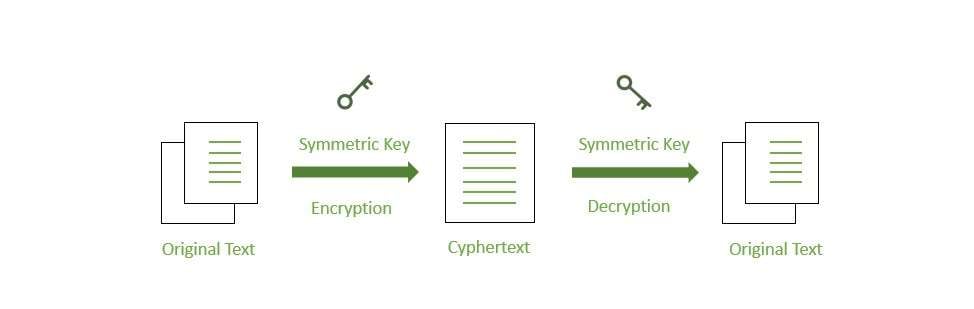

- Implementation of Data Encryption: Financial institutions have widely adopted data encryption as a risk management best practice. By encrypting sensitive customer information, banks ensure the secure transmission and storage of data, protecting against potential data breaches and cyber threats.

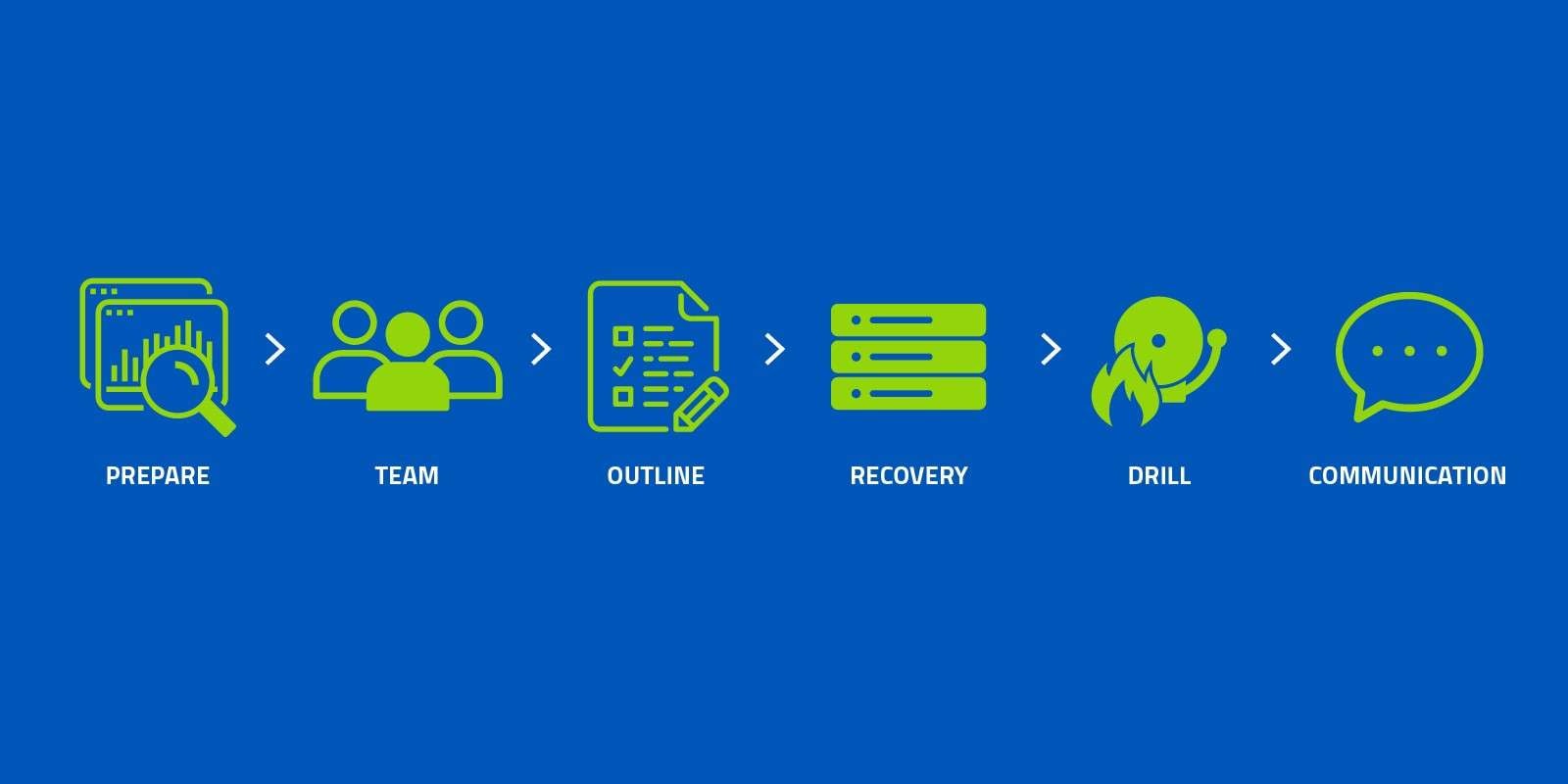

- Incident Response Plans: In the healthcare sector, successful risk management practices involve the creation of comprehensive incident response plans. These plans outline specific procedures to address emergencies, such as medical errors or natural disasters, ensuring swift and effective response measures.

- Adoption of Agile Methodology: In software development, organizations have found success by embracing agile methodologies in risk management. This approach allows for continuous monitoring, adaptation, and quick response to evolving risks, resulting in better overall project outcomes.

Key Areas to Focus on for Effective Risk Management

Implementing effective risk management practices, for example, third party risk management best practices, involves careful attention to specific areas. All of these areas are significant in the whole process.

- Risk Identification and Assessment: Organizations must invest in robust risk identification and assessment processes. This includes evaluating the likelihood and potential impact of risks, determining risk appetite, and establishing risk tolerance levels to guide decision-making.

- Risk Mitigation Strategies: Developing comprehensive risk mitigation strategies is crucial. Organizations should prioritize the implementation of measures aimed at reducing risk occurrence, impact, or probability, ensuring a proactive approach to risk reduction.

- Communication and Stakeholder Engagement: Successful risk management involves clear and effective communication with stakeholders and employees. By fostering an environment of open dialogue, organizations can enhance risk awareness and collaboration, ensuring a collective effort towards risk mitigation.

Continuous Improvement and Learning from Industry Leaders

Continuous improvement is vital to ensure that risk management best practices remain relevant and effective. Organizations should strive to learn from industry leaders and adopt emerging best practices.

- Regular Review of Risk Management Frameworks: Organizations must regularly review and update their risk management frameworks to align with evolving risks.

- Learning from Industry Benchmarking: Benchmarking against industry leaders and best-in-class organizations provide valuable insights into emerging risk trends and effective mitigation strategies.

- Encouraging Knowledge Sharing and Training: Integrating knowledge-sharing platforms and providing comprehensive training opportunities allows employees to develop their risk management skills and stay up-to-date with best practices.

Make Risk Management Charts Fast with EdrawMax

Wondershare EdrawMax offers a range of pre-made templates and symbols that can be used to create professional-looking risk management charts. Additionally, the tool has an impressive array of features to help customize charts and diagrams. The steps to create a risk management chart using the tool are as follows:

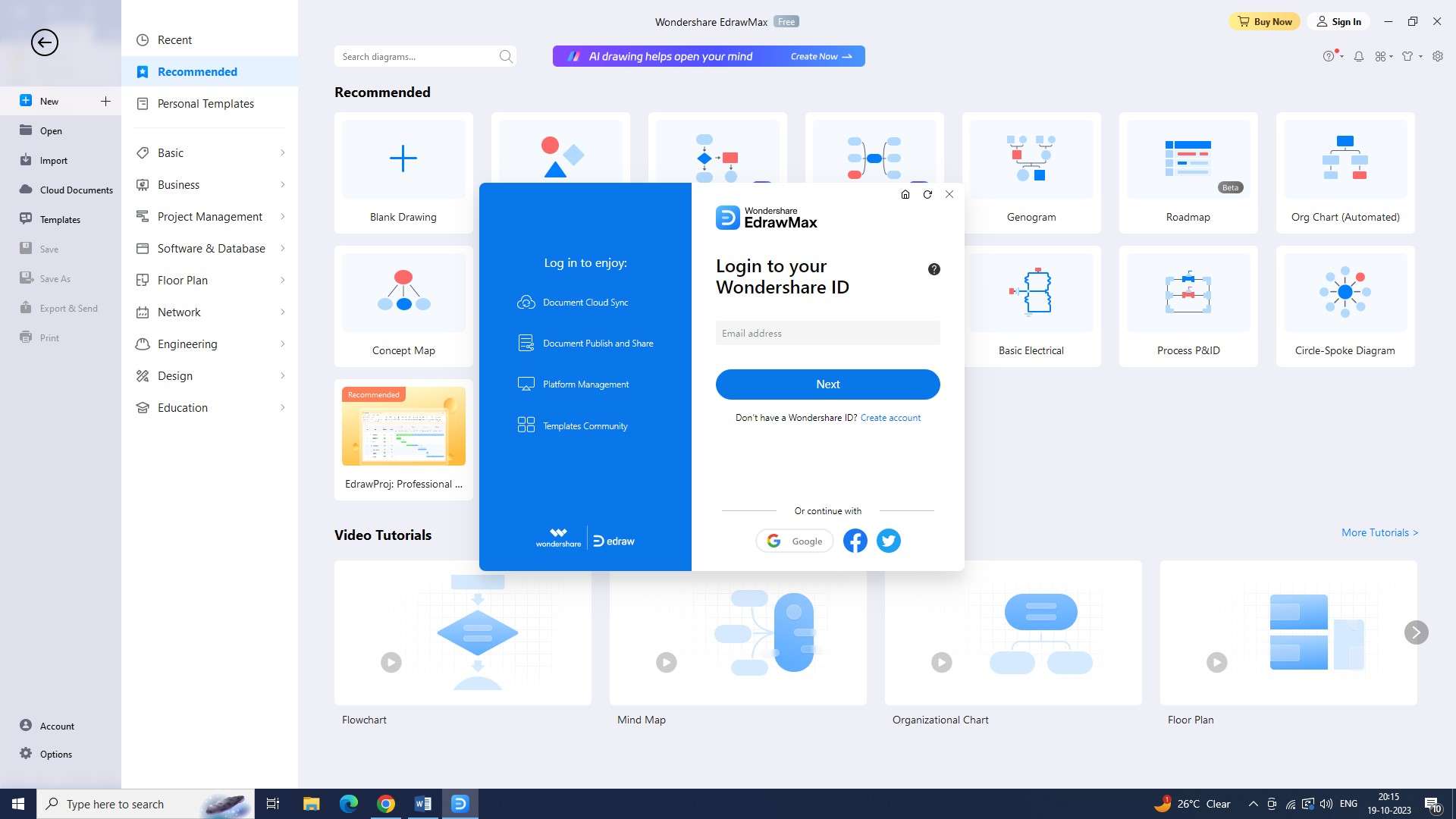

Step 1: Login into your EdrawMax account

Login into your account to start using EdrawMax. Remember to enter your email ID and password carefully.

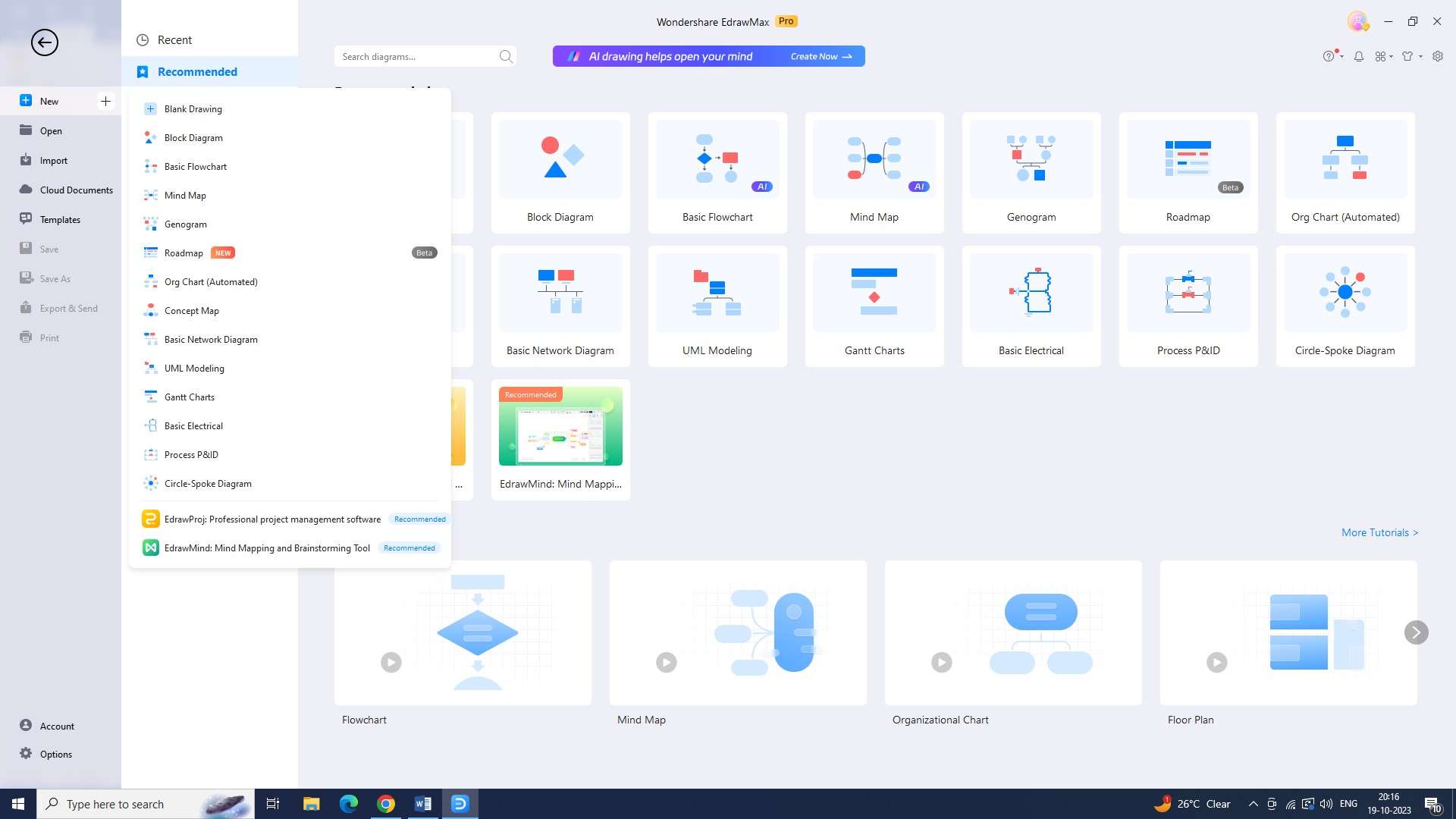

Step 2: Open a new document

Open a new document in the tool to start creating your risk management chart. Just select the "New" option after logging in to your account.

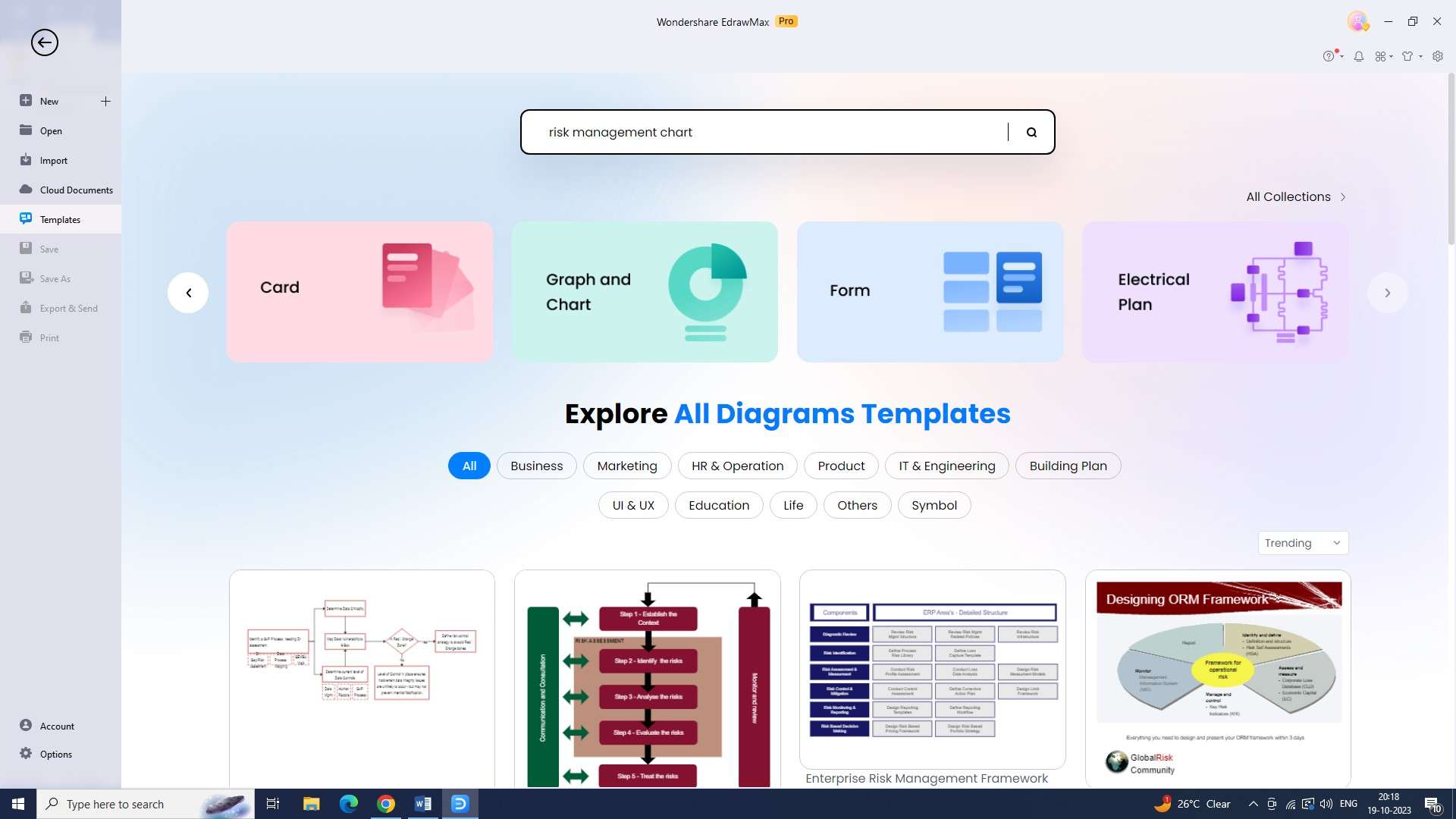

Step 3: Access the Templates section and search for "risk management chart"

Go to the "Templates" section by selecting it from the menu in the top-left corner of the screen. There are many templates available here. Type "risk management chart" into the search box and press enter.

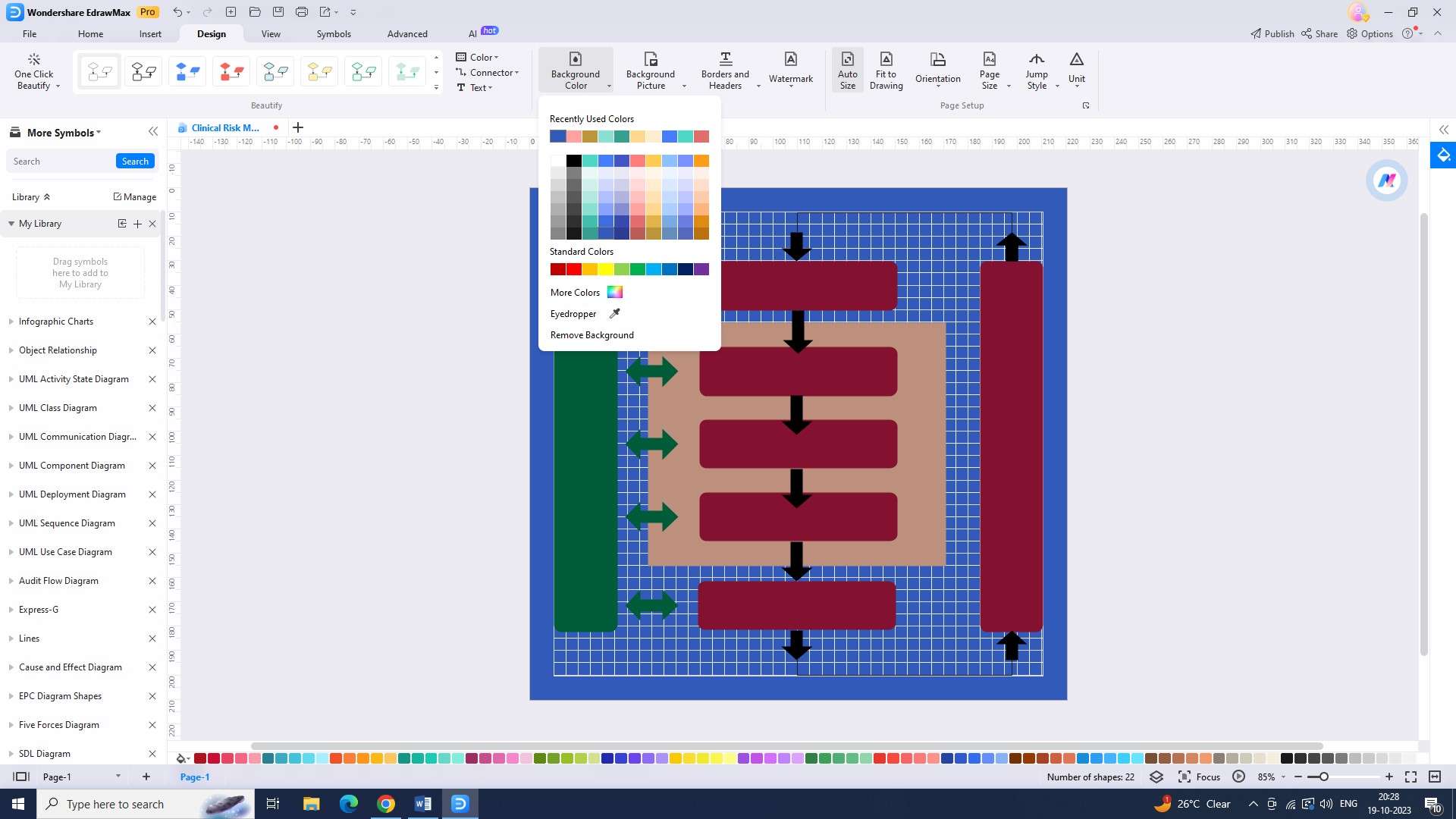

Step 4: Customize the template

Now, you can customize the template in any way you like. With an easy-to-use interface and a ton of customization possibilities, EdrawMax gives you the ability to customize anything.

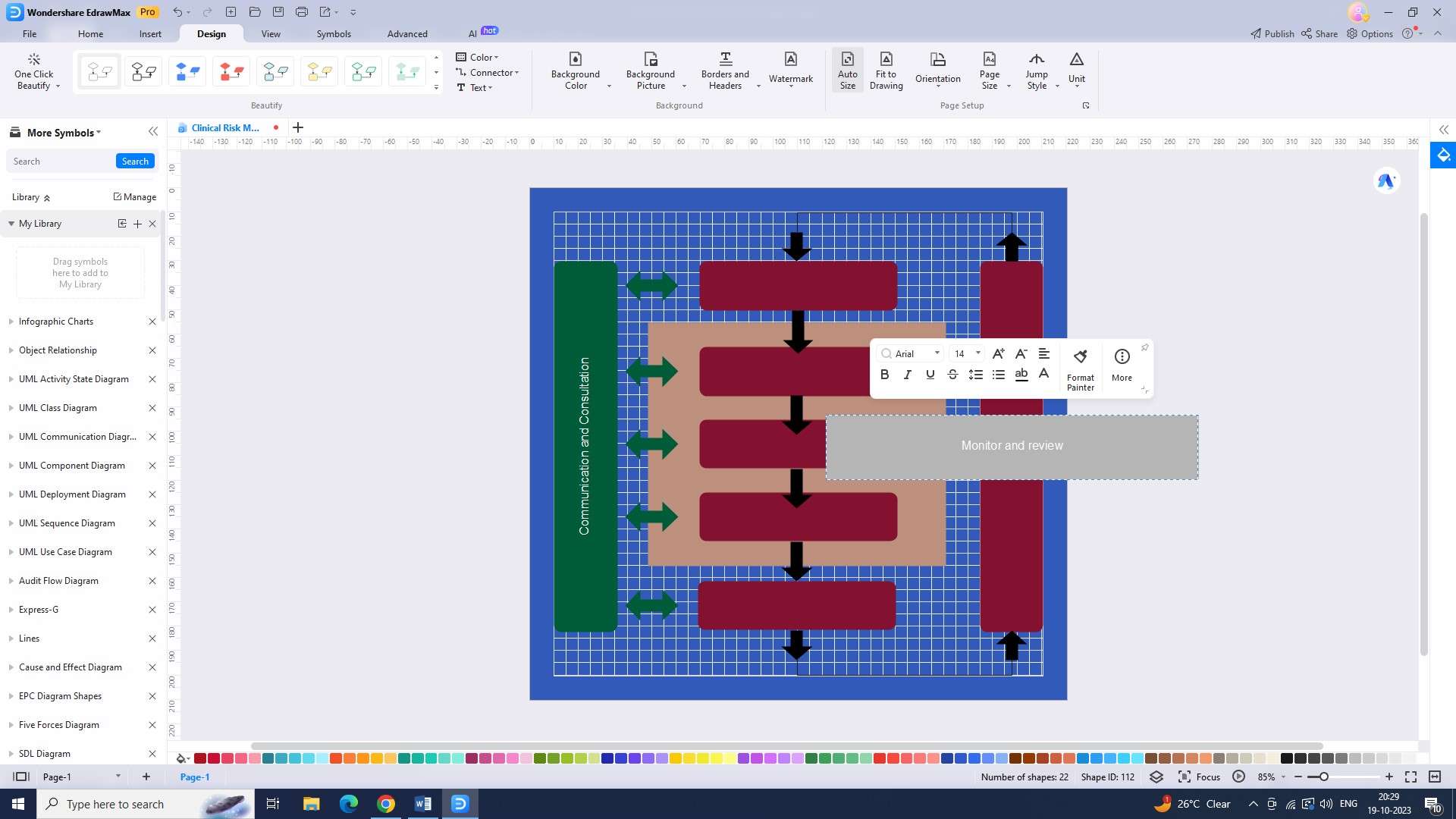

Step 5: Add information

Add the information to make your risk management chart come to life. Text boxes, and labels can be used for this.

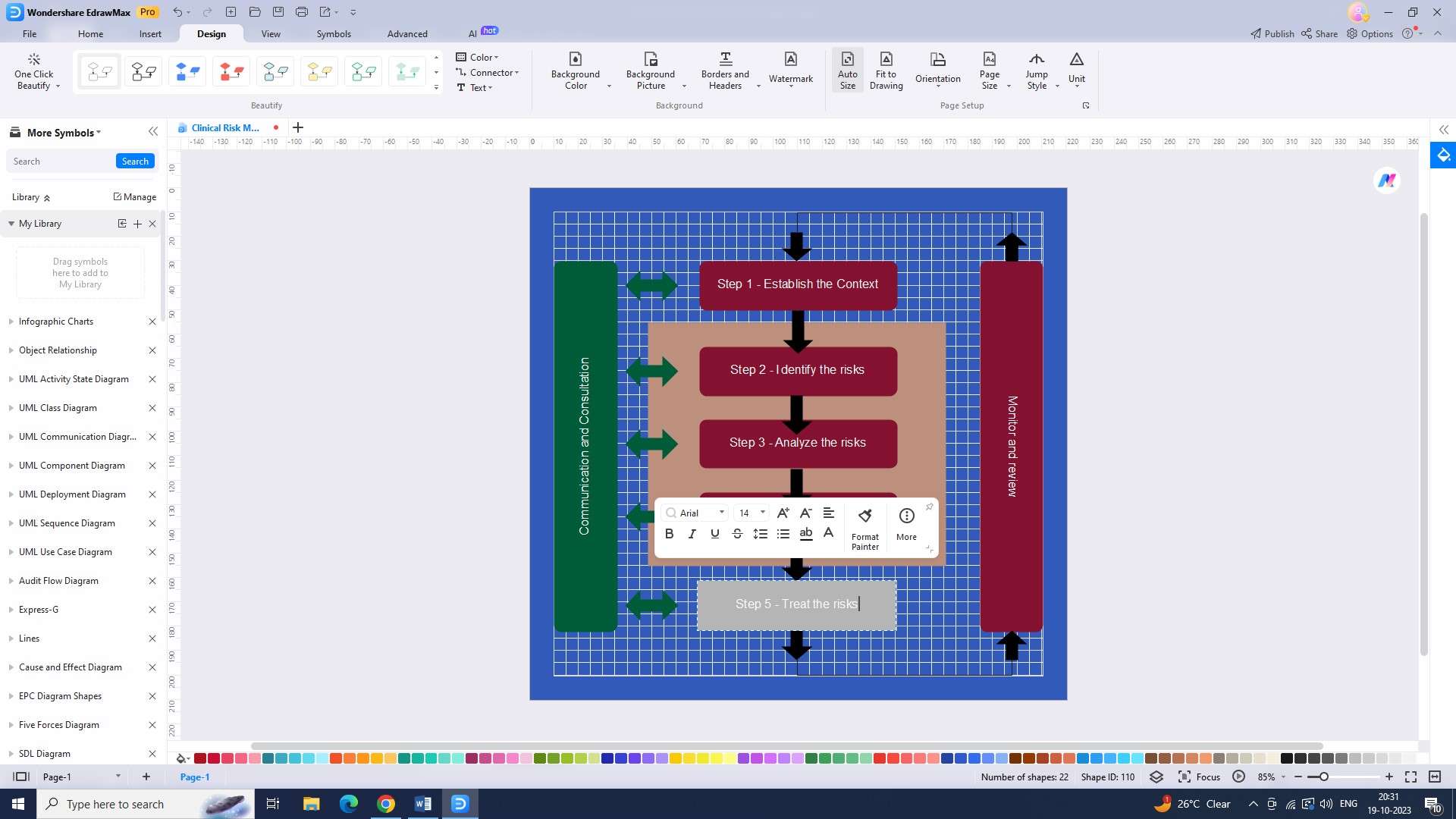

Step 6: Input potential mitigation methods

Now, you have to input the potential mitigation methods in the chart. Use symbols or icons to illustrate the various approaches taken to each risk.

Step 7: Save the chart

Click the "Save" option under the File menu. Your work will be safely stored as a result.

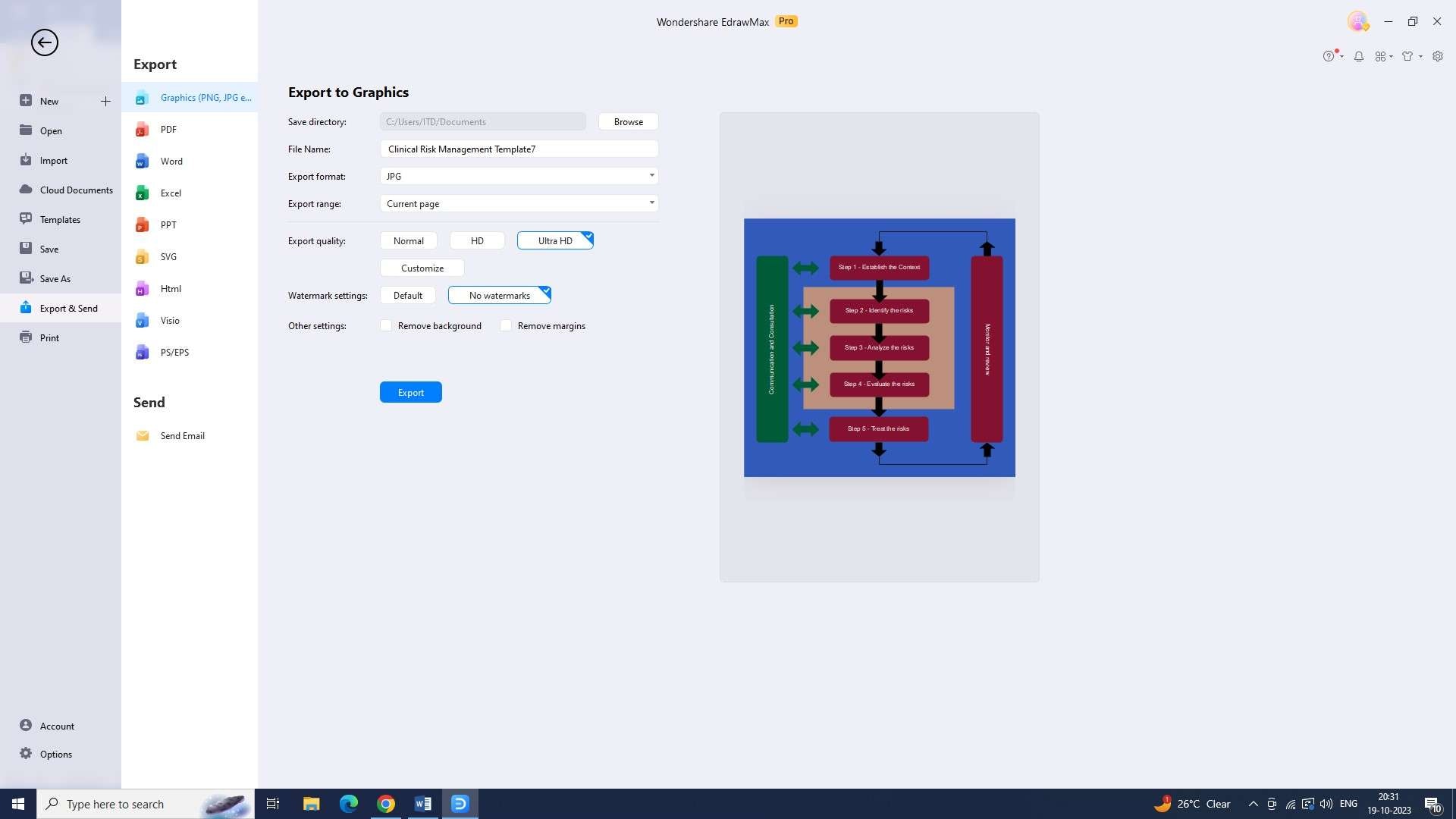

Step 8: Export your work

The chart should now be exported. You may export your chart in a variety of formats thanks to the tool’s easy exporting options.

Conclusion

Adopting best practices in risk management, like credit risk management best practices, among others, is crucial for organizations to navigate potential challenges effectively. This article explores the importance of these practices, provides examples of successful initiatives, and highlights key areas to focus on for effective risk management.