Market risk management is a critical process for banks, financial institutions, and corporations to monitor and control their exposure to losses from changes in market prices and rates. With the high volatility in today's markets, having robust systems for measuring and managing market risk is essential.

This article will provide an overview of market risk and risk management, explain the key types of market risks, outline effective strategies for market risk management, discuss the benefits of implementing sound risk analysis, and give guidance on creating risk management diagrams.

Part 1: What is Market Risk Management?

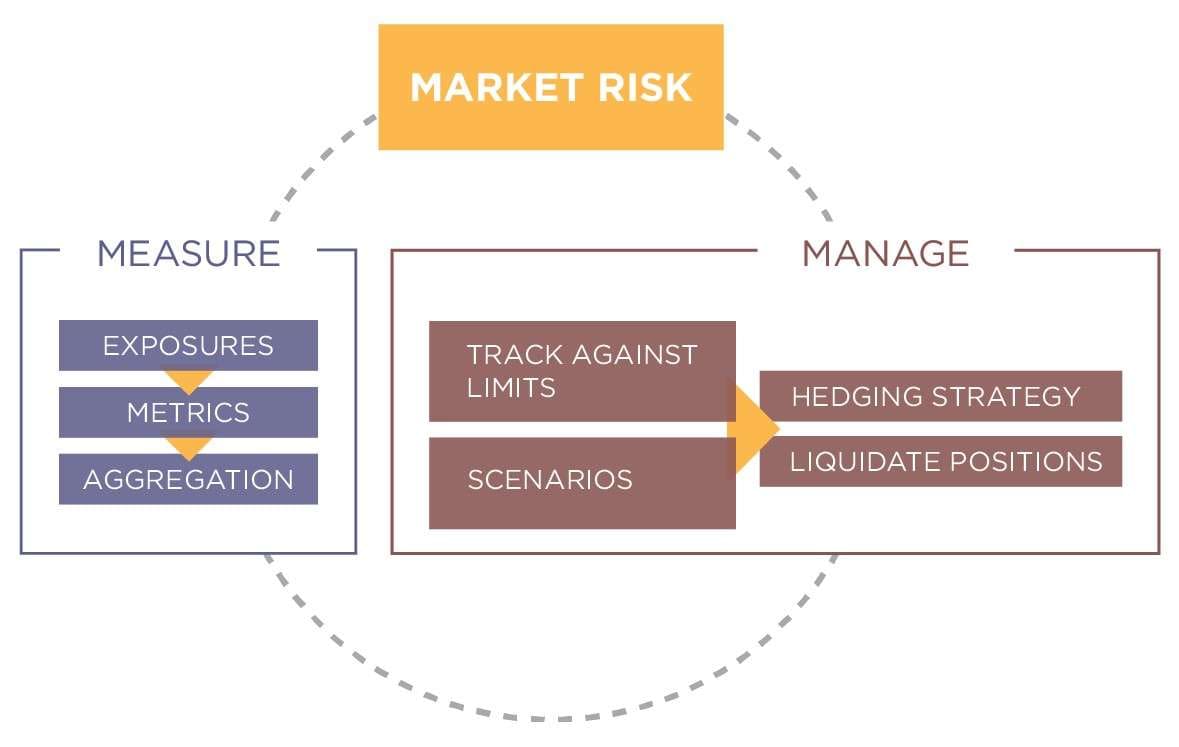

Market risk refers to the potential losses an organization may face due to fluctuations in market variables including prices, rates, indices, etc. Market risk management is the process of measuring, monitoring, and controlling market risk exposures to stay within acceptable parameters. The goal is to manage market risk in a way that balances risk and return.

Banks and other financial institutions are especially exposed to market risk due to their trading activities.

Part 2: Types of Market Risks

Major types of market risks include:

- Interest rate risk - potential impact of interest rate changes on asset/liability values

- Equity risk - the risk of loss from falling stock prices

- Commodity risk - the risk of commodity price changes

- Currency risk - potential impact of currency exchange rate fluctuations

- Credit spread risk - the risk that credit spreads widen due to downgrading in credit ratings

Banks need to manage exposures across these risk areas. The most significant market risk for banks is typically interest rate risk as changes in rates affect bank profits. However, banks also have exposures to equity, commodity, currency, and credit spread risks that require measurement and management.

Part 3: Best Strategies for Market Risk Management in Banks

Banks employ various strategies to manage market risks effectively:

- Robust risk metrics - Use models like Value at Risk (VaR), sensitivity analysis, and stress testing to quantify market risk and estimate potential losses

- Limits framework - Establish limits for various portfolios, products, and risk types to control exposures

- Hedging - Use derivatives like swaps, forwards, and futures to offset/reduce market risk

- Portfolio diversification - Avoid concentration in single markets; diversify across different asset classes

- Oversight - Senior management & board oversight of market risk activities

- Reporting - Timely monitoring & reporting to identify risks and trends

- Governance - Policies defining risk management practices, procedures, and controls

By implementing such strategies, banks can better understand and mitigate their market risk exposures.

Part 4: Benefits of Implementing Market Risk Management and Analysis

There are many benefits for banks and financial institutions in developing robust market risk management and analysis capabilities:

- Avoid large unexpected losses - Proactive risk management minimizes occurrences of outsized losses due to market fluctuations

- Optimize risk-return tradeoff - Measuring market risk helps make informed decisions aligning risk appetite and return objectives

- Meet regulatory requirements - Sound market risk practices help banks comply with regulations that require managing risks

- Enhanced corporate governance - Market risk management improves oversight and governance over bank activities

- Decision support - Risk analytics support many decisions including product pricing, position limits, capital allocation, hedging, etc.

Thus, banks that develop effective market risk management and analysis gain many benefits including improved financial performance, compliance, reputation, and decision-making.

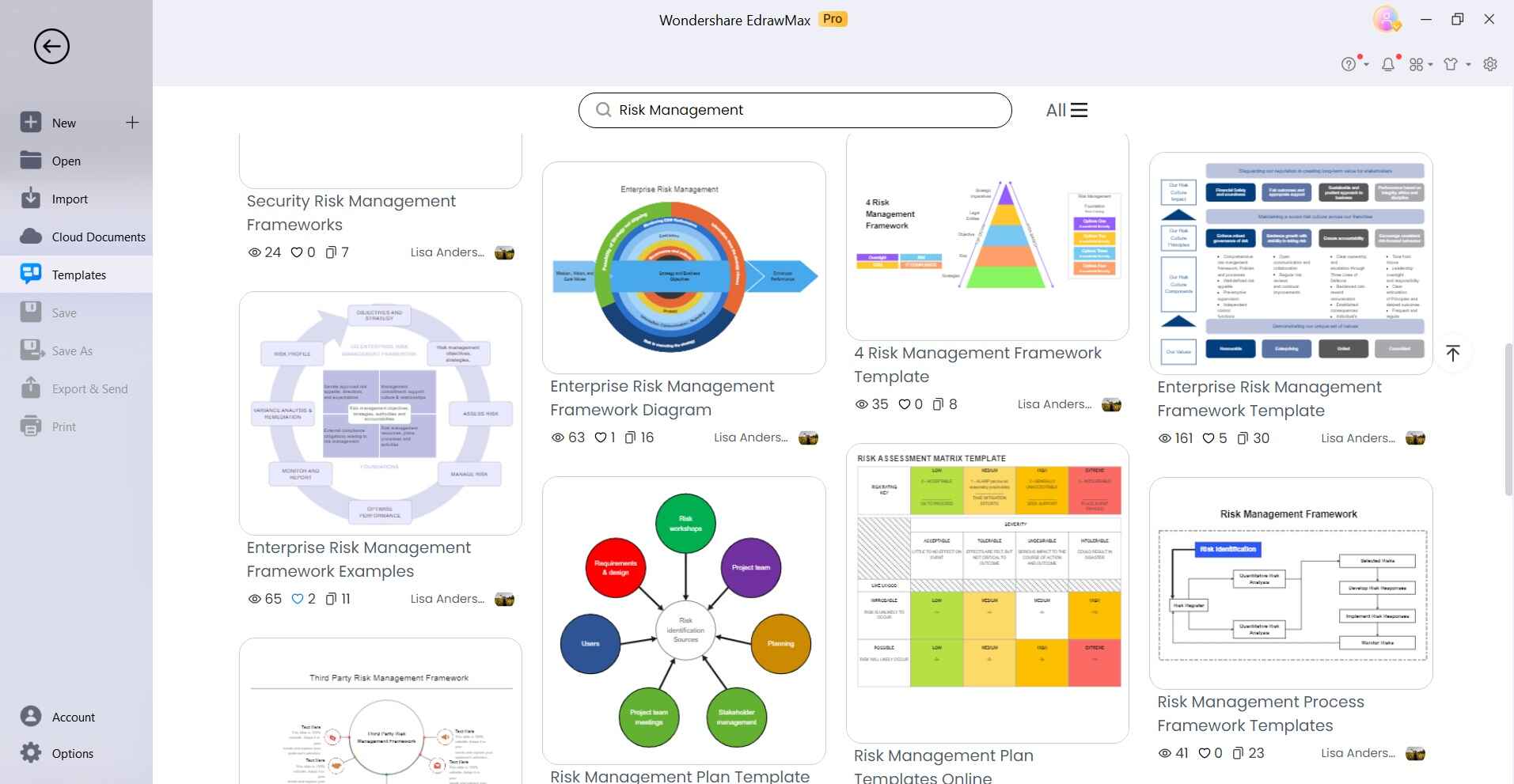

Part 5: Creating a Risk Management Diagram Using EdrawMax

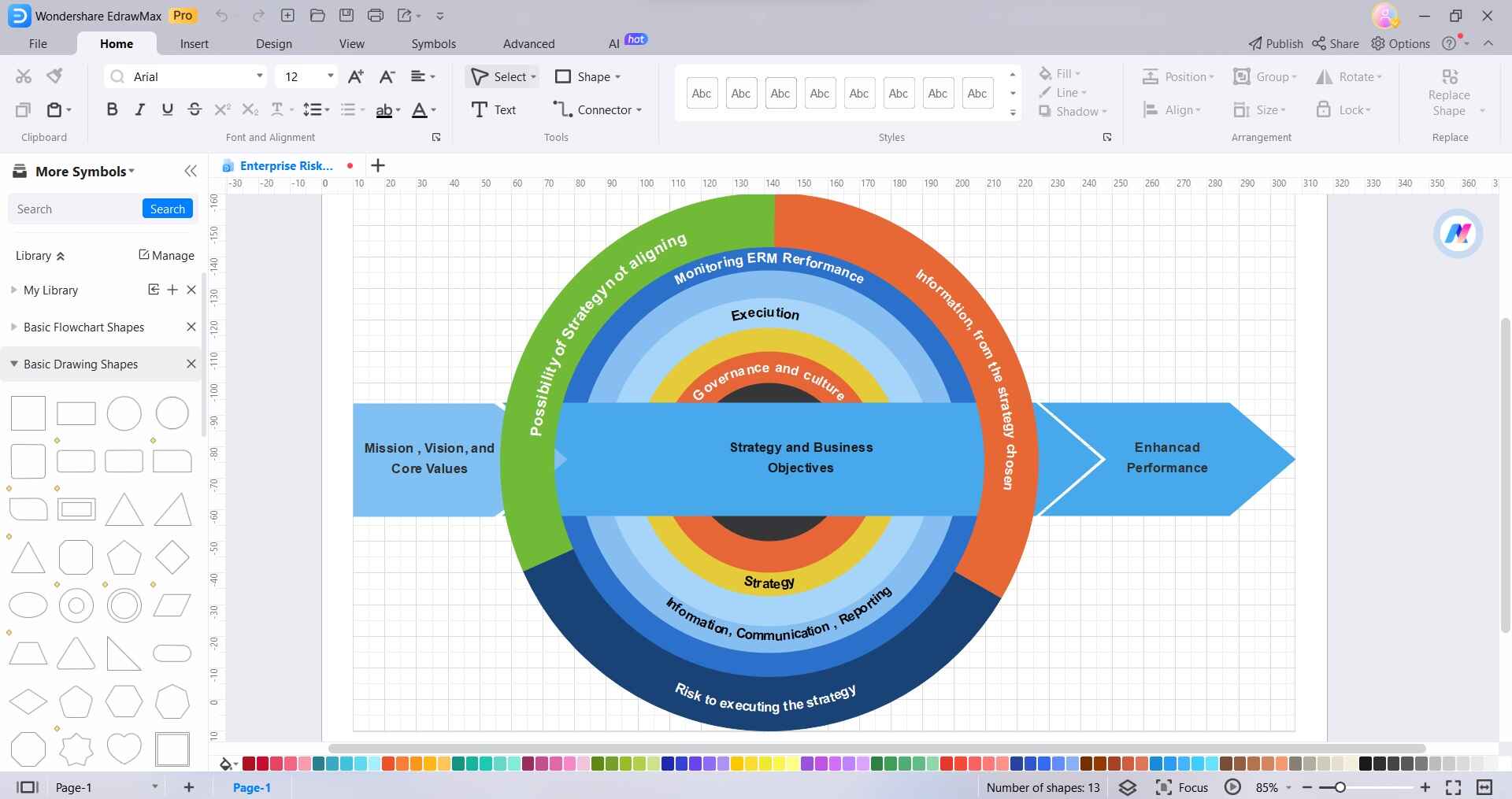

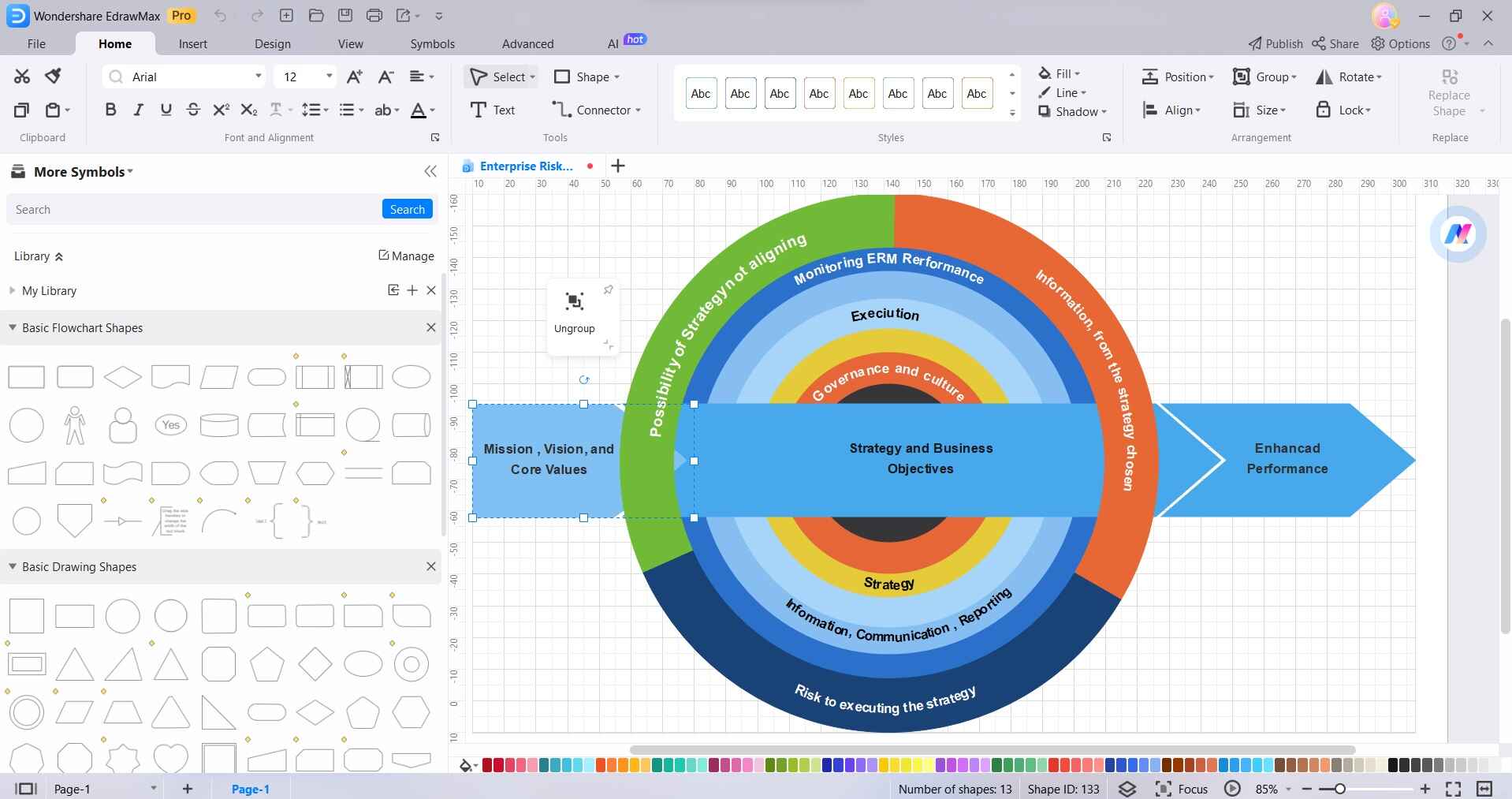

EdrawMax is a versatile diagramming software that can be used to create professional risk management diagrams. Using EdrawMax, banks can visualize their market risk management framework by creating flowcharts, process maps, organizational charts, and other diagrams. For example, a bank could design a diagram showing its market risk governance structure, including key departments, decision-making forums, reporting flows, and risk analytics systems.

Diagramming helps concisely communicate complex risk frameworks to stakeholders. EdrawMax provides the tools to create professional, visually appealing diagrams to represent market risk management models.

Key features of EdrawMax include:

- Intuitive drag-and-drop interface - Easy to create diagrams even for non-designers

- 5000+ templates and shapes - Lots of premade templates, symbols, and shapes

- Cross-platform compatibility - Create on Windows, Mac, Linux, and Web.

- Cloud collaboration - Enable team members to co-edit diagrams in real-time

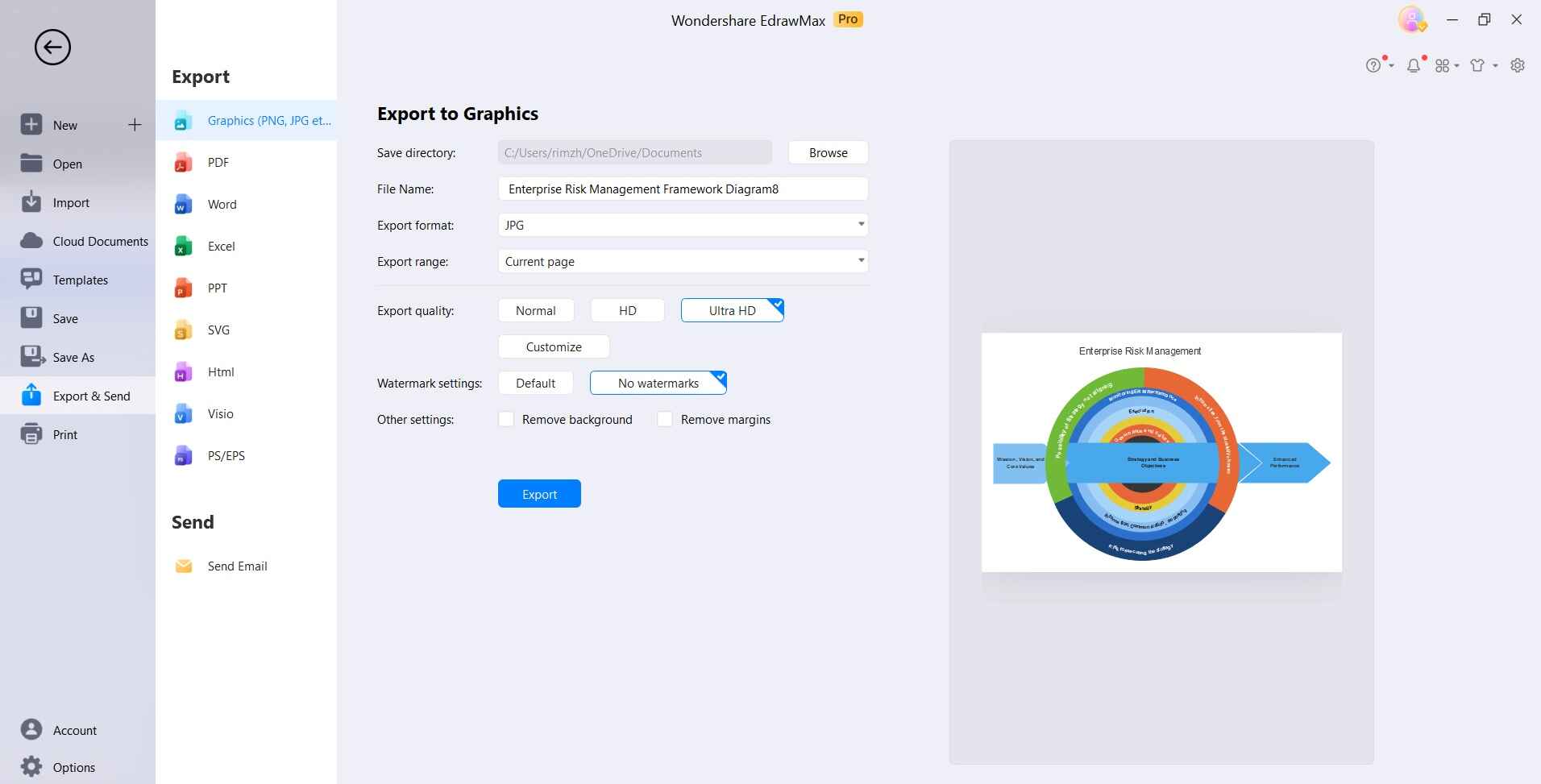

- Export to various formats - Share as image files, PDF, presentation slides, and more.

Here are the steps to create a risk management diagram using EdrawMax:

Step 1:

Launch the EdrawMax software on your computer. Also, the web diagram tool is available too.

In the template library, type "Risk Management" in the search bar, or browse through the available categories to find a suitable template for your diagram.

Step 2:

Once you've chosen a template, you can start customizing it to fit your requirements. This may include adding, deleting, or modifying shapes, text, colors, and other elements.

Step 3:

Double-click on text elements to edit them, and add labels to describe each component of the risk management process.

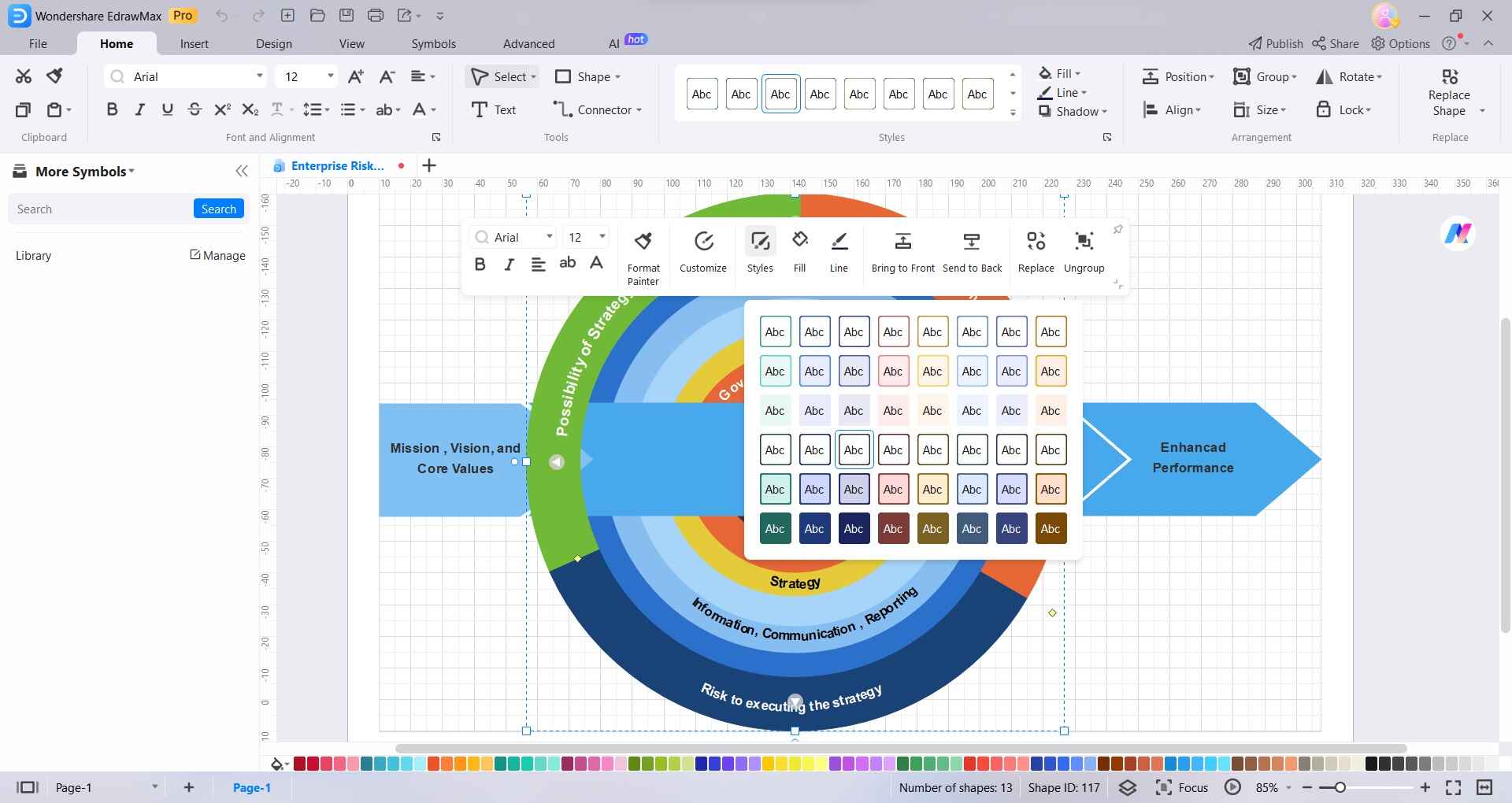

Step 4:

Use the formatting options in EdrawMax to change the colors, fonts, and styles of the diagram to make it visually appealing and easy to understand.

Step 5:

Click on "File" and select "Save As" to save your risk management diagram to your desired location on your computer.

Take your time to review and refine the diagram to ensure it effectively communicates the risk management process.

Conclusion

Market risk management is critical for banks and financial institutions seeking to manage exposures to asset prices, rates, indices, and other external market factors. By implementing robust measurement approaches, setting limits, leveraging hedging instruments, ensuring proper oversight, and creating risk visualization models, banks can effectively analyze and manage market risks while optimizing financial performance.