Treasury risk management plays a critical role in ensuring the financial stability and success of an organization. In an increasingly complex and volatile global marketplace, managing various types of risks is crucial for effective treasury management.

In this article

Part 1. What Is Treasury Risk Management?

Treasury risk management encompasses strategies and processes organizations implement to identify, assess, mitigate, and monitor risks associated with treasury functions. It involves managing and controlling risks to protect the organization's financial assets, optimize liquidity, ensure compliance, and support strategic decision-making.

Within an organization, the treasury department plays a central role in managing various risks. One of its primary responsibilities is to identify, measure, and analyze risks related to cash flow, interest rates, currencies, creditworthiness, liquidity, and operations.

Part 2. Types and Steps of Treasury Risk

There are various types of treasury risks. Each of these risks can have a significant impact on organizations, which is why efficient management is needed.

- Interest Rate Risk: Interest rate risk refers to the potential the impact that fluctuations in interest rates can have on an organization's financial performance.

- Currency Risk: Currency risk, also known as foreign exchange risk arises from fluctuations in exchange rates.

- Credit Risk: Credit risk refers to the potential loss arising from the failure of counterparties to fulfill their financial obligations.

- Liquidity Risk: Liquidity risk arises when an organization faces difficulties in meeting its financial obligations or liquidating assets promptly without incurring significant losses.

- Operational Risk: Operational risk refers to the risk of financial loss resulting from inadequate or failed internal processes, systems, human error, or external events.

Management of treasury risks is important for organizations. Treasury and risk management needs a step-by-step approach.

- Risk Identification: The first step in treasury risk management is identifying and understanding the potential risks faced by the organization.

- Risk Assessment: Once risks are identified, the treasury department conducts a comprehensive assessment to quantify their potential impact on the organization.

- Risk Evaluation: After assessing the risks, treasury professionals evaluate the organization's risk appetite and tolerance levels.

- Risk Response: In this step, treasury professionals devise and implement strategies to mitigate, transfer, or avoid identified risks.

- Risk Reporting: The final step in treasury risk management involves regular monitoring and reporting of risk-related information to relevant stakeholders.

Part 3. How Treasury Management Responds to Risk

Treasury management addresses risk through proactive and reactive approaches. Proactive measures include hedging, diversification, and contingency planning. Reactively, treasury management monitors risks and adjusts strategies accordingly.

SAP Treasury and Risk Management is an integrated software solution that assists organizations in streamlining and automating their treasury functions while minimizing risks. It provides functionalities for cash and liquidity management, risk analysis and

control, financial transaction processing, and compliance reporting.

Part 4. Make a Treasury Risk Management Flowchart with Tools

Using a treasury risk management flowchart creation tool is one of the best ways to visually analyze and manage risks.

1) Wondershare EdrawMax

Wondershare EdrawMax is an all-in-one diagramming tool that allows users to easily create professional-looking flowcharts and other diagrams to visualize and manage treasury risk. Follow these steps to create a treasury risk management chart using the tool:

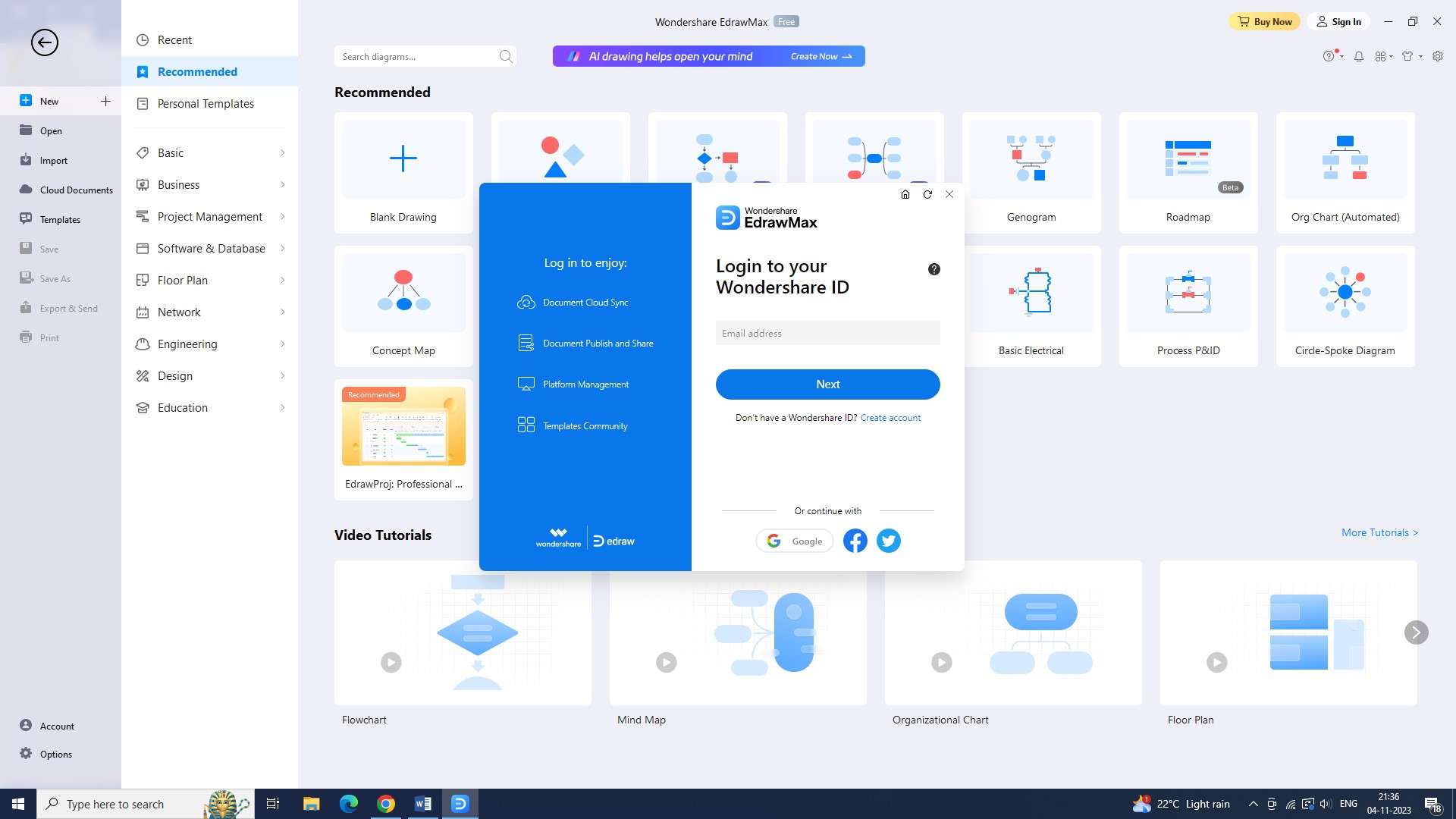

Step 1: Begin by signing into EdrawMax. Create an account if you do not already have one.

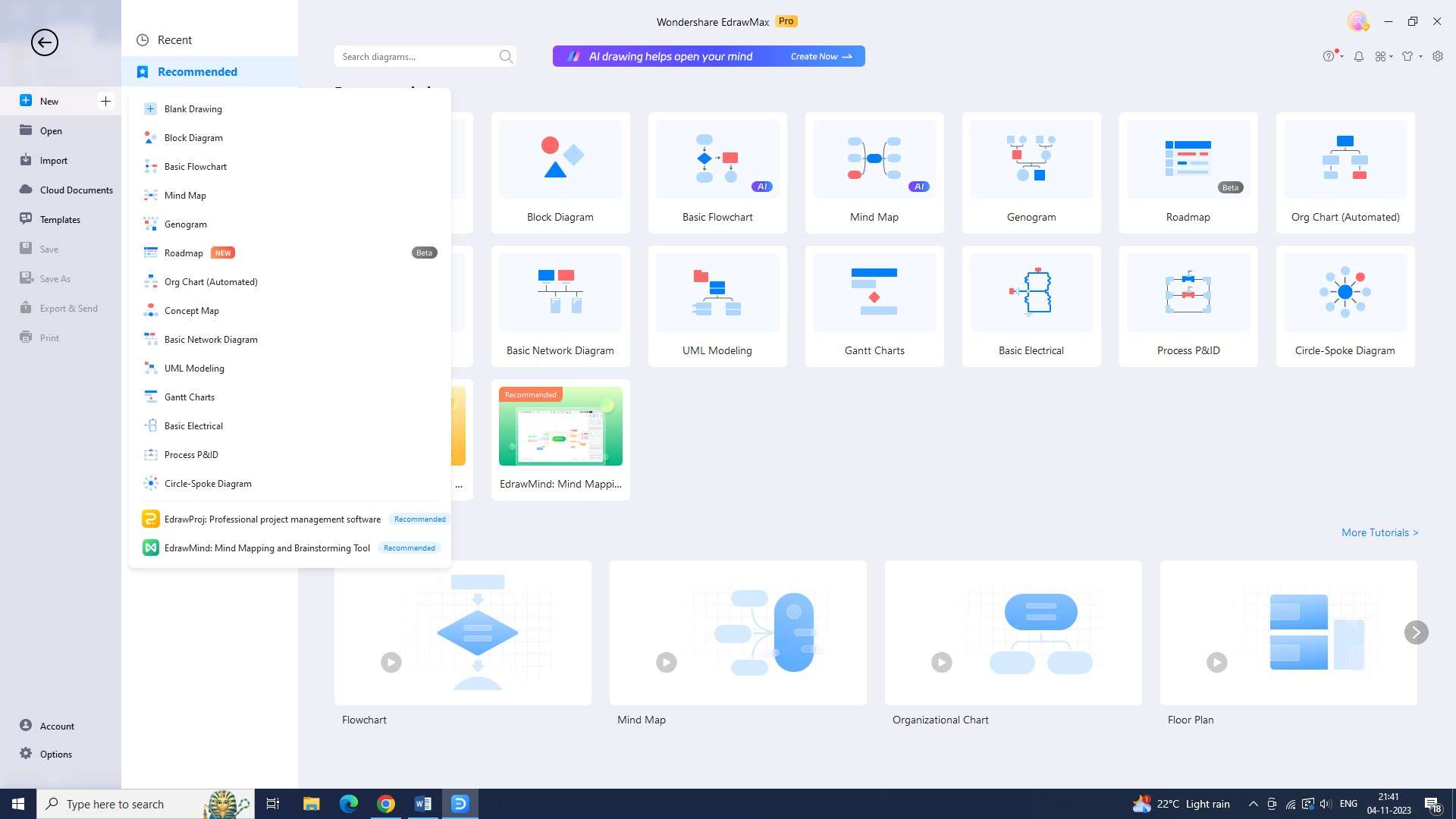

Step 2: Once signed in, open a new document from the main page. Click on the “+” symbol on the right side of the “New” button to do this.

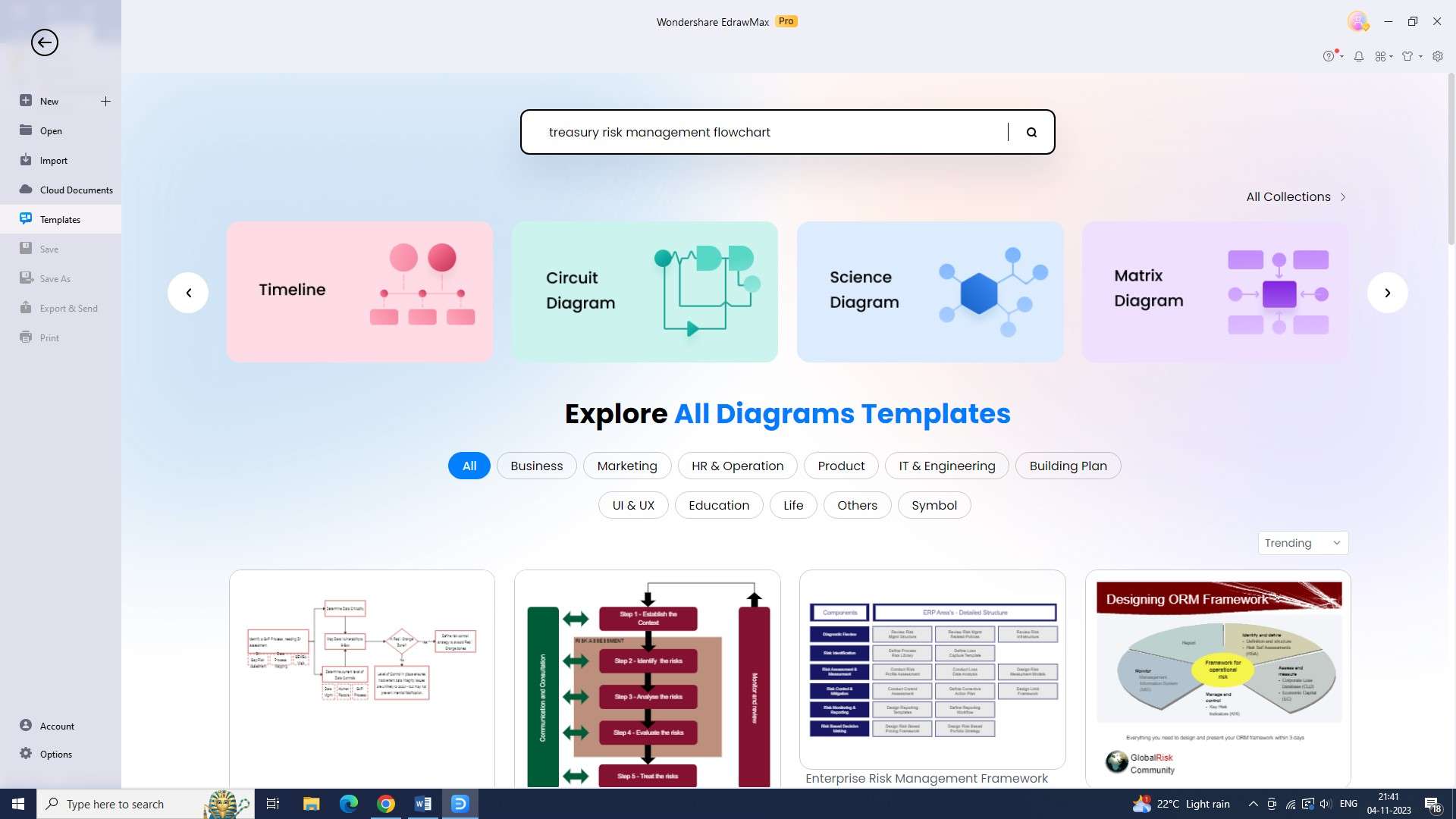

Step 3: From the “Templates” section, select “Flowchart” from the list of templates. Then, search for a treasury risk management flowchart template.

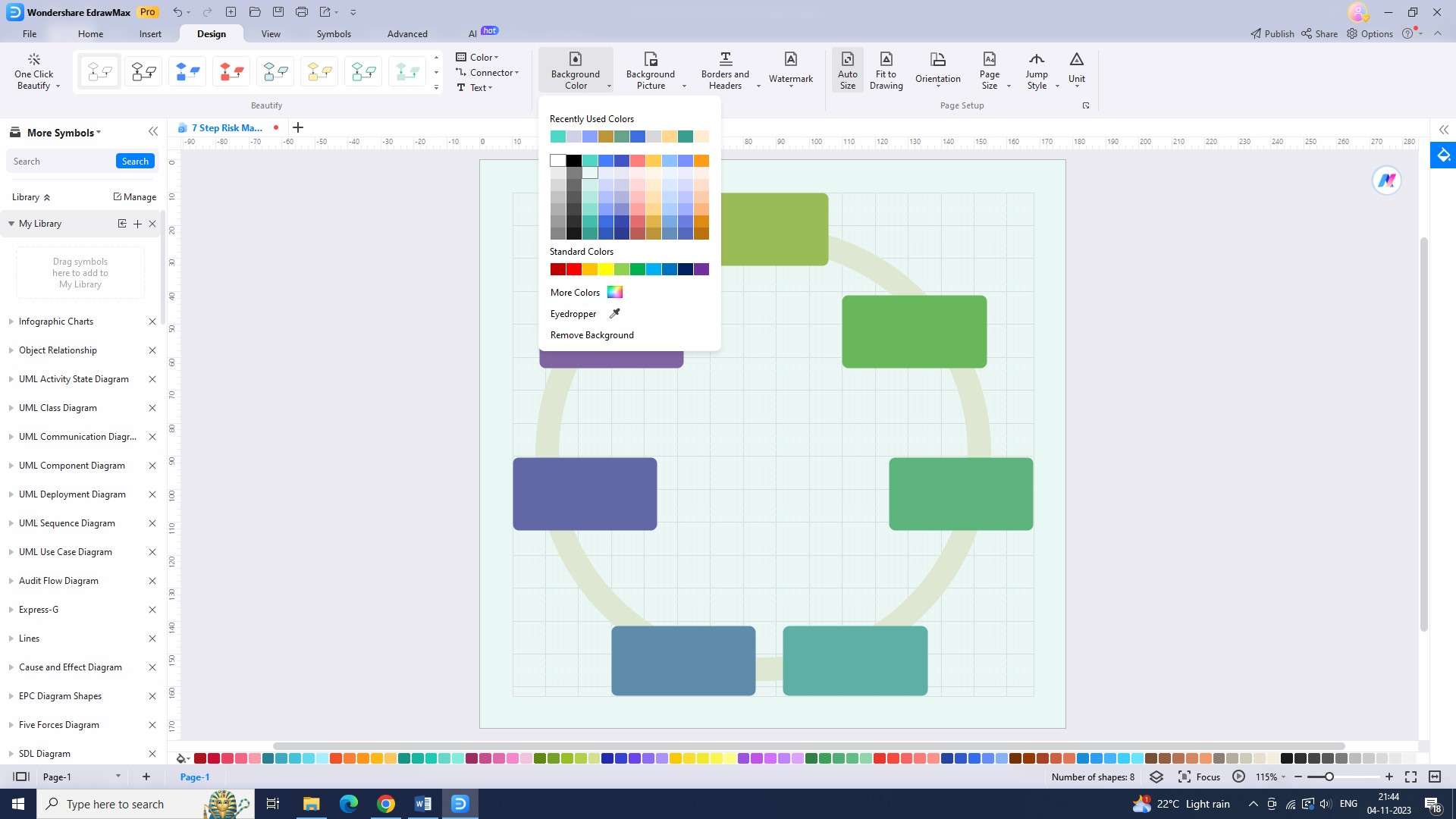

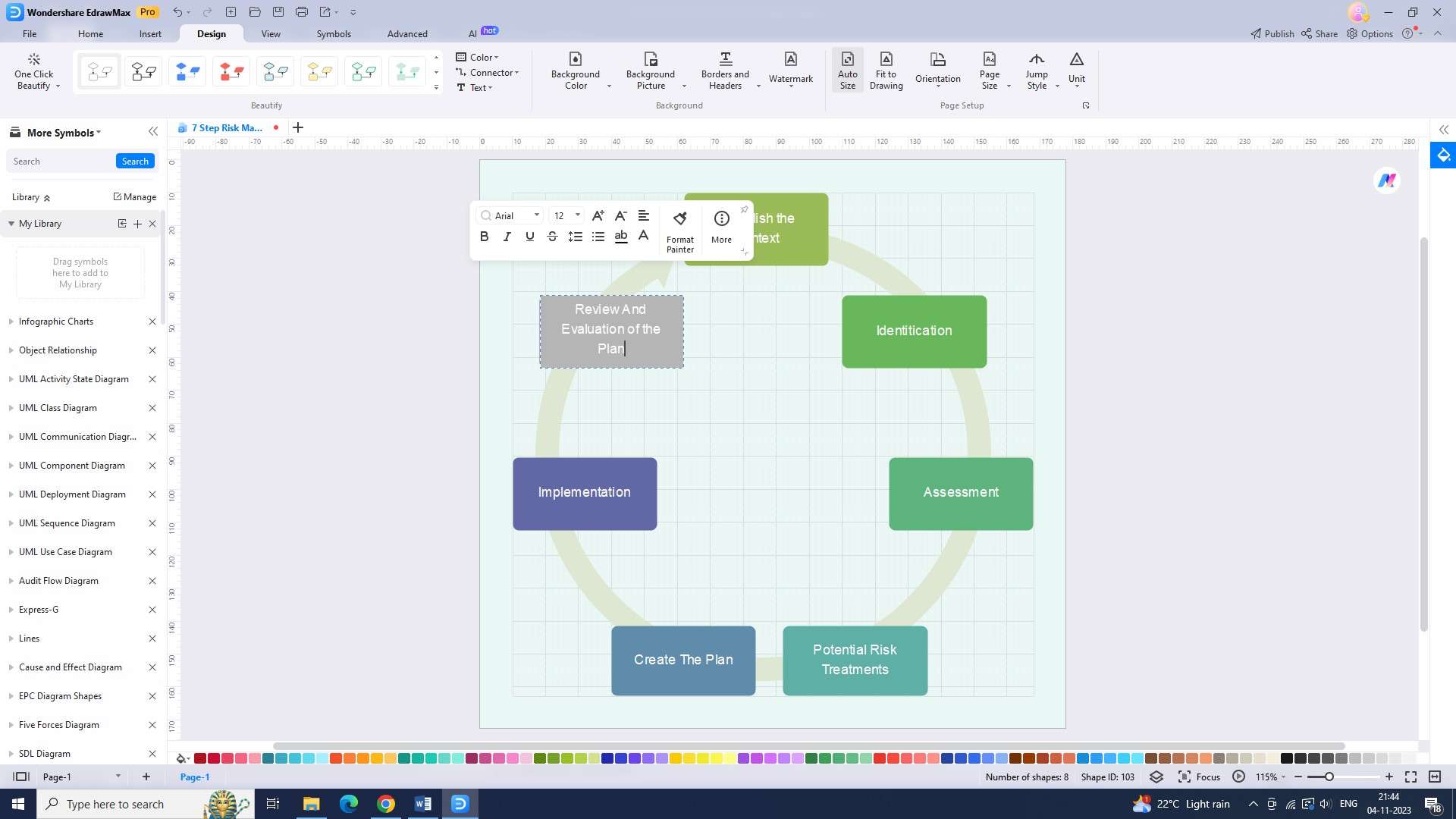

Step 4: Once you have found the template, customize it to your needs. Add or remove steps, edit shapes and text, and adjust colors to make it your own.

Step 5: Now, input all the necessary information in your chart. Click on the shapes and input your information inside them.

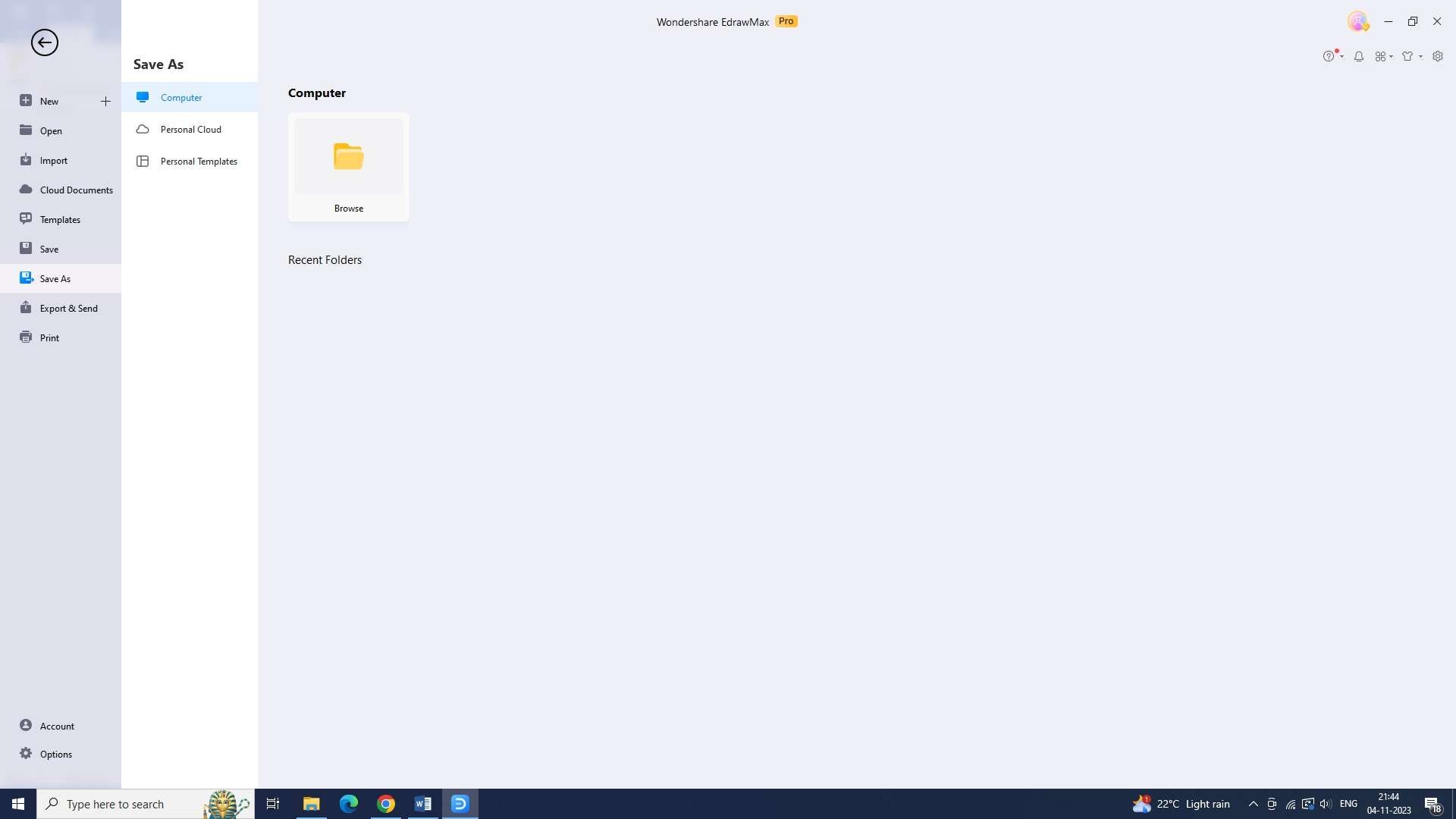

Step 6: When you are satisfied with your chart, save the chart by going to “File,” and then clicking on “Save As”.

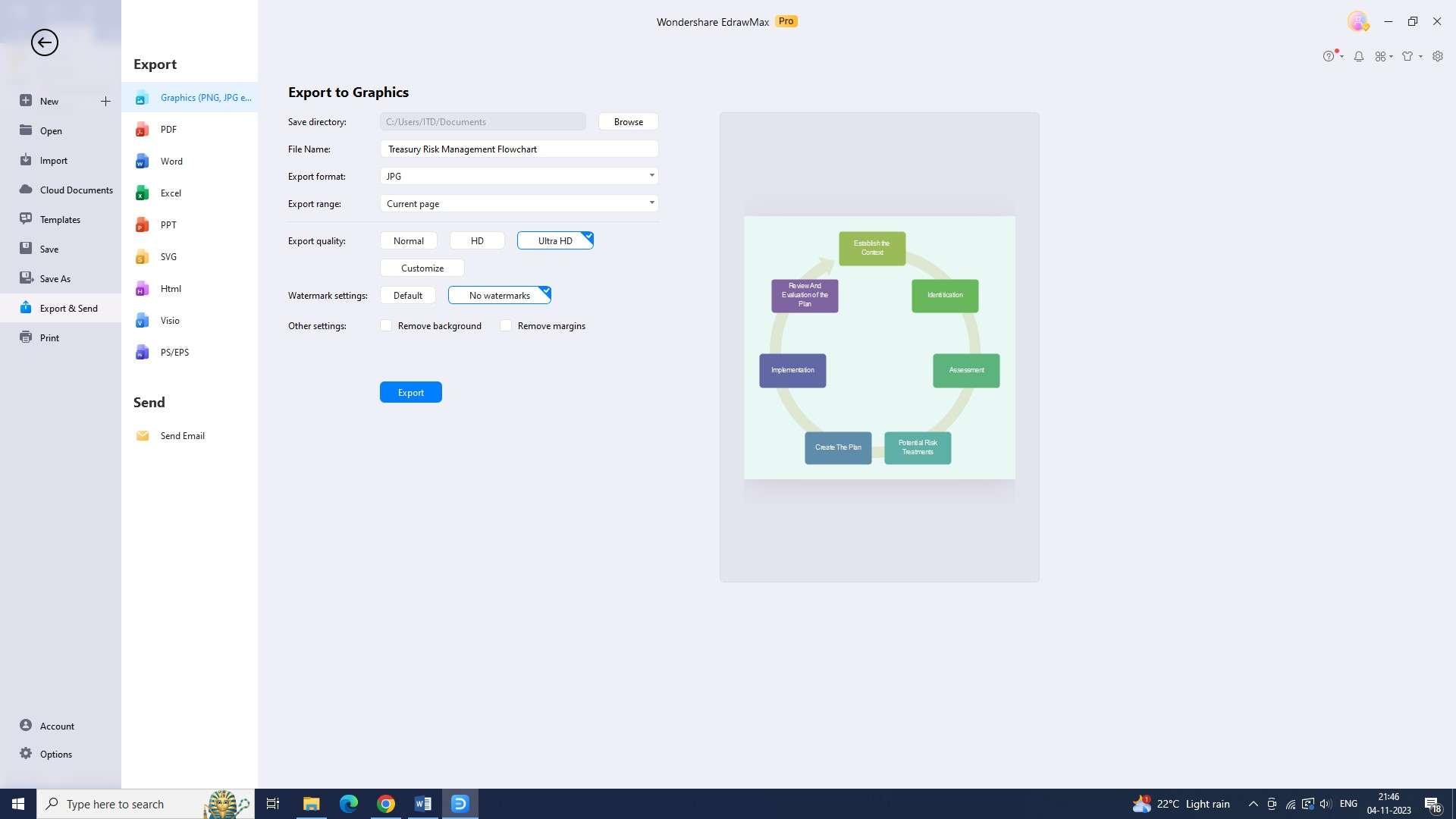

Step 7: Finally, when you are happy with the chart, export it in the desired file format for your use.

2) Creately

Creately is a powerful visual data analysis tool for creating treasury risk management flowcharts.

Features:

- Dedicated treasury risk management symbols: Tailored symbols for complex financial processes.

- Compliance templates: Pre-designed templates for industry regulations.

- Customizable data visualization: Create custom graphs and charts in flowcharts.

3) Lucidchart

Lucidchart is a comprehensive flowcharting and diagramming tool that enables users to create, share, and collaborate on treasury risk management flowcharts.

Features:

- Interactive decision trees: Enhance risk assessment and mitigation clarity.

- Advanced simulation modeling: Analyze scenarios and assess risk impacts.

- Advanced security controls: Granular access restrictions for sensitive flowcharts.

Conclusion

Treasury and risk management are crucial in today's dynamic business environment. By implementing appropriate risk management strategies, organizations can effectively mitigate risks.