In an era of unprecedented challenges, the role of a Certified Risk Management Professional (CRMP) is crucial. These seasoned experts have the knowledge and skills to steer businesses through turbulent waters. With a keen understanding of risk assessment, analysis, and strategic mitigation, CRMPs fortify organizations against unforeseen threats.

This guide illuminates the pivotal role they play in safeguarding business interests, ensuring a resilient and prosperous future in an unpredictable world.

In this article

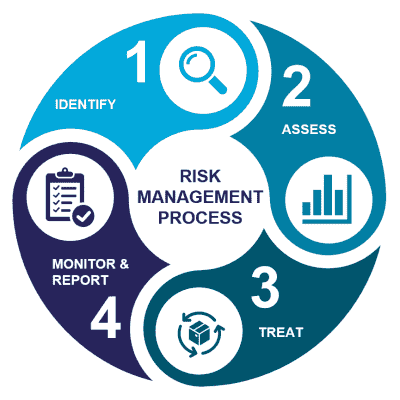

Part 1: What is Risk Management?

Risk management is like looking both ways before crossing the street. It's about identifying possible problems, figuring out how likely they are, and taking steps to stay safe. In business, it means recognizing and preparing for things that could go wrong so that the company can keep running smoothly. It's like wearing a seatbelt in a car - it's a smart way to protect what's important.

Part 2: Who is a Certified Risk Manager (CRM)?

A Certified Risk Manager (CRM) is a highly skilled professional in identifying, assessing, and managing organizational risks. So, a certified risk professional undergoes specialized training and certification to excel in this role. CRMs play a vital role in safeguarding businesses from potential threats that could impact their success. They are adept at analyzing various types of risks, from financial to operational, and develop strategies to minimize their impact. Their expertise ensures companies can confidently navigate uncertainties, making them indispensable assets in today's complex business landscape.

Part 3: Role of a Certified Risk Management Professional

A Certified Risk Management Professional (CRMP) plays a multifaceted role in protecting an organization's interests and assets.

- Identifying potential risks and threats within an organization.

- Developing and implementing strategies to mitigate and manage risks effectively.

- Conducting a thorough analysis of financial, operational, and reputational risks.

- Collaborating with cross-functional teams to ensure comprehensive risk management.

- Remaining current with industry regulations and integrating best practices.

- Providing expert guidance to leadership in making informed decisions.

- Safeguarding the organization's assets and interests against unforeseen challenges, ensuring long-term sustainability.

Part 4: Job Roles and Industries for Certified Risk Managers

Certified Risk Managers find valuable roles in diverse industries, where their expertise is indispensable in safeguarding against potential threats and uncertainties.

- Banking and Financial Services

- Healthcare and Pharmaceuticals

- Construction and Engineering

- Insurance and Reinsurance

- Manufacturing and Supply Chain Management

- Information Technology and Cybersecurity

- Energy and Utilities

- Consulting and Advisory Services

- Government and Public Sector

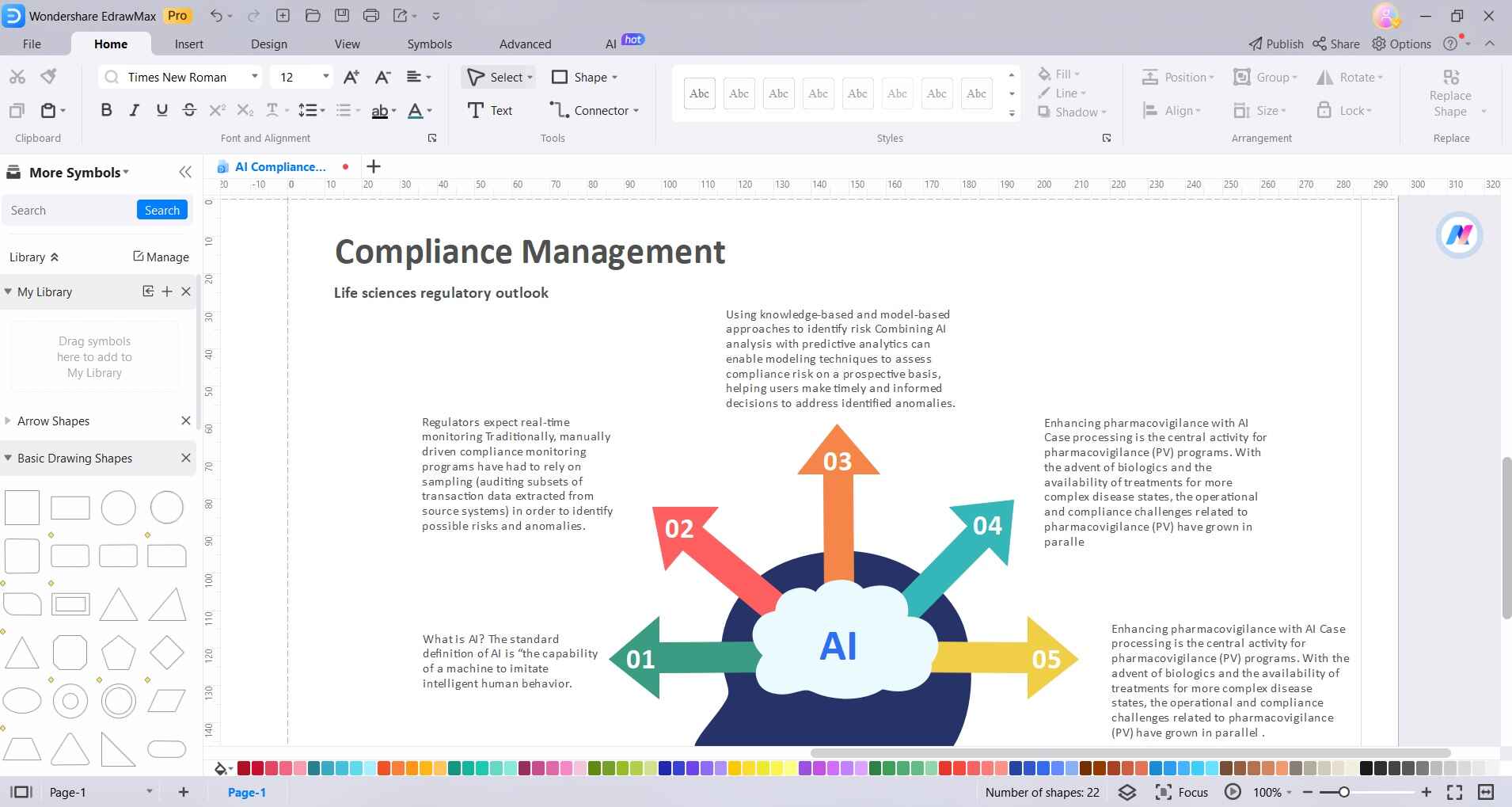

Part 5: Creating a Compliance Management Diagram Using EdrawMax

Creating a Compliance Management Diagram with EdrawMax is like making a clear roadmap for following rules and regulations in a company. It's important because it helps everyone understand what to do to stay compliant. With EdrawMax, it's easy to draw out this roadmap.

Plus, it helps spot any areas that might need improvement. This way, the company can work smoothly and be ready for any changes in rules. In simple terms, EdrawMax helps keep the company on the right track, following the rules and staying efficient.

Here are the steps to create a compliance management diagram using EdrawMax:

Step1

Launch the EdrawMax software on your computer. Click on "File" in the menu bar and select "New." Alternatively, you can switch to the “Template” section and then choose a template that suits your compliance management needs.

Step2

Drag and drop shapes, symbols, and icons from the left sidebar onto the canvas to represent different elements of your compliance framework. Use shapes like rectangles for processes, diamonds for decisions, and arrows to connect them.

Step3

Use arrows or connectors to link the shapes and show the flow of compliance procedures. This helps in visualizing how different elements relate to each other.

Step4

Customize the colors, fonts, and styles to make the diagram visually appealing and easy to understand.

Step5

Navigate to File> Save. Once satisfied with the compliance management diagram, save it in your preferred format (e.g., .pdf, .png) for easy sharing and future reference.

EdrawMax offers a user-friendly interface with a wide range of shapes and customization options, making it an excellent tool for creating professional-looking compliance management diagrams.

Part 6: Benefits of CRM Certification

Attaining a CRM certification brings a host of advantages, both professionally and personally. Here are the key benefits of becoming a certified risk and compliance management professional.

- Validates Expertise: Certifies a professional's proficiency in risk management.

- Enhances Credibility: Boosts trust among colleagues, clients, and employers.

- Expands Knowledge: Provides in-depth understanding of risk assessment and mitigation.Career

- Advancement: Opens doors to higher-level positions and increases earning potential.

- Demonstrates Commitment: Shows dedication to staying updated with industry best practices.

- Networking Opportunities: Connects with a community of fellow certified risk management professionals.

Conclusion

In simple terms, a Certified Risk Management Professional (CRMP) is like a shield for businesses, protecting them from unexpected problems. Preparing risk management diagrams and frameworks with EdrawMax is like having a powerful tool in hand, making it easier to understand and manage risks. It's a smart move for a safer and more successful future in any industry.

[没有发现file]