Enter a realm of revolutionary compliance risk management. In a rapidly shifting financial landscape, adherence to norms is no longer the benchmark. This guide introduces cutting-edge strategies to not only navigate regulatory compliance risk but to redefine it.

Uncover the power of technology and a robust compliance culture in propelling your institution forward. Join us in charting the course for the future of compliance risk in banking.

In this article

Part 1: What is a Compliance Risk?

Compliance risk is the chance that a company might not follow important rules and laws. This could lead to problems like fines or damage to its reputation. It happens because every business has to follow specific rules. Managing compliance risk means making sure a company sticks to these rules by having good policies and checks in place. This helps keep the company on the right track and out of trouble.

Part 2: Difference Between Compliance and Risk

Compliance is about following rules, laws, and regulations that apply to a business. It ensures operations stay within legal boundaries. Risk, on the other hand, involves identifying and dealing with potential problems or uncertainties that could affect a company's goals. It includes various types of financial, operational, or compliance risks. While compliance focuses on obeying rules, risk management is about preparing for and handling unexpected events that could impact the business.

Part 3: Types of Compliance Risks

Navigating compliance risks is crucial for businesses. Here are four key types to be mindful of:

- Regulatory Compliance Risk: This type of risk arises from failing to comply with government laws and regulations applicable to a particular industry. It includes areas such as data protection, consumer rights, and financial reporting, and may result in fines, penalties, or legal action.

- Industry-specific Risk: Pertaining to specific sectors, this risk relates to compliance with industry standards, codes of practice, or guidelines. Non-compliance may lead to reputational damage, loss of business partnerships, or exclusion from industry associations.

- Internal Policies and Procedures Risk: This risk involves non-compliance with an organization's internal policies, protocols, and operational procedures. It can result in inefficiencies, mismanagement, or conflicts within the company.

- Legal Compliance Risk: Arising from breaches of contract, copyright infringement, or other legal obligations, the legal and compliance risk can lead to lawsuits, financial losses, and reputational harm. It emphasizes adherence to the broader legal framework beyond industry-specific regulations.

Part 4: Role of Compliance Risk in Banking Sector

In the banking industry, compliance risk management is vital for ensuring that institutions operate within legal boundaries and maintain financial stability. Here’s how:

- Maintaining Regulatory Adherence: Ensuring banks abide by government rules and financial regulations.

- Safeguarding Financial Stability: Identifying and mitigating risks to prevent financial crises.

- Preserving Reputation: Upholding trust by avoiding legal issues and negative publicity.

- Enhancing Consumer Protection: Implementing measures to safeguard customer interests and rights.

- Facilitating Ethical Conduct: Promoting a culture of integrity and ethical behavior within the institution.

- Mitigating Financial Loss: Minimizing potential losses due to non-compliance with regulatory requirements.

- Enabling Informed Decision-Making: Providing data and insights for sound risk management strategies.

Part 5: Create an Enterprise Risk Management Framework Diagram Using EdrawMax

Creating an Enterprise Risk Management (ERM) framework diagram using EdrawMax is crucial for businesses seeking to comprehensively assess and mitigate risks. EdrawMax's intuitive interface and diverse templates streamline the process, enhancing clarity and enabling stakeholders to visualize complex risk relationships. This tool empowers organizations to customize their ERM framework, ensuring it aligns with their unique industry dynamics and risk profile.

Additionally, EdrawMax facilitates efficient communication of risk strategies, promoting a proactive approach to risk management and safeguarding long-term success.

Here are the steps to create a simple enterprise risk management diagram using EdrawMax:

Step1

Open the EdrawMax application on your computer. From the main interface, switch to the “Template” category and pick a template that suits your needs. You can search for “Risk Management”, “Enterprise Risk Management” or anything that suits your requirements.

Step2

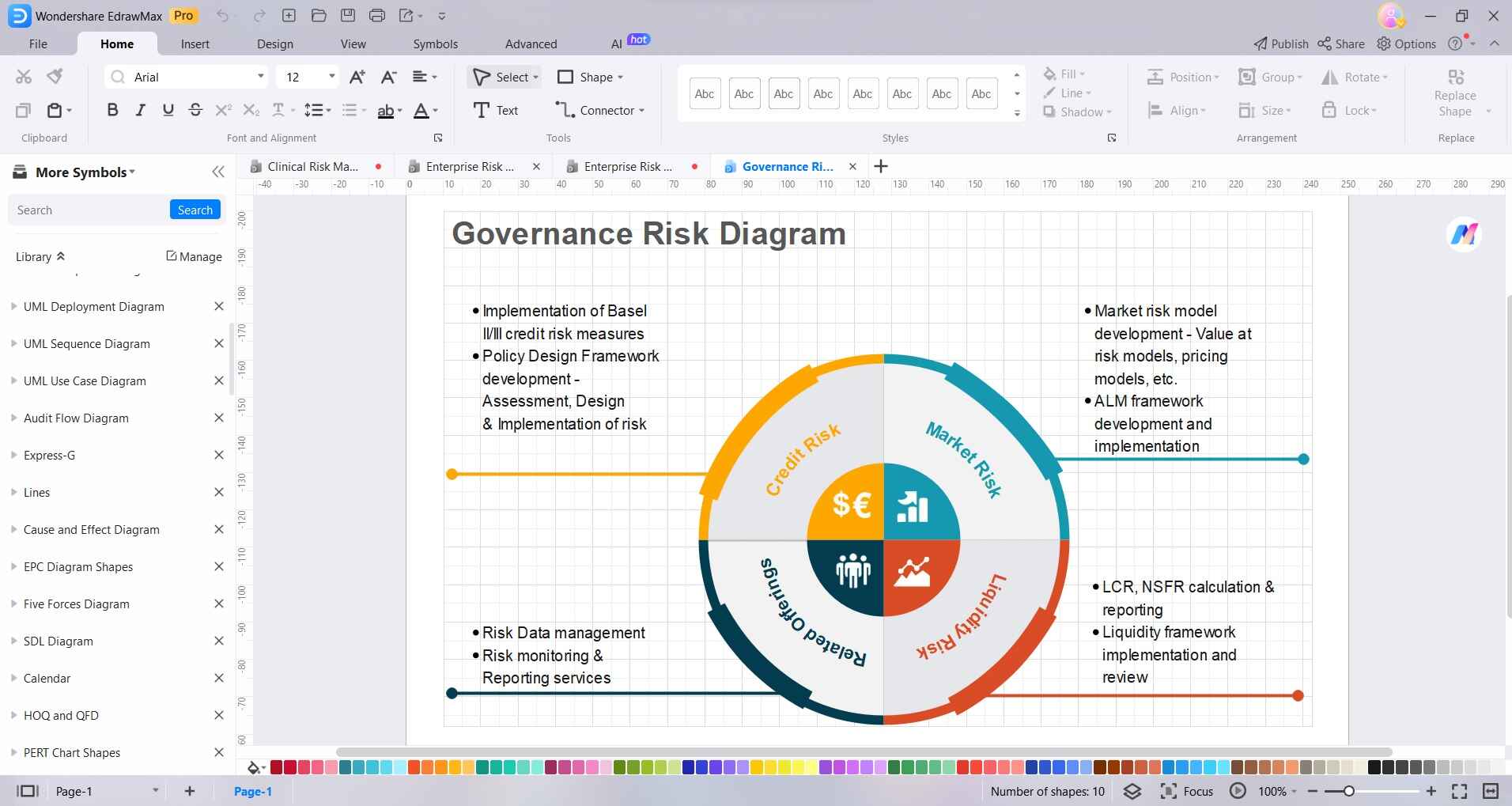

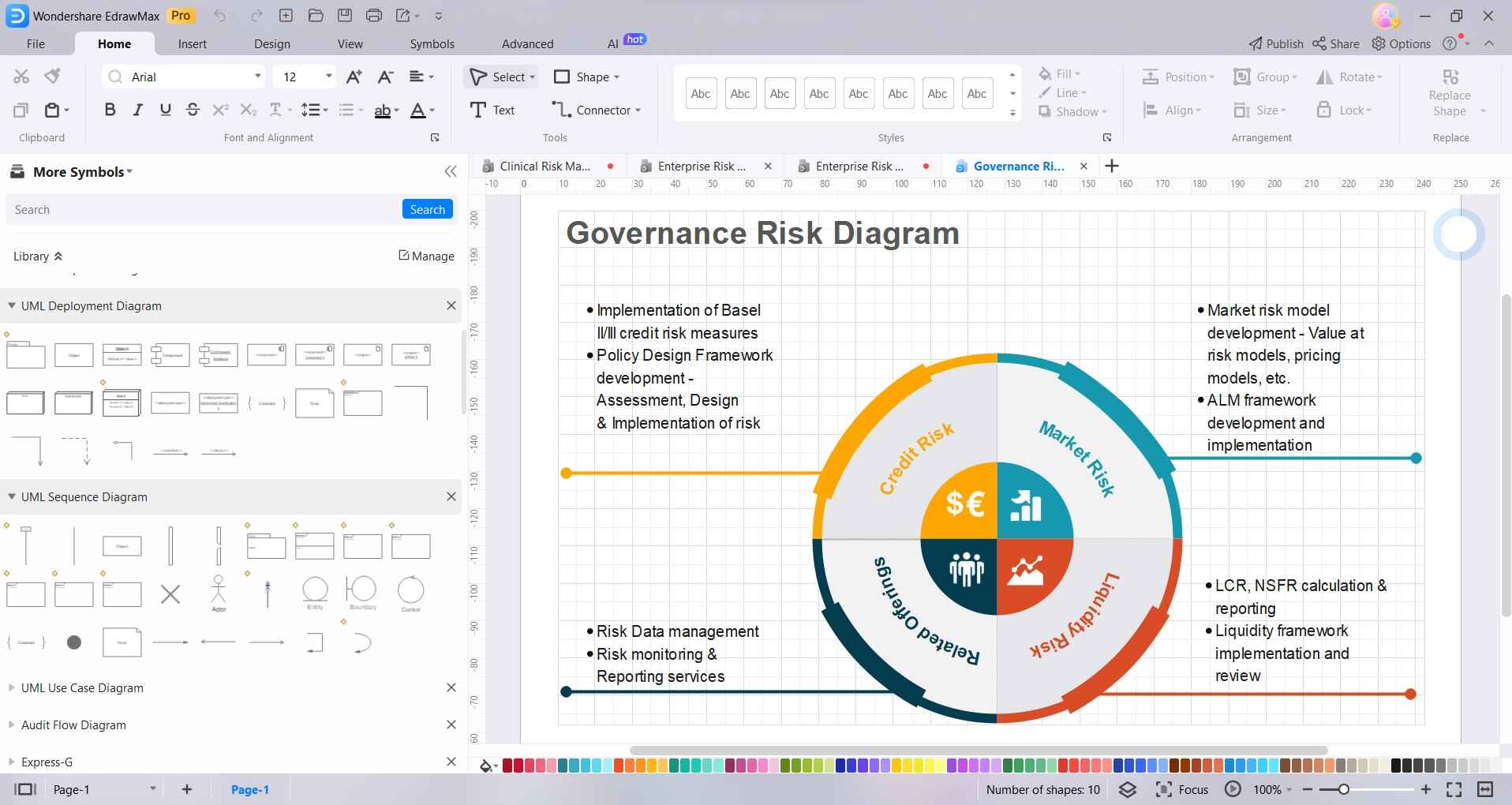

Drag and drop shapes from the left panel onto the canvas to represent various elements of your ERM framework. These may include rectangles for processes, diamonds for decision points, and ovals for endpoints.

Step3

Use connector lines to illustrate the flow of processes and decisions within the ERM framework. Click and drag from one shape to another to create connections.

Step4

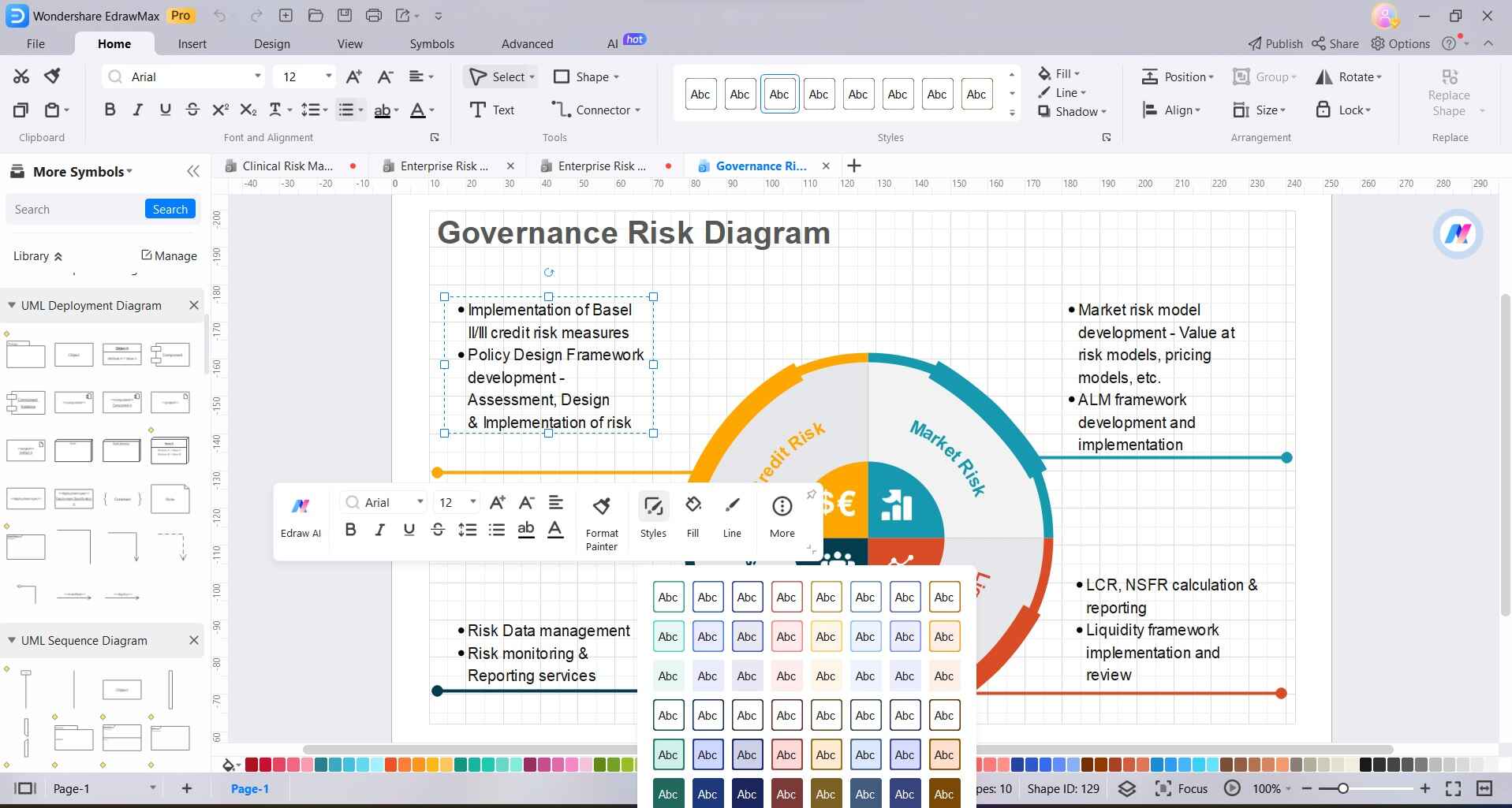

Select a shape or element in your ERM diagram and from the context menu, choose the "Style" option. Here, you can modify various aspects such as color, font, size, and alignment to enhance the visual appeal and clarity of your diagram.

Step5

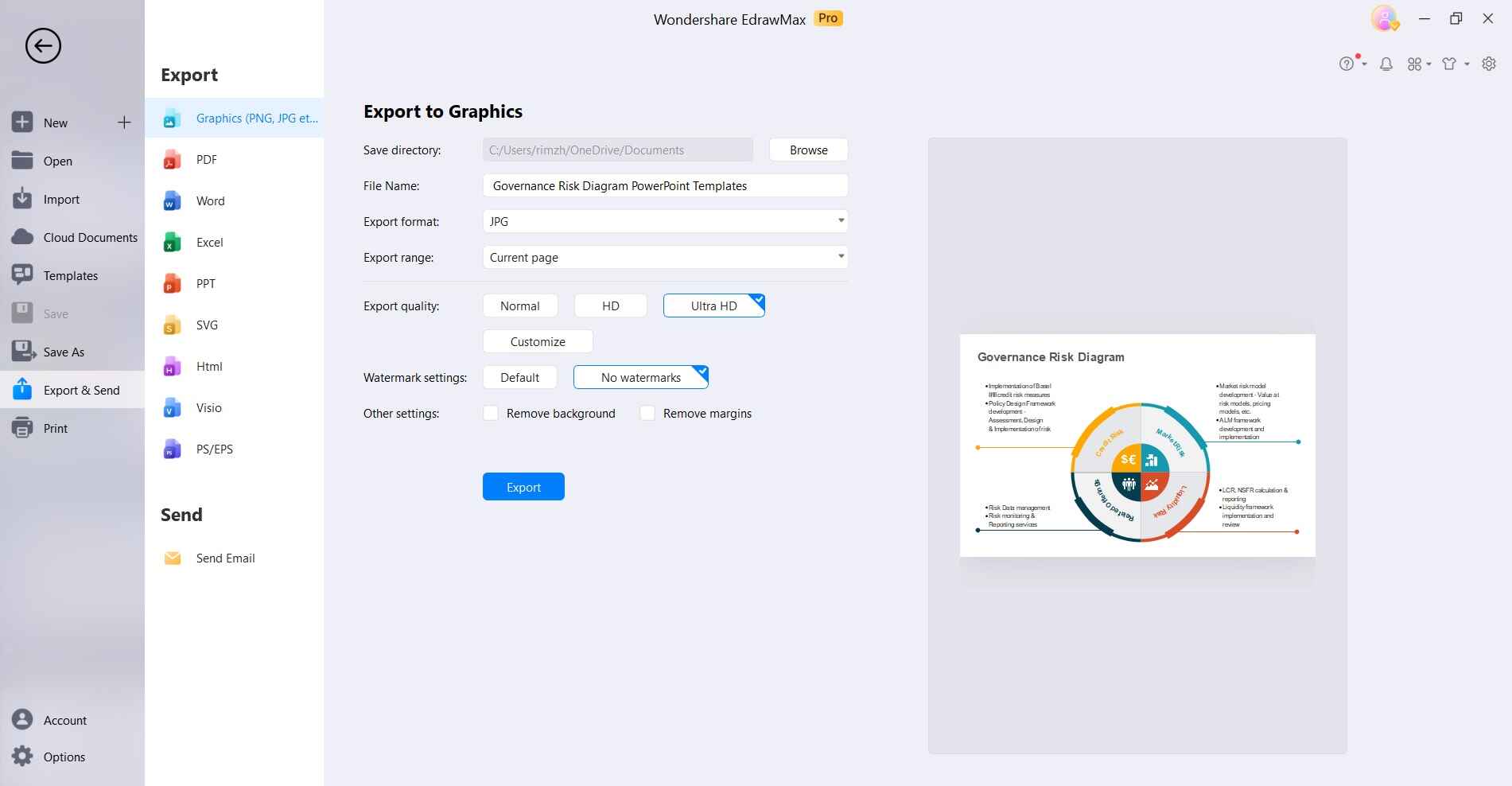

Once satisfied, navigate to File> Save to save your ERM diagram in a suitable file format. You can also export it for sharing or presentation purposes.

This step-by-step guide should help you create a simple but effective ERM diagram using EdrawMax.

Conclusion

In summary, using EdrawMax for an Enterprise Risk Management (ERM) diagram is a smart move for businesses. It helps create clear visuals of complex risks and allows easy customization. By following the steps, companies can build a tailored ERM plan that fits their industry. This tool strengthens risk strategies, ensuring long-term success in today's business world. Embracing EdrawMax is a proactive step towards a secure and thriving future.