In business, dealing with risks is crucial. The COSO Risk Management framework is like a roadmap that helps identify, evaluate, and deal with potential problems. Using COSO principles, businesses can become stronger and more confident in facing challenges. This guide explains in easy terms how COSO Risk Management can be a game-changer for businesses, helping them survive tough times and grow stronger.

In this article

Part 1. What is Risk Management?

Navigating the uncertainties and hazards of the business world requires proactive identification and mitigation of potential threats. Risk management provides organizations with a framework to detect, examine, and address vulnerabilities across operations, finances, strategy, and reputation. It empowers companies to take a holistic view of the risk landscape and quantify exposure levels to negative events.

Part 2. Importance of Effective Risk Management

Managing risk effectively is crucial for companies to thrive in an uncertain world. Here’s why COSO risk assessment is crucial for businesses:

- Identifies potential threats and vulnerabilities to mitigate risks

- Quantifies risk exposure to support data-driven decision-making

- Minimizes financial losses from unforeseen events

- Reduces operational disruptions and maintains business continuity

- Protects company image, reputation, and customer trust

- Ensures compliance with laws and regulations

- Provides strategic, financial, and operational benefits

- Enables informed risk-taking and opportunity-capture

- Promotes long-term sustainability and competitive advantage

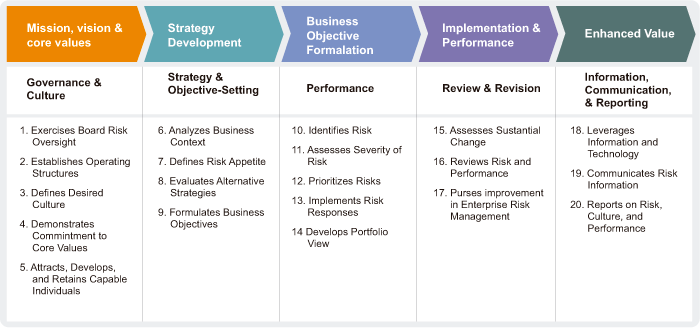

Part 3. Components of COSO Risk Management

The COSO risk management framework has eight interrelated components:

- Internal Environment - Foundation for risk management with integrity and ethical values.

- Objective Setting - Aligns objectives with organizational mission and risk appetite.

- Event Identification - Recognizes internal and external events affecting objectives.

- Risk Assessment - Analyzes risks for likelihood and impact on objectives.

- Risk Response - Select strategies to mitigate risks within risk tolerance.

- Control Activities - Implement policies to help ensure effective responses.

- Information & Communication - Captures and shares risk information for decision-making.

- Monitoring - Evaluates performance and adapts risk management approach.

Here are some benefits of implementing COSO Risk Management: Implementing COSO Risk Assessment provides a structured approach to handling risks.

A. Enhanced Risk Awareness and Responsiveness:

Implementing COSO Risk Management enhances an organization's ability to identify, assess, and respond to risks in a proactive and informed manner, fostering a culture of vigilance and preparedness.

B. Improved Decision-making and Strategy Formulation:

By integrating COSO Risk Management principles, organizations can make more informed and strategic decisions, aligning their actions with risk tolerance levels and ultimately driving sustainable growth and success.

C. Increased Stakeholder Confidence and Trust:

The adoption of COSO Risk Management practices instills confidence in stakeholders, demonstrating a commitment to sound risk management practices, which in turn builds trust and credibility with investors, customers, and other key stakeholders.

Part 4. Creating a Flowchart Easily Using EdrawMax

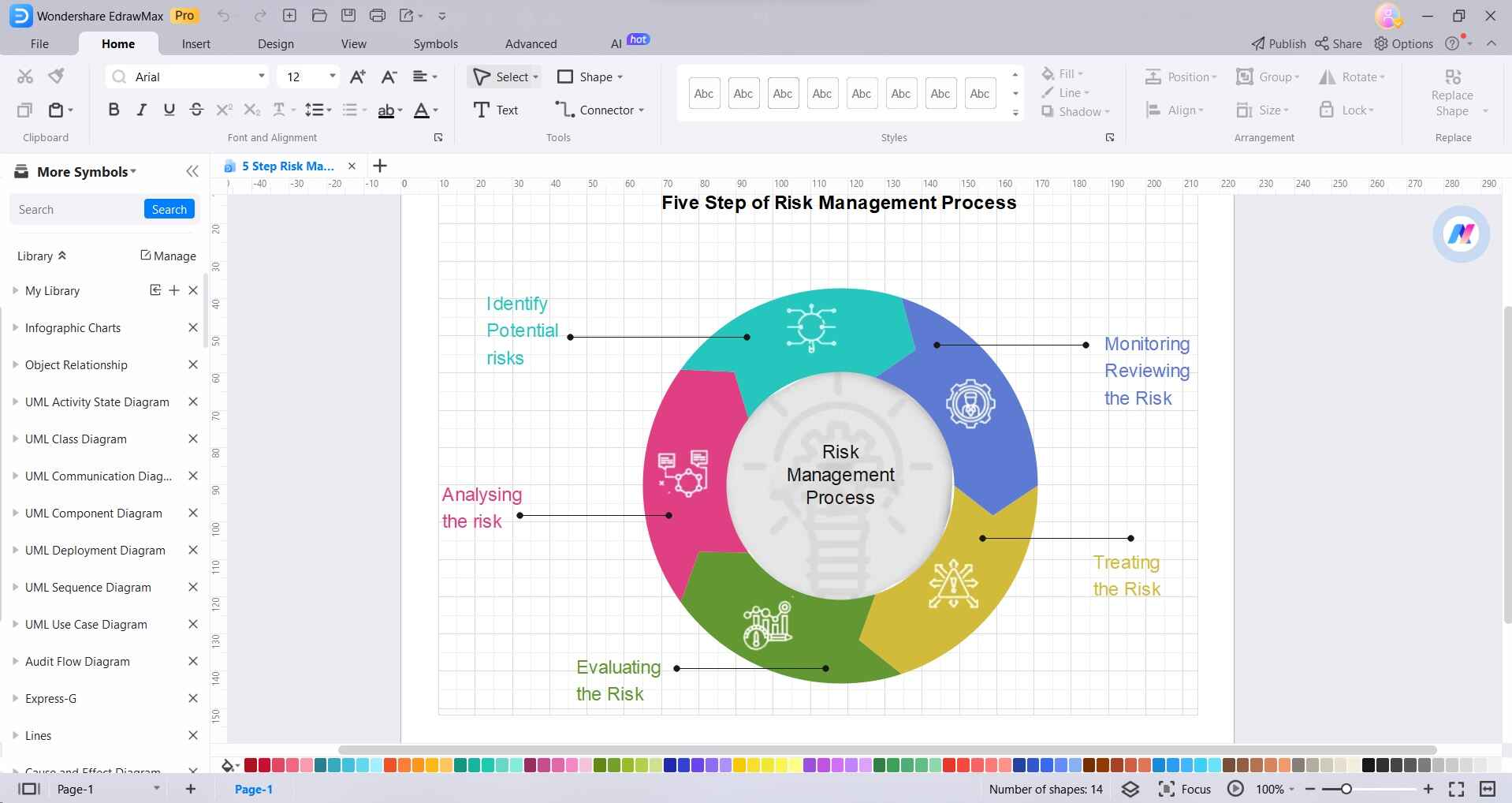

Visualizing an organization's enterprise risk management framework through an ERM diagram is crucial for effectively communicating risk management processes and responsibilities across the business. Wondershare EdrawMax is an ideal tool for creating clear and professional ERM diagrams that map out the key components like risk identification, assessment, response, monitoring, governance, and integration with objectives. The visual diagram can help various stakeholders quickly understand the interconnected risk management activities, risk owners, and reporting flows.

Having a well-designed ERM diagram is an efficient way to get alignment on risk procedures, promote engagement in risk discussions, and continuously improve risk intelligence across the organization.

With user-friendly EdrawMax, companies can quickly develop comprehensive, customizable ERM diagrams that serve as valuable strategic communication and reference tools for enterprise-wide risk management.

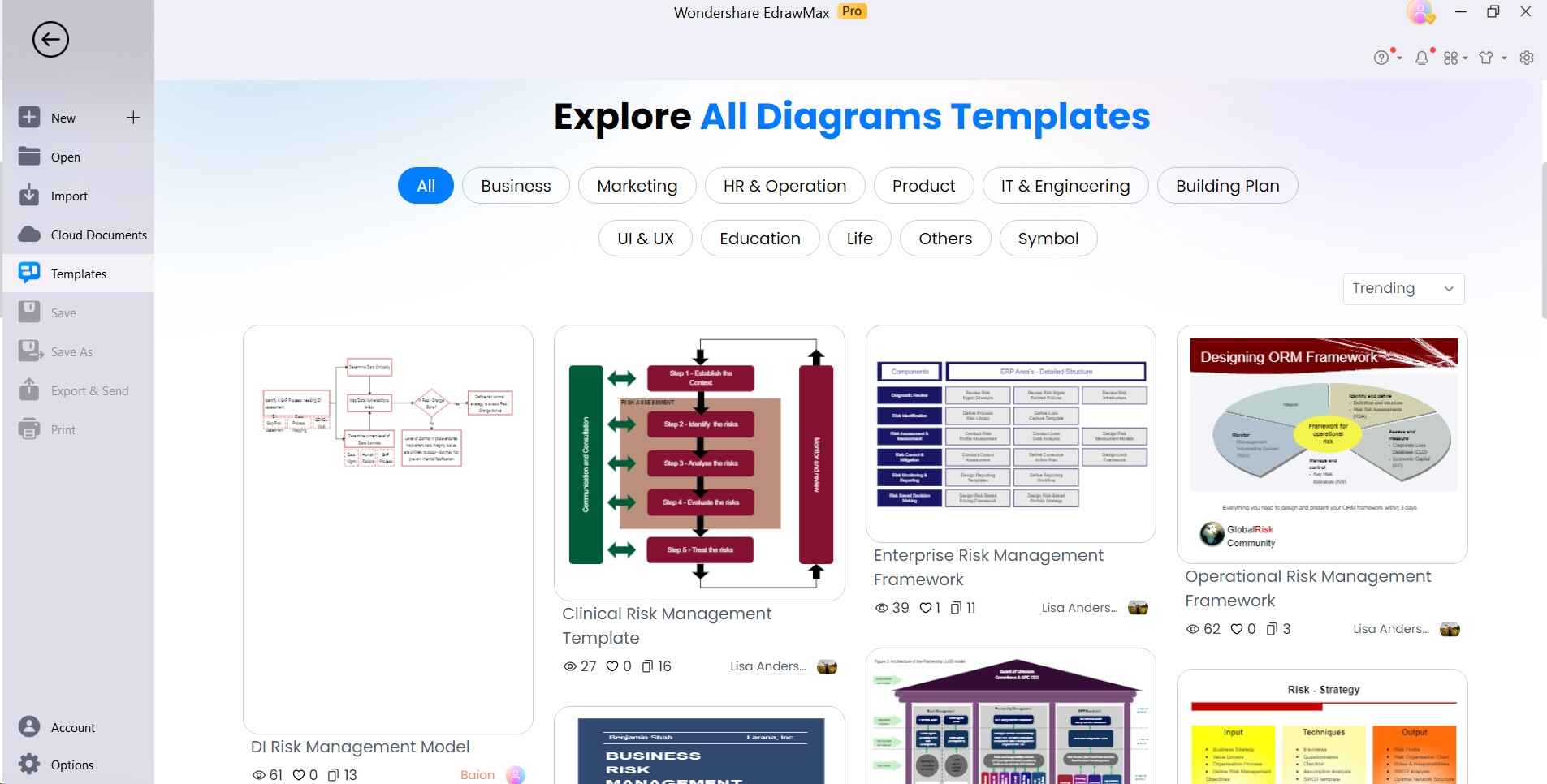

Here are the steps to create a simple enterprise risk management diagram using EdrawMax:

Step 1: Launch the EdrawMax software on your computer. In EdrawMax, go to the template library or start a new diagram. In the search bar, type "enterprise risk management" or related keywords to find suitable templates. Browse through the available ERM templates and choose one that suits your needs. Click on it to open it in the editing window.

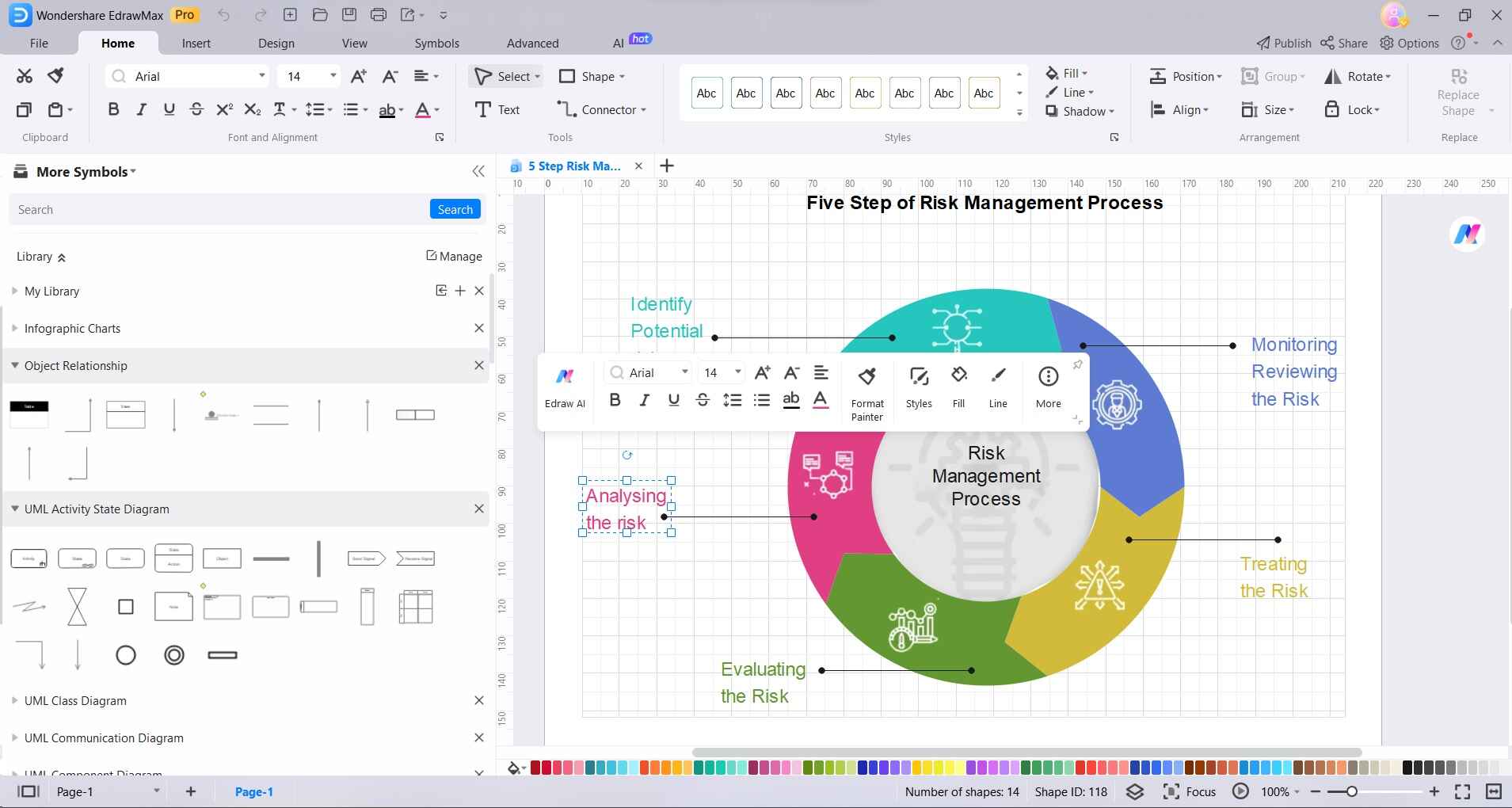

Step 2: Customize the template to fit your specific ERM needs. Here are some common elements you should include. Add shapes or text boxes to represent various sources of risks. These could be internal, external, financial, operational, etc.

Step 3: Add elements that represent strategies for managing and mitigating risks. This could include risk transfer, risk avoidance, risk reduction, etc. Use text boxes or shapes to denote who is responsible for various aspects of the ERM process.

Step 4: Modify shapes, add text, and adjust colors, fonts, and sizes to make the diagram clear and visually appealing.

Step 5: Take a step back and review the diagram. Make any necessary adjustments to ensure clarity and coherence.

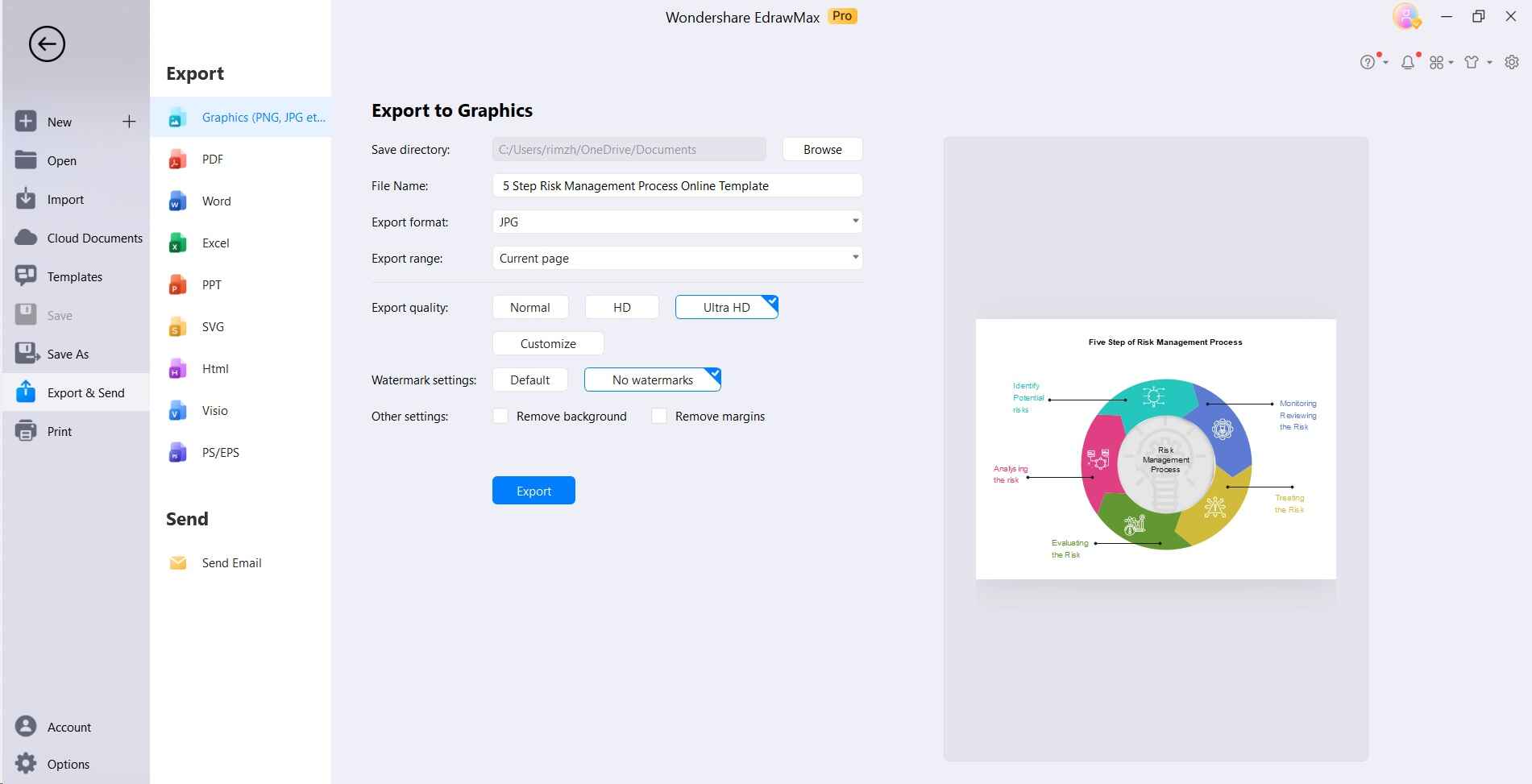

Step 6: Once you're satisfied with the diagram, save it to your computer in a format of your choice (e.g., .pdf, .png, .jpeg, etc.). Depending on your needs, you can export the diagram for use in presentations, reports, or other documents.

Remember to consult any specific guidelines or standards for ERM diagrams that may be relevant to your industry or organization.

Conclusion

COSO Risk Management plays a crucial role in businesses by offering a structured way to handle risks. It improves decision-making, boosts risk awareness, and strengthens overall resilience. With EdrawMax, creating effective risk management diagrams becomes easy. This combination empowers businesses to navigate uncertainties, ensuring long-term success in a dynamic market.