In the world of finance, managing credit risk is crucial. Our guide, "Mastering Advanced Credit Risk Analysis and Management," gives you the knowledge and tools to handle this aspect of finance. Whether you're a professional or just interested in the topic, we provide practical tips on assessing borrower reliability and reducing risk.

Boost your financial skills and protect your investments with us!

In this article

Part 1. What is Credit Risk Analysis

Credit risk analysis is the process of evaluating the likelihood that a borrower may default on their financial obligations. It involves assessing various factors, including the borrower's credit history, financial stability, and industry-specific conditions. This analysis helps lenders and investors make informed decisions about extending credit or investing in a particular entity. By gauging the level of risk associated with a borrower, institutions can implement appropriate measures to mitigate potential losses and ensure a more secure financial environment.

Part 2. Significance of Credit Risk Analysis in Financial Decision-Making

Credit risk analysis is vital in financial decisions. It helps lenders and investors predict if a borrower might not repay loans. By looking at their financial stability and other factors, it guides smart lending and investing choices. This analysis is like a safety net, protecting against potential losses. Understanding credit risk is key to staying financially secure and successful in the ever-changing world of finance.

In today's rapidly evolving financial landscape, technology plays a pivotal role in revolutionizing credit risk analysis, enabling more accurate and efficient decision-making processes.

Technology, including data analytics and machine learning, helps extract insights from big data, improving credit risk prediction. Automated risk assessment tools speed up evaluations and reduce errors, ensuring consistency in analysis. Credit risk management software streamlines the process, offering tools for monitoring and mitigating risks, and strengthening financial stability.

Part 3. Types of Credit Risk

Understanding the various types of credit risk is essential in navigating the complex terrain of financial decision-making. Let's explore the four key categories to gain a clearer perspective:

1. Default Risk:

Default risk, also known as counterparty risk, is the possibility that a borrower fails to meet their financial obligations, such as repaying a loan or bond. Lenders must assess default risk to anticipate and mitigate potential losses, ensuring responsible lending practices.

2. Credit Spread Risk:

Credit spread risk refers to the potential for the difference in interest rates between low and high-quality bonds (credit spread) to widen, leading to a reduction in the value of the lower-quality bonds.

3. Concentration Risk:

Concentration risk arises when a significant portion of a lender's or investor's exposure is concentrated in a particular borrower, industry, or asset class. Diversification strategies help mitigate concentration risk, spreading exposure across various entities or sectors.

4. Downgrade Risk:

Downgrade risk pertains to the possibility of a borrower's credit rating being lowered, indicating a decrease in their creditworthiness. Lenders and investors need to monitor for downgrade risk as it can impact the value and risk profile of the borrower's debt instruments.

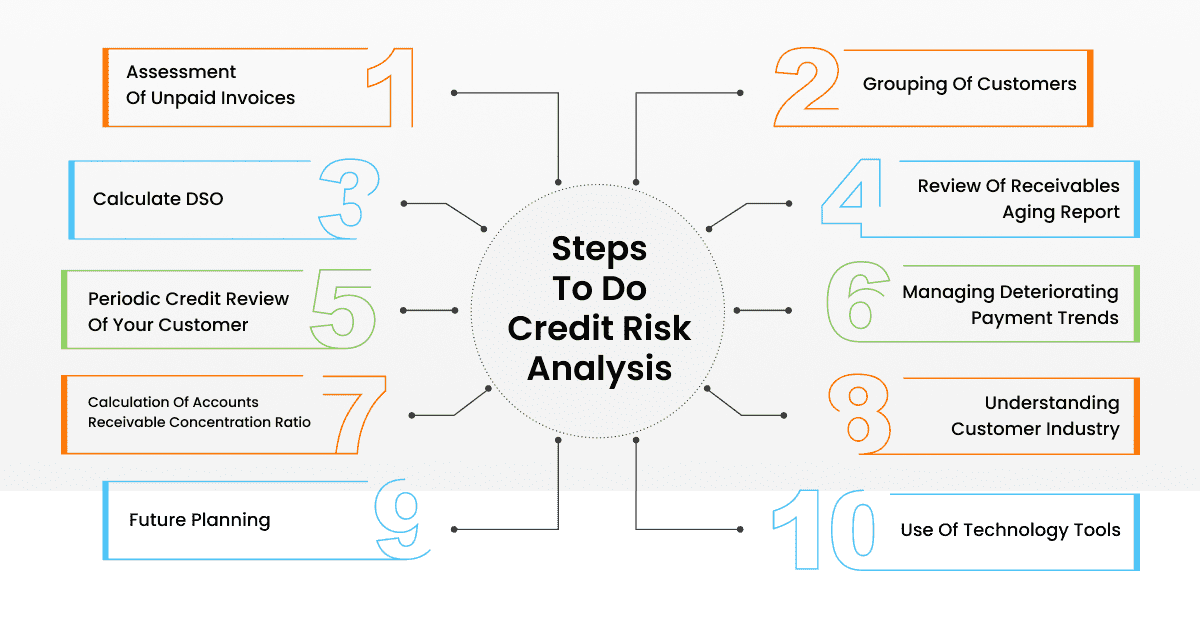

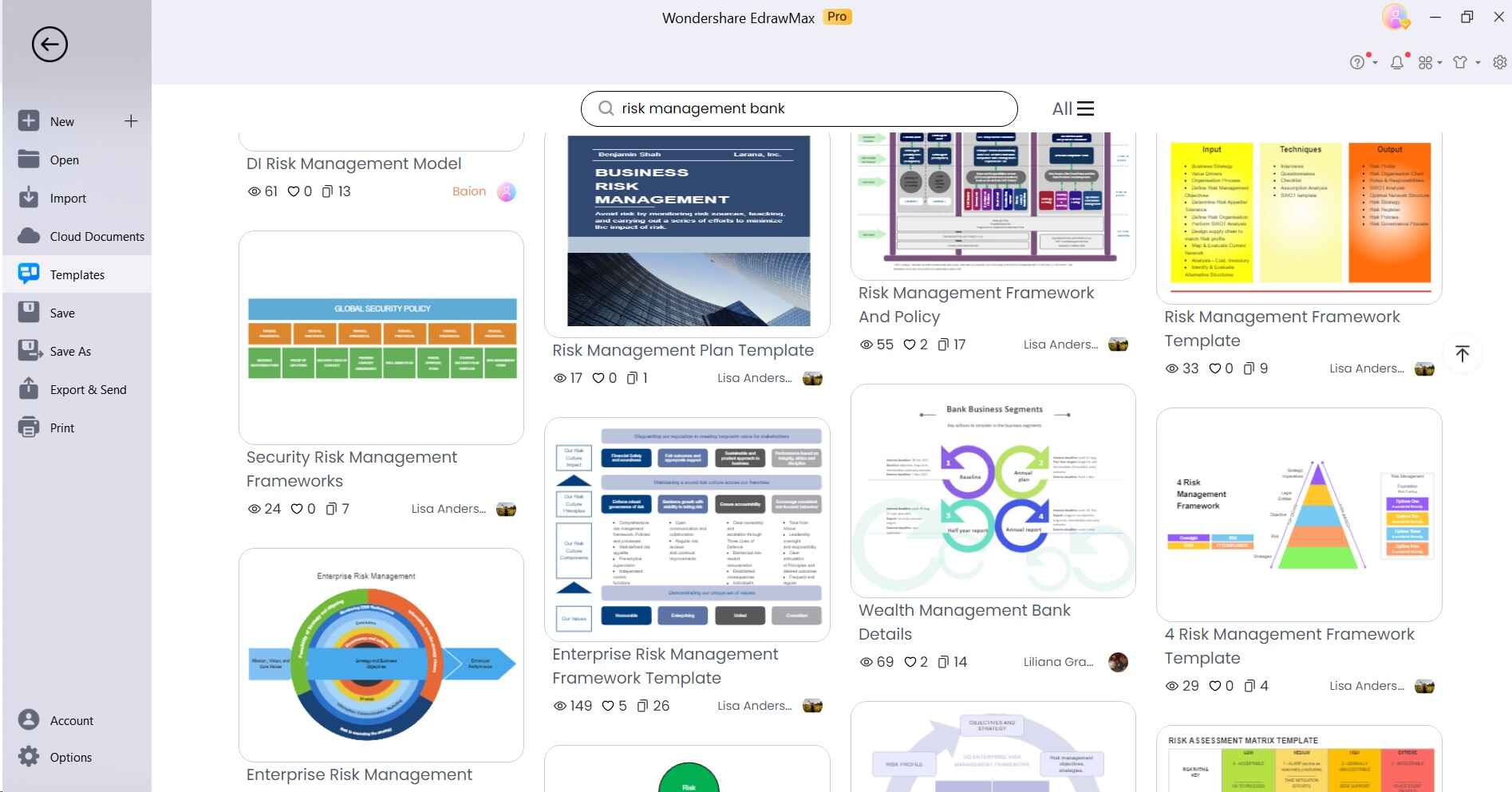

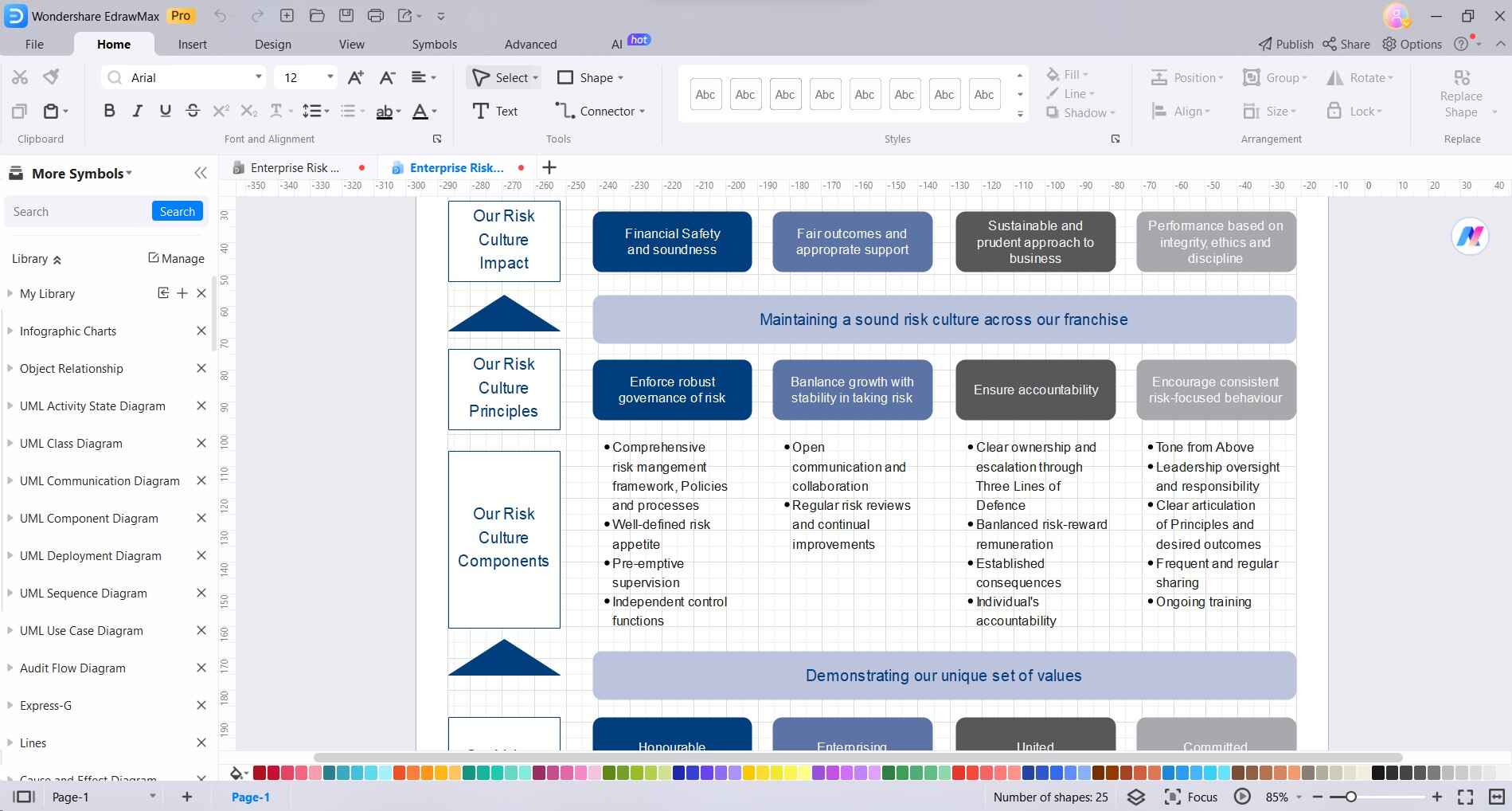

Part 4. Creating an Enterprise Risk Management Diagram Using EdrawMax

With Wondershare EdrawMax, crafting an Enterprise Risk Management (ERM) diagram is your secret weapon. It transforms complex risk scenarios into visual blueprints, fostering crystal-clear communication across your team.

EdrawMax's intuitive interface and rich template library make the process a breeze. This diagram isn't just a picture – it's your strategy, your shield against uncertainties. It's the difference between merely surviving and thriving in the business world. Elevate your risk game with EdrawMax, and let's chart a course to success!

Here are the steps to create a simple enterprise risk management diagram using EdrawMax:

Step 1: Launch the EdrawMax application on your computer. Click on "New" and then choose "Business Diagram" from the template categories. Or switch to the “Template” category from the main interface and look for an Enterprise Risk Management template.

Step 2: Drag and drop ERM shapes onto the canvas. These shapes represent elements like risks, controls, assessments, and more. You can find these in the left sidebar under the "Symbol" section.

Step 3: From the left sidebar, use connector lines to link the shapes and illustrate the relationships between them. To add a connector, select the shape, click on the connector icon, and drag it to the desired shape.

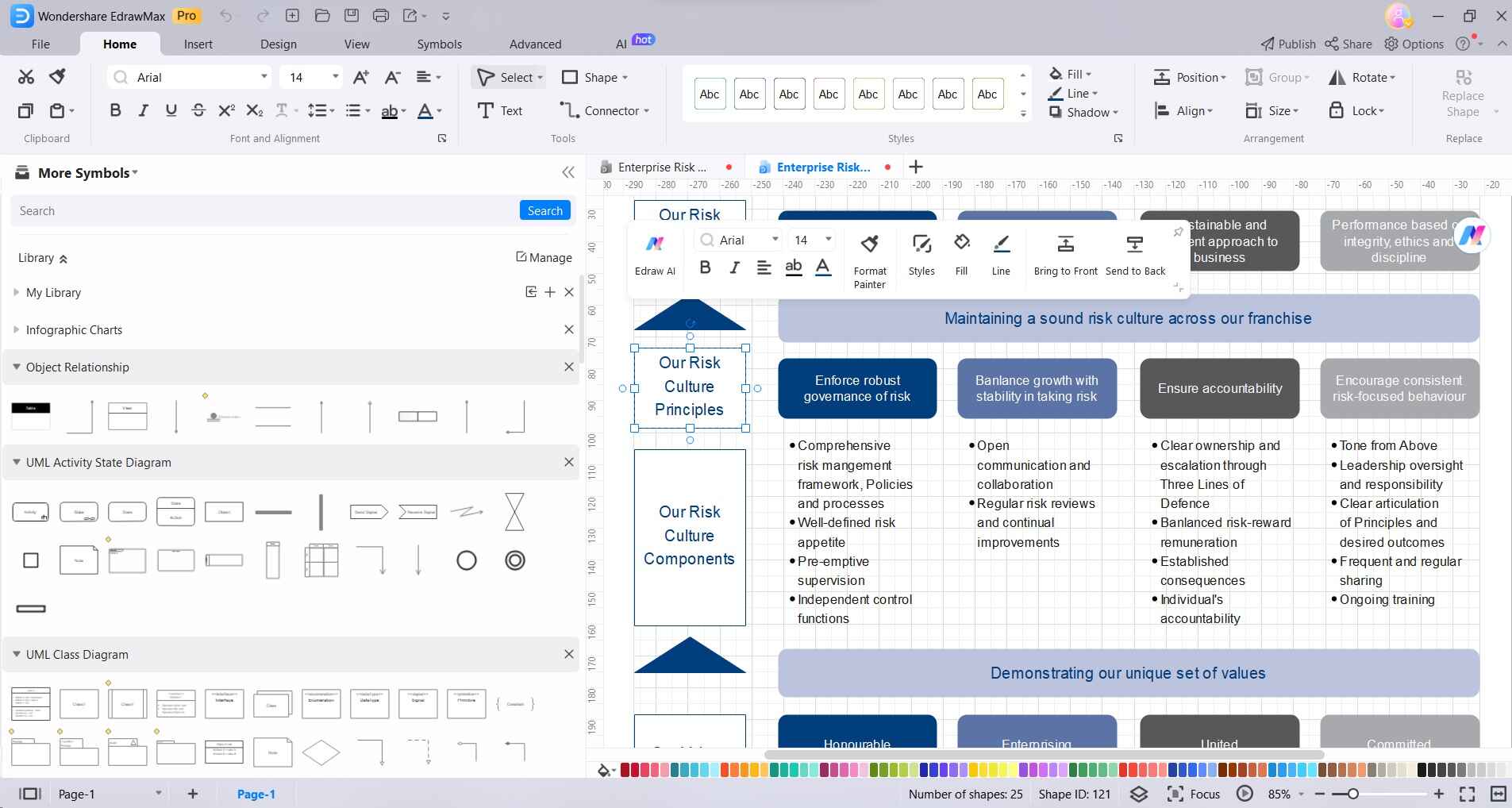

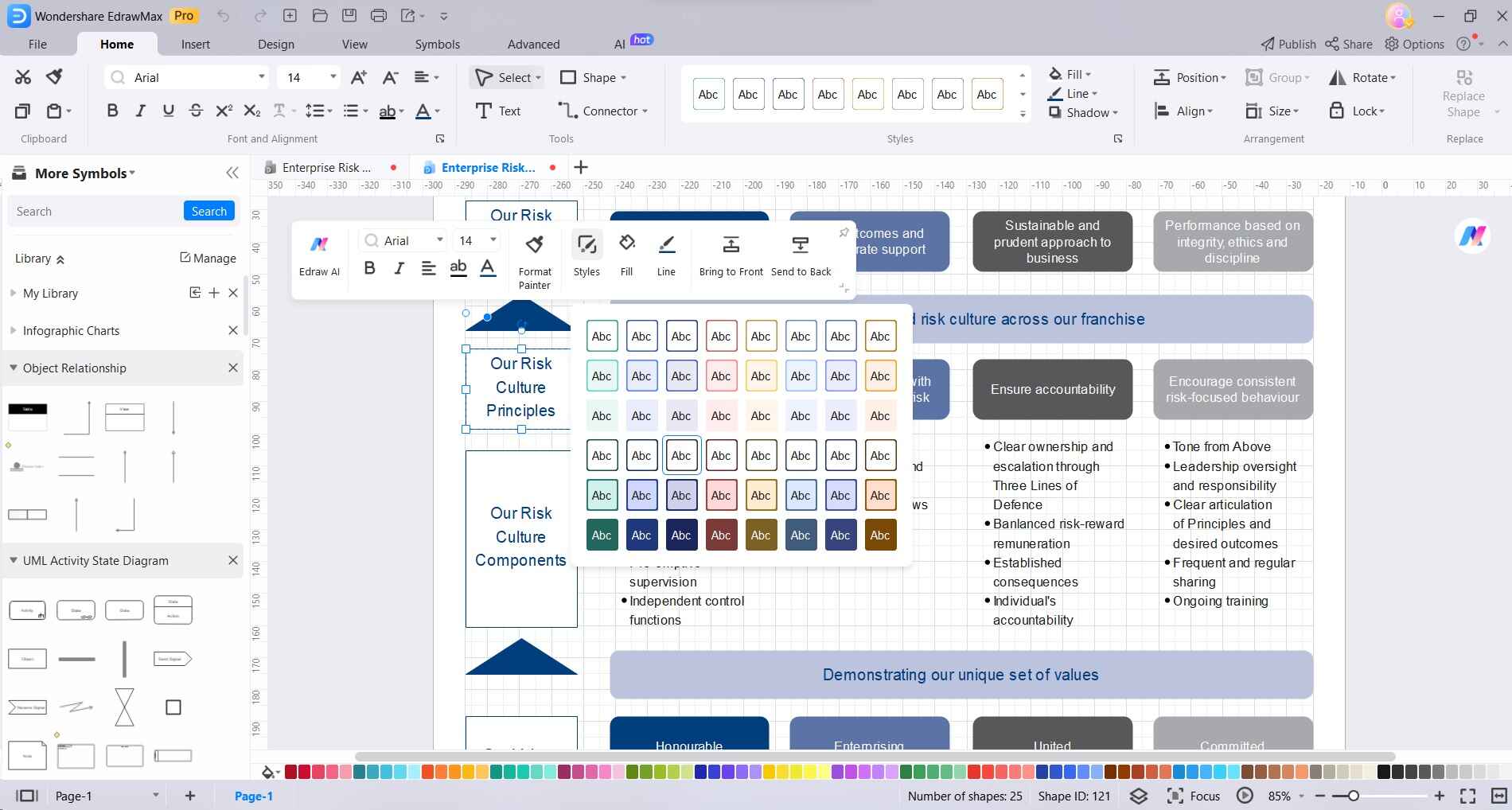

Step 4: Click on any entity and select “Styles”. Customize the shapes' colors, fonts, and styles to make the diagram visually appealing and easy to understand.

Step 5: Arrange the shapes on the canvas to create a logical flow. Use alignment tools to ensure a clean and professional look.

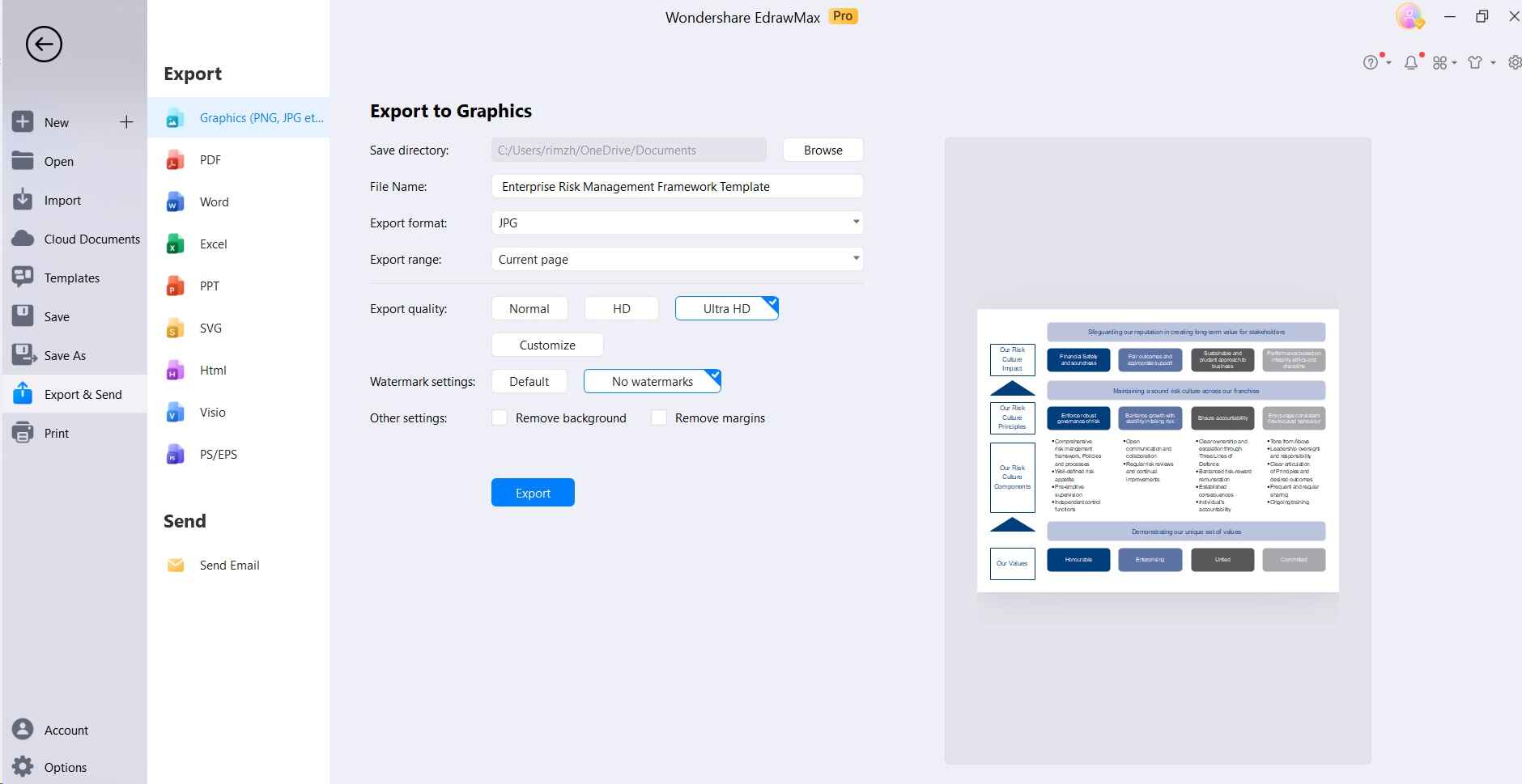

Step 6: Click on "File" and then "Save" to save your ERM diagram to your desired location on your computer.

EdrawMax offers a range of features and customization options, so feel free to explore and experiment to create an ERM diagram that best suits your specific needs.

Conclusion

In a nutshell, technology has transformed how we handle credit risks. Tools like data analytics and automated assessments make it quicker and more accurate. EdrawMax, a user-friendly software, enhances this process by creating easy-to-understand risk diagrams. By using these tools, we're better equipped to make smart financial decisions and secure long-lasting success.