Banks today need to be smart about managing risk when lending money. This guide will teach you key skills for success in the changing world of banking. You will learn how to make good lending choices, control risk, and increase profits. Whether you're an experienced banker or just starting, you'll get useful insights. This article covers the basics but also advanced strategies for credit risk management.

Master these ideas and you'll be ready to safely navigate lending in our complex financial system. The tips and tools here will help any bank thrive through the ups and downs of the modern economy.

In this article

Part 1. What is Credit Risk Management

Credit risk management is the practice of making good lending decisions and minimizing risk for banks. It involves evaluating borrowers to determine their ability to repay loans. Banks use credit risk management to reduce losses from defaults and write-offs. Effective techniques include requiring collateral, thoroughly analyzing applicants, and structuring loans appropriately. The goal is to lend profitably while avoiding excessive risk. Good credit risk management is essential for banks to operate safely and soundly.

Part 2. Strategies For Implementing Credit Risk Management In Banks

Banks can implement effective credit risk management through various strategies. Carefully assessing borrowers using credit reports and financial statements is essential. Establishing lending limits and requiring collateral reduces risk. Diversifying loans across industries limits exposure. Using credit scoring models helps make informed lending decisions. Regularly monitoring loans and taking early action on problem accounts minimizes losses.

Maintaining adequate loan loss reserves provides a buffer. Following regulatory guidelines and industry best practices enables healthy credit risk management. The key is balancing profitability with prudent, controlled lending.

Part 3. Components of Credit Risk Management

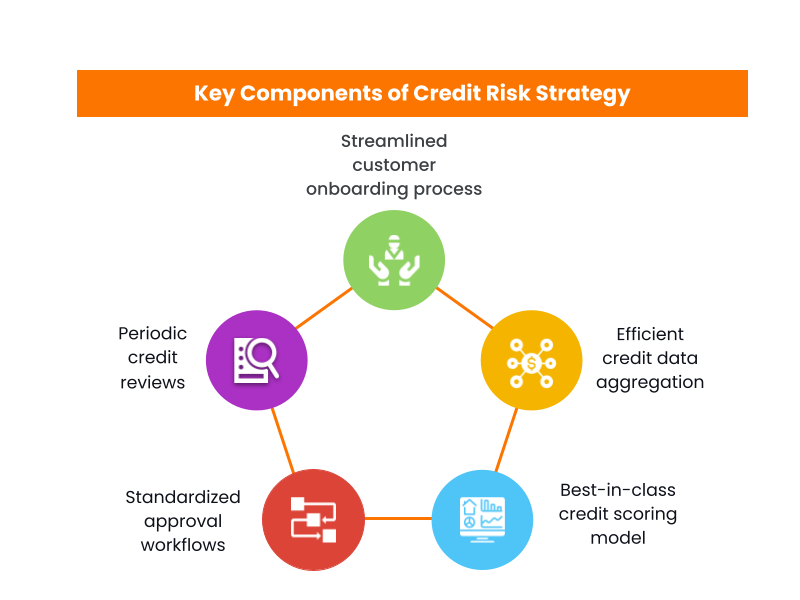

Listed below are several vital elements within credit risk management:

- Credit Policy: Establishing guidelines for lending criteria, risk tolerance, and approval processes.

- Credit Analysis: Assessing borrower creditworthiness through financial statements, credit reports, and risk models.

- Risk Grading: Categorizing loans based on their level of risk to facilitate proper monitoring.

- Portfolio Diversification: Spreading risk by lending to diverse industries and geographic regions.

- Collateral Management: Evaluating and managing assets provided as security for loans.

- Monitoring and Review: Continuously tracking loans for early signs of default or deterioration.

- Reserve Adequacy: Maintaining provisions for potential credit losses.

Effective credit risk management offers major advantages for banks.

- Reduces loan losses and write-offs through careful applicant vetting and lending decisions

- Maximizes profits by enabling prudent, calculated lending

- Limits exposure to default risk via diversification and collateral requirements

- Promotes stability by preventing excessive risk concentration

- Ensures sound operations that align with regulations and industry standards

- Builds a reputation for controlled growth and financial strength

In today's dynamic landscape, robust credit risk management is critical for banks to operate safely and profitably.

Part 4. Creating A Credit Risk Management Framework Using Edrawmax

Crafting a credit risk management framework with Wondershare EdrawMax is crucial for establishing a robust and structured approach to handling credit risks. EdrawMax provides user-friendly tools and templates that simplify the process, ensuring all necessary components are included. This framework serves as a roadmap, guiding banks in making informed lending decisions, minimizing defaults, and ultimately, safeguarding financial stability.

EdrawMax provides a wide range of pre-designed templates specifically tailored for creating credit risk management frameworks. These templates serve as a starting point, ensuring that all essential components are included, and can be customized to meet specific organizational needs. This accelerates the process and ensures a well-structured framework.

Here are the steps to create a risk management framework using EdrawMax:

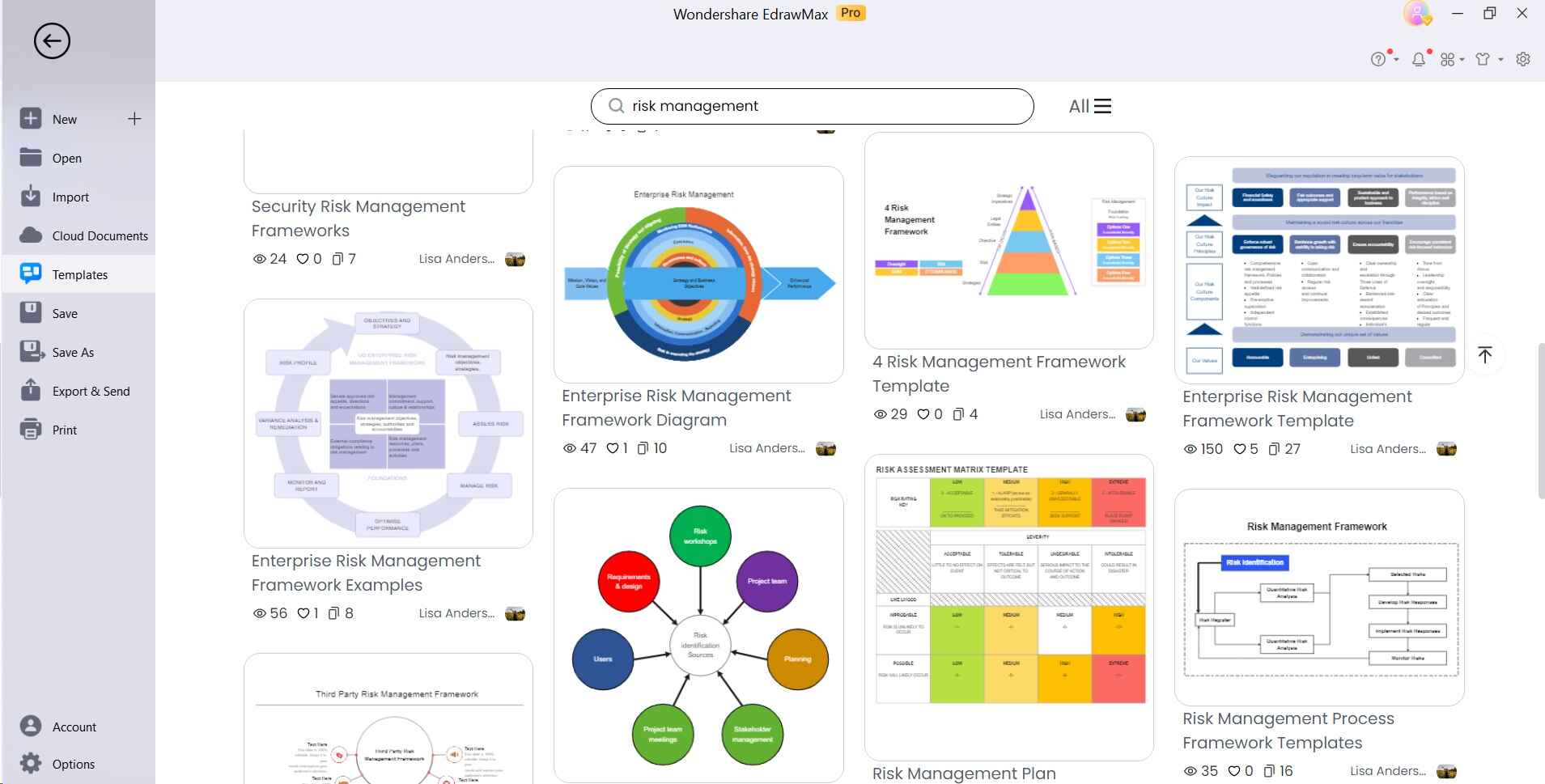

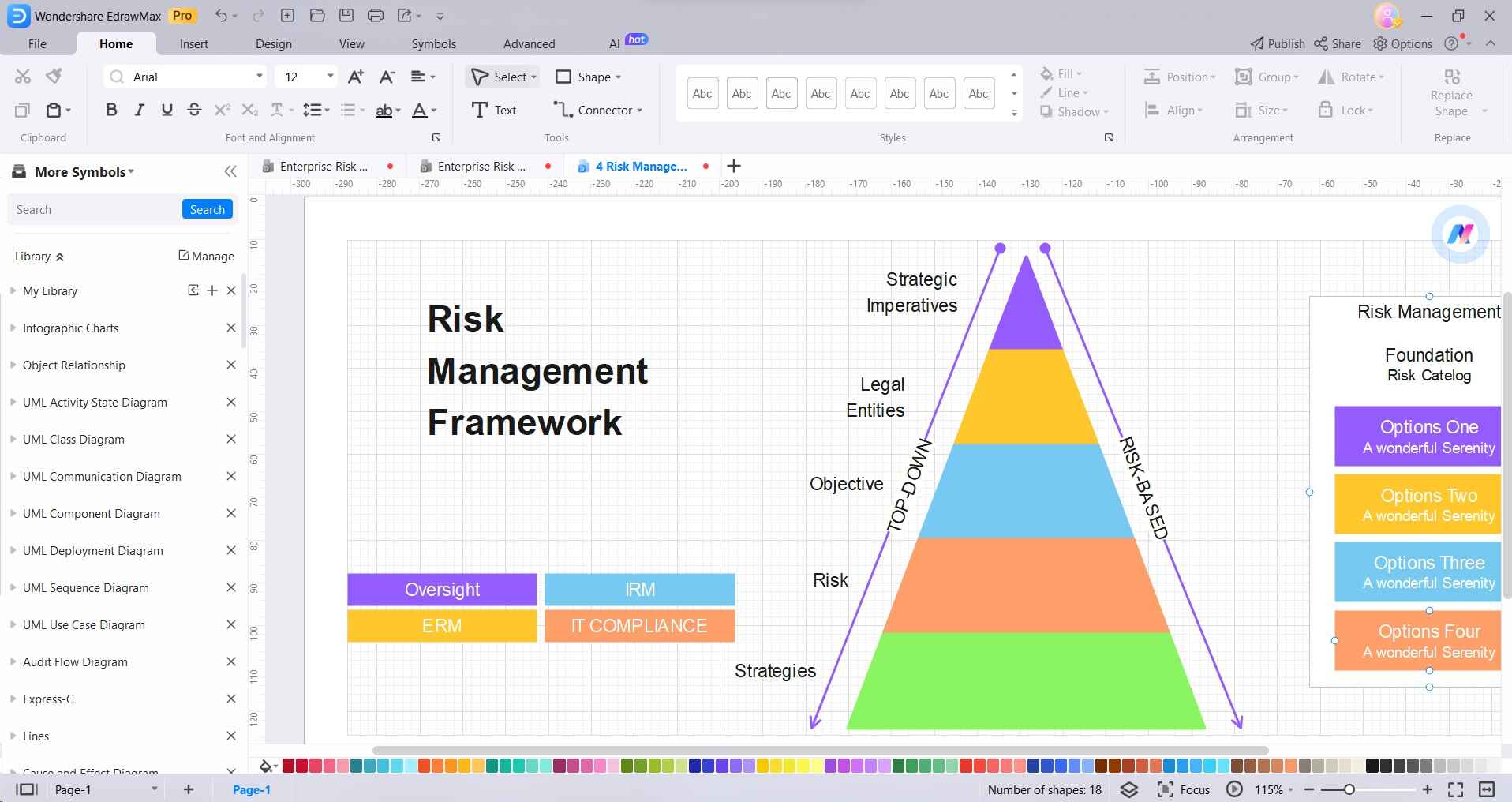

Step 1: Open the EdrawMax application on your computer. Navigate to the "Templates" section and search for "Risk Management Framework" or a related keyword. Choose a suitable template to serve as the foundation for your framework.

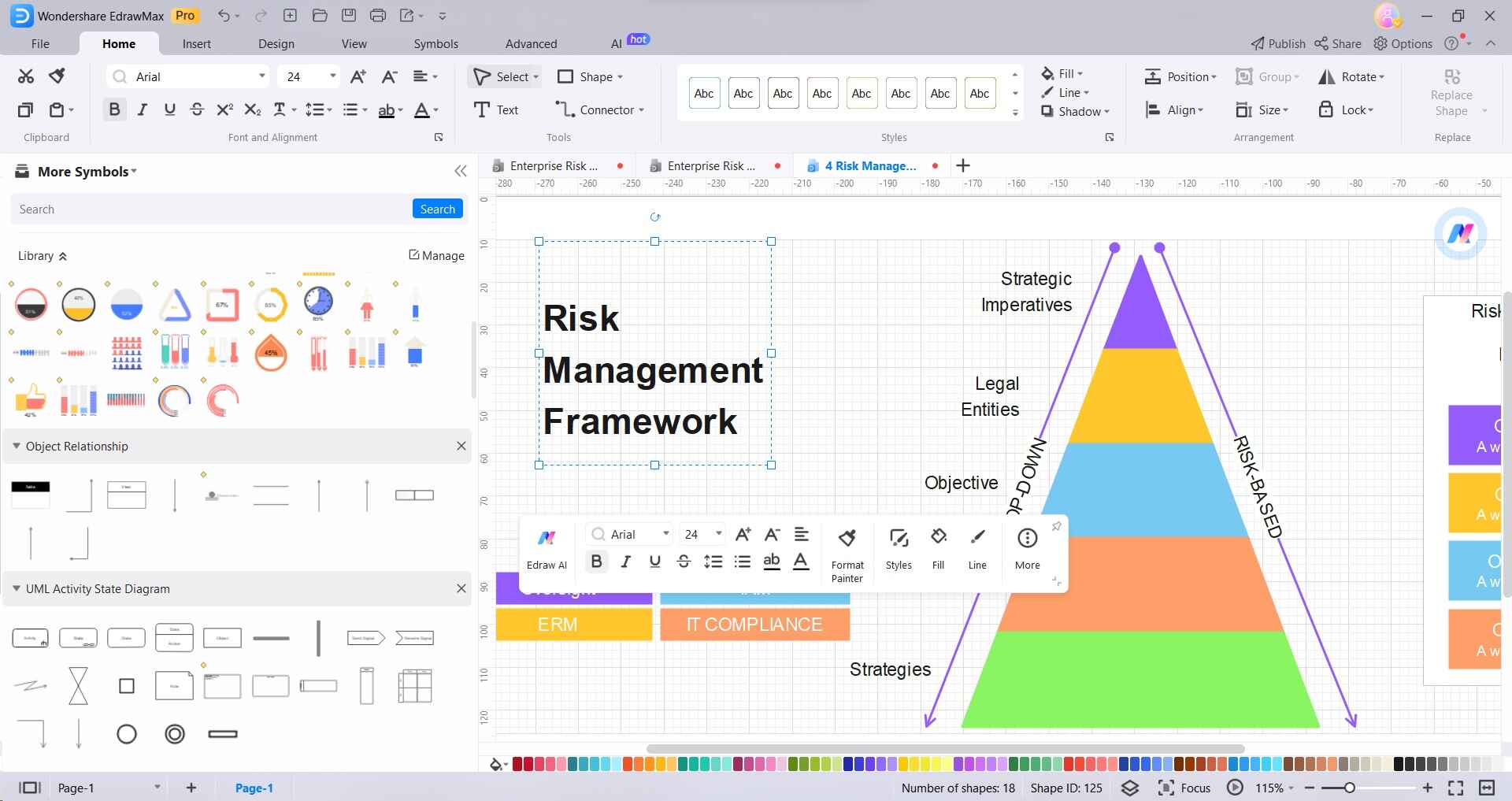

Step 2: Edit the template to include specific components relevant to your organization's risk management needs. This may include risk identification, assessment criteria, mitigation strategies, and monitoring processes.

Step 3: Utilize charts, graphs, and diagrams to represent data or relationships between different elements of the framework. This visual representation can enhance understanding and retention.

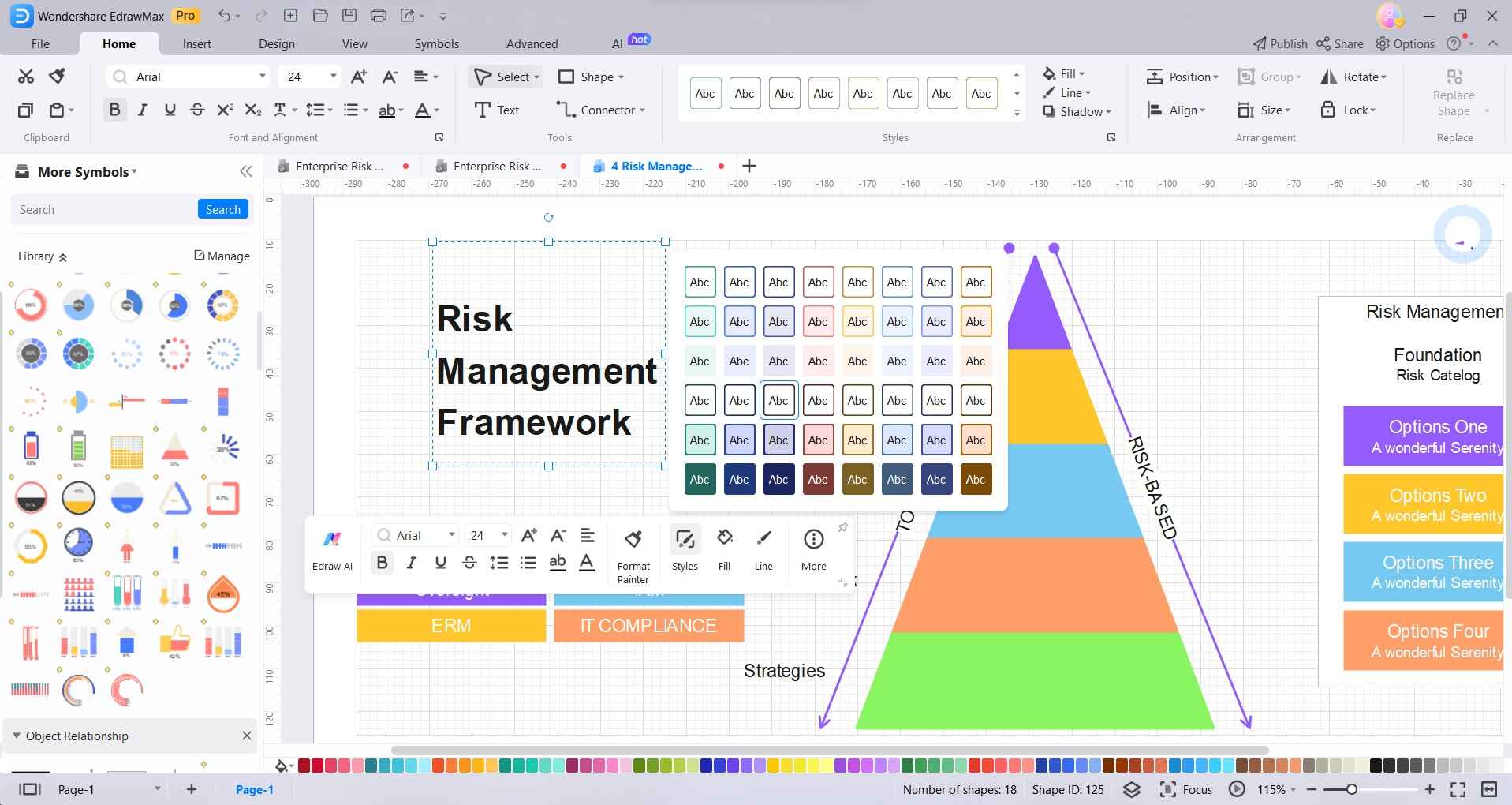

Step 4: Click on the "Styles" tab to access a range of font and color options. Tailor the appearance of your risk management framework to align with your organization's branding or preferences. This step allows for further personalization and visual refinement.

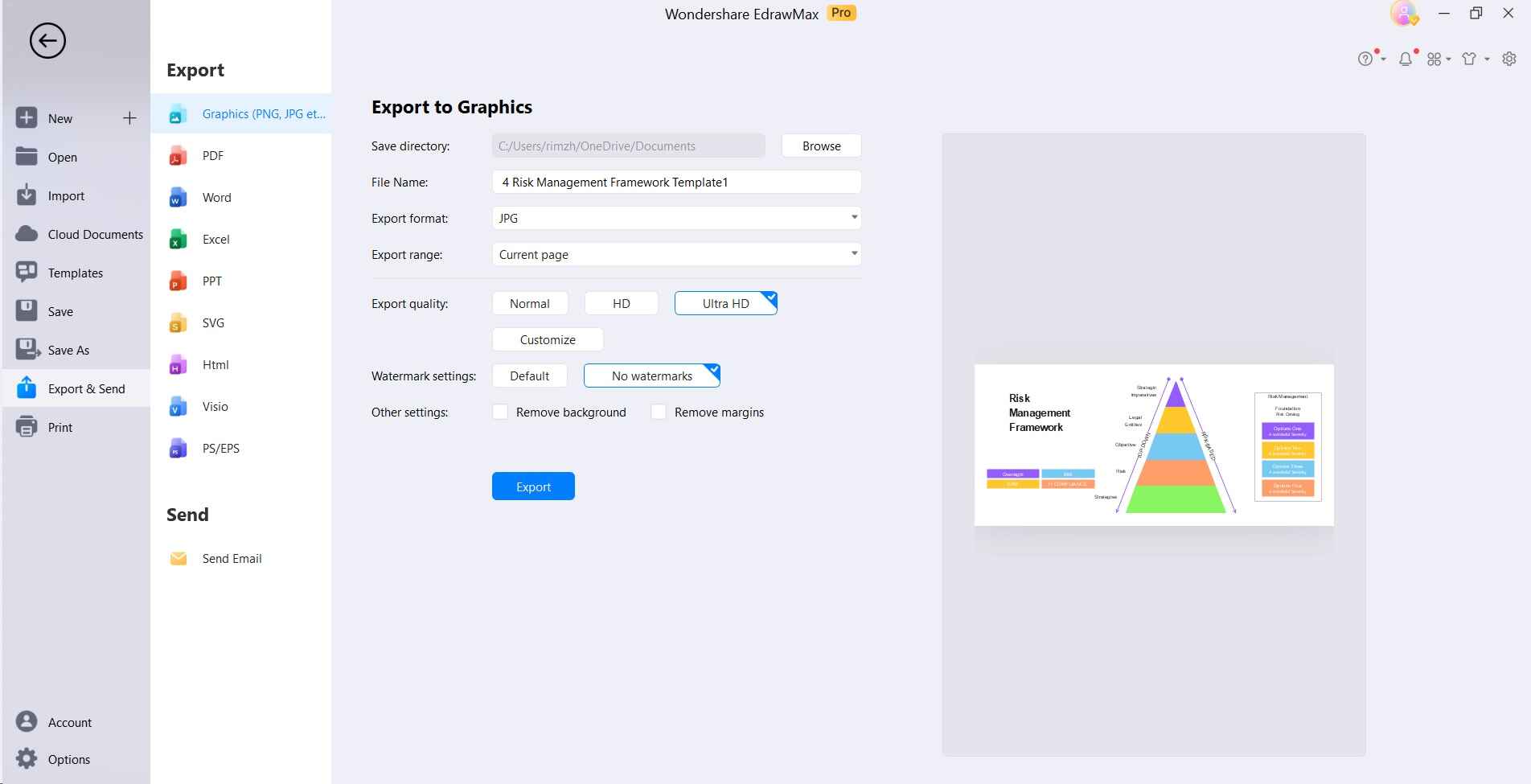

Step 5: Once you're satisfied with the framework, head to File> Save to save the file in a location of your choice on your computer.

NOTE: Regularly review and update it as needed to ensure its continued effectiveness. By following these steps, you can efficiently create a comprehensive risk management framework using EdrawMax.

Conclusion

Establishing a robust credit risk management framework is indispensable for financial institutions, ensuring prudent lending decisions and fortifying long-term stability. EdrawMax, with its user-friendly interface and comprehensive templates, proves invaluable in this endeavor. Its intuitive tools expedite the creation process, while customizable styles enhance visual appeal.

By leveraging EdrawMax, banks can navigate the complexities of credit risk management with confidence. This software stands as an indispensable ally in bolstering financial resilience and safeguarding success in an ever-evolving economic landscape.