The business environment is constantly changing, which creates financial risks that companies must manage to succeed. This guide looks at different ways businesses can plan and respond to reduce those risks and protect their financial health. By learning strategic risk management best practices, organizations can weather uncertainties and build durable financial strength over time.

We'll explore practical steps to anticipate threats, avoid pitfalls, and foster long-term fiscal fitness so your company stays stable and profitable into the future.

Managing financial risk is key to business health. A financial risk management system involves identifying potential threats to profits and assets and then minimizing the impacts through strategic planning and mitigation tactics. By assessing exposures, anticipating market fluctuations, and implementing measured safeguards like hedging and insurance, organizations can capsize-proof their finances.

In this article

Part 1. Understanding the Financial Risk Management Process

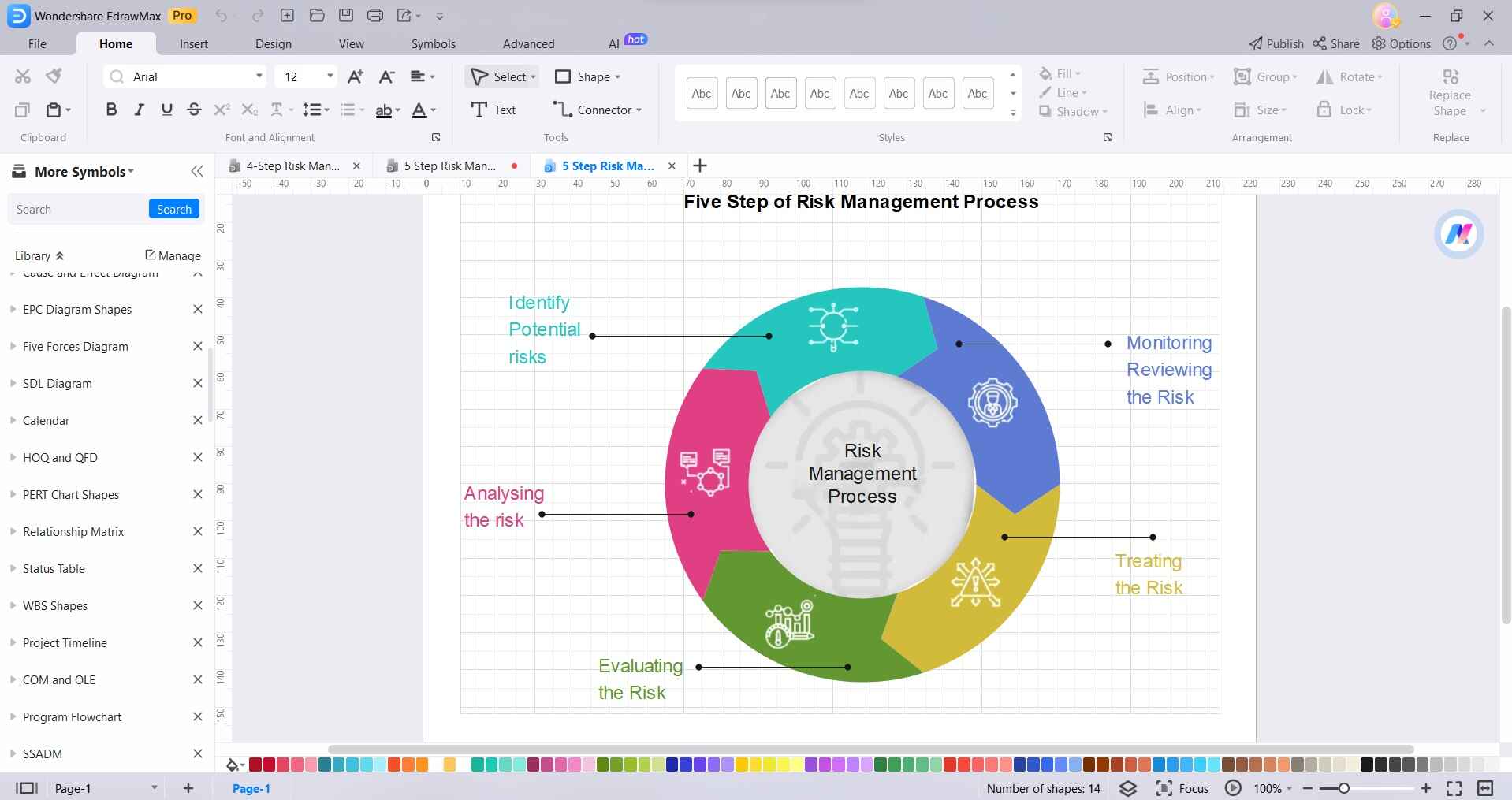

Effective financial risk management is crucial for safeguarding an organization's financial stability and ensuring its long-term success. Below are the crucial stages in the procedure:

- Identify and categorize risks: Recognize potential financial threats and classify them as market, credit, operational, and liquidity risks.

- Assess and measure risks: Evaluate the impact and likelihood of each identified risk to prioritize them for mitigation.

- Develop risk mitigation strategies: Create plans and policies to minimize or eliminate identified risks.

- Implement risk controls: Put in place measures such as hedging, diversification, and insurance to manage risks effectively.

- Monitor and review: Continuously oversee the risk management process, adjusting strategies as necessary based on changing market conditions and business operations.

Part 2. Best Financial Risk Management Strategies

Implementing a combination of these strategies can significantly enhance an organization's ability to manage financial risks effectively.

- Diversification: Spread investments across different asset classes to reduce exposure to any single risk.

- Hedging: Hedging involves employing financial instruments such as options and futures to counterbalance potential losses.

- Insurance: Transfer specific risks to an insurance provider through policies like property and casualty insurance.

- Scenario Analysis: Evaluate the potential impacts of various economic scenarios on the organization.

- Stress Testing: Simulate extreme financial conditions to assess the resilience of the business.

- Capital Adequacy: Maintain sufficient capital reserves to absorb unexpected losses and ensure solvency.

Part 3. Implementing Financial Risk Management Strategies

Effectively implementing these considerations can strengthen an organization's ability to navigate financial uncertainties and protect its stability.

- Alignment with Business Goals: Ensure risk management strategies are in line with overall business objectives and risk appetite.

- Regular Review and Updates: Continuously assess and adjust strategies to account for changing market conditions and business dynamics.

- Regulatory Compliance: Ensure that chosen strategies adhere to relevant industry and government regulations.

- Real-time Monitoring: Implement systems for ongoing tracking of risks and the effectiveness of mitigation efforts.

- Training and Awareness: Educate employees on risk management protocols and their roles in the process.

Part 4. Creating a Risk Management Diagram

In an era of complex financial environments and rapidly evolving markets, visualizing risk scenarios is indispensable. EdrawMax offers a user-friendly interface coupled with powerful features, allowing for the seamless creation of comprehensive risk management diagrams. This software enables professionals to depict various risk categories, assess their potential impact, and devise effective mitigation strategies.

With its intuitive drag-and-drop functionality, EdrawMax simplifies the process, making it accessible to both seasoned risk managers and those new to the field.

EdrawMax's extensive range of features further solidifies its significance in risk management. The software provides a diverse library of pre-designed templates and symbols tailored for risk analysis.

Additionally, EdrawMax allows for collaborative work, facilitating team efforts in identifying, evaluating, and mitigating risks. Its export capabilities enable seamless integration with other business tools and presentations, enhancing the overall risk management process.

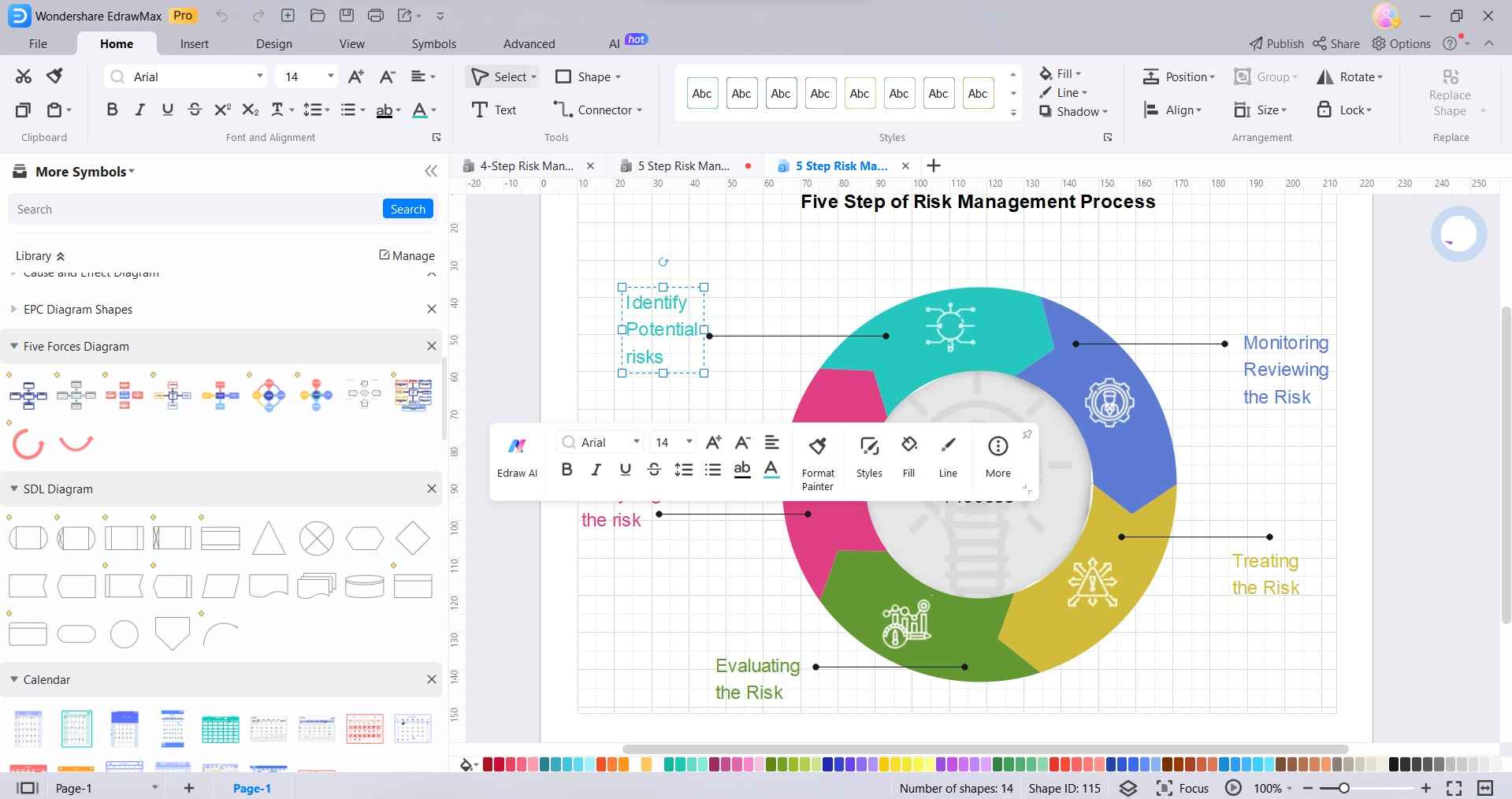

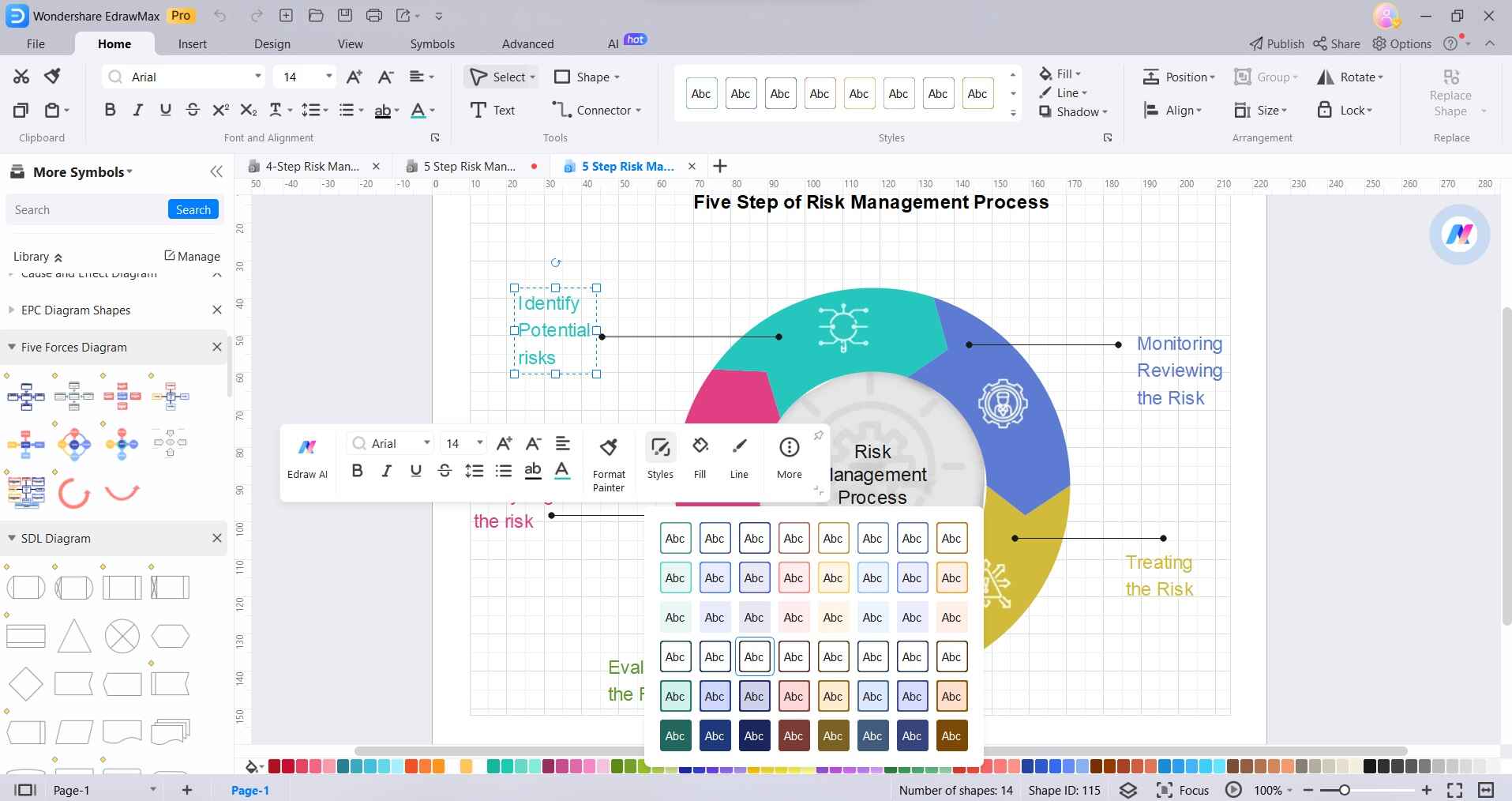

Here are the steps to create a risk management framework diagram using EdrawMax:

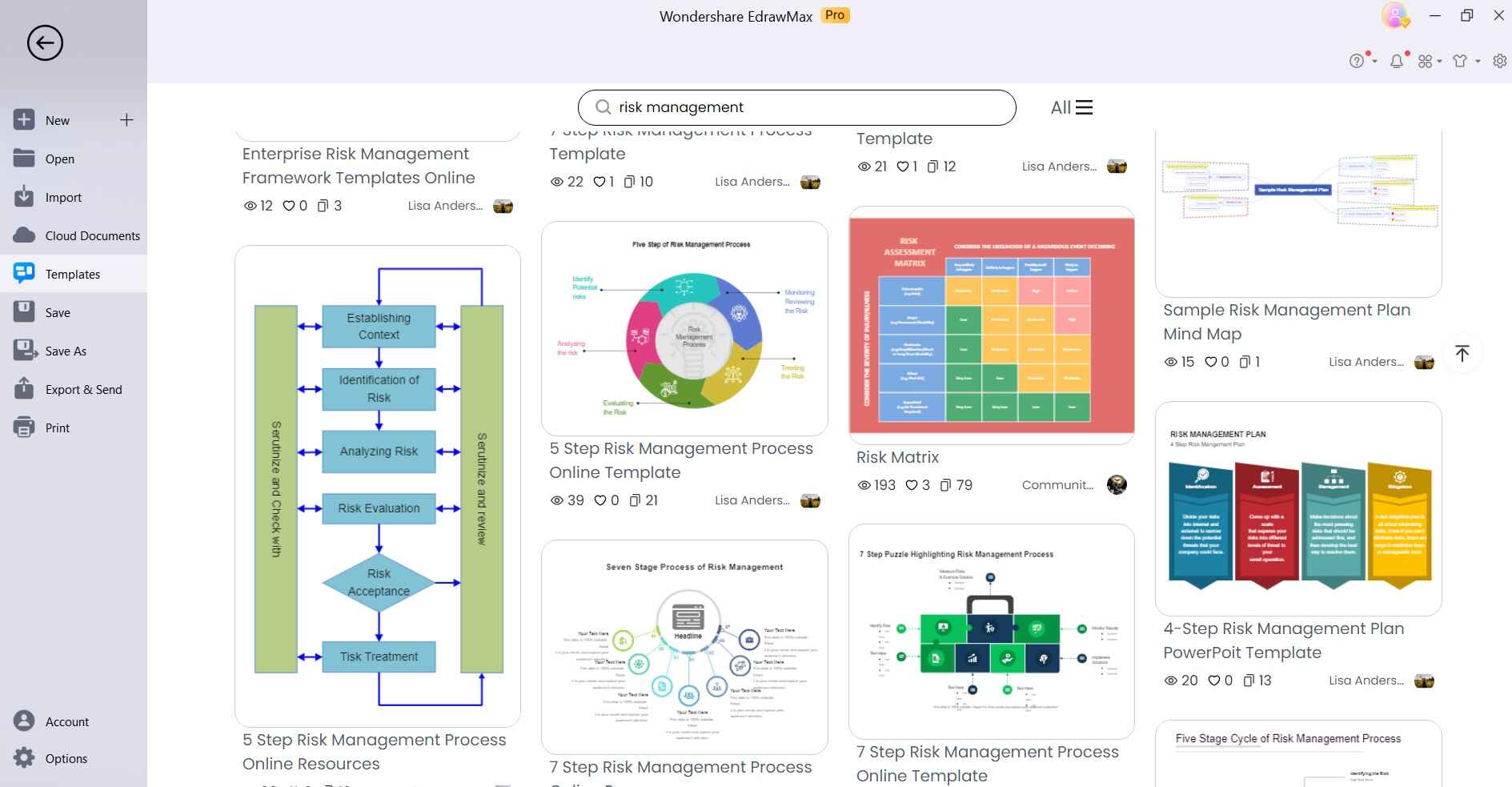

Step 1: Open the EdrawMax software on your computer and create a new document or open an existing one if you have a template in mind. Navigate to the template library and search for "Risk Management Framework" or related keywords. Choose a template that best suits your specific requirements.

Step 2: Use the drag-and-drop functionality to add elements to your diagram. These may include boxes representing different stages of the risk management process, arrows to indicate flow and text boxes for labels and descriptions.

Step 3: Use connectors or arrows to establish relationships between different stages or components of the risk management framework.

Step 4: Click on the element (shape, text box, etc.) that you want to format and select “Styles”. This will activate the formatting options in the toolbar.

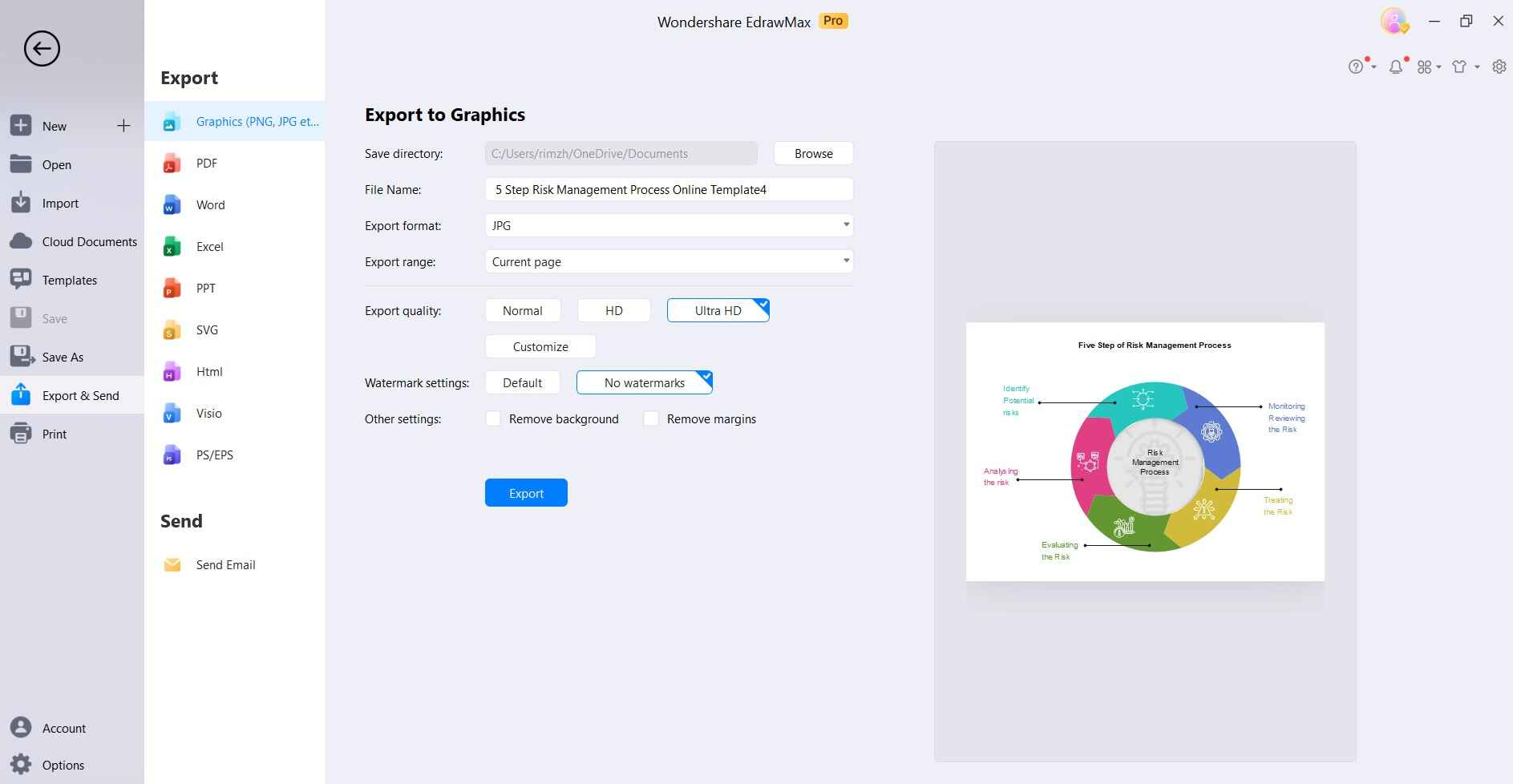

Step 5: Save your work in a suitable format (e.g., .eddx for EdrawMax's native format, or .png, .jpg, etc., for images). This allows for easy sharing and future edits.

With EdrawMax's intuitive interface, you can create a clear and comprehensive risk management framework diagram tailored to your organization's needs.

Conclusion

In summary, adopting effective financial risk management strategies is vital for a stable organization. Techniques like diversification, hedging, and insurance play a crucial role. Tools like EdrawMax simplify the process by helping visualize risk plans. By addressing financial risks proactively, businesses ensure long-term success in a changing economy.