Risk insurance and management is a critical aspect of business operations aimed at identifying, assessing, and mitigating potential risks that may impact an organization's financial stability and operational continuity. In this article, we will explore the role and benefits of risk insurance, as well as the key steps involved in effective risk insurance management.

In this article

Understanding Risk Insurance Management

Risk and insurance management society is a complex and crucial aspect of modern-day business operations. It involves the identification, assessment, and mitigation of potential risks that may affect an organization's financial stability and operational continuity.

Risk and insurance management has a lot of advantages. They help protect against unforeseen events. Therefore, they are essential for organizations.

1. Financial Protection:One of the primary roles of risk insurance is to provide financial protection against potential losses arising from unforeseen events.

2. Risk Mitigation:Risk insurance allows businesses to transfer the financial consequences of potential risks to insurance companies.

Key Steps in Risk Insurance Management

Risk insurance management society involves some key steps. These steps are all equally crucial. They help organizations immensely in managing risk insurance.

1. Risk Identification:The first step in risk insurance management is identifying potential risks that may impact an organization.

2. Insurance Needs Analysis:After identifying the risks, organizations should conduct an insurance needs analysis.

3. Insurance Policy Selection:Once the insurance needs analysis is completed, organizations

should proceed with the selection of appropriate insurance policies.

Evaluating and Selecting Risk Insurance Solutions

Risk insurance solutions should be evaluated and selected properly. This ensures that the right solutions are chosen.

1. Coverage Suitability:When evaluating risk insurance solutions, it is essential to assess whether the coverage provided is suitable for the identified risks.

2. Financial Stability of Insurer:It is crucial to evaluate the financial stability and reputation

of the insurance provider before finalizing a risk insurance solution.

Tools to Create Risk Insurance Management Charts

There are online tools that can help you in creating a risk insurance management chart. These charts help in creating charts easily.

1) Wondershare EdrawMax

Creating a risk insurance management chart with Wondershare EdrawMax is a great way to visualize your risk management data and create insightful reports. With the tool, you can quickly and easily create professional-looking charts that help you manage risk. Follow these steps to create a risk and insurance management chart using the tool:

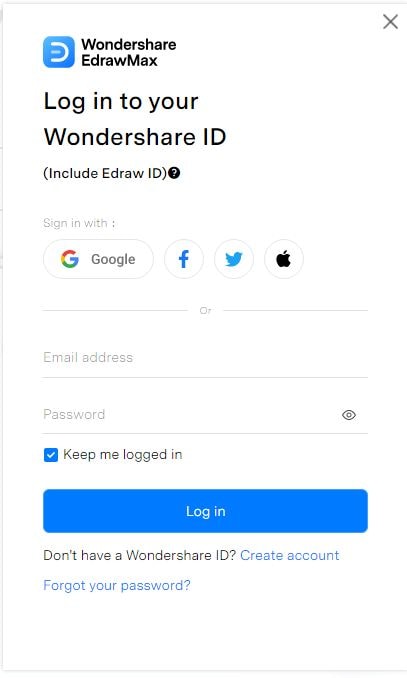

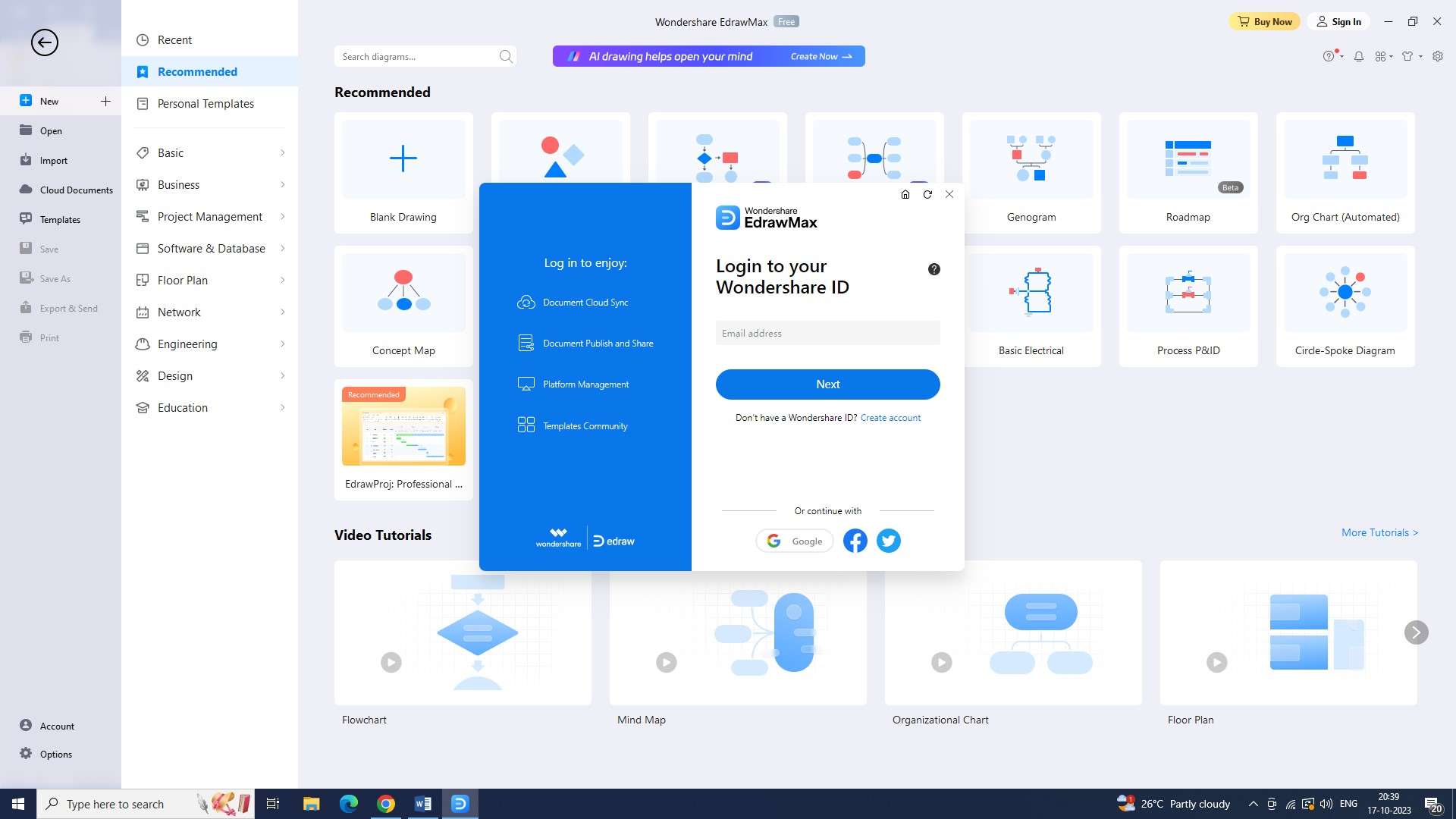

Step 1: Before moving into the main steps, you first have to log in. Log in to Wondeshare EdrawMax by entering the necessary details.

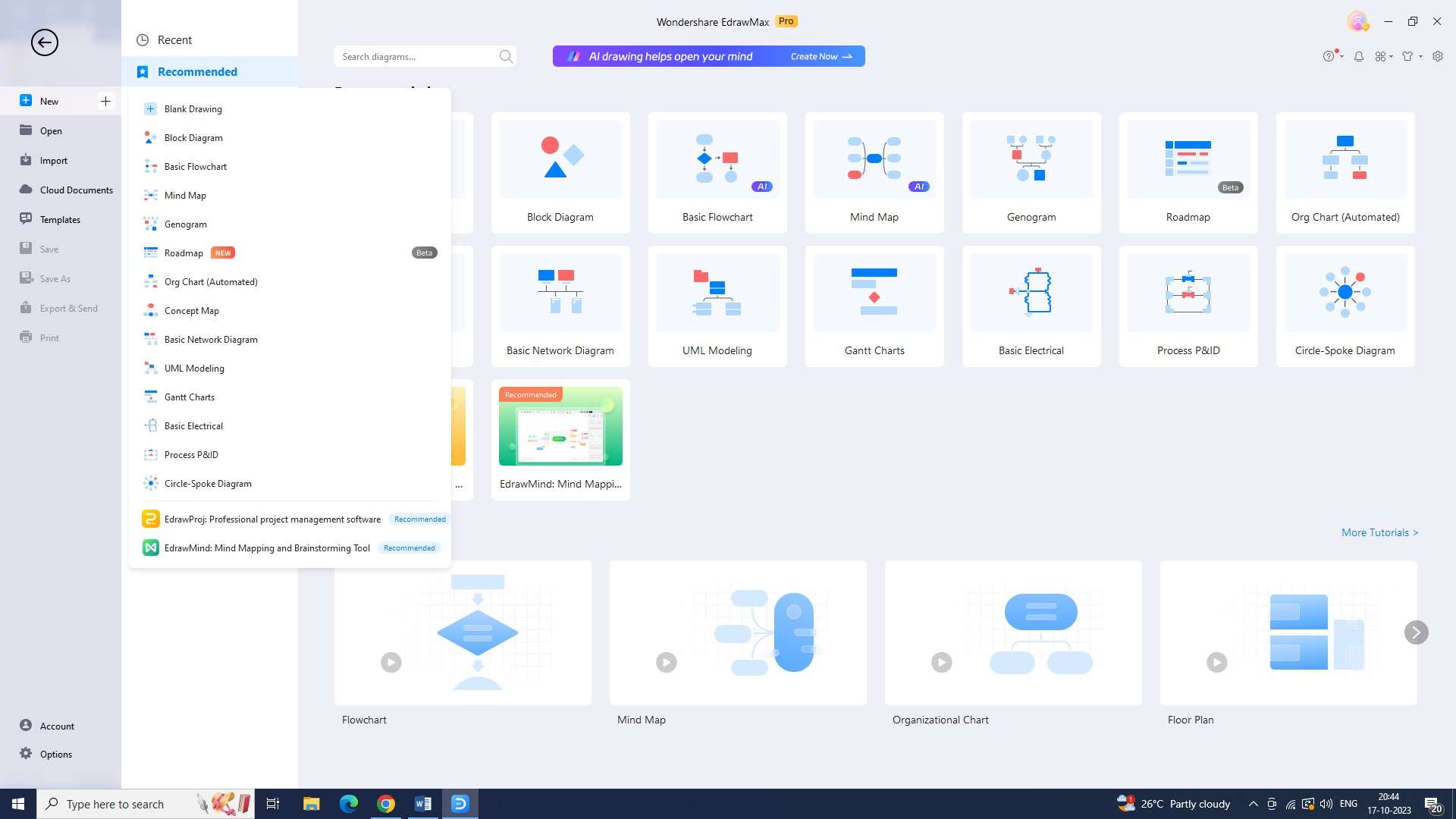

Step 2: Now, you have to create a new document. By clicking on the plus sign on the right side of the “New” button, you can create a new document.

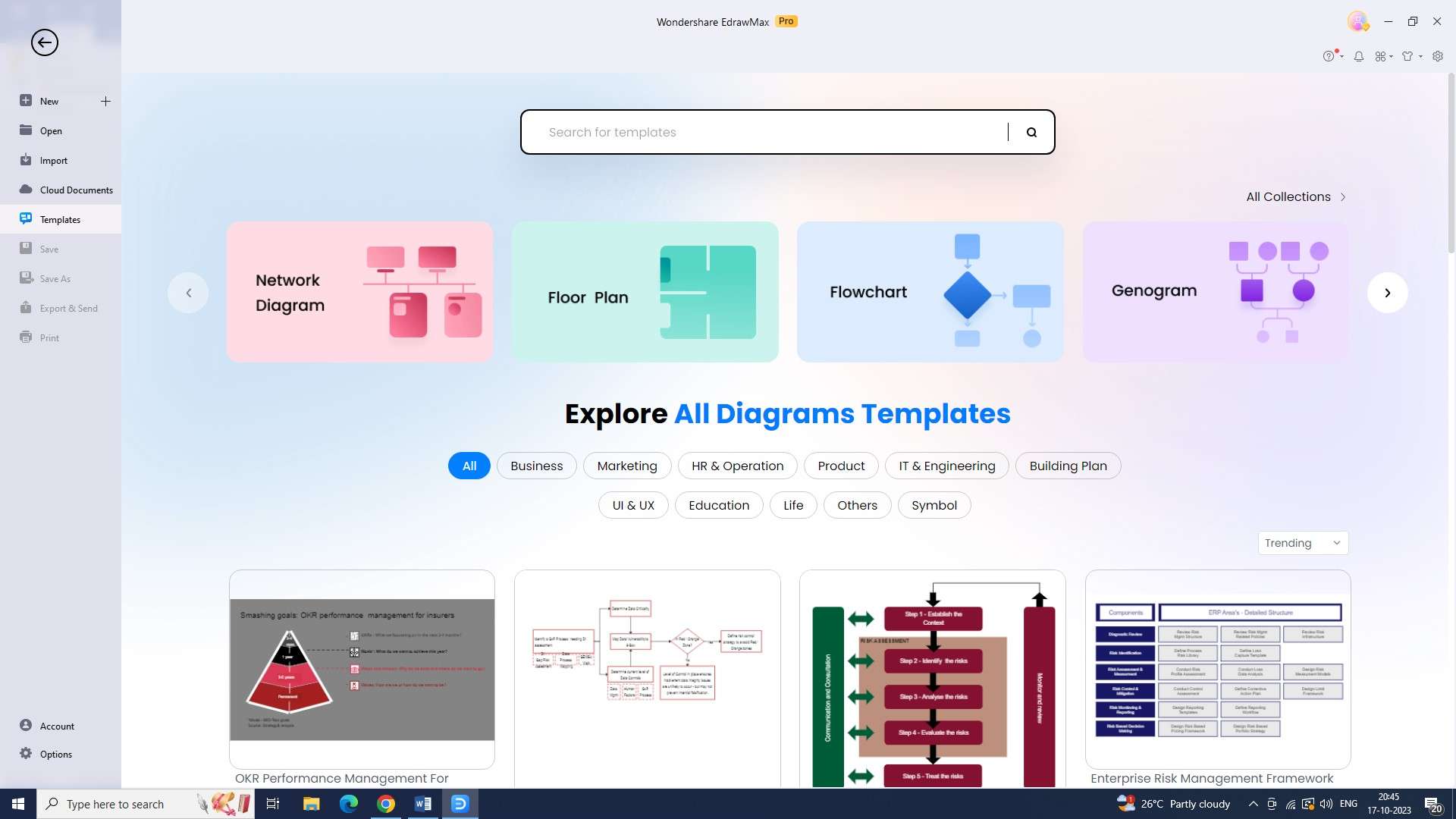

Step 3: Now go to the “Templates” section and search for “risk insurance management chart.” Browse through the templates, and pick the one that you find appropriate.

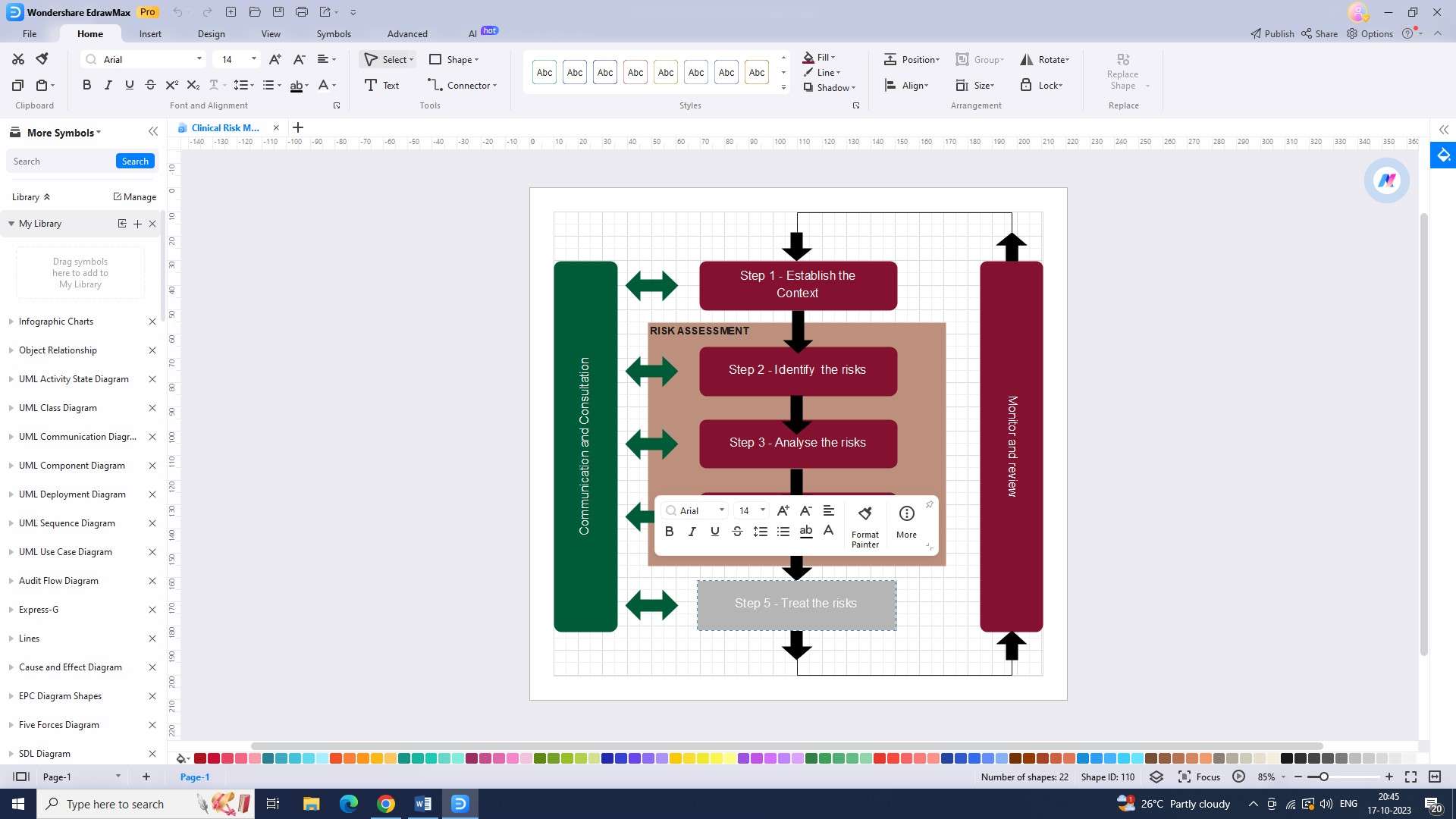

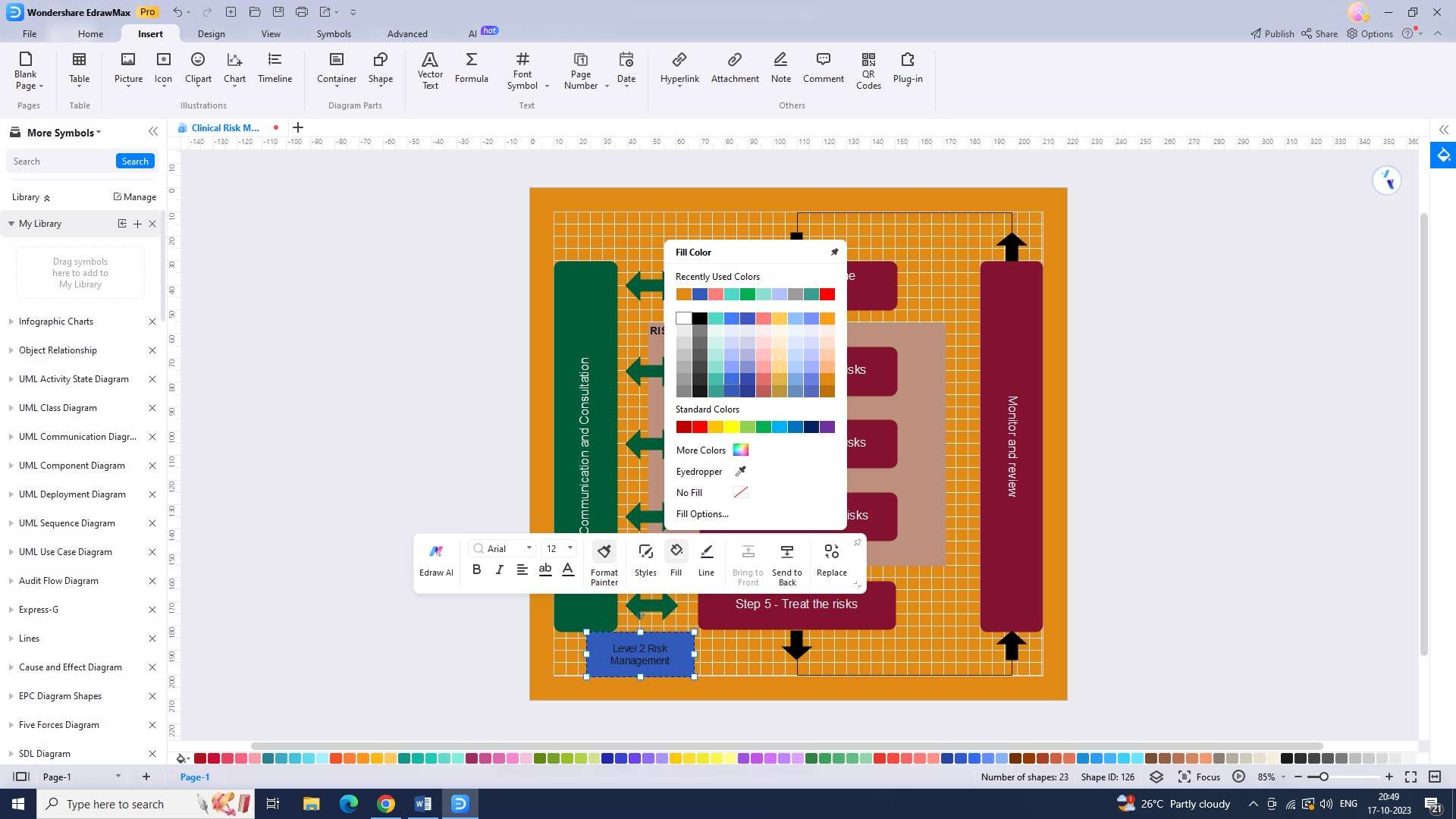

Step 4: Once you’ve chosen the template, you can start adding categories and data to your chart. Adding data is necessary for your chart.

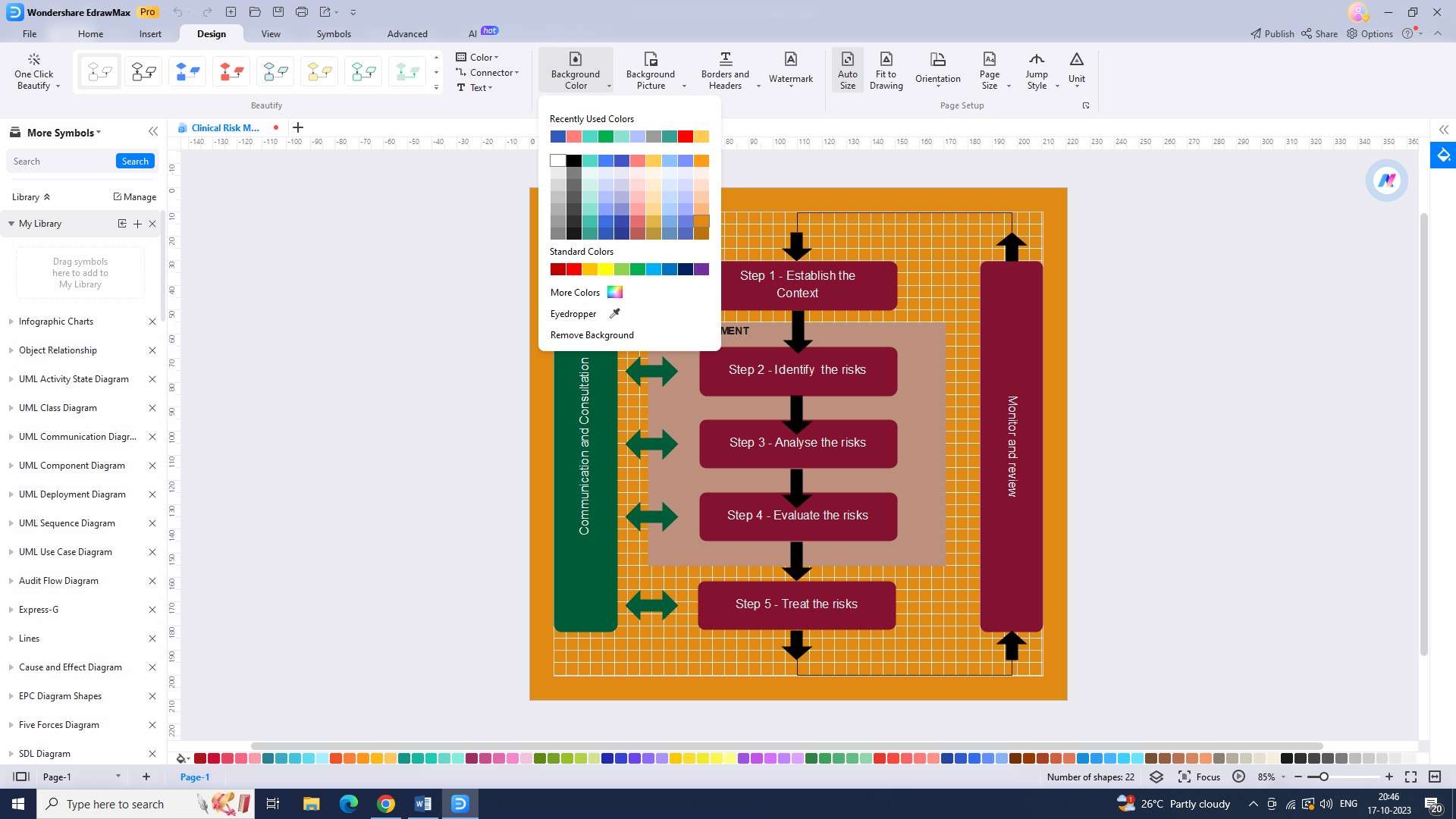

Step 5: Once you’ve added the data, you can personalize your chart by changing the colors, fonts, and other visual elements.

Step 6: You can add notes and annotations to your chart. This will help by providing additional information.

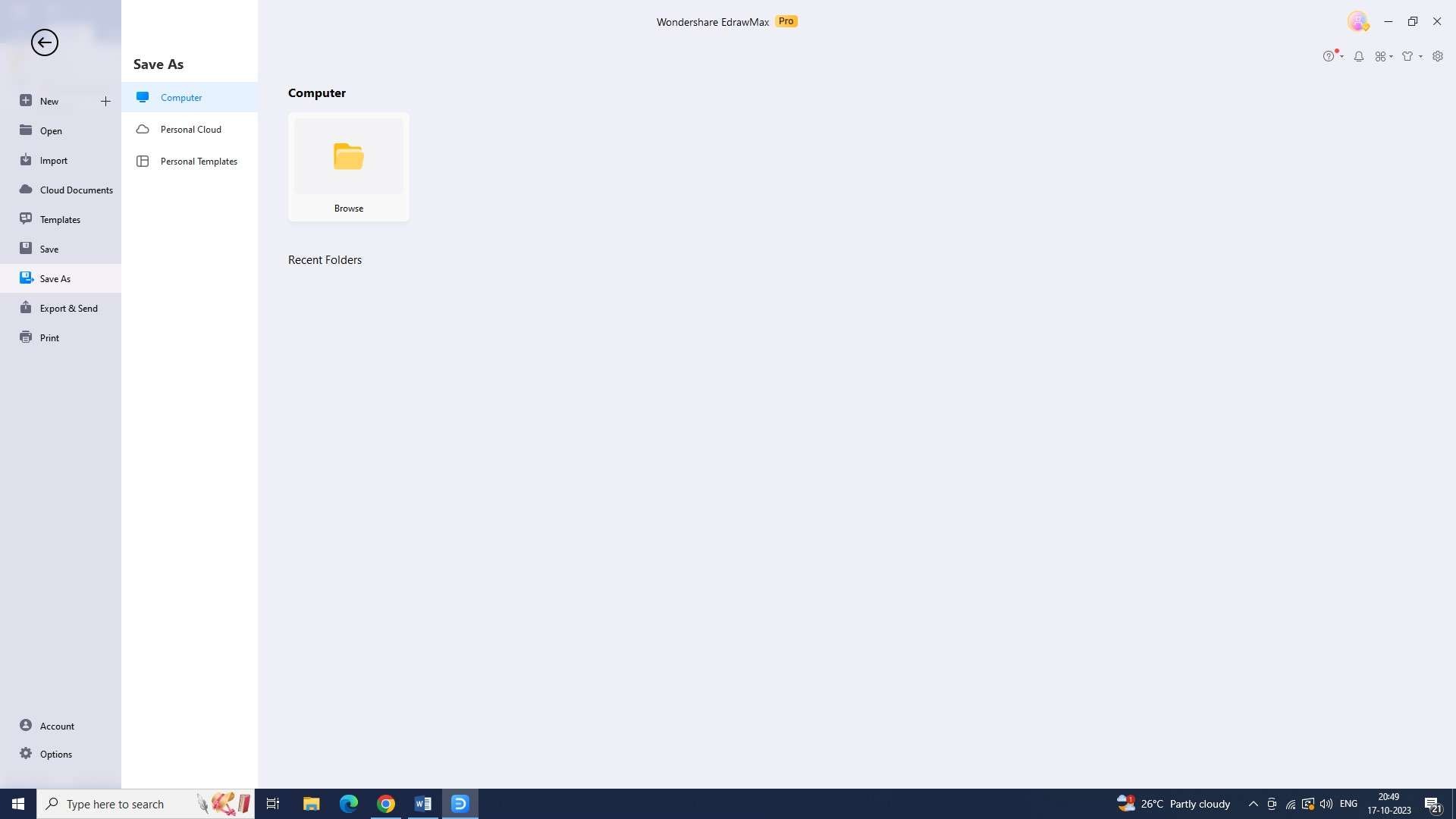

Step 7: Once you’re done creating your chart, you’ll need to save it. To do this, go to “File,” click the “Save” button, and enter the file name you want to save it under.

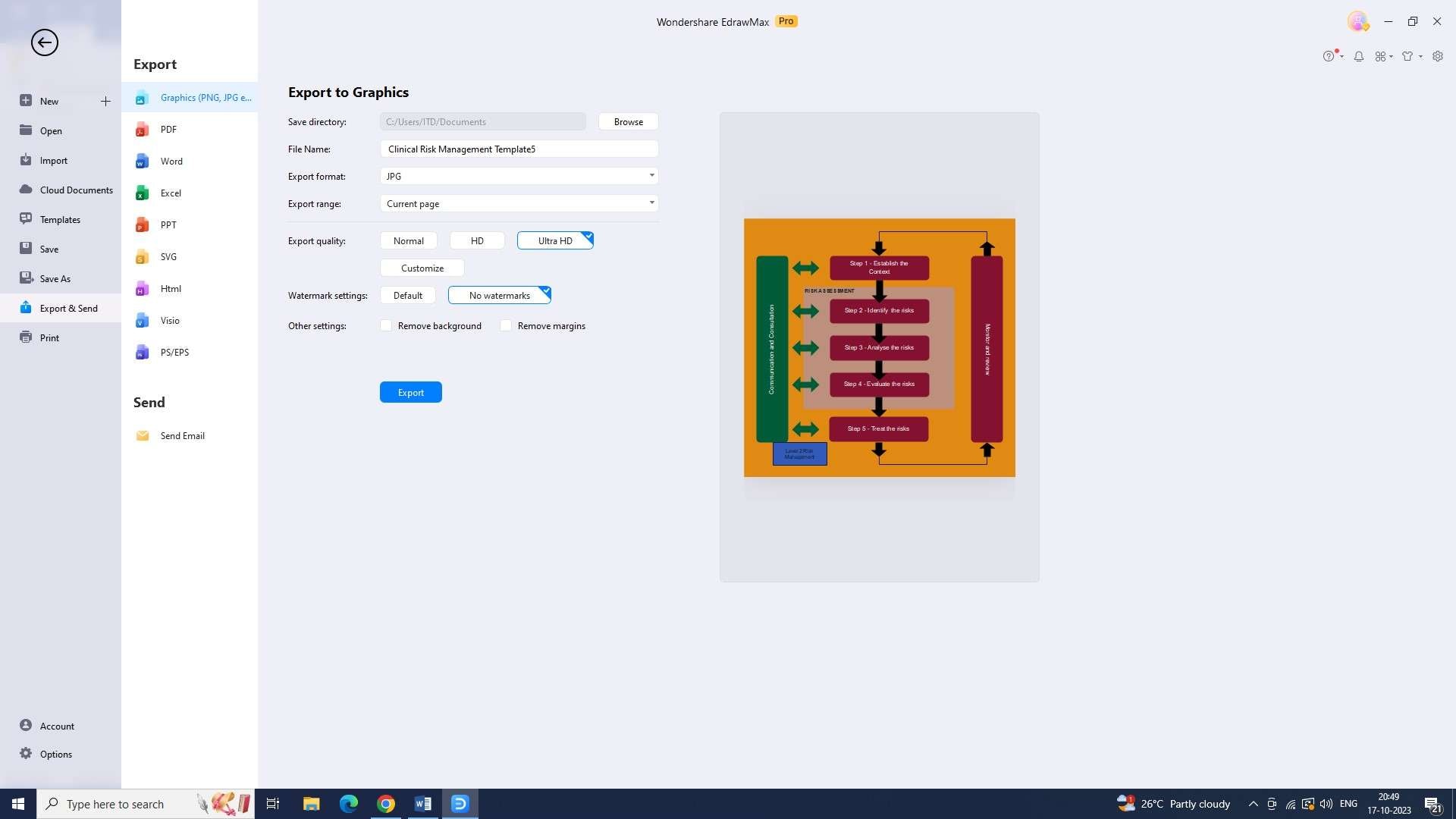

Step 8: Finally, you’ll need to export your chart. For this step, you have to go to “File,” then “Export,” and select the file format you want to export it in.

2) Pingboard

Pingboard offers a risk insurance management chart creation tool that allows users to easily create and customize charts to visualize their risk management strategies. With Pingboard, users can input and track various types of risks.

Features:

- Automated notifications: Alerts team members of changes made to the charts.

- Live data integration: Real-time updates on risk insurance management charts.

- Role-based access control: Granular control over user permissions based on roles.

Pros:

- Employee directory integration: Links employees to specific risks or insurance policies.

- Smart analytics: Advanced analytics capabilities for trend analysis and insights.

- Mobile app: Access and update charts on the go.

Cons:

- Limited third-party integrations: Few integrations with niche software.

- Lack of advanced reporting features: Basic reporting capabilities.

Compatibility:

Windows and Mac.

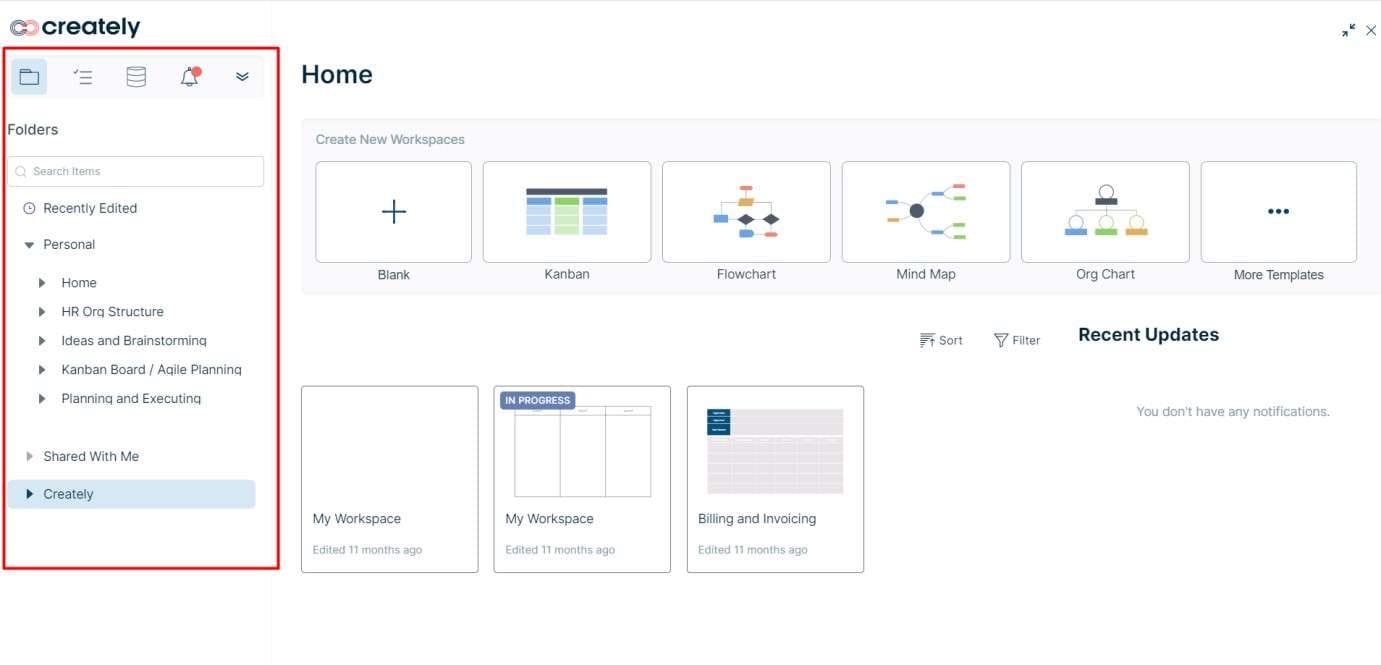

3) Creately

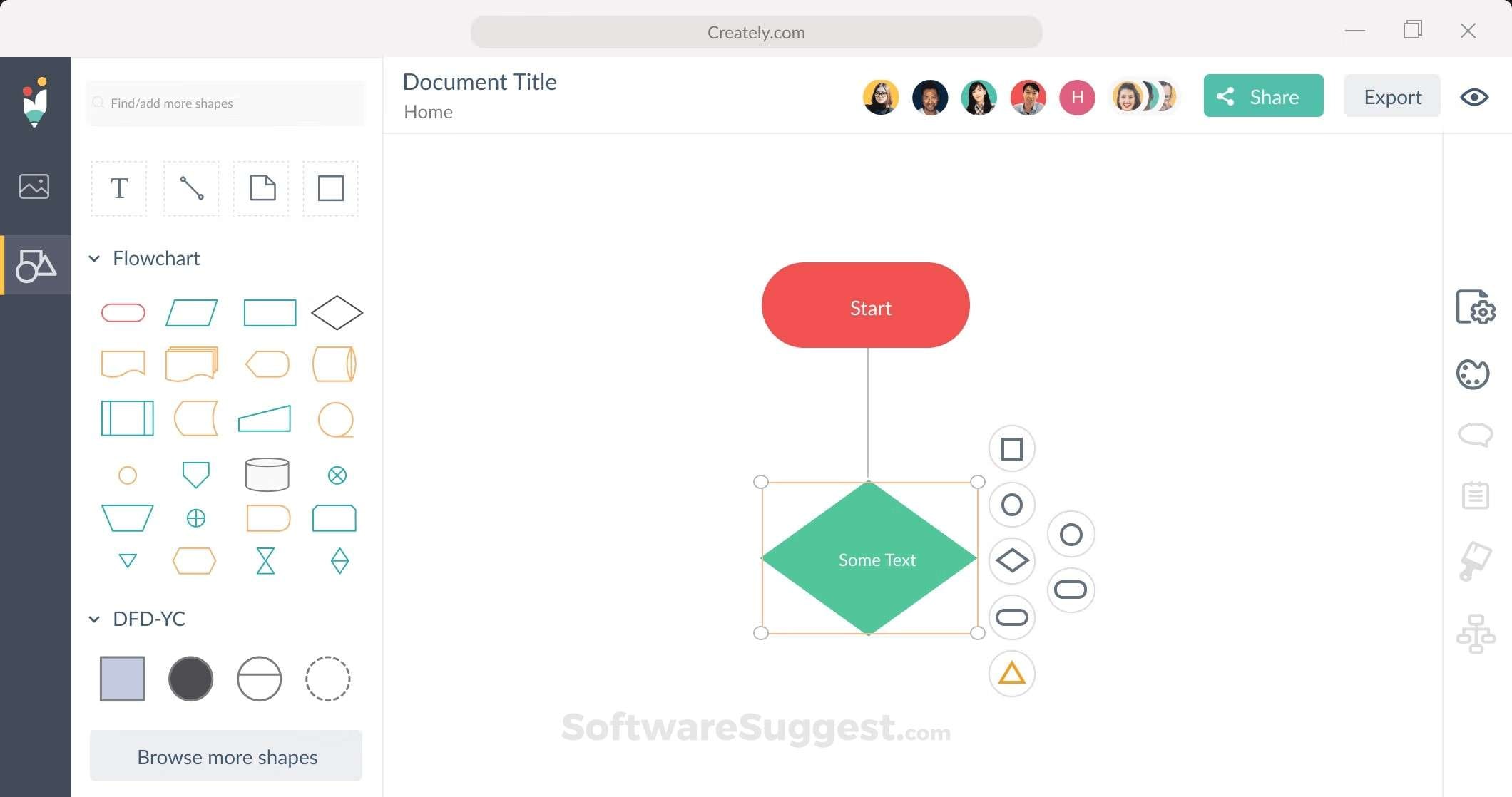

Creately provides a user-friendly risk insurance management chart creation tool that enables users to design visually appealing and informative charts. With Creately, users can easily drag and drop various risk elements onto the chart.

Features:

- Smart connectors: Automatically adjust when shapes are moved.

- Collaboration heatmaps: Visualize team collaboration and engagement.

- Version control and history: Track changes made to the charts.

Pros:

- Interactive prototypes: Create interactive prototypes for feedback.

- Real-time chat and comments: Facilitate communication and collaboration.

- Offline mode: Work on charts without an internet connection.

Cons:

- Limited animations and transitions: Few dynamic presentation options.

- Lack of advanced data analysis tools: Basic data visualization capabilities.

Compatibility:

Windows and Mac.

Conclusion

Risk and insurance management plays a vital role in safeguarding organizations against unforeseen events and potential financial losses. By identifying and prioritizing risks, conducting insurance needs analysis, and selecting appropriate insurance policies, businesses can ensure the continuity of their operations.