Effective risk management is crucial for organizations to achieve their objectives and mitigate potential threats. This article explores the competencies of a Professional Risk Manager, the role of T100 Risk Management Software in enhancing risk management practices, and more.

In this article

Definition of a Professional Risk Manager

Professional Risk Manager (PRM) are individuals who possess a deep understanding of both quantitative and qualitative aspects of risk management. PRMs are responsible for identifying, assessing, and managing potential risks that may impact an organization's objectives.

A holistic understanding of the PRM role requires an examination of their core competencies. PRMs possess strong analytical skills, including risk assessment and data analysis.

T100 Risk Manager and its Users

A notable tool in risk management practices, T100 Risk Manager, has gained popularity among organizations aiming to enhance their risk management capabilities. This software enables risk managers to streamline their risk assessment processes.

T100 Risk Management Software offers invaluable support to organizations by aligning risk management practices with their overarching goals. The software aids in identifying potential risks, developing risk response plans, and more. Active Risk Manager is a popular alternative to the T100 Risk Management Software.

Types and Examples of Supplier Risks

The significance of supplier risk management cannot be overstated. Globalization has amplified the vulnerability of organizations to disruptive events. For these reasons, taking the help of a supplier risk manager is of high importance.

Forex risk management refers to the mechanisms implemented by organizations to mitigate potential adverse effects caused by fluctuations in foreign exchange rates. By optimizing currency exposure, a forex trading risk manager can help organizations safeguard themselves against potential losses.

Supplier risks come in various forms. Each of these risks poses unique challenges to organizations.

1. Cybersecurity Risks: Digital landscape exposes organizations to cyber threats compromising sensitive information.

2. Compliance Risks: Suppliers' non-compliance with regulations poses risks to organizations.

3. Business and Financial Risks: Suppliers' financial instability impacts operations.

4. Event Risks: Unforeseen events disrupt the supply chain (e.g., natural disasters, pandemics).

Best Tools to Make Risk Management Strategy Charts

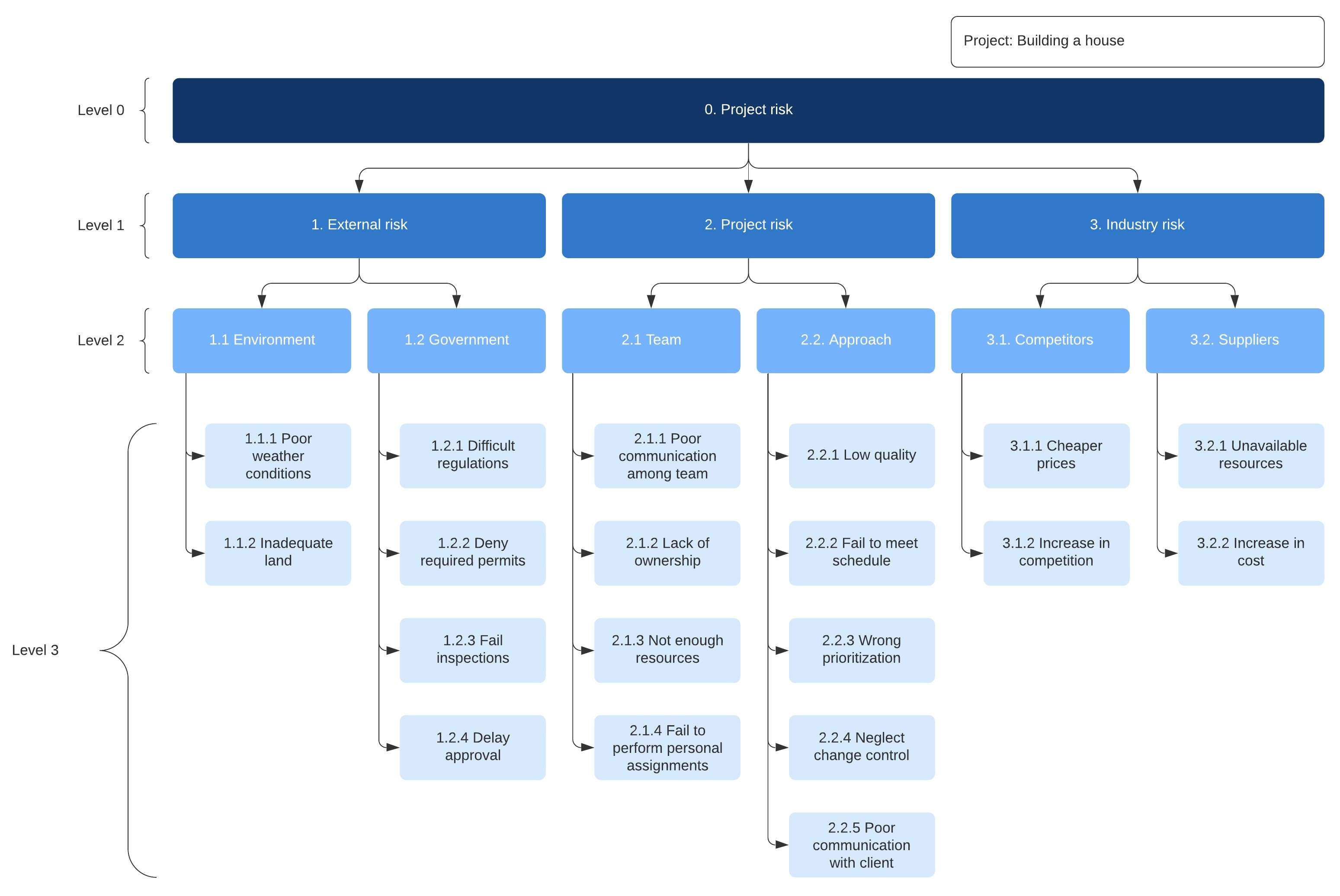

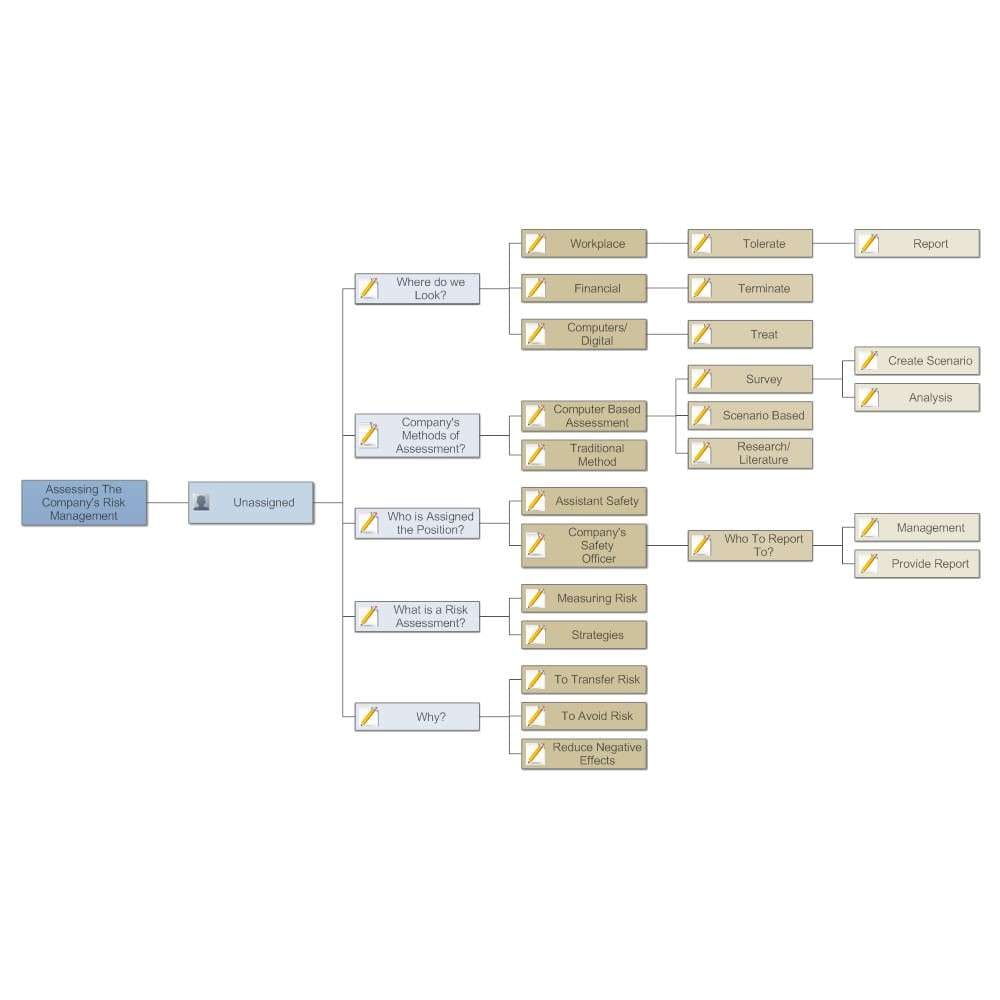

Risk management strategy chart creation tools are beneficial for a business risk manager because they help simplify the complex process of risk management.

1) Wondershare EdrawMax

Wondershare EdrawMax simplifies the creation of a chart for risk management by allowing users to easily create and share high-quality diagrams. Here are the steps to create a risk management strategy chart using the tool:

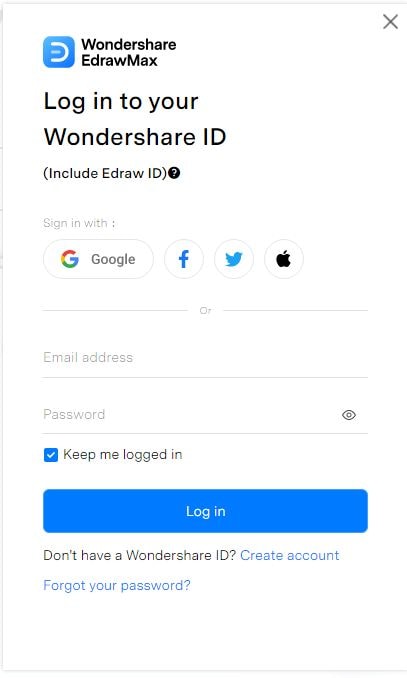

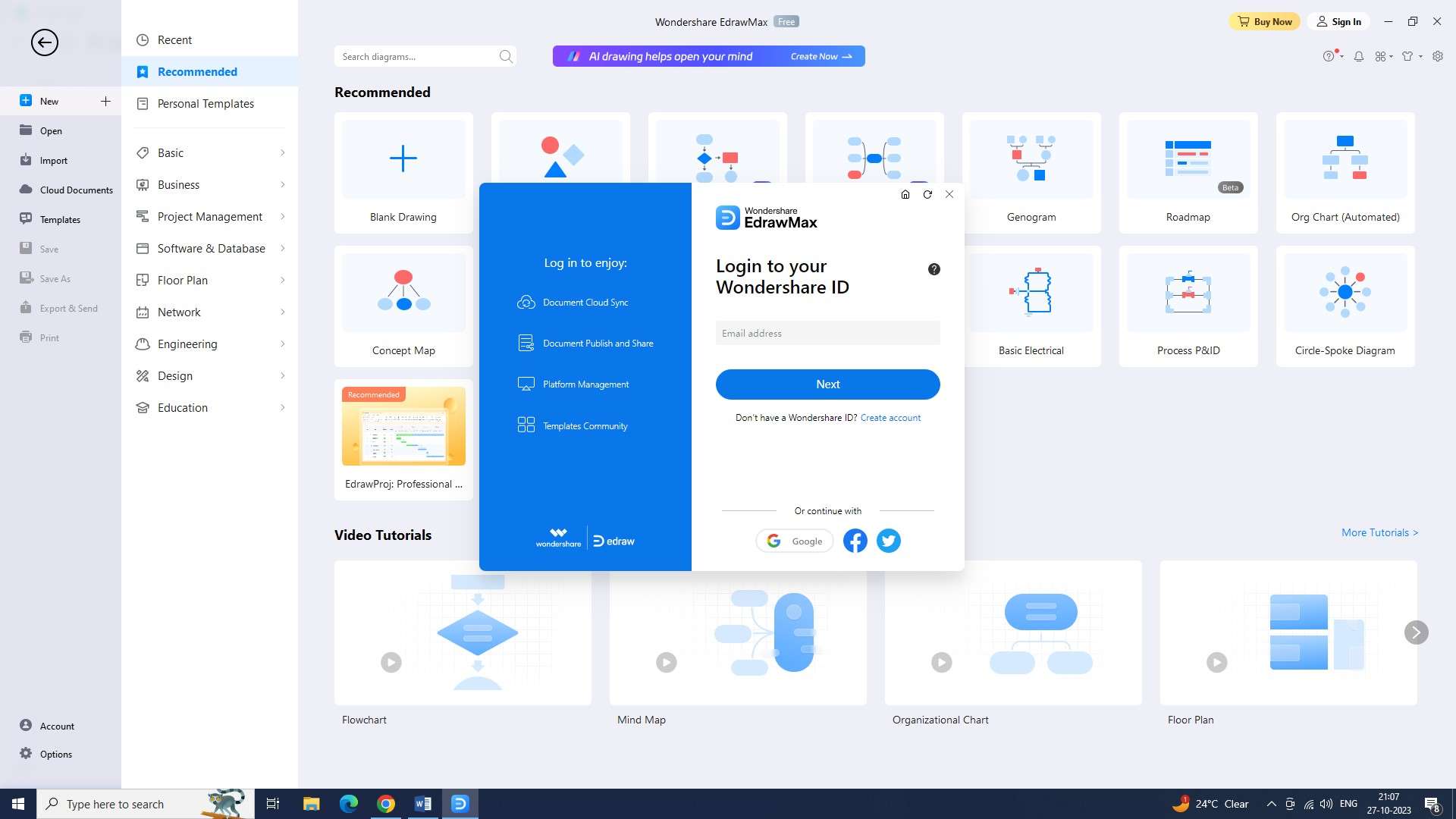

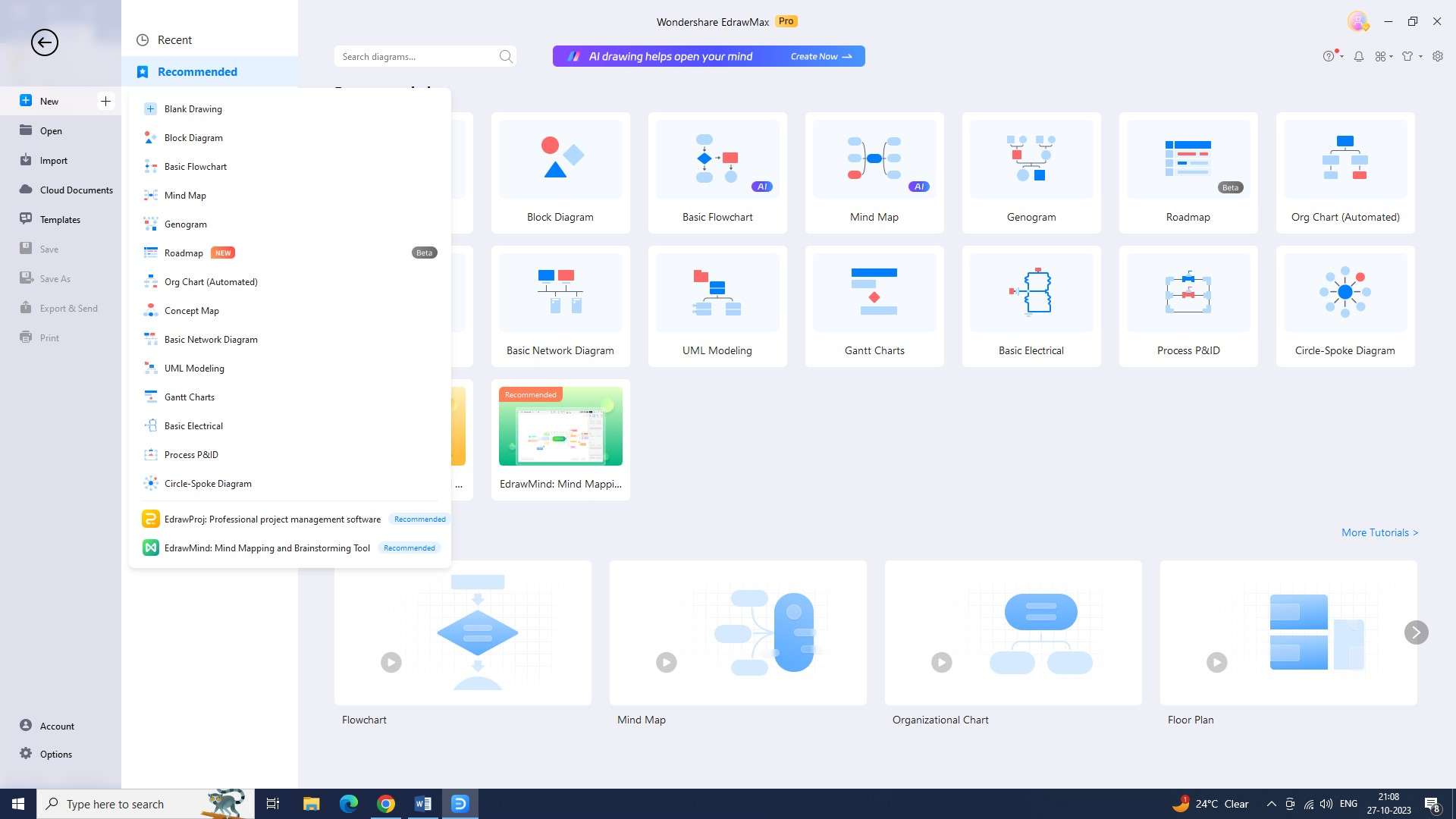

Step 1: The initial step to creating a chart is to log in to EdrawMax. Before you can begin creating your chart, you'll need to log in to your account.

Step 2: The second step is to open a new document in EdrawMax. After logging in to your account, you'll have to select a new document option.

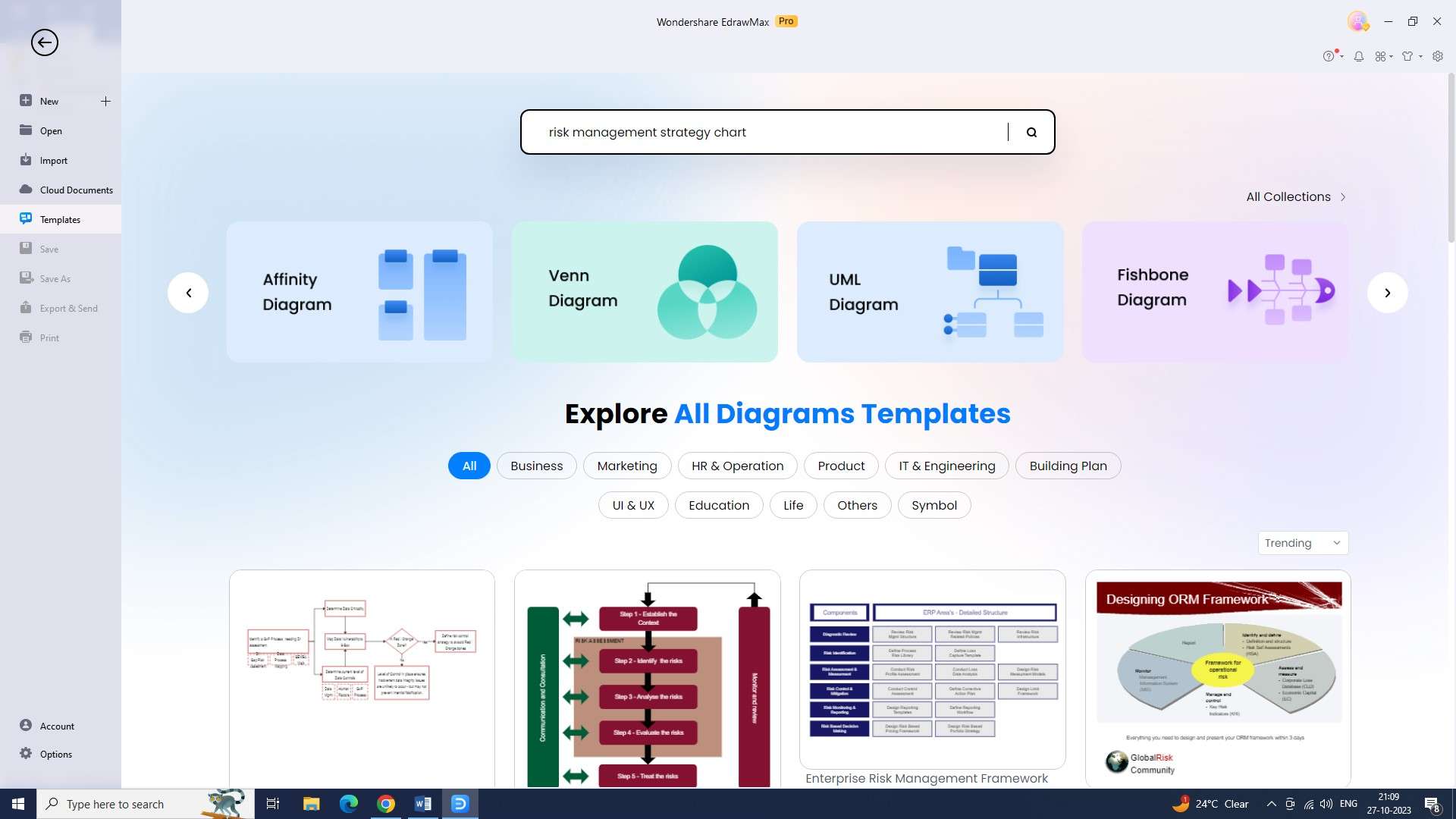

Step 3: Now navigate to the “Templates” section. Then search for a risk management strategy chart.

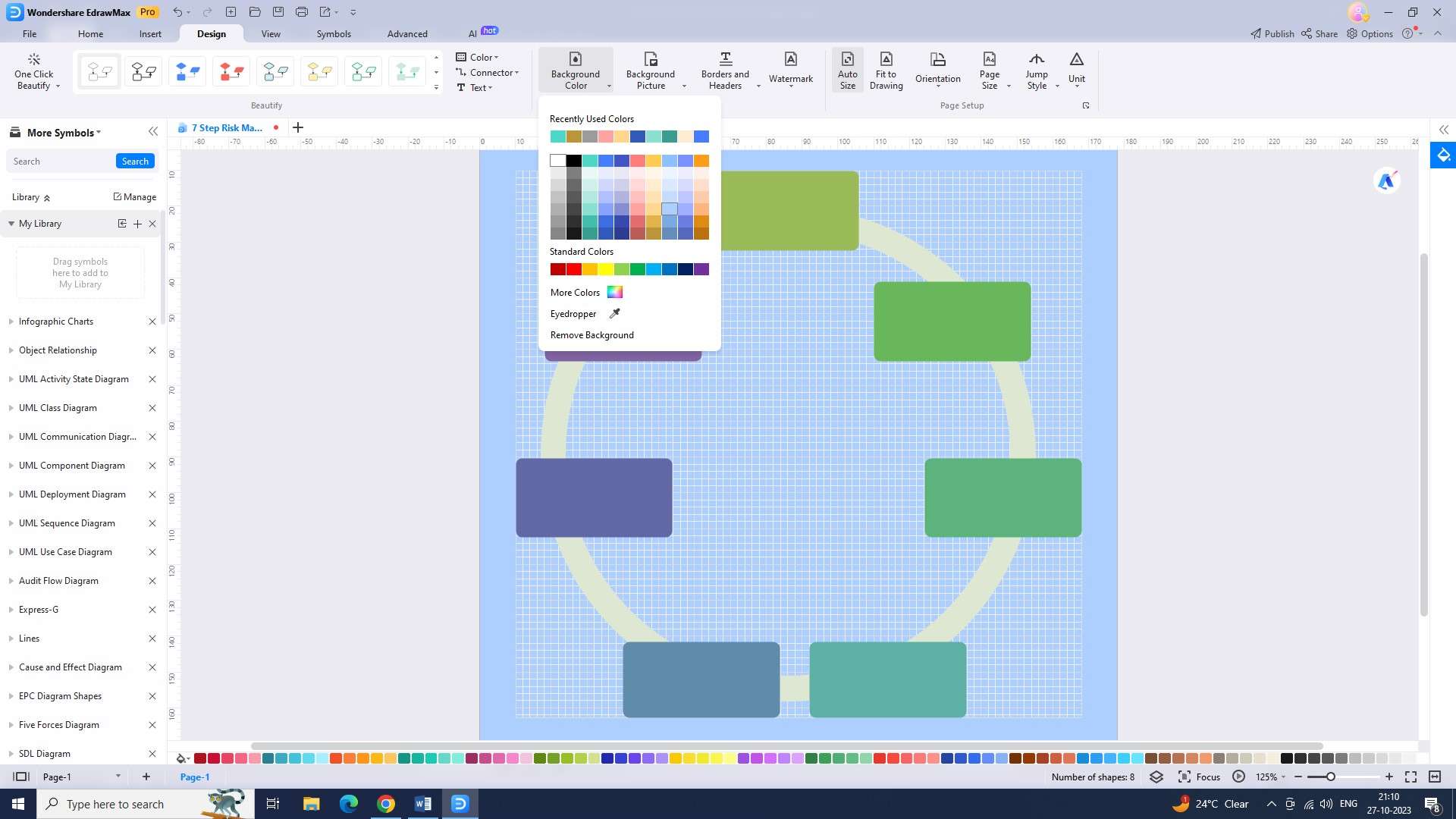

Step 4: Now it's time to customize your chart. Customize the colors and chart size to match your needs.

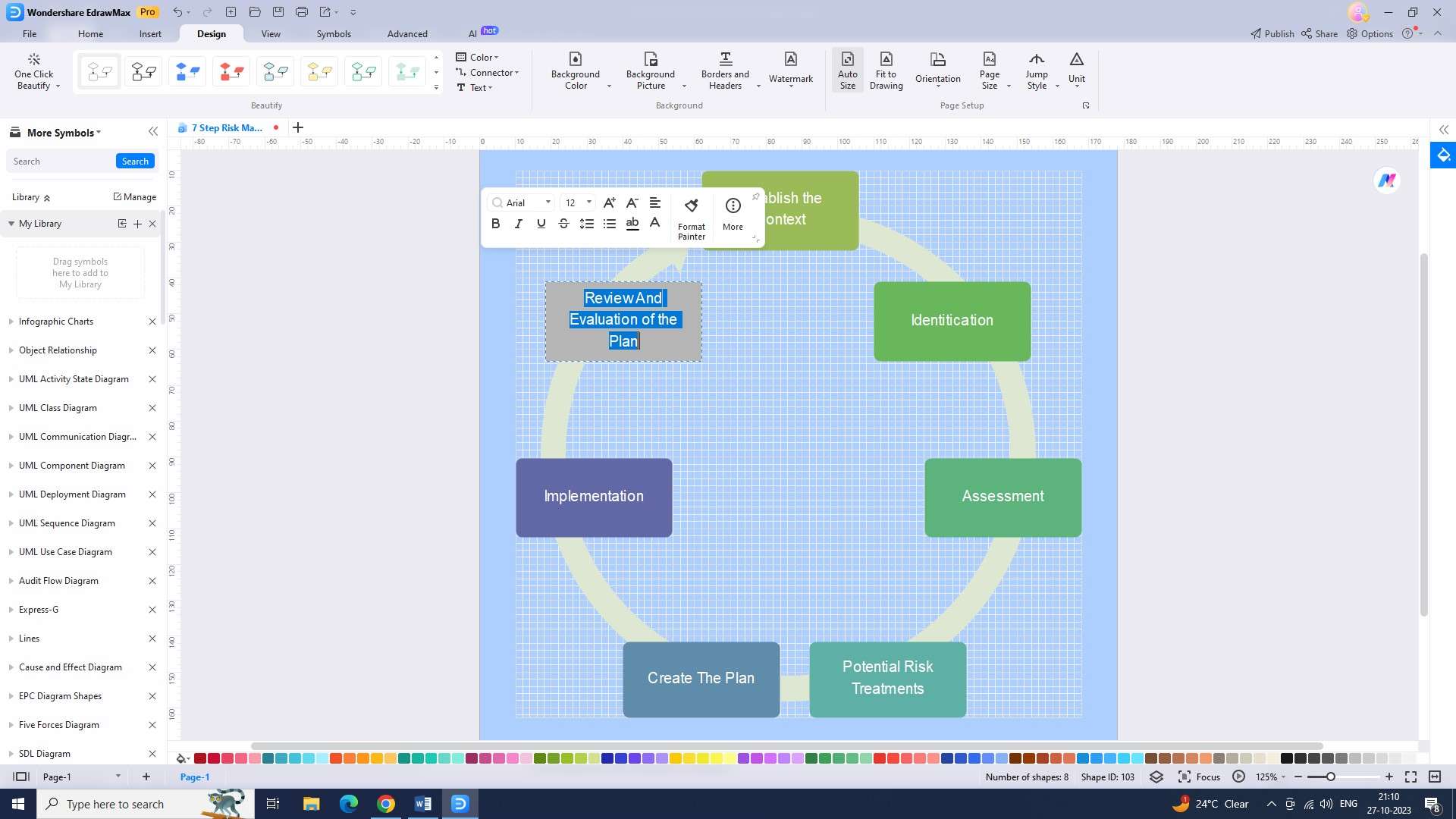

Step 5: The fifth step is to add the details related to the risk management strategy. This will make it easy for you to refer to this list when making risk management decisions.

Step 6: You can now save your chart. Navigate to “File,” and then click on “Save as” to save your chart.

Step 7: The last step is to export the chart. You can export the chart to multiple formats like JPEG, PNG, PDF, and more.

2) Lucidchart

Lucidchart helps users focus on how risk should be managed by quickly resource allocating and categorizing threats. It offers easy-to-understand charts and diagrams.

Features:

- Risk impact mapping: Identify potential cascading effects.

- Dynamic risk visualization: Create animated charts to showcase the evolution of risks over time.

- Risk benchmarking: Compare risk management strategies against industry standards.

Pros:

- Risk simulation and modeling: Simulate different risk scenarios and assess their impact on the overall strategy.

- Integration with risk assessment tools: Seamlessly integrate with popular risk assessment tools.

- Automated risk reporting: Automate the process of generating risk reports based on the data inputted.

Cons:

- Limited customization options: Users find the options for customizing visual elements to be limited.

- Complexity for novice users: Advanced features are overwhelming for users with limited experience.

3) SmartDraw

SmartDraw helps users create risk management strategy charts with the help of simple drag-and-drop functions. It enables users to quickly get a visual representation of their risk management plans.

Features:

- Risk correlation analysis: Analyze the correlation between different risks within the strategy chart.

- Real-time risk monitoring with alerts: Monitor risks in real-time with customizable alerts.

- Interactive risk heat maps: Create interactive risk heat maps for exploring different risk scenarios.

Pros:

- AI-powered risk analytics: Analyze risk data using artificial intelligence algorithms.

- Compliance tracking: Track compliance requirements and ensure alignment with regulatory standards.

- Risk prioritization using machine learning: Automatically prioritize risks based on historical data.

Cons:

- Limited integration with specialized software: Limitations when integrating with specialized risk management software.

- Lack of advanced scenario analysis: Scenario analysis capabilities are relatively basic.

Conclusion

Professional Risk Managers are instrumental in helping organizations navigate the ever-changing risk landscape. T100 Risk Manager provides valuable support by streamlining risk assessment processes.