Risk and risk management is an integral part of today's financial landscape, ensuring the stability and prosperity of individuals, corporations, and economies alike. This article delves into the various dimensions of risk management, exploring its definition, significance, and more.

In this article

Part 1. Why is Risk Management Important?

At its core, risk refers to the potential for loss or harm that arises from uncertainties or adverse events. Risk and risk management, on the other hand, serves as a systematic approach to identify, assess, and mitigate potential risks.

The importance of risk management cannot be overstated, particularly in today's complex and interconnected financial systems. By identifying and quantifying potential risks, risk management enables individuals and organizations to protect their assets against unexpected events.

Part 2. What are the Risks of Fixed-Income Securities?

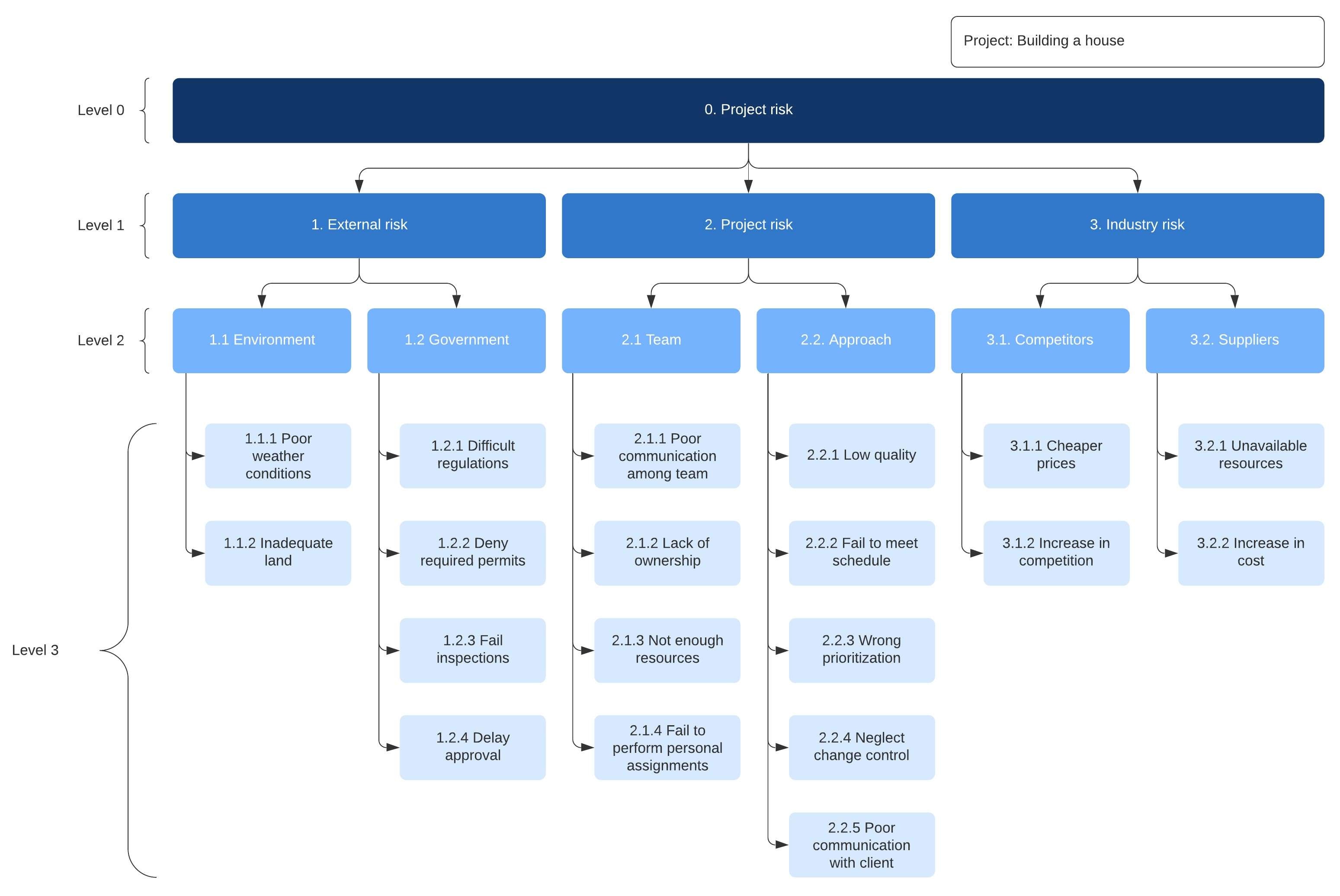

In risk and risk management, risks are often categorized into three distinct levels: strategic, operational, and financial risks.

Strategic risks relate to long-term objectives and direction. Operational risks involve internal processes, procedures, and human factors. Financial risks encompass market fluctuations, credit default, liquidity constraints, and legal and regulatory compliance.

Fixed-income securities, like bonds, carry risks that investors and risk managers must consider. These risks include interest rate fluctuations and the possibility of issuer default. Credit risk refers to the possibility of default by the issuer, leading to a loss of principal or interest payments.

Part 3. What is the Valuation of Fixed-Income Securities?

In the realm of risk management, accurate valuation of fixed-income securities plays a crucial role. Fixed income securities valuation risk and risk management involve determining the present value of expected future cash flows associated with a fixed-income security. Factors considered in the valuation process include prevailing interest rates, credit quality, maturity profile, and market demand.

Inherent risk in risk management represents the level of risk present in a particular activity, process, or investment strategy prior to the implementation of risk management measures. Understanding inherent risk helps define the starting point for subsequent risk management processes.

Part 4. Tools to Make Risk Management Flowchart

A risk management flowchart creation tool is a powerful and easy-to-use tool that helps simplify and streamline the process of creating well-structured, visually attractive flowcharts.

1) Wondershare EdrawMax

With Wondershare EdrawMax, users can easily create risk and risk management flowcharts of various levels for different risk scenarios. Additionally, users can also visualize risk management process flows and view relationships among different risk factors. The steps to create a risk management flowchart using the tool are:

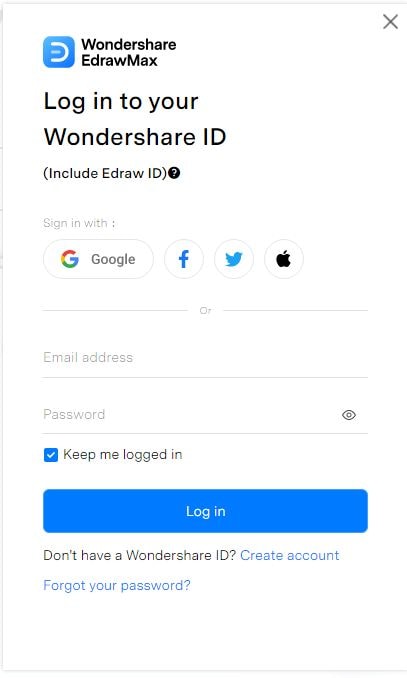

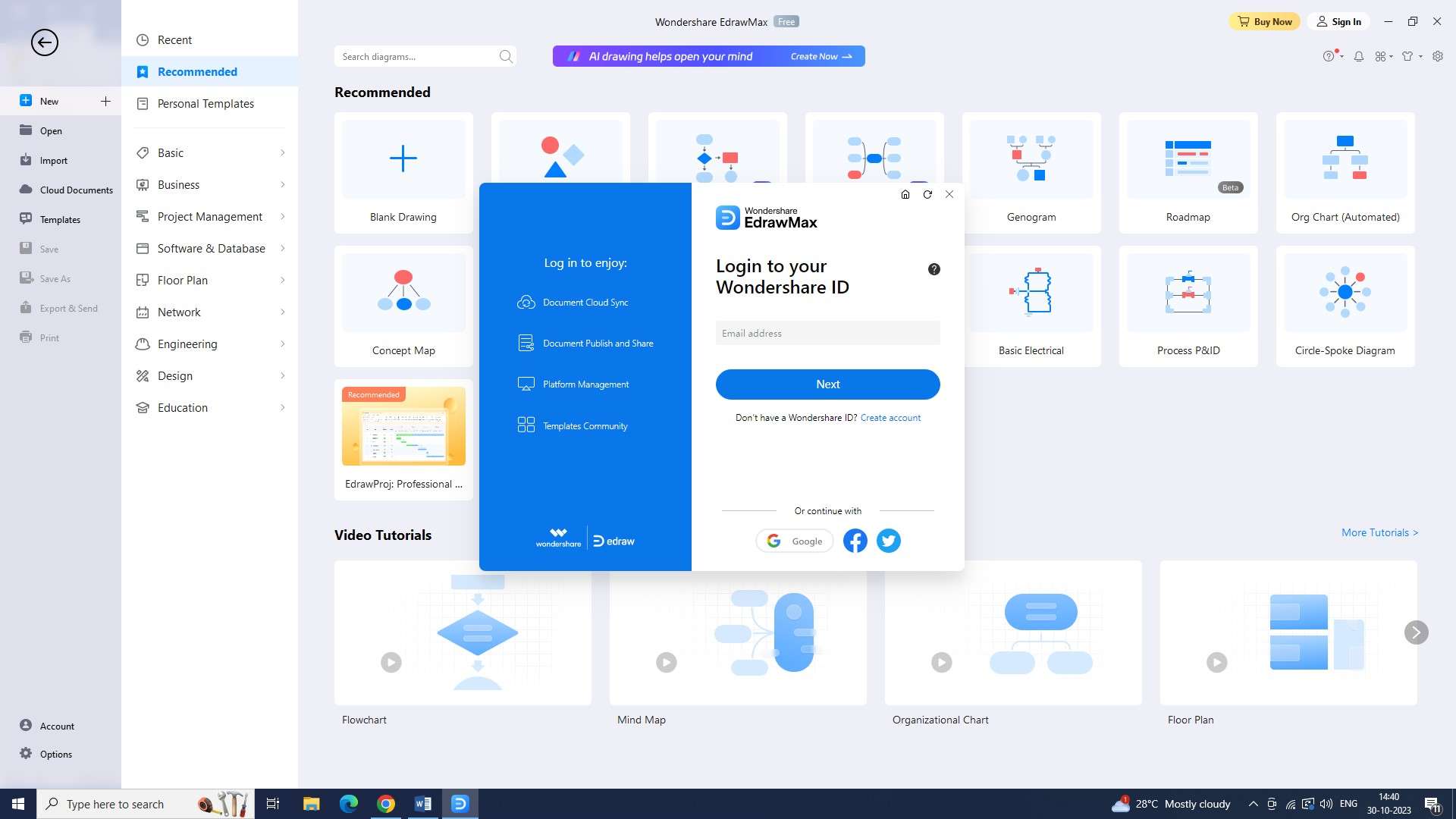

Step 1: Start Wondershare Edrawmax first. To access your account, click the "Sign in" button and provide your login information.

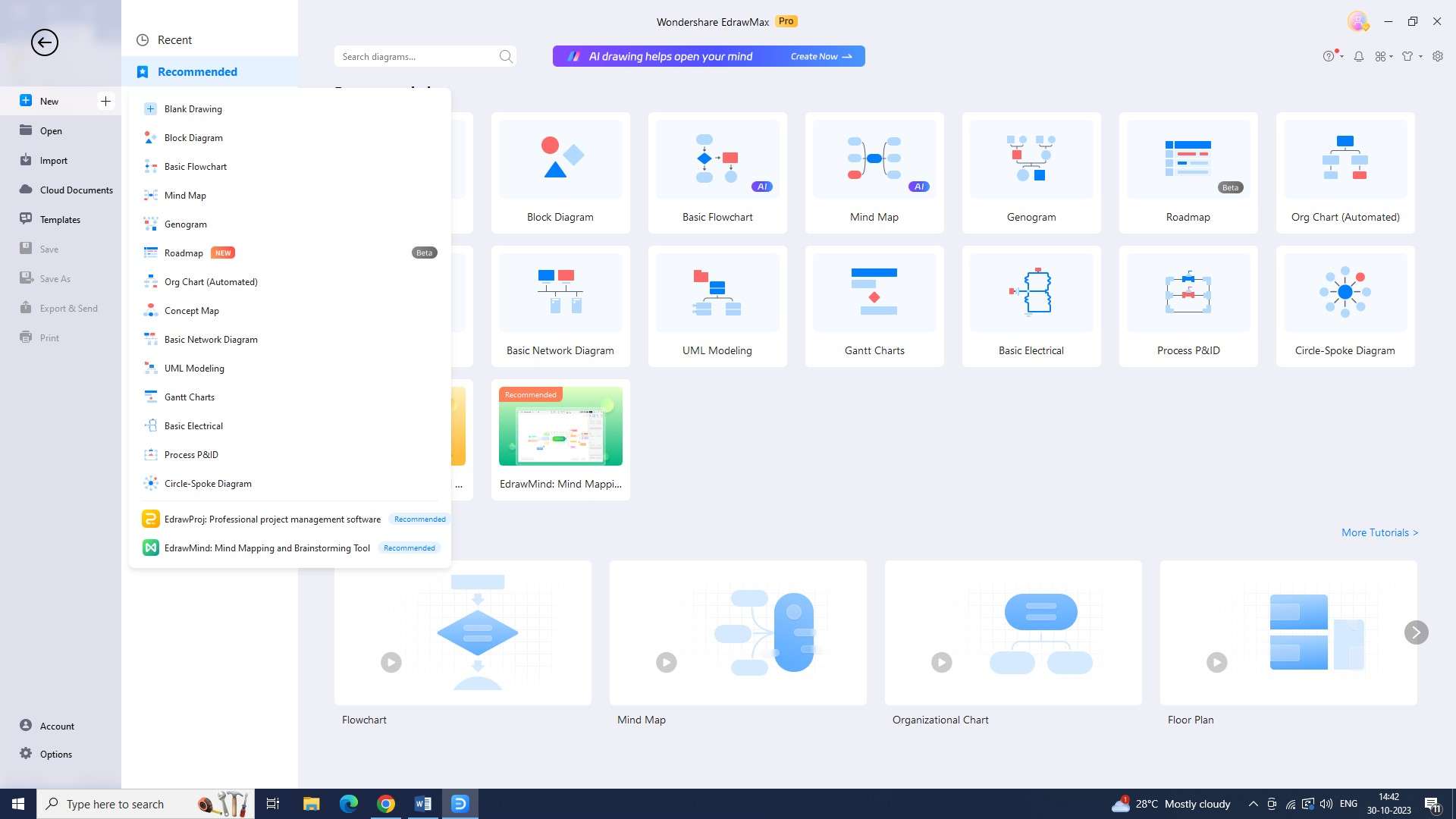

Step 2: After logging in, open a new document. To begin a new project, click the + symbol next to the "New" button.

Step 3: Look through the many templates in the "Templates" section to select a suitable risk management flowchart template. Next, open the template in the editor.

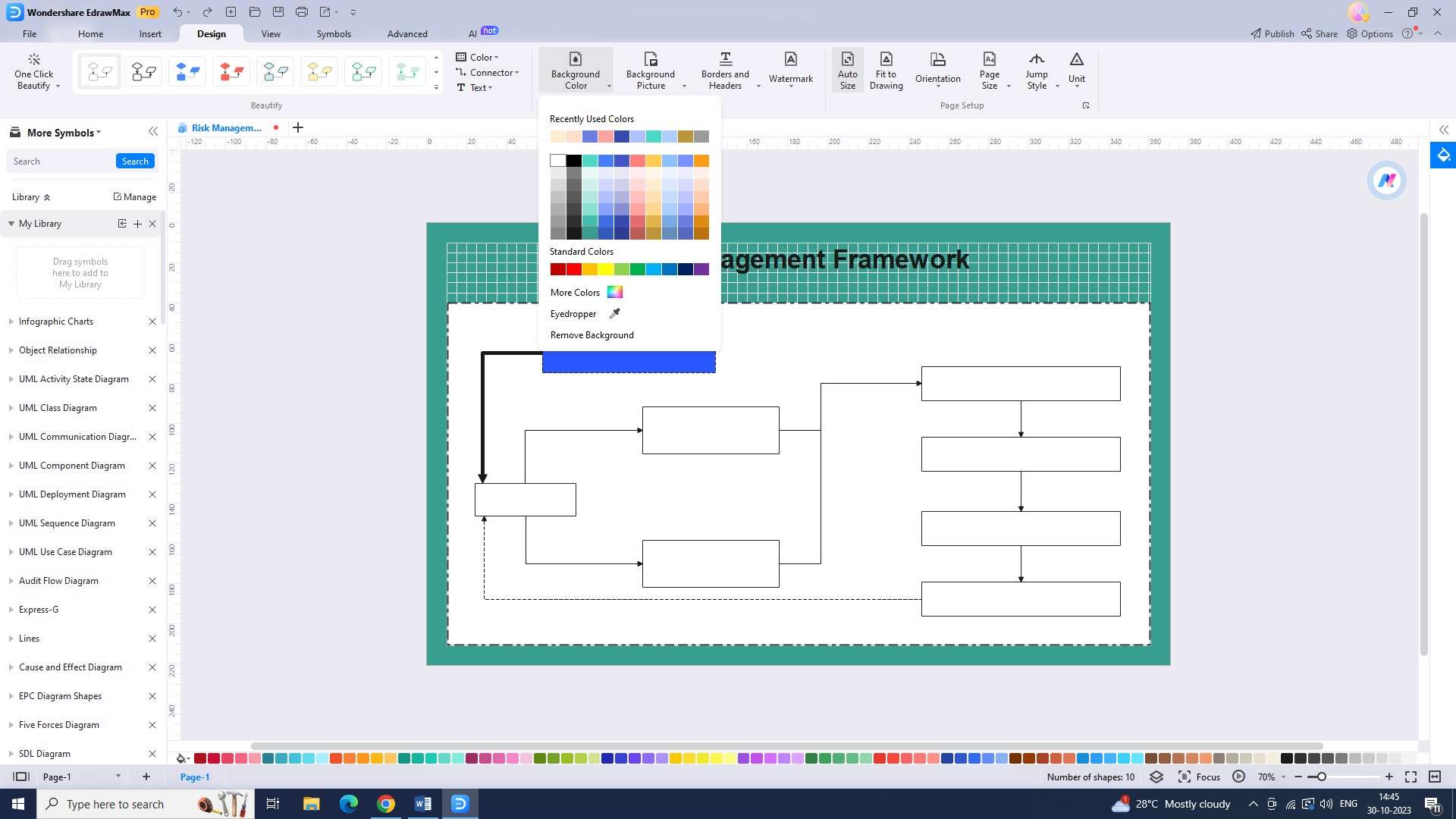

Step 4: Adjust the line styles, and colors to personalize the flowchart's appearance. Utilize the formatting options found in the toolbar to produce a visually appealing and understandable flowchart.

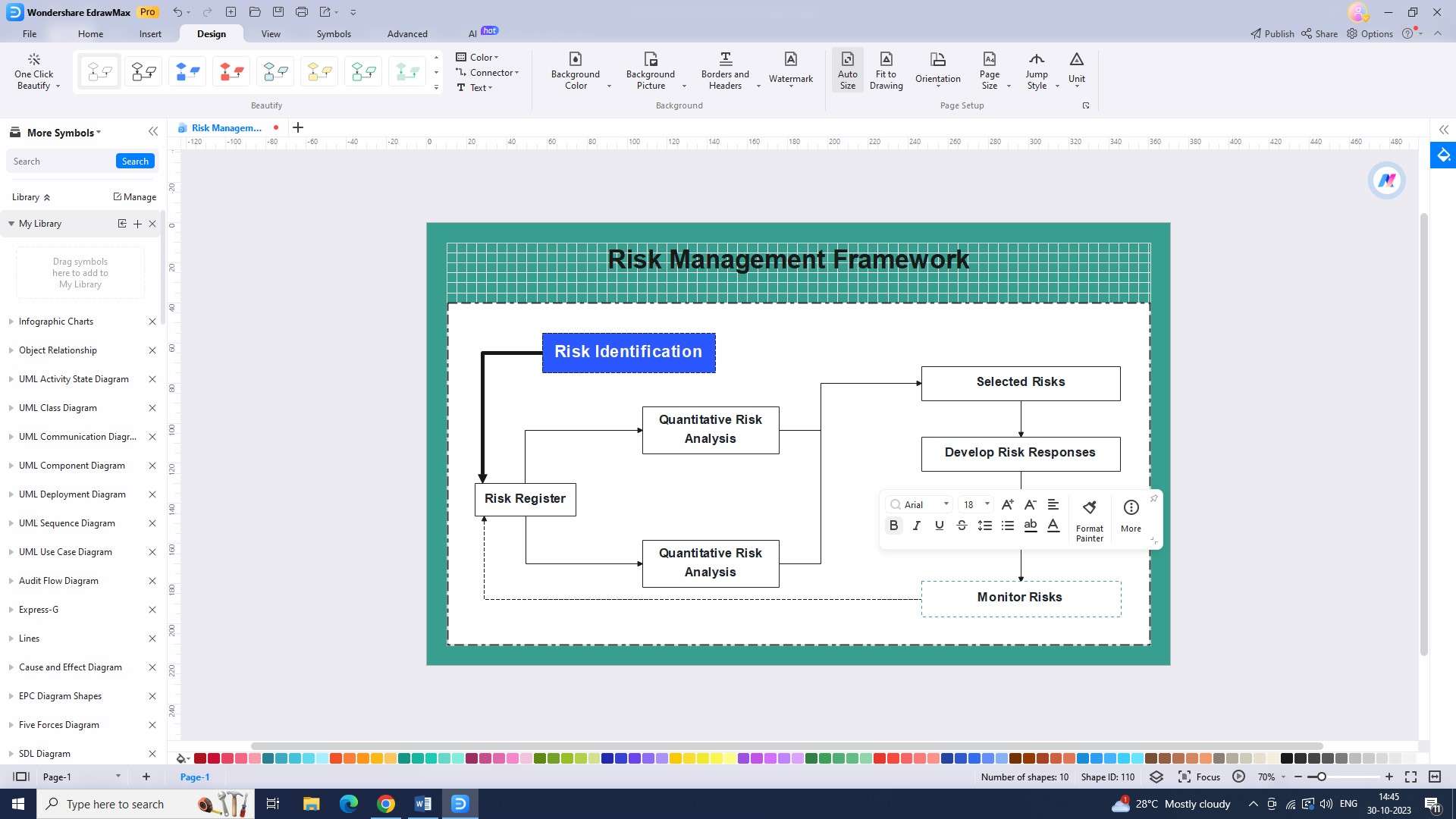

Step 5: Fill up the shapes with the necessary content according to the specific stages you want your flowchart to include.

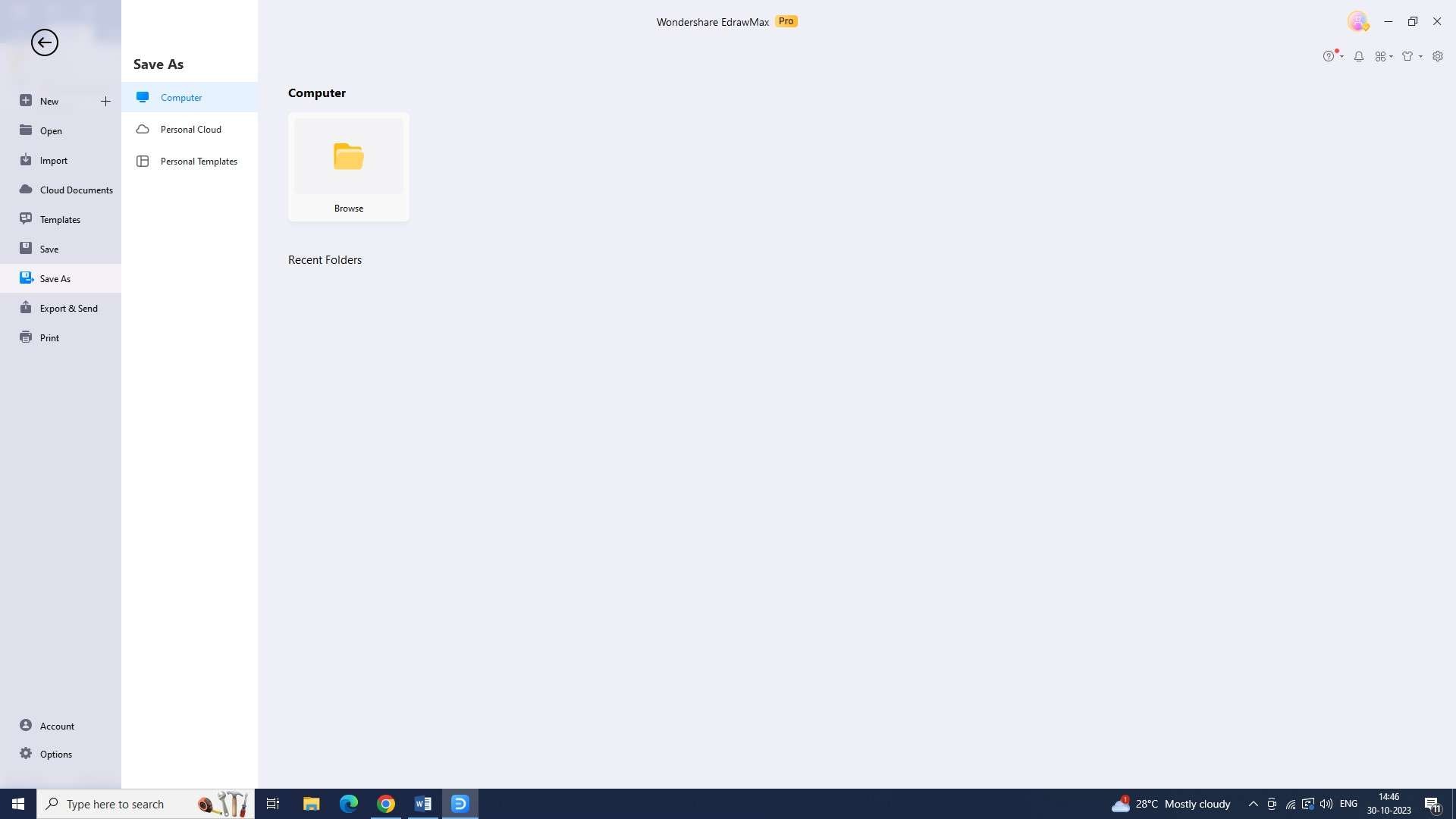

Step 6: Select "Save" from the "File" menu to save your work. To save the file on your computer or in cloud storage, choose a suitable location.

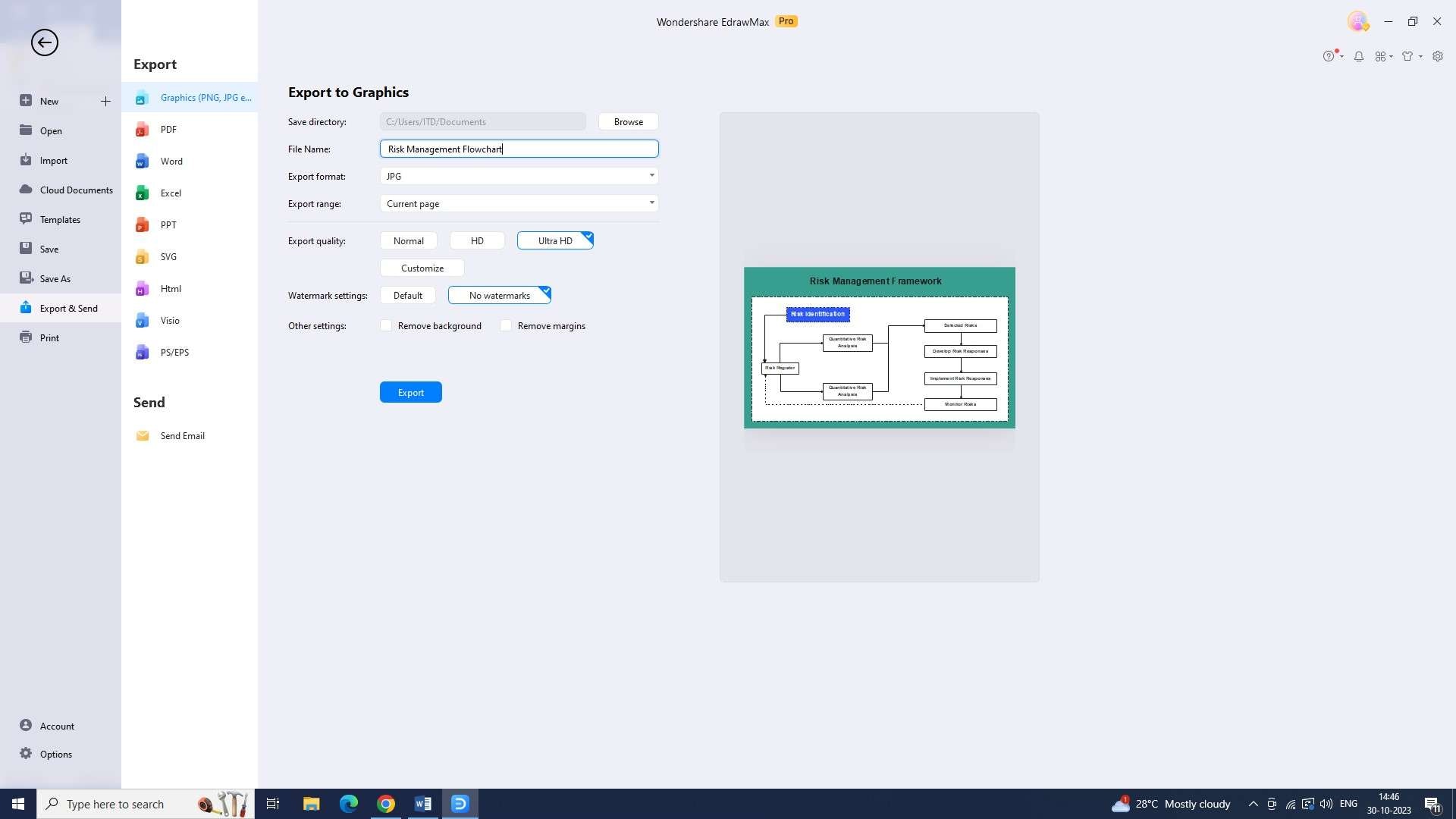

Step 7: Now, click the "Export" button under "File" and select the format in which you wish to export your flowchart.

2) Creately

Creately is a risk management flowchart creation tool that helps users quickly and easily create flowcharts to visualize risks and processes.

Features:

- Interactive decision trees: Creately allows users to create interactive decision trees within flowcharts, enhancing the risk analysis process.

- AI-powered diagram suggestions: Creately provides AI-powered suggestions for improving flowchart structure and layout.

- Social media-style commenting: Creately includes a commenting system for real-time collaboration on flowcharts.

3) Lucidchart

Lucidchart is a comprehensive risk management flowchart creation tool that enables users to create diagrams to visualize and manage risks.

Features:

- Automated diagram validation: Lucidchart includes an automated diagram validation feature.

- Real-time collaboration heatmaps: Lucidchart provides heatmaps to identify critical sections and facilitate discussions.

- Interactive simulations with user input: Lucidchart allows the creation of interactive simulations within flowcharts.

Conclusion

Risk and risk management serves as the bedrock for financial stability, enabling individuals and organizations to protect their assets, make informed decisions, and navigate uncertainties successfully.