A risk maturity model is a valuable tool that organizations can use to enhance their risk management capabilities. By adopting a structured approach aligned with best practices, businesses can effectively manage risks. In this article, we will explore the purpose of a risk maturity model framework, the implementation process, and more.

In this article

Why Use a Risk Maturity Model?

A risk maturity model serves as an invaluable tool for organizations in identifying, assessing, and managing risks. By adopting such a model, businesses can enhance their risk management capabilities by implementing structured processes that align with best practices.

The primary purpose of a risk maturity model framework is to assess an organization's current risk management practices and provide a roadmap for advancement. It aids businesses in evaluating their maturity level across various risk management dimensions.

What Stages Are Part of a Risk Maturity Model?

Organizations should start by conducting a comprehensive assessment of their current risk management practices and capabilities. This could involve reviewing policies, procedures, and key risk indicators, as well as conducting interviews with relevant stakeholders.

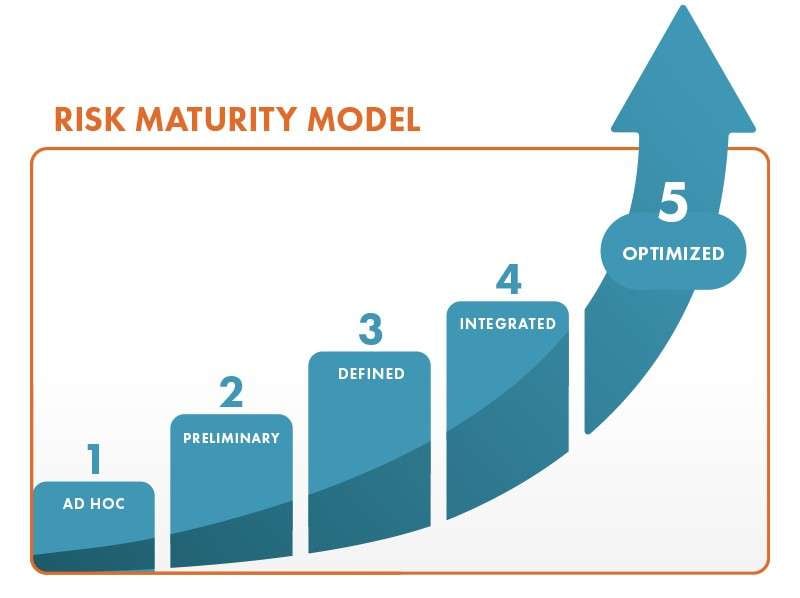

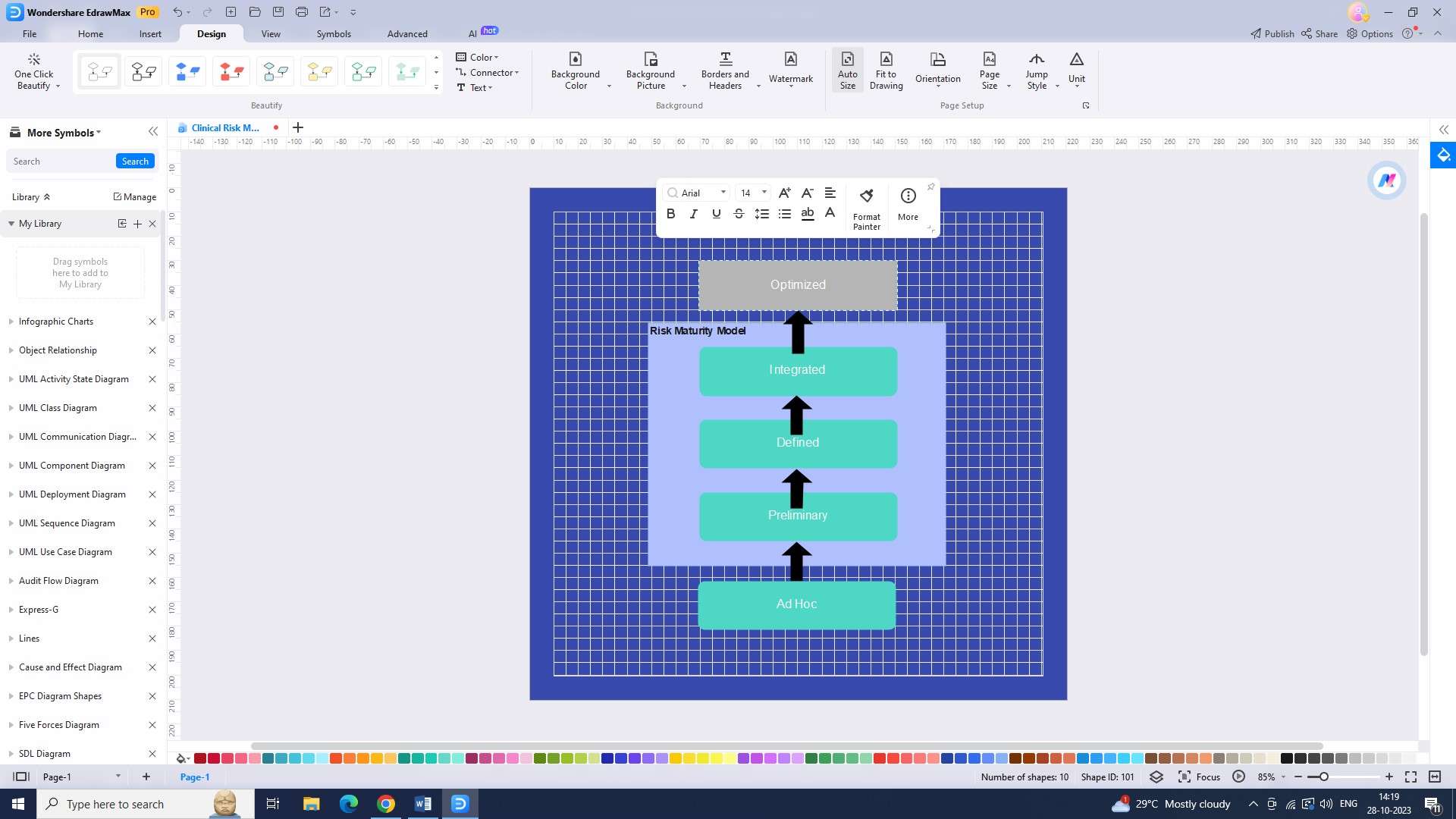

A risk maturity model typically consists of some key stages. These stages represent the organization's progressive journey towards a mature risk management framework.

1. Ad Hoc: In this initial stage, risk management activities are generally unstructured and decentralized.

2. Preliminary: In the preliminary stage, businesses begin recognizing the need for a more systematic approach to risk management.

3. Defined: The defined stage signifies the establishment of a formalized risk management framework.

4. Integrated: The integrated stage involves the integration of risk management practices across various business operations.

5. Optimized: Organizations in this stage have a proactive and dynamic risk management framework.

What is ERM Framework ISO 31000?

The ERM framework ISO 31000 constitutes an internationally accepted standard for enterprise risk management. Developed by the International Organization for Standardization (ISO), the risk maturity model ISO 31000 provides guidelines and principles to assist organizations in designing and implementing effective risk management practices.

Best Risk Maturity Model Tools

The purpose of risk maturity model tools is to enable organizations to visually represent and communicate their risk management practices, facilitating better understanding and collaboration among stakeholders.

1) Wondershare EdrawMax

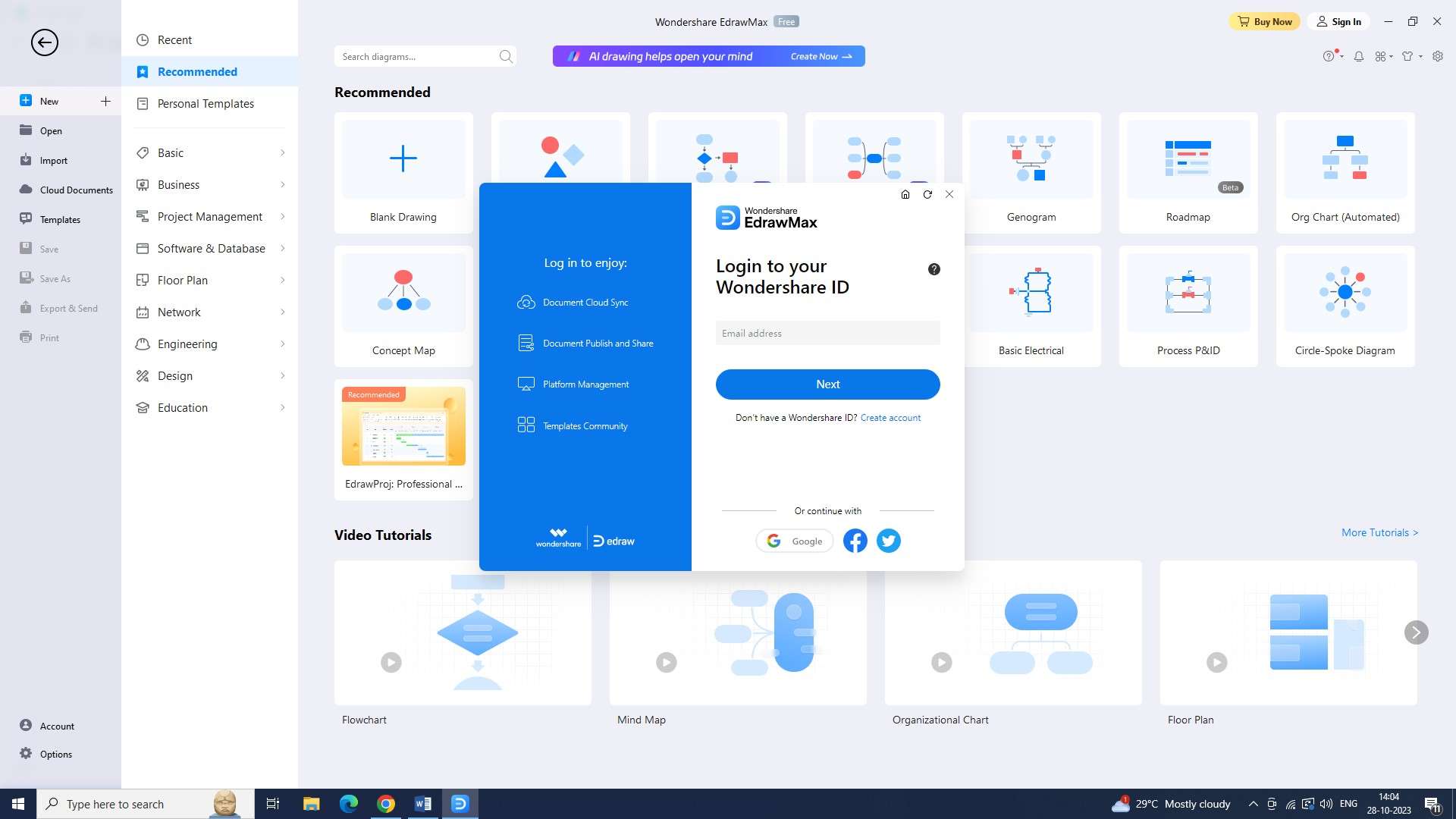

Wondershare EdrawMax is a comprehensive risk maturity model tool that offers a wide range of features and functionalities to help organizations assess and improve their risk management practices. Here are the steps to create a risk maturity model chart using the tool:

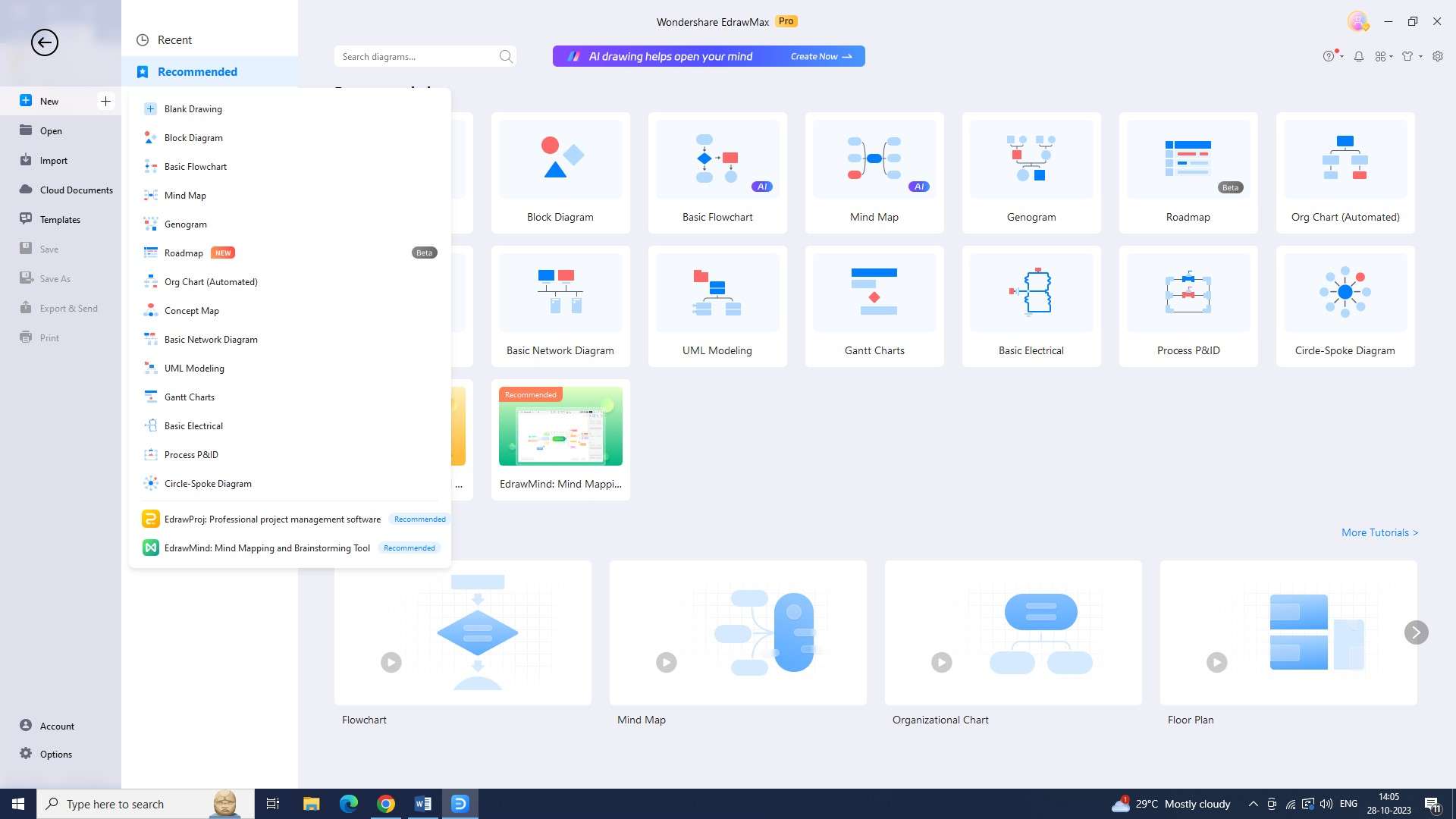

Step 1: Logging into Edrawmax is the initial step. You will be sent to the Edrawmax homepage after logging in.

Step 2: The tool now requires you to open a new document. To open a new document, click the "+" symbol next to the "New" button.

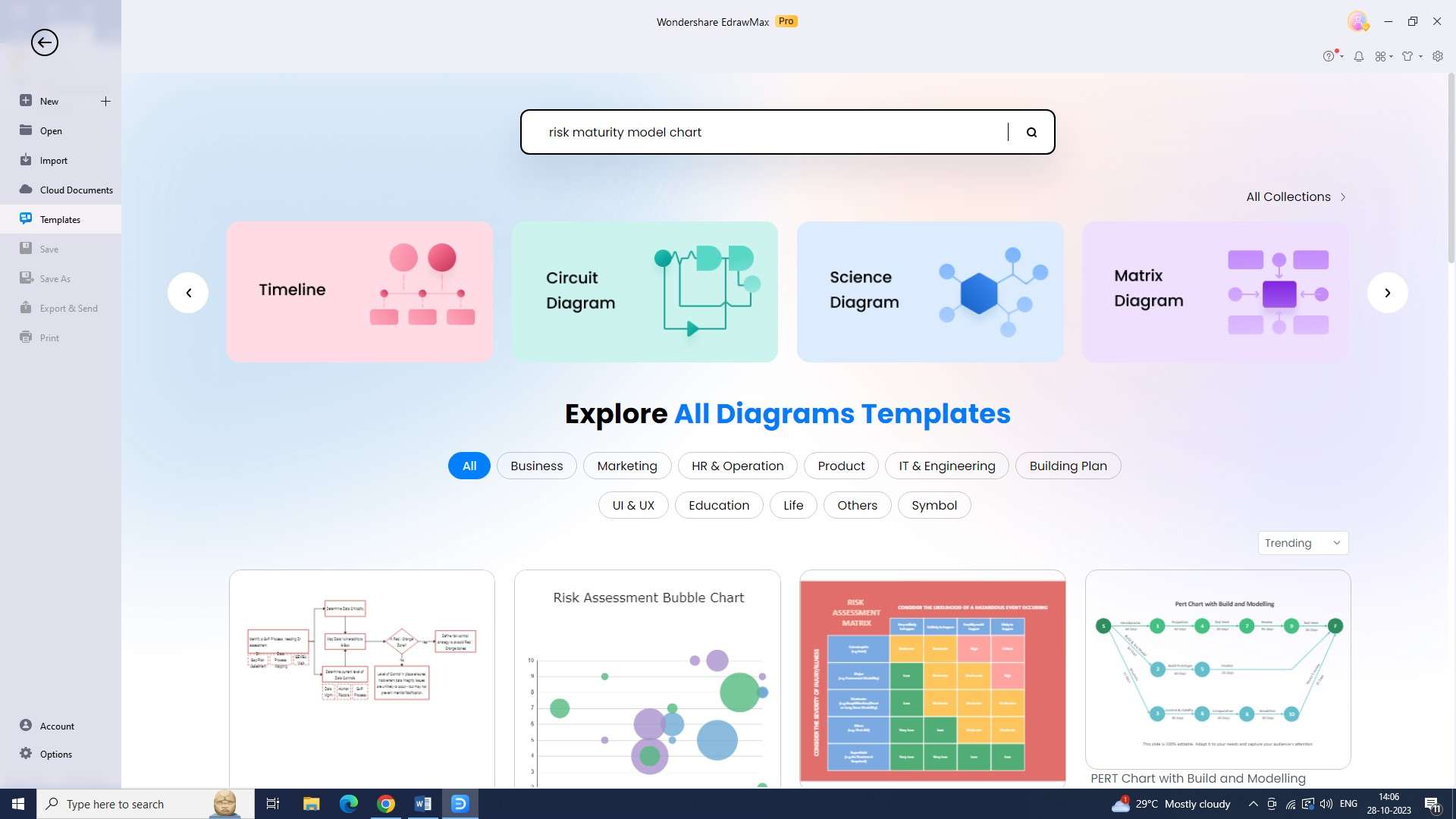

Step 3: At this point, you have to decide which template best suits your requirements. Navigate to the "Templates" section, look for a risk maturity model chart, and select a template from the list that appears.

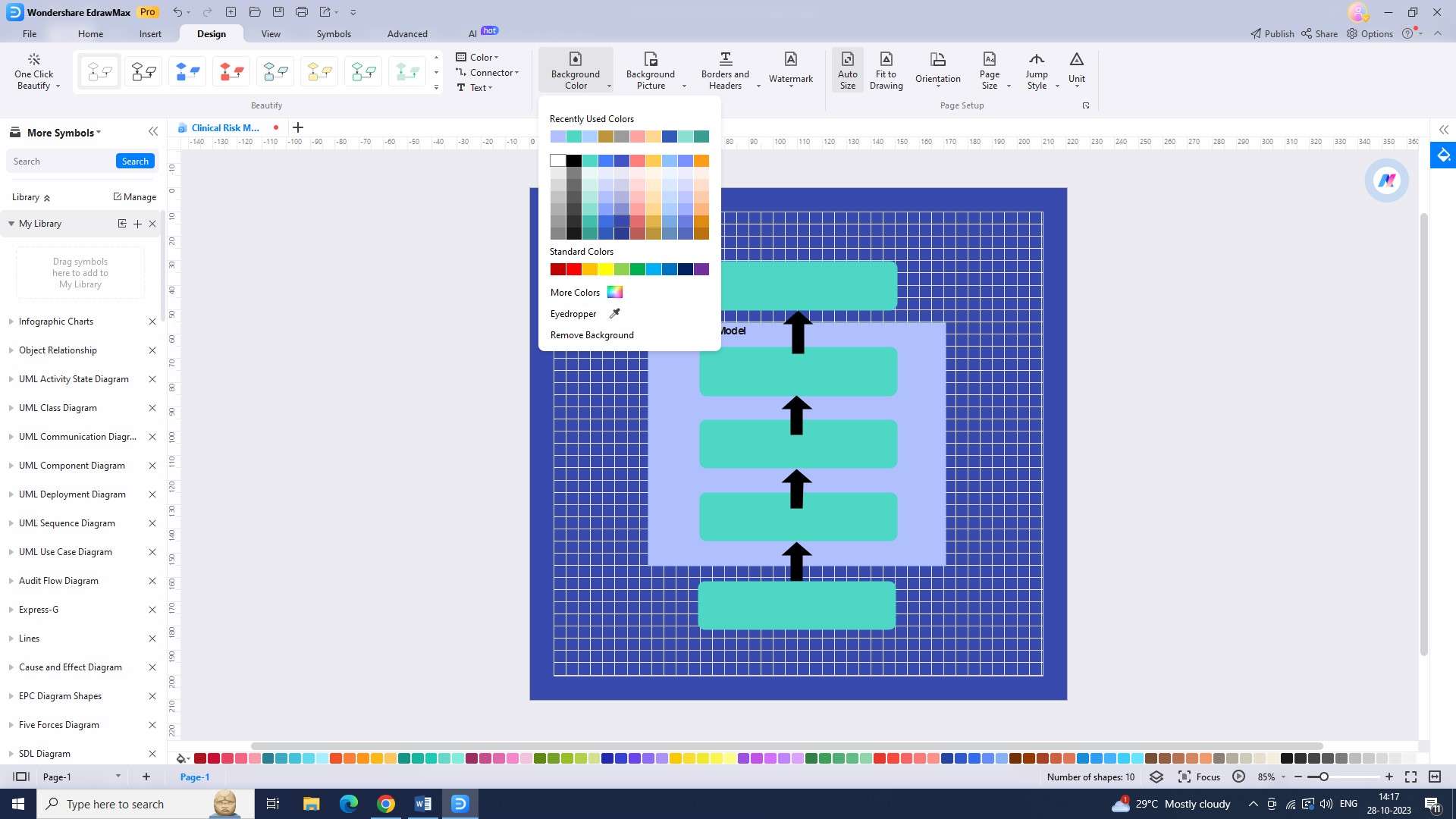

Step 4: After choosing the template, it has to be customized. To create the chart you require, you can modify the chart to suit your preferences.

Step 5: The text in the chart has to be inserted now. Fill up the chart with the relevant content for the risk maturity model framework.

Step 6: You can save the chart once you've completed making it. By selecting "File" and then "Save," you can save the chart.

Step 7: Exporting the chart is the last step. You can do this by selecting the "Export" option under "File."

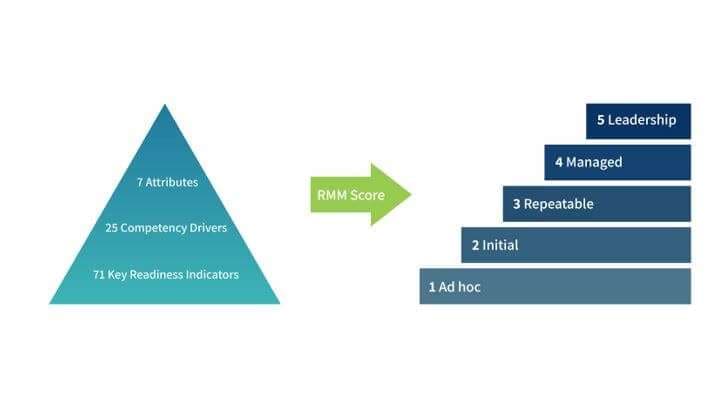

2) RIMS Risk Maturity Model

Developed by the Risk and Insurance Management Society (RIMS), the RIMS Risk Maturity Model provides a structured framework for assessing the maturity of an organization's risk management program.

Features:

- Actionable recommendations: The RIMS Risk Maturity Model provides actionable recommendations to improve risk management capabilities.

- Continuous monitoring: Allows regular monitoring of risk management maturity levels and progress tracking.

- Stakeholder engagement: Emphasizes stakeholder engagement for a comprehensive evaluation.

Pros:

- Global applicability: Designed to be globally applicable, considering regulations, cultural differences, and industry-specific requirements.

- Executive-level insights: Provides insights for informed decision-making and resource allocation.

- Industry-specific benchmarks: Offers benchmarks for comparing risk management maturity against similar companies.

Cons:

- Resource-intensive: Requires significant time, effort, and resources, including dedicated personnel and data collection.

- Limited scalability: Scalability challenges with complex or large organizations.

3) LogicManager

LogicManager helps organizations establish a comprehensive risk management framework, ensuring that risks are identified, evaluated, and mitigated in a systematic and efficient manner.

Features:

- Advanced analytics: Offers predictive modeling and data visualization for better decision-making and risk mitigation.

- Regulatory compliance support: Provides built-in compliance frameworks and guidance.

- Risk heat maps: Enables visual representation and prioritization of risks based on severity and impact.

Pros:

- Workflow automation: Automates risk management processes, streamlining operations.

- Integration with external data sources: Integrates with market data, financial information, and industry reports for data-driven decisions.

- Scalable reporting: Offers customizable reporting capabilities for different stakeholders.

Cons:

- Potential data security risks: Risk of data breaches or unauthorized access without proper security measures.

- Dependency on vendor support: Relies on vendor support for technical assistance and updates, making organizations vulnerable to disruptions.

Conclusion

Implementing a risk maturity model can greatly benefit organizations in their risk management practices. It allows for the evaluation of current practices and provides a roadmap for improvement.