The reliance on external parties to facilitate various operations has grown exponentially. However, this dependence also introduces inherent risks that can have significant implications for organizations. In this article, we will explore the multifaceted concept of third party vendor risk management, its relevance to businesses, and more.

Third party vendor risk management can be understood as the process through which organizations identify, assess, and mitigate potential risks that arise from their interactions with external entities. Such entities, commonly called vendors or third parties, provide goods, services, or access to critical resources essential for business operations.

In this article

Part 1. Types of Third-Party Vendor Risks

Understanding the importance of third party vendor risk management is crucial for organizations of all sizes and sectors. Engaging with vendors magnifies the scope of potential risks as organizations extend their networks beyond their internal control mechanisms.

Third party vendor risk comes in various types. Managing these risks systematically should be given high priority by organizations.

- Cybersecurity Risk:Cybersecurity risk involves the threat of unauthorized access, data breaches, or disruptions to digital systems and sensitive information.

- Operational Risk:Operational risks stem from inadequate processes, system failures, personnel errors, or insufficient disaster recovery plans within vendors' operations.

- Legal, Regulatory, and Compliance Risk:Failure to comply with applicable laws or regulations can lead to legal disputes, financial penalties, reputational damage, or even the termination of business operations.

- Financial Risk:Financial risk pertains to the possibility of economic losses or instability arising from vendor relationships.

Part 2. How Can Businesses Monitor and Manage Vendor Risk?

Monitoring and managing third-party risks is essential for businesses. To effectively monitor and manage third-party risks, businesses should employ a comprehensive approach utilizing various strategies.

- Risk Assessments and Security Questionnaires: Conducting security questionnaires enables organizations to evaluate vendors' security measures, information handling protocols, and compliance with industry standards.

- Due Diligence:Performing due diligence involves thoroughly investigating potential vendors to gain a comprehensive understanding of their organizational structure, operational practices, financial stability, and past performance.

- Continuous Monitoring:Continuous monitoring allows organizations to proactively identify any changes in vendors' operations or risk profiles.

Part 3. How to Conduct a Third-Party Risk Assessment?

Conducting a third party vendor risk assessment calls for a systematic approach. Following a step-by-step procedure is important for this.

Step 1: Understand Your Vendor Risks

Begin by identifying the inherent risks associated with each vendor and how they align with your organization's risk appetite and business objectives.

Step 2: Determine Risk Criteria

Establish risk evaluation criteria that align with your organization's strategic priorities, regulatory requirements, and industry best practices. This criterion will aid in scoring vendors' risk levels consistently.

Step 3: Evaluate Every Good and Service

Evaluate each good or service provided by vendors to determine the associated risks and potential impact on your business operations.

Step 4: Consult with Professionals

Engaging professionals well-versed in third party vendor risk management, such as legal advisors, cybersecurity experts, and auditors, can provide valuable insights and guidance throughout the assessment process.

Step 5: Evaluate Each Vendor

Apply the established risk evaluation criteria to assess vendors individually and rank them according to their risk levels.

Step 6: Organize Vendors by Risk Level

Categorize vendors into risk tiers based on their assessed risk levels. This helps prioritize risk mitigation efforts and allocate resources accordingly.

Part 4. Create a Risk Management Plan with Wondershare EdrawMax

Utilize Wondershare EdrawMax to develop a comprehensive risk management plan. With the help of the intuitive and easy-to-use tool, you can quickly create an effective risk management plan that meets all your needs. Given below are the steps to create a third party vendor risk management plan using the tool:

Step 1: To begin, you must first sign in to Wondershare EdrawMax. Use your email address and password in order to log in.

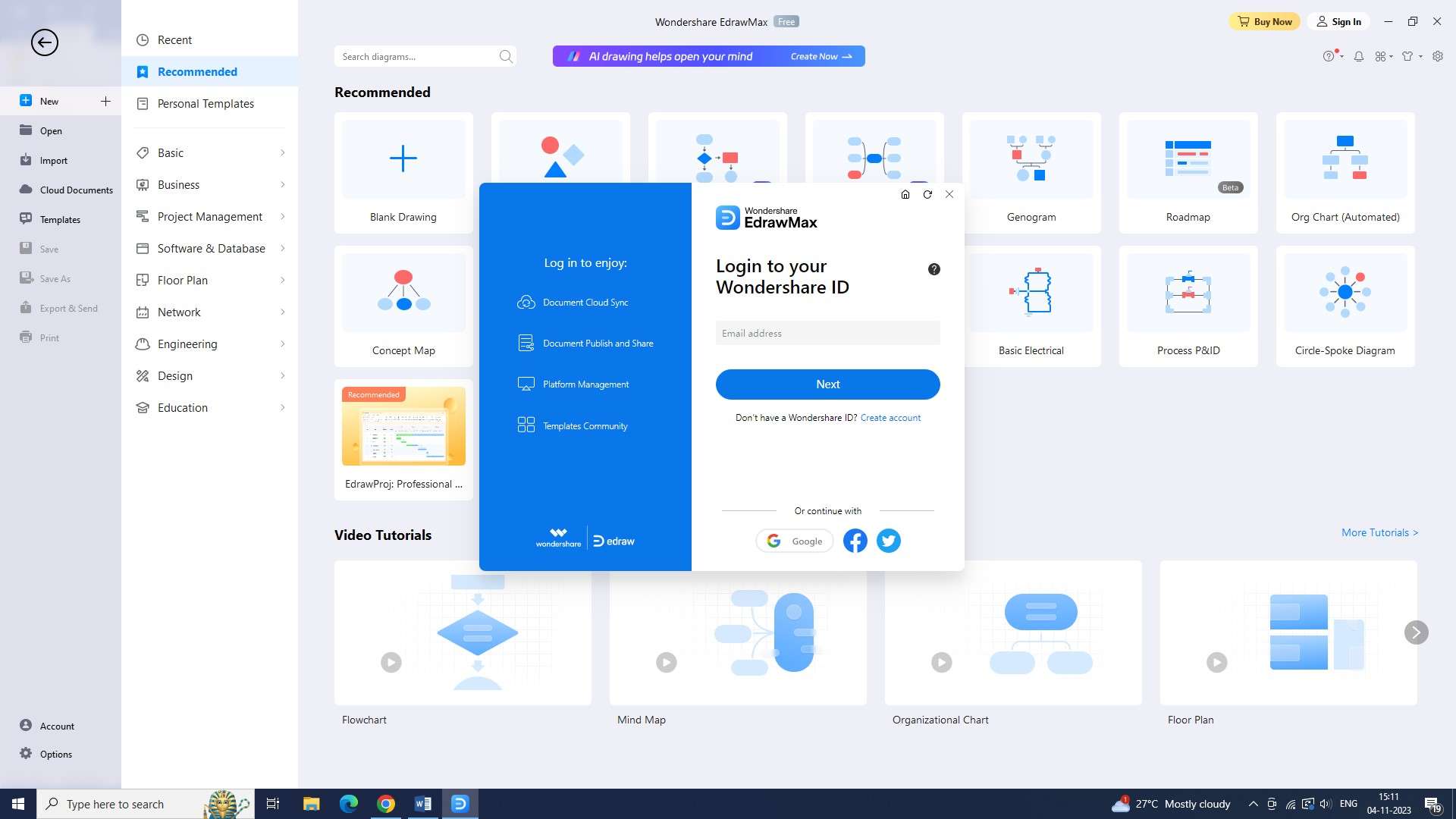

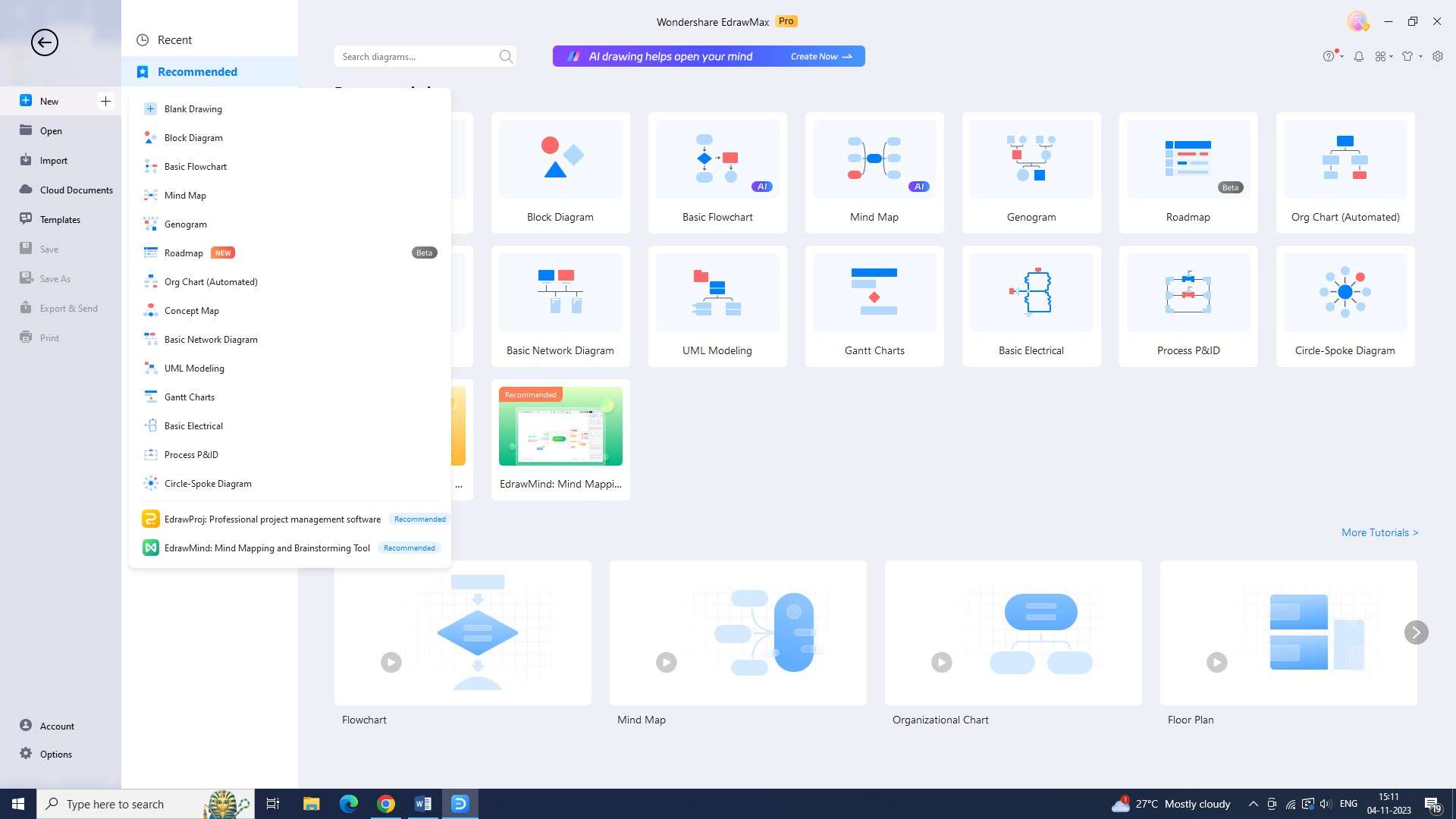

Step 2: The next step is to open a new document. After signing in, you will be able to open a new document by clicking on the “+” sign next to the “New” option.

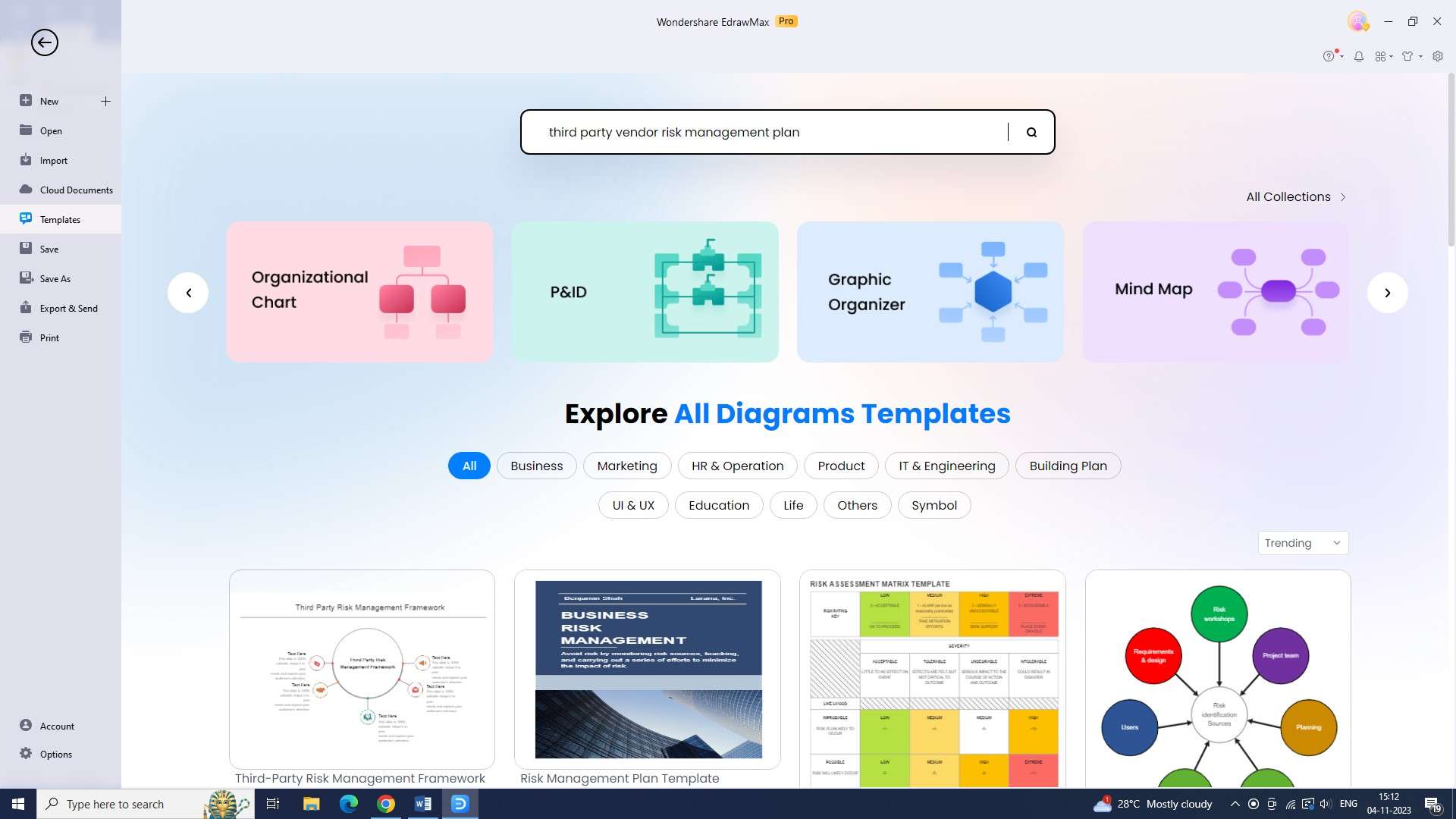

Step 3: Now search for an appropriate template for creating your third party vendor risk management plan in the “Templates” section.

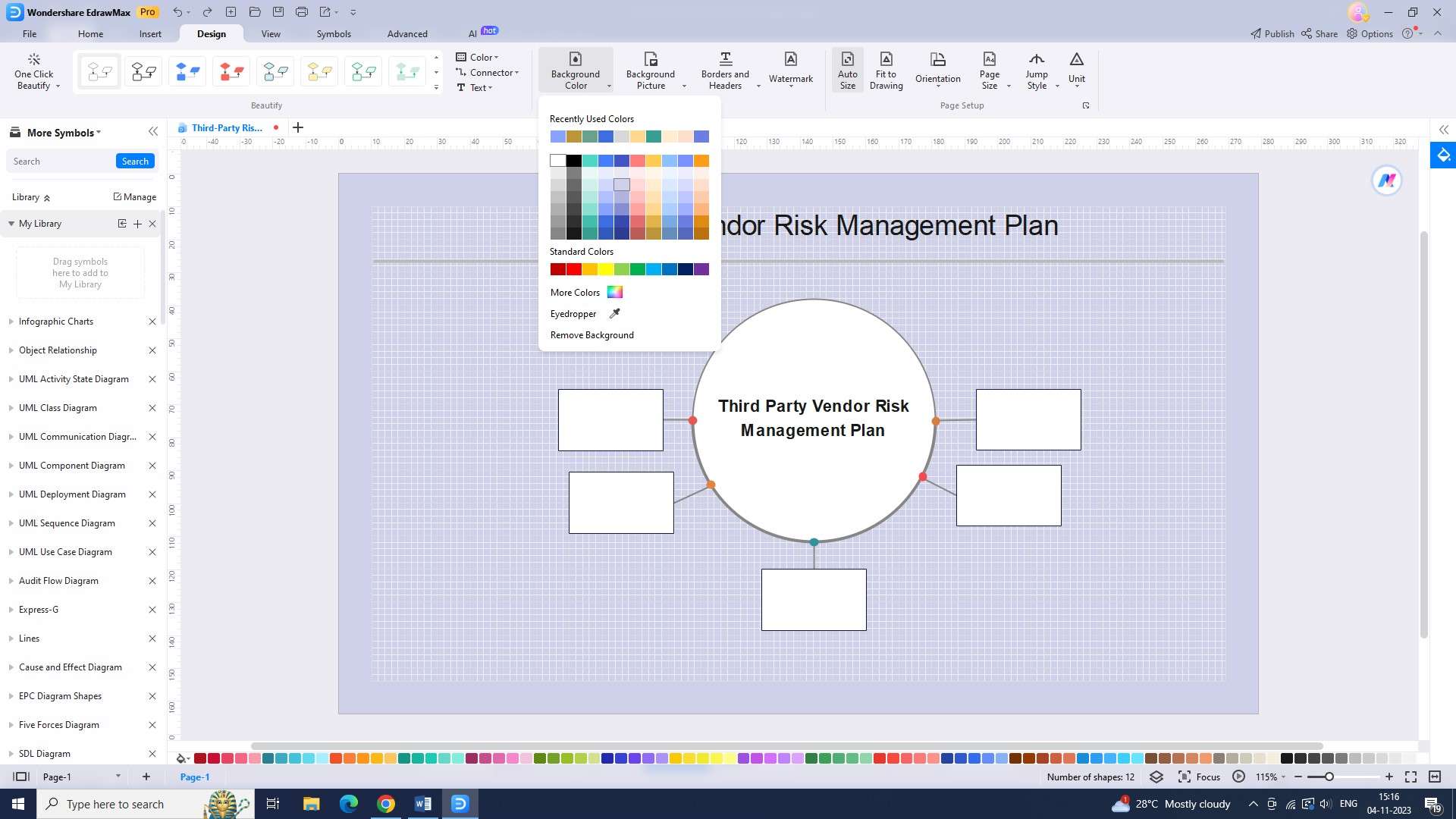

Step 4: After selecting the template, you can customize the chart. You can choose from colors, symbols, lines, arrows, shapes, etc., to modify the chart according to your requirements.

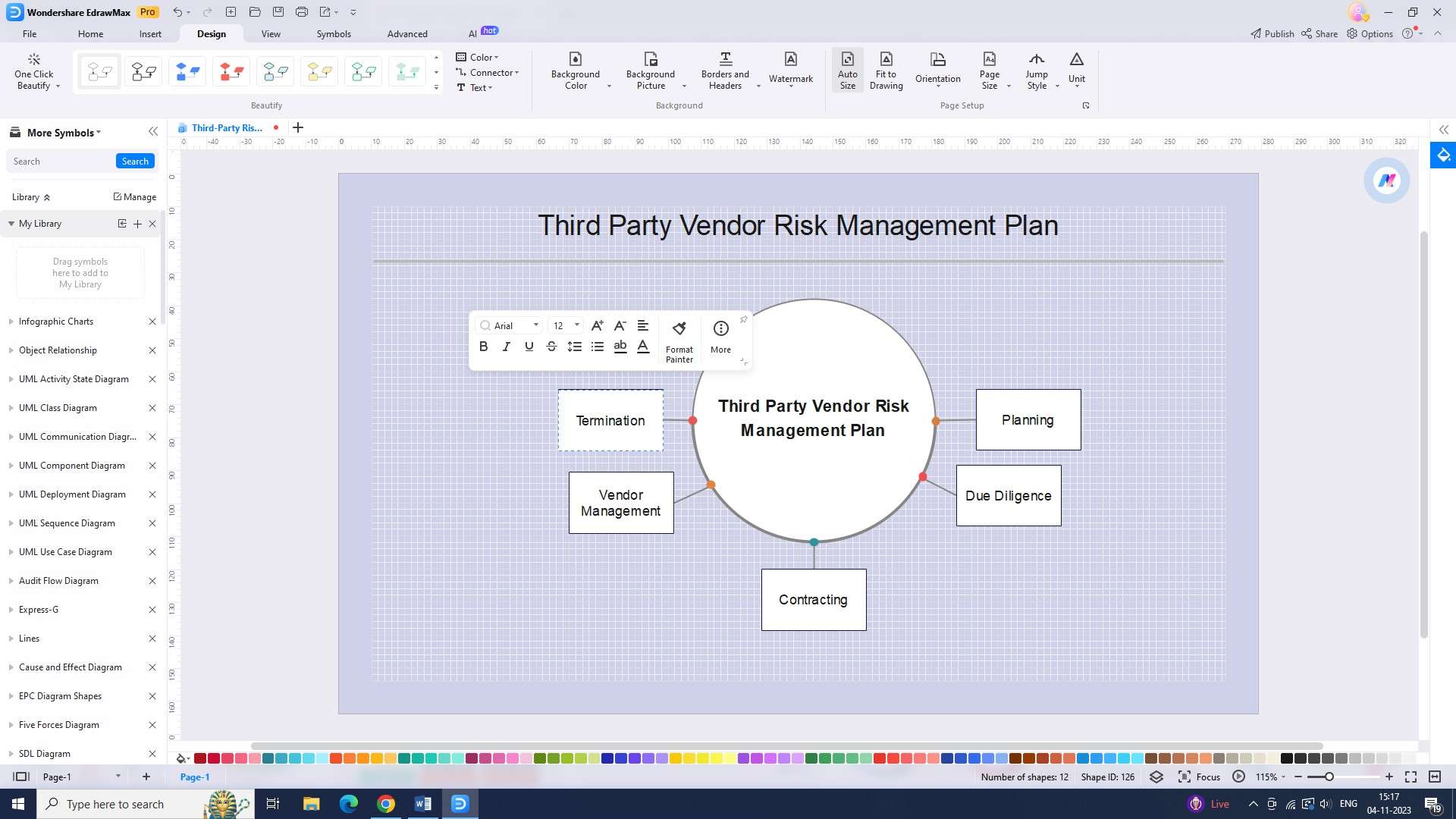

Step 5: Next, you can add text to the chart. This is especially useful if you want to give a detailed description of each risk and the associated resolution plans.

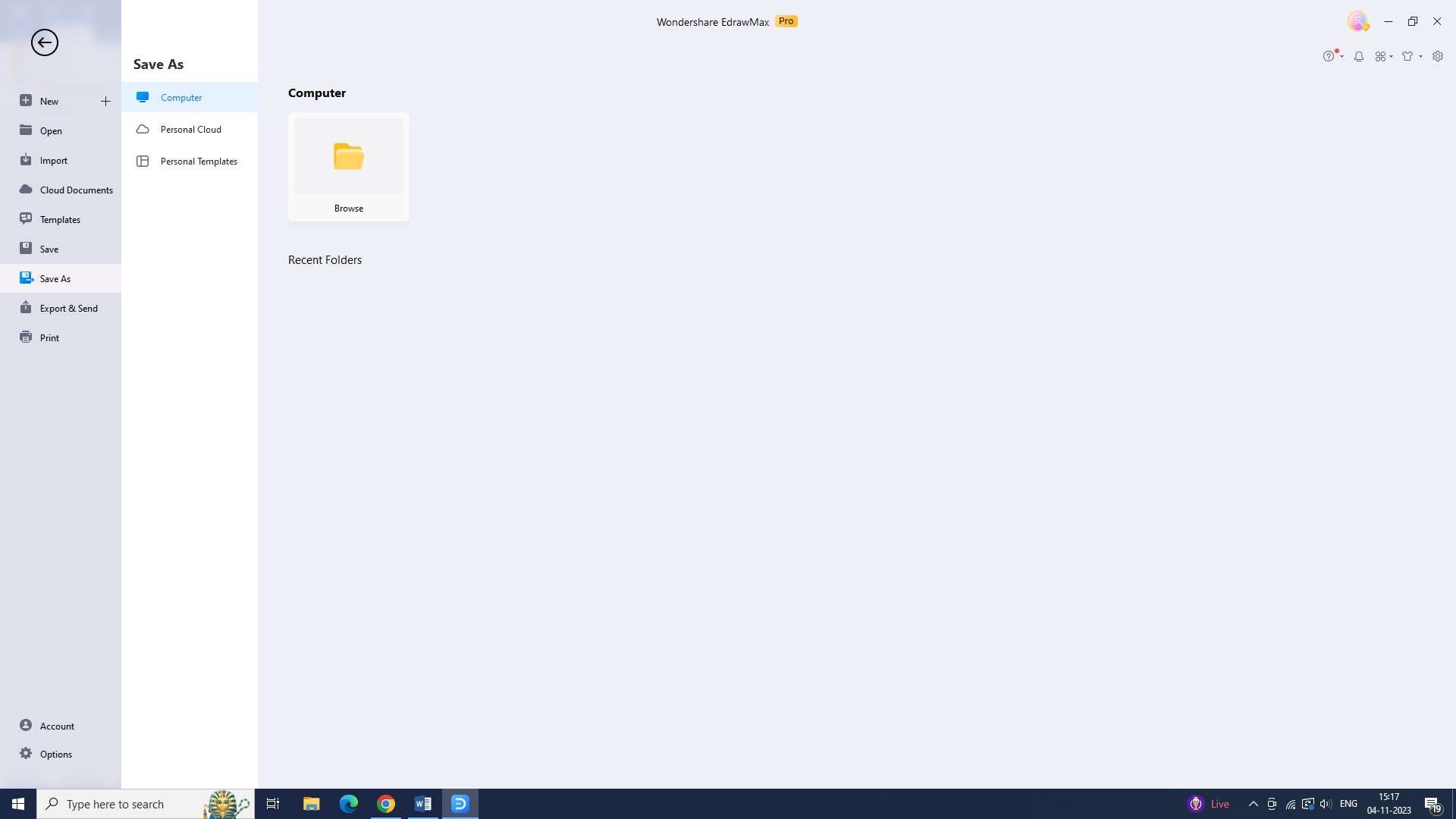

Step 6: The next step is to save the chart. To do this, click the ‘Save’ button after going to “File” and select a location on your computer to save the chart.

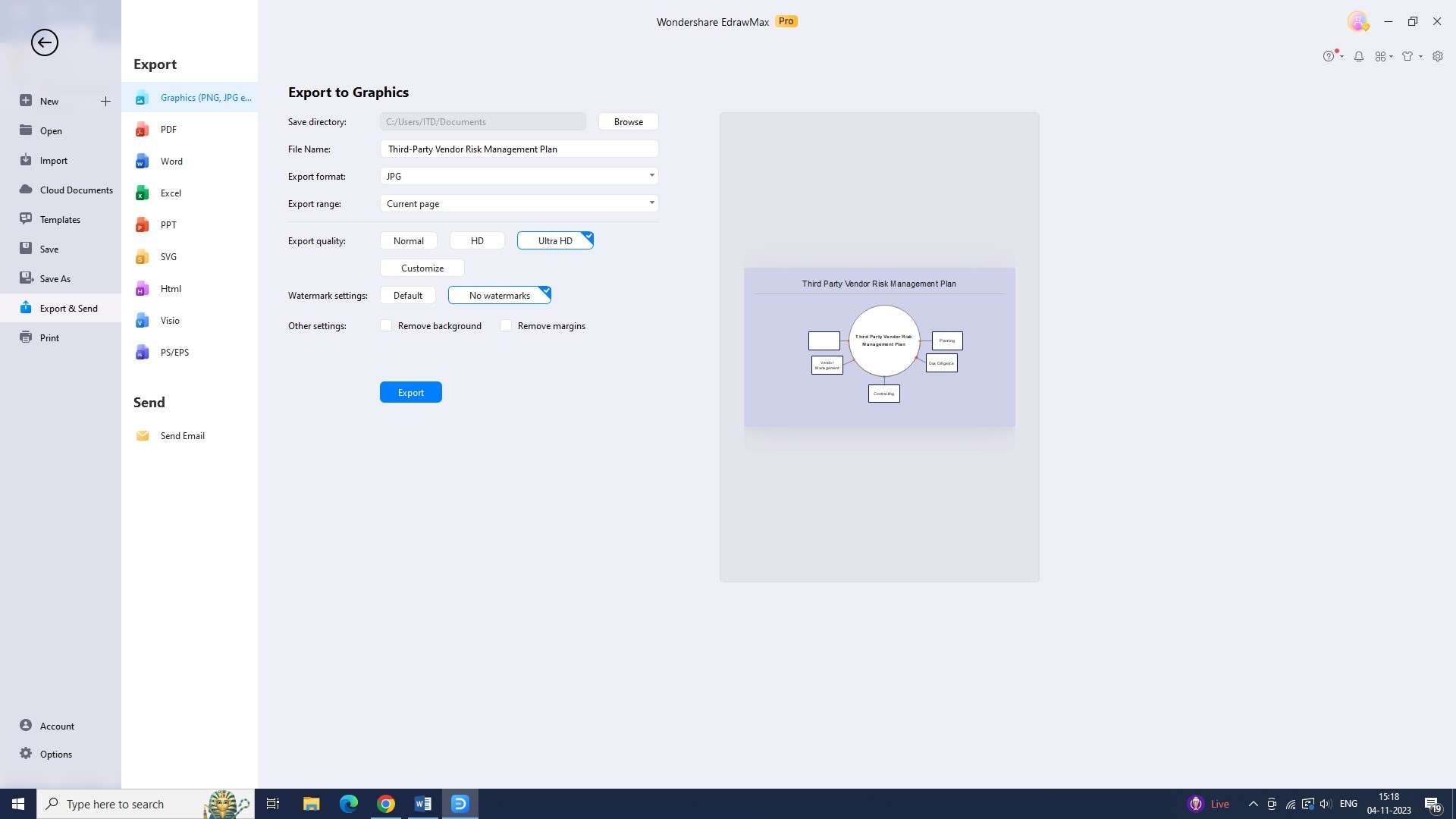

Step 7: The final step is to export the chart. Once you have saved the chart, you can export it to various formats, including PDF, PNG, and JPG.

Stay updated with evolving legal and regulatory frameworks to ensure ongoing compliance and adapt risk management approaches accordingly.

Regularly reassess vendor risks and update risk management plans at least annually to account for any changes in the vendor landscape, security threats, or regulatory requirements.

Final Thought

Efficient third party vendor risk management is a critical component of organizational resilience in today's interconnected business environment. With a well-rounded approach to third-party risk management, organizations can safeguard their operations, reputation, and long-term sustainability.