Maintaining a strong reputation is crucial for organizations. Reputational risk, the potential harm to an organization's image and credibility, can arise from various sources such as ethical misconduct, product failures, cybersecurity breaches, and negative social impact. Understanding and effectively managing reputational risk is essential for organizations to protect their brand, maintain stakeholder trust, and ensure long-term success.

In this article

Part 1. What Is Reputational Risk?

Reputational risk refers to the potential harm an organization may suffer to its reputation or brand image as a result of negative stakeholder perceptions or actions. It encompasses the risks associated with public opinion, media coverage, social media, legal issues, ethical lapses, corporate scandals, and other factors that can tarnish an organization's image, credibility, and trustworthiness.

It is crucial to understand that this kind of risk extends beyond financial implications, as it can have long-lasting and far-reaching consequences that affect stakeholder perceptions, employee morale, customer loyalty, and investor confidence.

Part 2. Common Causes of Reputational Risk

The types of reputational risk can stem from various sources, each posing a unique challenge to organizations. These causes can affect the reputation of organizations severely. For this reasons organizations should ensure that necessary steps are taken to avoid these common causes.

1. Ethical misconduct and scandals: Unethical practices, fraud, or misconduct can damage reputation. Strong ethics, governance, and transparency are crucial.

2. Product or service failures: Failure to deliver or defects harm reputation. Quality control, customer feedback, and recall procedures are vital.

3. Cybersecurity breaches: Data breaches and cyber-attacks erode trust. Robust cybersecurity measures, training, and incident response plans are essential.

4. Negative social or environmental impact: Neglecting social responsibilities or causing harm leads to reputational backlash. Sustainable practices and positive community relationships are important.

Part 3. Impact of Reputational Risk on Organizations

The consequences of risks associated with reputation can be far-reaching and damaging to an organization's bottom line, market position, and survival. Therefore, organizations need to implement precautionary measures to guarantee efficient reputational risk management.

1. Financial implications: Negative publicity can result in decreased sales, loss of customers, reduced investor confidence, and declining share value, leading to challenging and time-consuming financial recovery.

2. Erosion of stakeholder trust: Reputational damage shakes stakeholder trust, impacting relationships with customers, investors, employees, suppliers, and regulators. Rebuilding trust and credibility requires years of concerted effort.

3. Legal and regulatory challenges: Reputational risk may lead to lawsuits, regulatory investigations, fines, and penalties, resulting in significant legal expenses and potential long-term repercussions.

4. Talent acquisition and retention issues: Organizations with damaged reputations struggle to attract and retain top talent, leading to decreased productivity, cultural challenges, and difficulties in rebuilding the organization's image.

Part4. Tips for Managing and Mitigating Reputational Risk

To effectively manage and mitigate the various types of reputational risk, organizations should consider some essential strategies. These strategies enable organizations to manage reputational risks smoothly. They also ensure that these kind of risks are alleviated easily.

1. Implement a robust risk management framework: Establish a comprehensive framework to identify, assess, and monitor potential reputational risks. Conduct regular risk assessments, monitor external narratives, and address concerns promptly.

2. Foster a culture of ethics and transparency: Prioritize strong ethical values, integrity, and transparency. Implement codes of conduct, ethics training, and whistleblower mechanisms to encourage responsible behavior.

3. Develop crisis communication plans: Be prepared for reputational crises by having a well-prepared communication plan. Proactively communicate with stakeholders, provide transparent and timely updates, and show commitment to resolving the situation.

4. Engage in stakeholder relationship management: Build and maintain positive relationships with stakeholders. Actively engage with customers, employees, investors, and regulators to understand expectations, address concerns, and build trust.

Part 5. Creating a Reputational Risk flowchart with EdrawMax

Using Wondershare EdrawMax to create a reputational risk assessment flowchart can be beneficial in several ways. It allows for a visual representation of potential risks, making it easier to identify and analyze them. It also helps in developing strategies to mitigate these risks and communicate them effectively to those concerned. The steps to create such a flowchart using the tool are as follows:

Step1: Selecting an appropriate flowchart template

In Wondershare EdrawMax you will be able to find a vast range of templates for creating an effective flowchart by searching in the search bar of the tool’s “Templates” section. Select the template that is perfect for your needs.

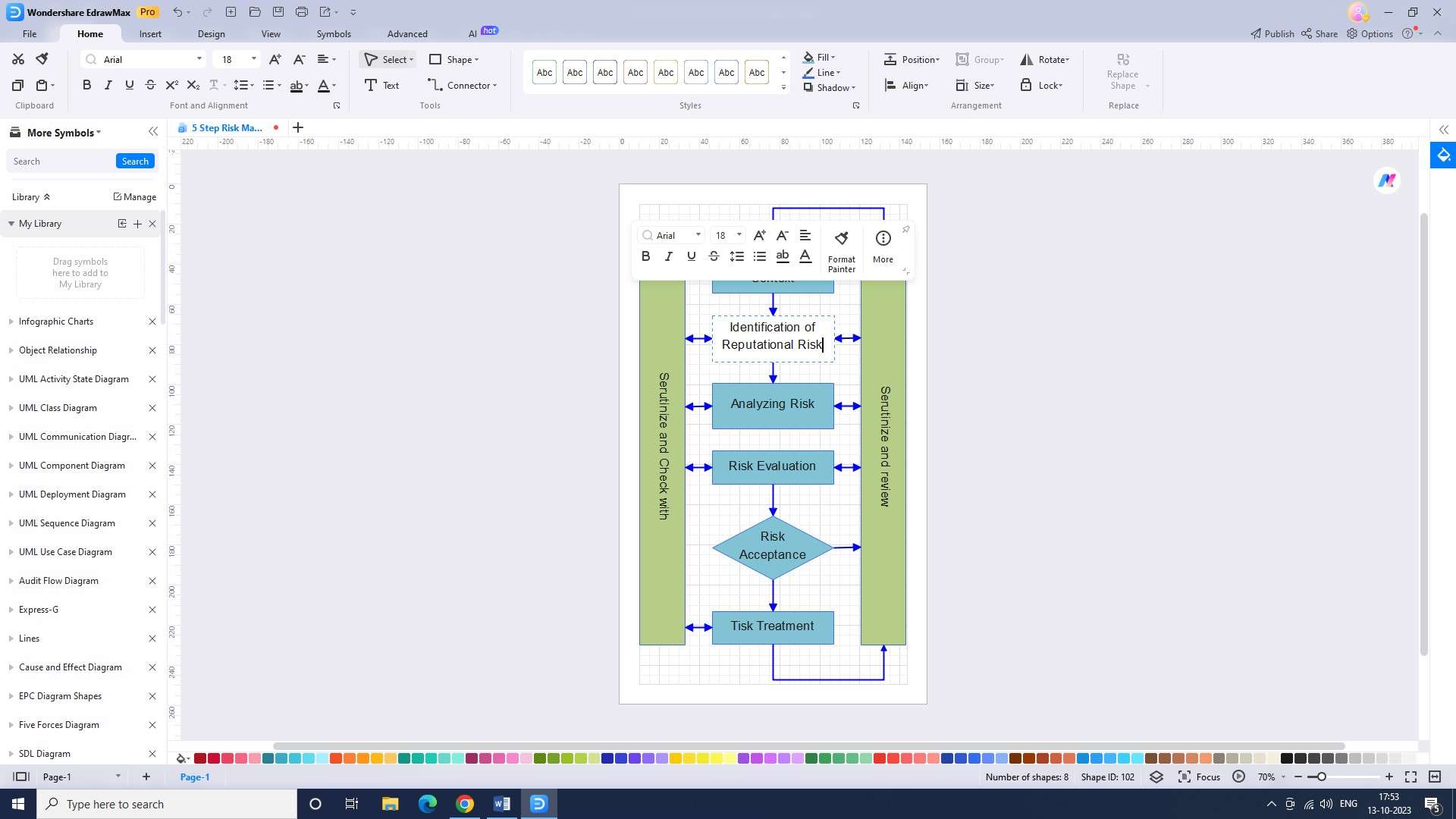

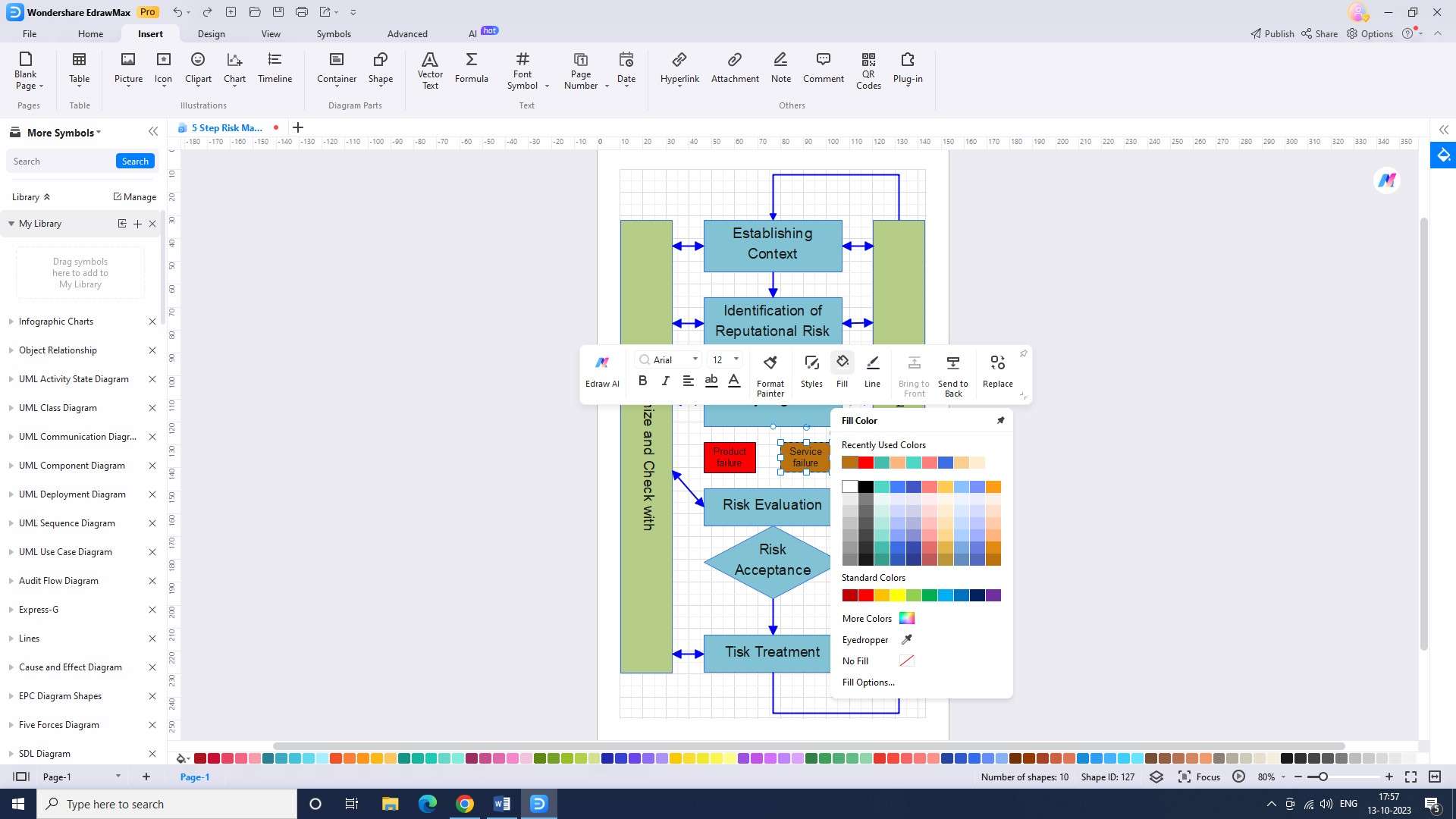

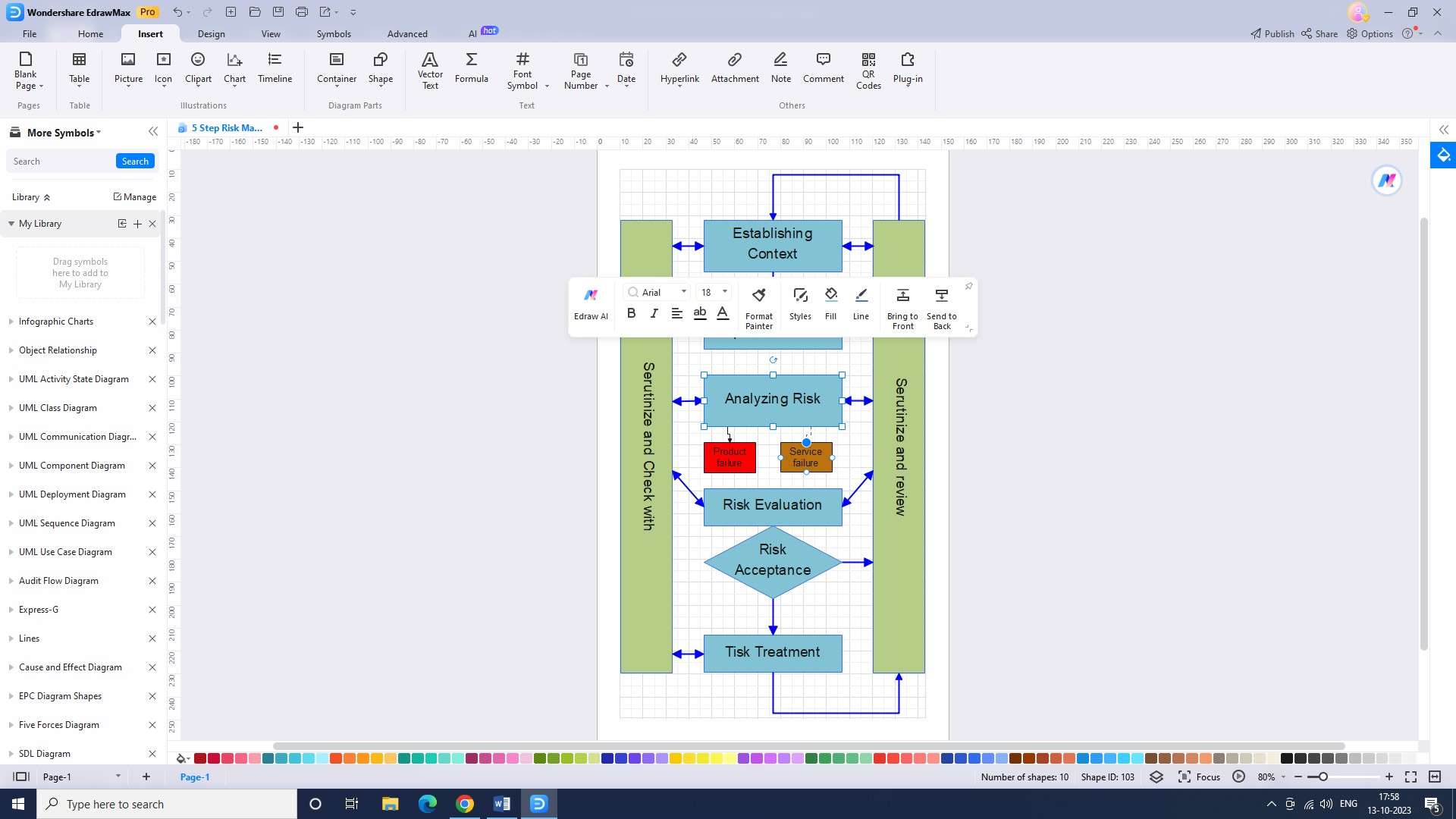

Step2: Customizing the template with text, shapes, and visuals

You can customize the template to your liking. You can do this by adding text, shapes, and other visuals.

Step3: Adding risks and potential responses to the flowchart

Now that you have your template, you can begin to create your flowchart. Start by adding in the risks that your organization may face. You can also add in the potential responses to each risk.

Step4: Creating relationships between risks and responses with arrows

Once you have all the information in place, you can add arrows pointing from the risks to the responses. This will show the relationships between the risks and the responses.

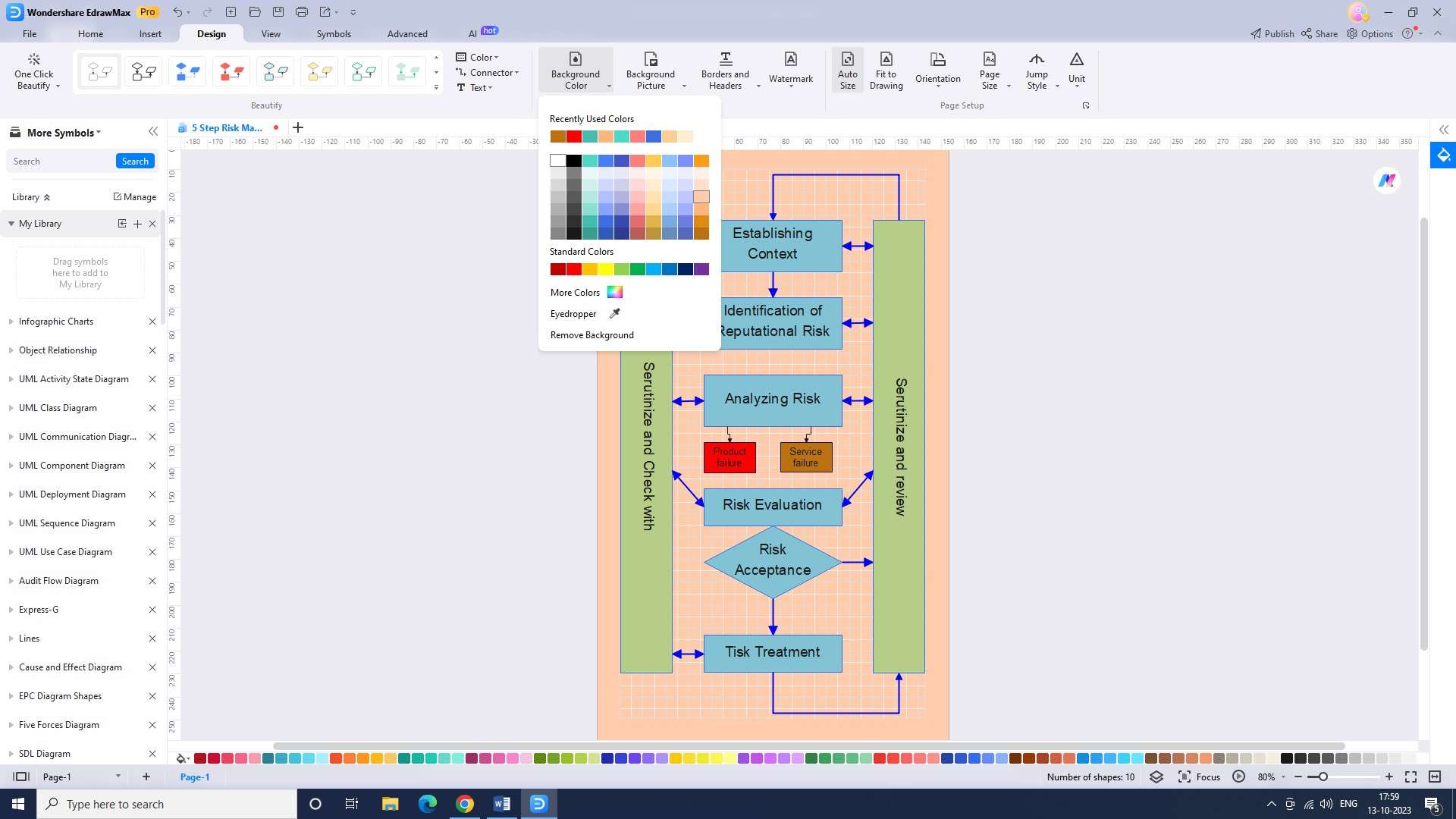

Step5: Improving the flowchart with additional information, colors, or symbols

You can now add in any additional information, such as colors or symbols, to make the flowchart more visually appealing.

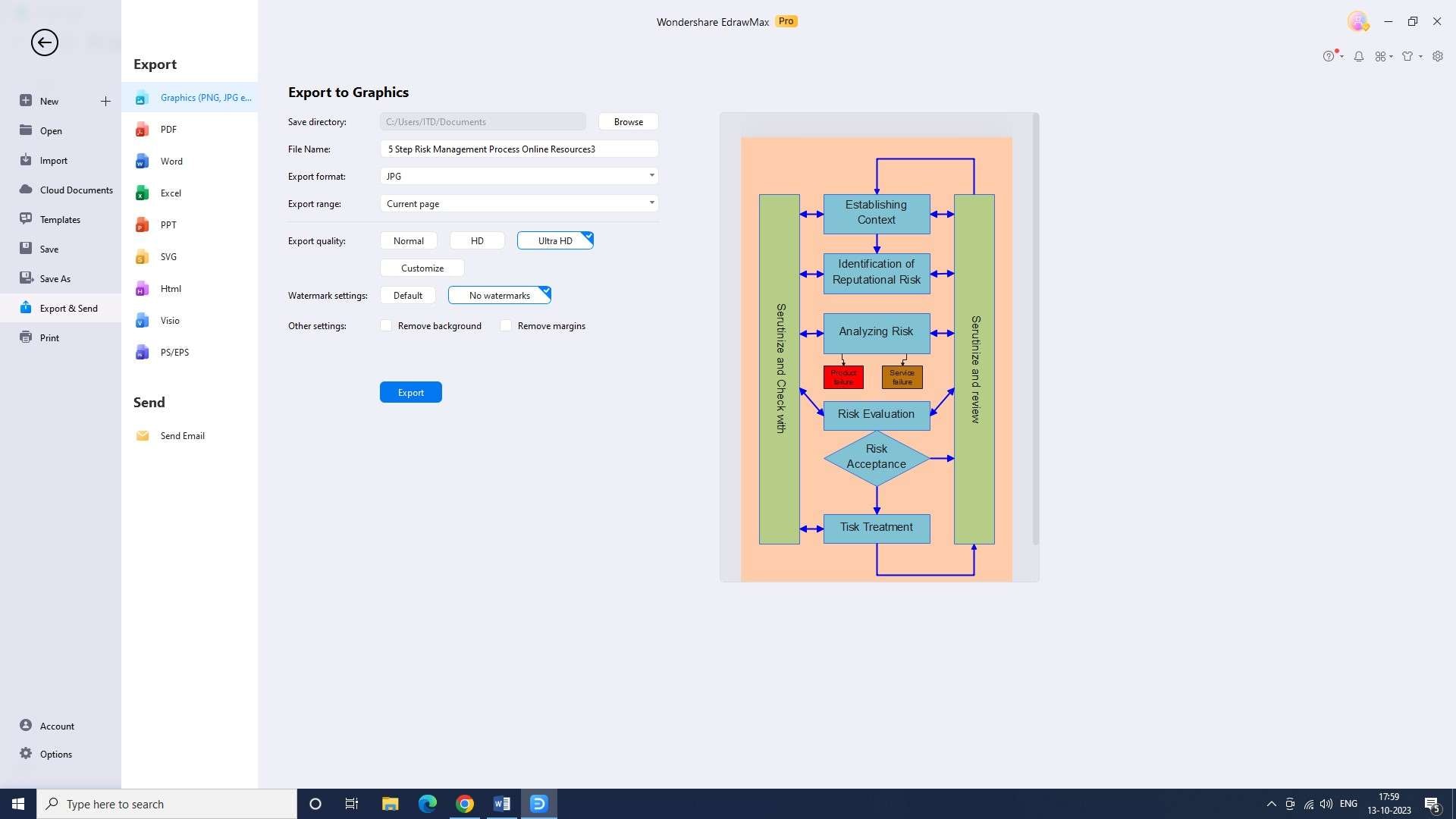

Step6: Exporting the completed flowchart

You can quickly export your reputational risk flowchart in a variety of formats once you've finished designing it. You only need to select "Export" from the "File" menu. You may then choose the preferred format from there.

Conclusion

Interest and exchange rate risk management plays a vital role in the financial industry by identifying, assessing, and mitigating potential risks associated with interest rate fluctuations. This overview explores the factors influencing risk rates, techniques for assessing and calculating them, and strategies for effectively managing and reducing these risks.