Accounts payable flowcharts empower companies to better their fiscal condition. Through actual portrayal, they ensure adherence to payment protocols.

In modern business, effective financial management is a cornerstone of success. The management of the accounts payable process impacts financial stability. Businesses engage in countless transactions with suppliers and vendors. Thus, efficiently handling these payable accounts becomes vital.

Accounts payable procedures flowcharts are visual tools that unveil the path of each payment. This article demystifies the concept of an accounts payable invoice processing flowchart. Also, the guide will offer keen insights into its importance, types, and key steps. Let's learn how to visualize the process of accounts payable flowchart.

In this article

Part 1. Insights Into Accounts Payable

Accounts payable (AP) is the cash amount a business owes to its suppliers and creditors. It may be payable for goods or services received on credit. The amount owed is recorded when a company buys goods on credit from vendors or suppliers. This amount is usually stored in the AP account. In simpler terms, accounts payable represent the short-term debts a company owes to other firms for purchases. These debts are expected to be settled within a specific period.

You can consider AP as a financial metric on a company's balance sheet. An increase in AP indicates that the company is in an adverse condition. It is relying on buying goods on credit rather than making cash payments. In contrast, a decrease in accounts payable means that the company is settling its prior credits. Also, it is buying new items in less amount on a credit basis.

Accounts payable can include many types of payables, such as:

- Bills

- Supplier invoices

- Employees' salaries

- Employees' wages

- Expenses

- Taxes

- Governmental payments

Part 2. What Is an Accounts Payable Flowchart?

An accounts payable flowchart is a visual portrayal of the step-by-step accounts payable process. The flow diagram shows how a company handles its AP debts. It outlines all the pivotal elements, such as invoices, documents, and payment processing. Such visuals simplify the troubles of financial payments. They also allow companies to know, analyze, and optimize their payable procedures.

Key Process in The Accounts Payable Flowchart

The specific accounts payable processes can vary depending on the company's size and internal procedures. Yet, these are common steps typically found in AP processing:

Invoice Receipt

The process begins with the receipt of an invoice. The supplier or vendor sends it for goods provided to the company on credit.

Invoice Verification

The accounts payable team verifies the accuracy of the invoice. They check if the goods or services were received, ensuring no discrepancies.

Invoice Approval

The invoice reaches the appropriate personnel or department for approval. The approval process may involve authorization based on company policies.

Recording in Accounting System

After approval, the invoice details are recorded in the company's accounting system. They are usually saved in the AP account.

Payment Terms Review

The accounts payable team reviews the payment terms mentioned on the invoice. For example, they analyze the price, due date, and available discounts. The team then prepares the purchase order.

Payment Processing

The AP team initiates the payment process. It may involve preparing checks or utilizing other payment methods. The approved payment is sent to the vendor within the time frame.

Advantages of Using Accounts Payable Flowchart

Process Visualization

The accounts payable cycle flowchart shows the entire AP lifecycle. This visual depiction helps members grasp the flow of tasks in managing accounts payable. Thus, they help avoid confusion and ensure everyone involved understands the process clearly.

Process Visualization

The accounts payable cycle flowchart shows the entire AP lifecycle. This visual depiction helps members grasp the flow of tasks in managing accounts payable. Thus, they help avoid confusion and ensure everyone involved understands the process clearly.

Transparency and Accountability

With a well-defined AP process flow chart, accountability becomes evident. It is because each step of the AP process is clear-cut. Employees responsible for specific tasks can be easily identified. You can promote a sense of responsibility using this approach. This transparency ensures that all involved parties understand their roles. This strategy reduces error chances or missed deadlines.

Internal Controls

The accounts payable flow chart process allows internal controls. They ensure compliance with company policies. These controls help prevent fraudulent activities, unauthorized payments, or deviations from approved procedures. Also, the flow chart for the accounts payable process acts as a reference for auditors to verify the proper controls.

Employee Training

Accounts payable flow charts provide a structured overview of the entire payment process. They make it easier for new hires to understand their roles and responsibilities. This strategy shortens the learning curve. It also ensures consistency in the payment handling process.

Supplier Relationship Improvement

The invoice processing accounts payable process flow charts foster timely supplier payments. On-time payments help build positive bonds with suppliers. Such courtesy also leads to better credit terms and discounts.

Bottleneck Removal

Analyzing the accounts payable cycle flowchart allows you to find bottlenecks in the AP process. They can pinpoint areas where delays occur. Also, companies can apply process improvements to enhance efficiency.

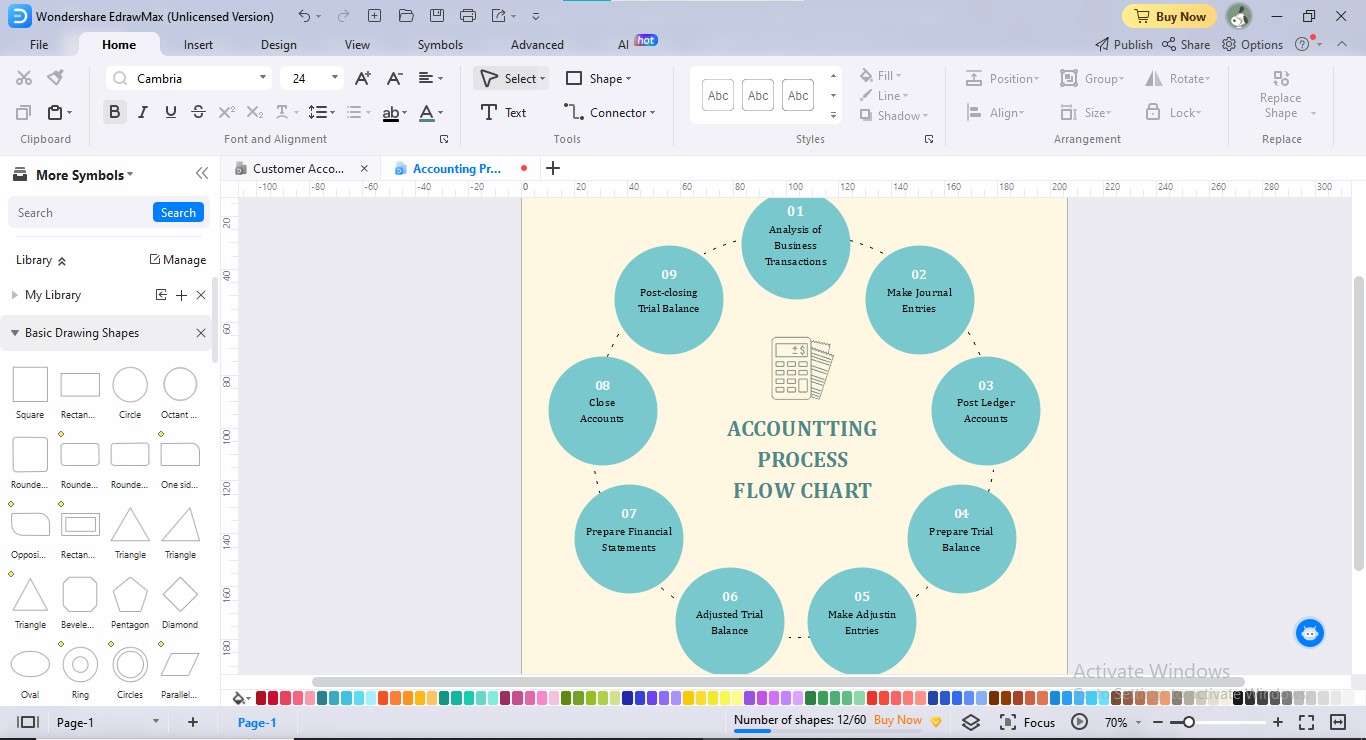

Part 3. Design Your Accounts Payable Flowchart With EdrawMax!

With increasing payable debts, payment processing becomes a labyrinthine challenge. But fear not! EdrawMax comes to the rescue. The tool unfolds a world of possibilities to help you easily overcome these hurdles.

This flowchart tool boasts great options to ease your account payable flowchart creation. You can enjoy its vast array of templates to represent each step easily.

Also, the tool makes flowchart creation effortless by providing a drag-and-drop feature. The tool's symbols library is endless and all-inclusive. Built-in themes, colors, and multimedia import are some other noticeable features of EdrawMax.

How to Create an Accounts Payable Flowchart Using EdrawMax?

Want to breathe new life into your old-school AP cycle? EdrawMax is your go-to solution if you're looking to show your AP processes. Here is how to transform your intricate process into a polished diagram:

Step1

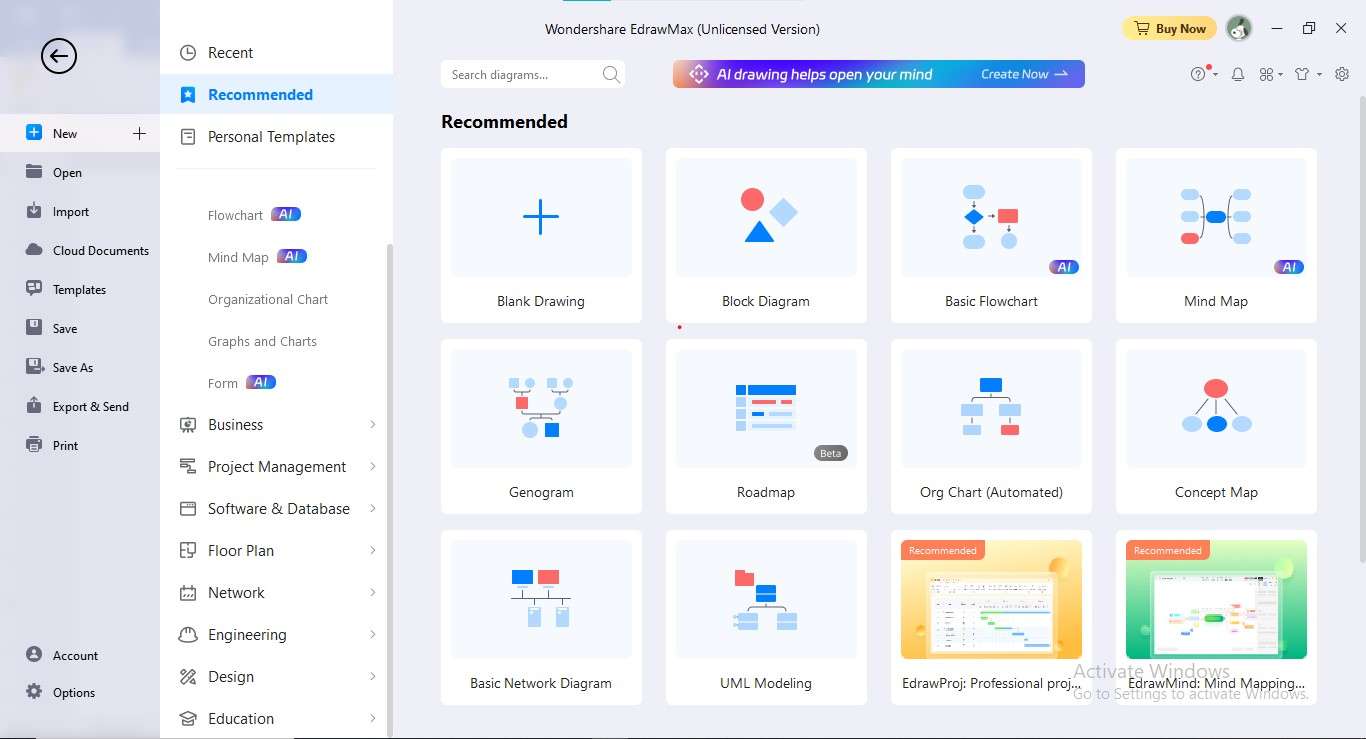

Download the "EdrawMax" application or access its online version. Sign up to create your AP process flowchart.

Step2

Go to the "New" option in the left panel. Choose the "Blank Drawing" or "Basic Flowchart" tab.

Step3

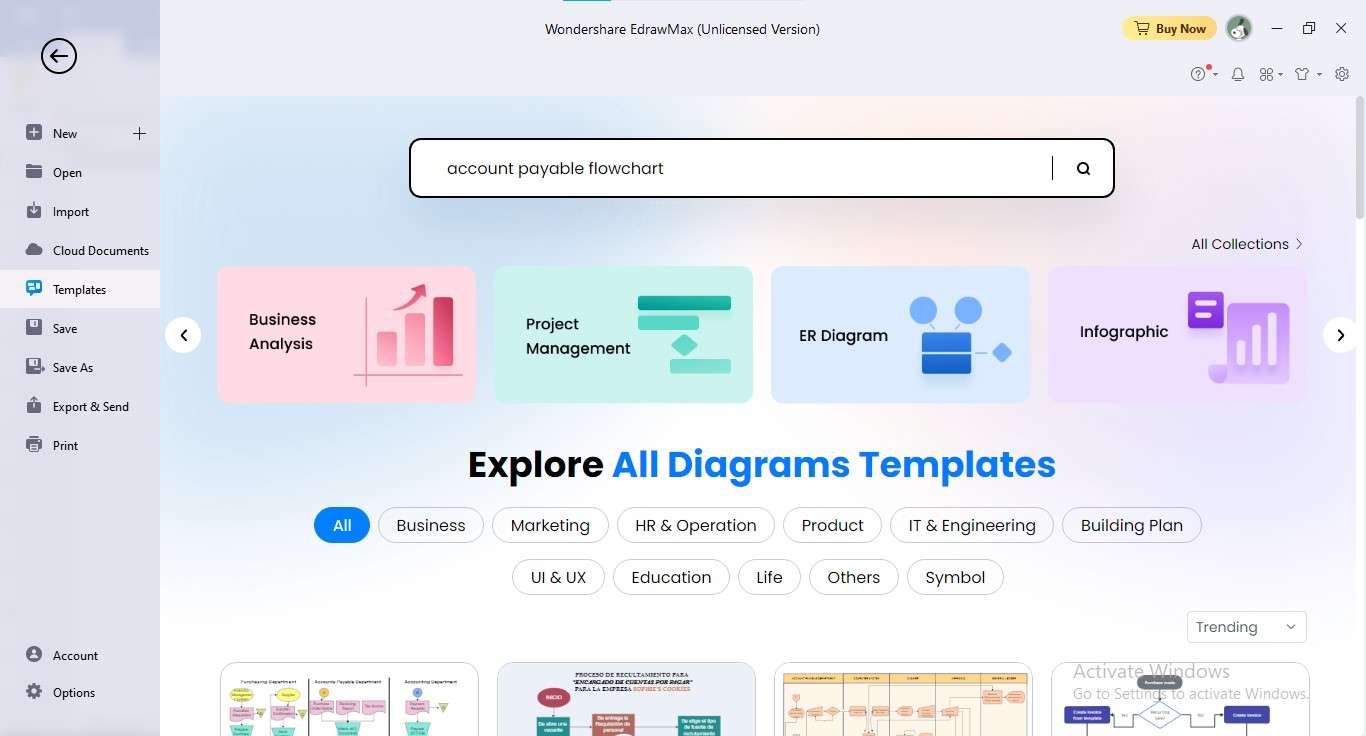

To proceed with a template, click the "Templates" option. Type "Account Payable Flowchart" in the search bar. Choose your preferred flowchart template.

Step4

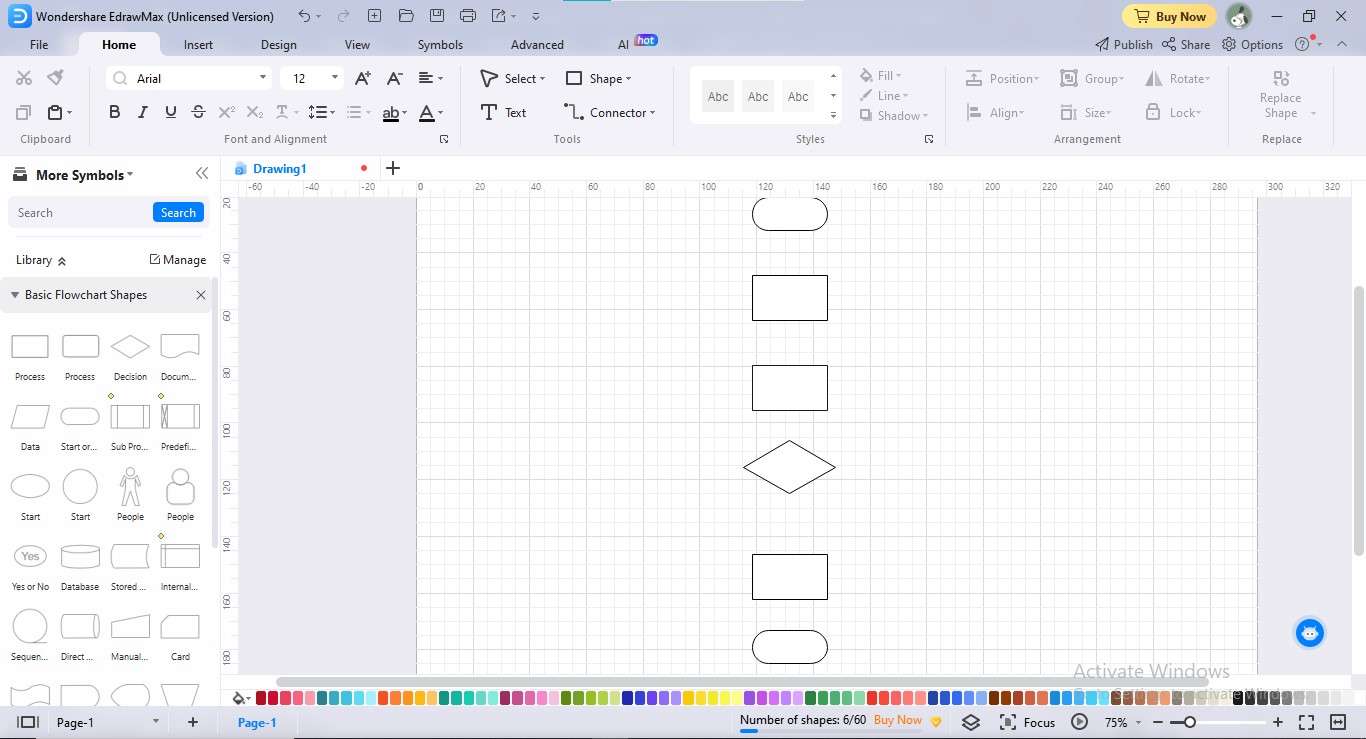

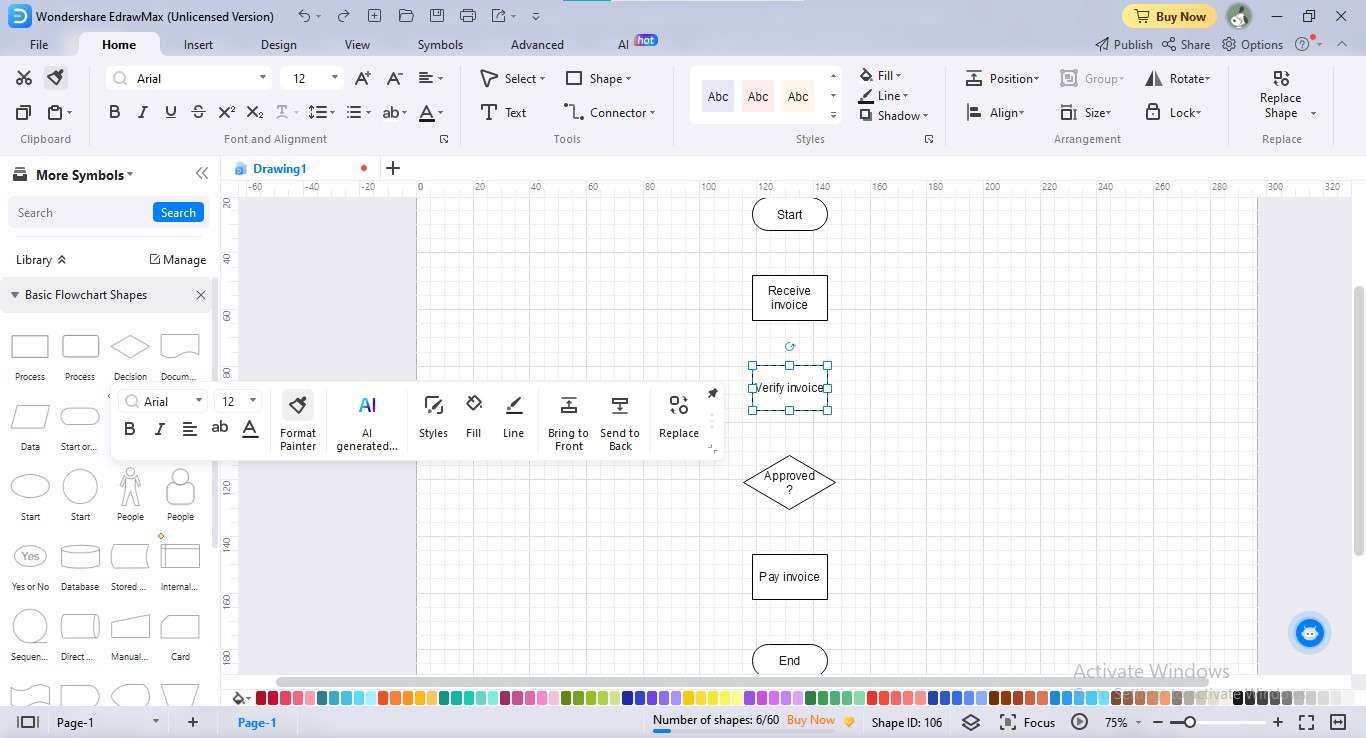

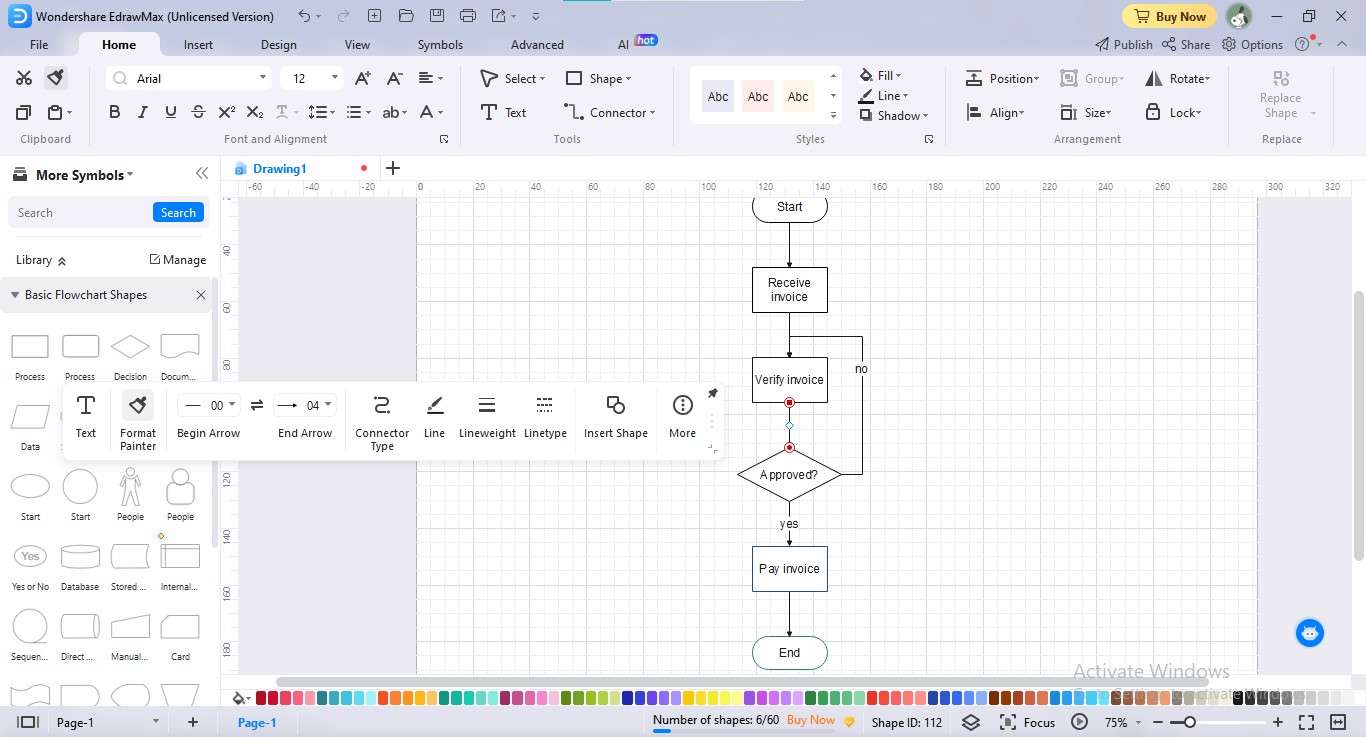

Sketch all the required shapes on the canvas. You can drag and drop the symbols from the Symbols Library on the left.

Step5

Enter relevant text in each shape. For this, double-click the shape and edit your data.

Step6

Join all the shapes by drawing connectors. Go to the "Connector" option under the "Home" menu for connectors.

Step7

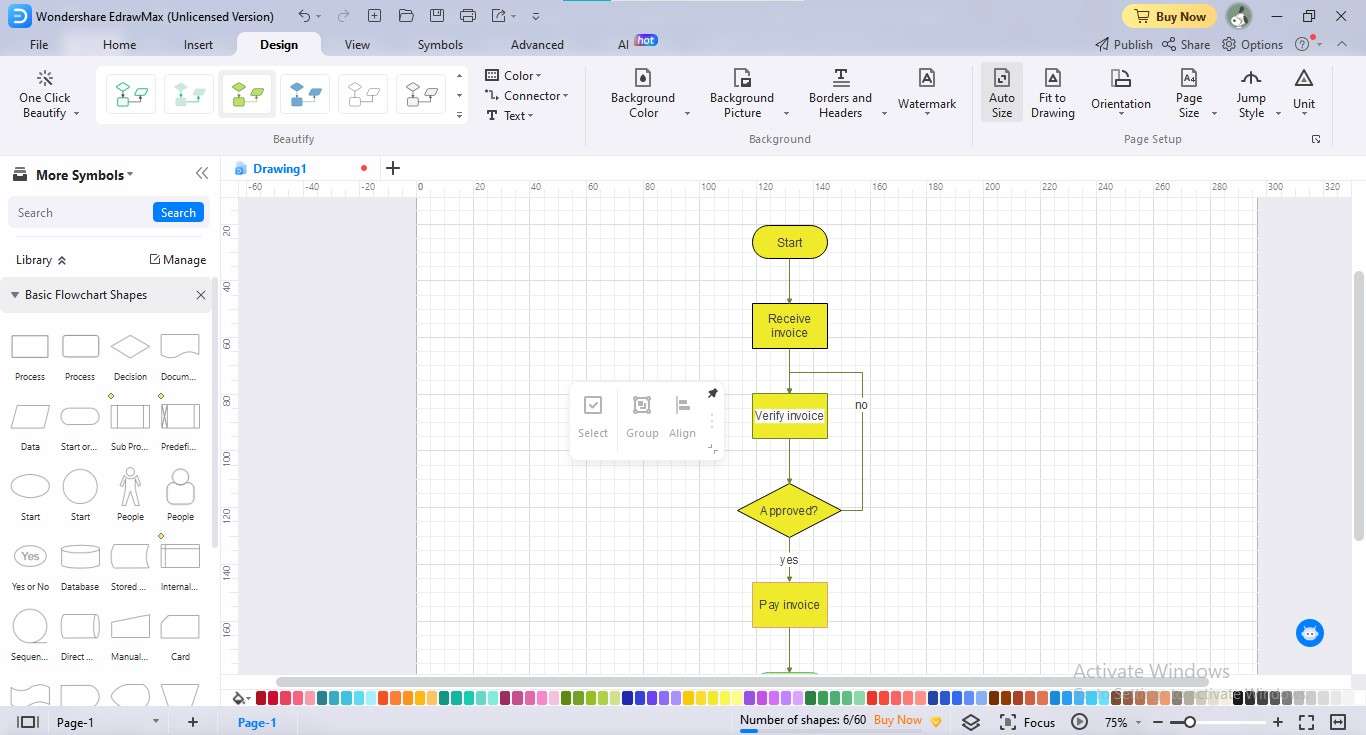

Tailor your flowchart's outlook by applying your desired theme. For this, go to the "Design" menu. Do your favorite manual edits.

Step8

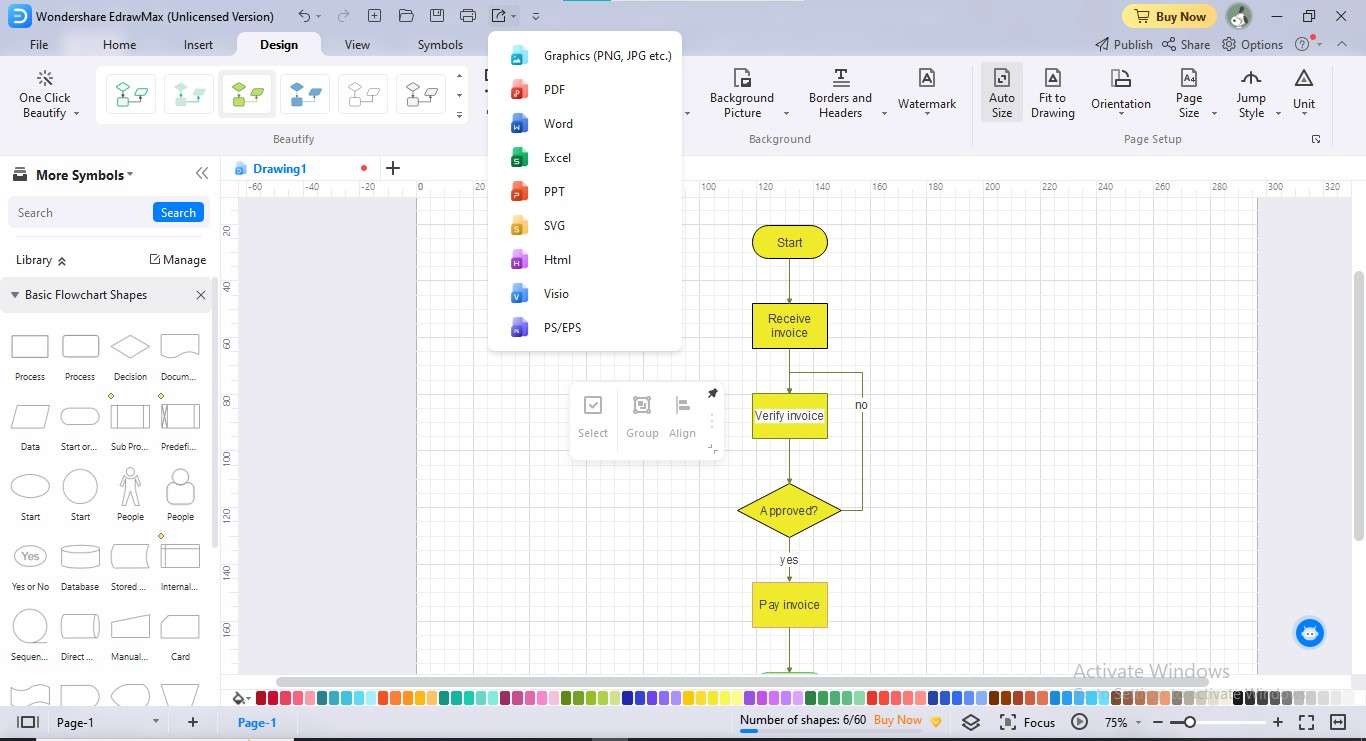

After completing your AP flowchart, save it. Click the "Export" icon above to export your flow diagram.

Part 4: Best Examples of Accounts Payable Flowchart Templates

Nothing speaks louder than a visual example. We have introduced these AP templates to tailor your payment workflows. Have a look at these AP process flowchart templates:

The above flowchart explains how an account payable process navigates among different departments. The purchasing department first requests the specific product. It prepares the purchase order for the purchased goods. This order reaches the supplier, who confirms it. The vendor sends the invoice to the Account Payable department. The AP department sends the payment request to the Accounting department. The accounting manager prepares the check and transfers it to the vendor.

The accounting payment process starts with a contract between the company and a vendor. The accounting department creates an application form detailing what's needed and the costs. After approval, a purchase order is created. The PO goes to the chief accountant for review. If everything is accurate, payment is made based on the purchase order. The payment is recorded in the general ledger for financial records.

In the company's AP process, three-way matching involves coordination between different departments. Accounts Payable tier verifies vendor invoices against purchase orders and supporting documents. The Computer Database stores all relevant data for easy reference. Once matched, the Cashier executes accurate payments. The General Ledger records the payment made. This process ensures timely and compliant payments

The above flowchart shows the AP process from the vendor's viewpoint. When a customer makes a buying, the vendor creates an invoice. The invoice is sent to the buyer for verification of goods. The vendor may apply a discount as a token of appreciation. If the buyer makes the payment, the vendor prints an AR report. If a payment becomes uncollectable, the vendor marks it as "uncollectable".

Conclusion

Accounts payable flowcharts offer a structured overview of the entire payment journey. They ensure timely payments while fostering fiscal clarity. Using these visual diagrams, companies can strengthen vendor relationships. Using account payable flowcharts is a transformative step towards having financial clarity.

We have presented a complete process to craft an AP process flow chart. Also, you can take help from the above-described account payable templates.

below.

below.  below.

below.