A Bank loan is a vital financial lifeline for persons and businesses seeking fiscal assistance. They offer a gateway to fulfilling life's major goals, such as buying a home or getting higher education. Also, acquiring a bank loan during an unexpected loss is a life-saving approach. They offer necessary monetary support when personal savings fall short.

To ensure a seamless loan application and approval process, banks use loan process flow charts.These loan flow charts serve as a guide, outlining each step. In this article, we will explore loan approval process flowcharts. We will also delve into the general steps on loan application flowchart creation.

In this article

Introduction of Bank Loan Process

A bank loan is a financial service banks offer to individuals and businesses. It involves providing a specific amount of money to the borrower. The client agrees to repay the loan amount along with interest over a set period. The interest charged on the loan serves as compensation for the bank's risk in lending money. It is also a sort of reward for providing the financial service.

Bank loans are useful for various purposes. For example, people take loans to buy a house, finance a car, or cover personal expenses. Both the bank and the borrower mutually agree on the terms and conditions before payment. They can include the interest rate, repayment schedule, and loan duration. Bank loans serve as a significant help in difficult times.

Loan Processing Flowcharts

In today's complex financial landscape, securing a bank loan has become a vital source to access funds. To perform this process, banks use bank loan process flowcharts. These flowcharts serve as visual roadmaps. They guide borrowers and bank staff about the intricacies of loan applications.

A loan application flowchart is a visual depiction of the step-by-step journey involved in obtaining a bank loan. It outlines the various stages and activities that both the borrower and the bank must undergo. Such flowcharts visualize each stage, from application to loan approval. The purpose of loan process flowcharts is to conform to a structured loan procedure. These visuals in EdrawMax make process understanding easier for all parties involved.

Importance of Bank Loan Process Flow Charts

The bank loan flowcharts have emerged as a powerful visual tool benefitting both borrowers and banks. Let's uncover the significance of bank loan process flowcharts:

- A flowchart of loan applications fosters communication between borrowers and the bank. Both parties can quickly grasp the status of the loan application.

- Most newbie borrowers are unaware of the loan process. These flowcharts help enhance their understanding. They break down complex steps into easy ones.

- Loan processing flowcharts allow banks to follow a consistent and organized approach. They reduce the chances of errors and delays in loan processing.

- A full-fledged loan flowchart defines the role of each involved bank member. Hence, everyone will know what he's responsible for.

- If a bank uses bank loan flowcharts, it can gain customers' trust. Thus, these flowcharts help develop positive customer relationships.

- Analyzing loan flowcharts can help banks identify areas for improvement. Hence, banks can make changes to boost efficiency.

- Loan application flowcharts are a useful training tool for bank employees. They can learn how to handle different scenarios and bottlenecks.

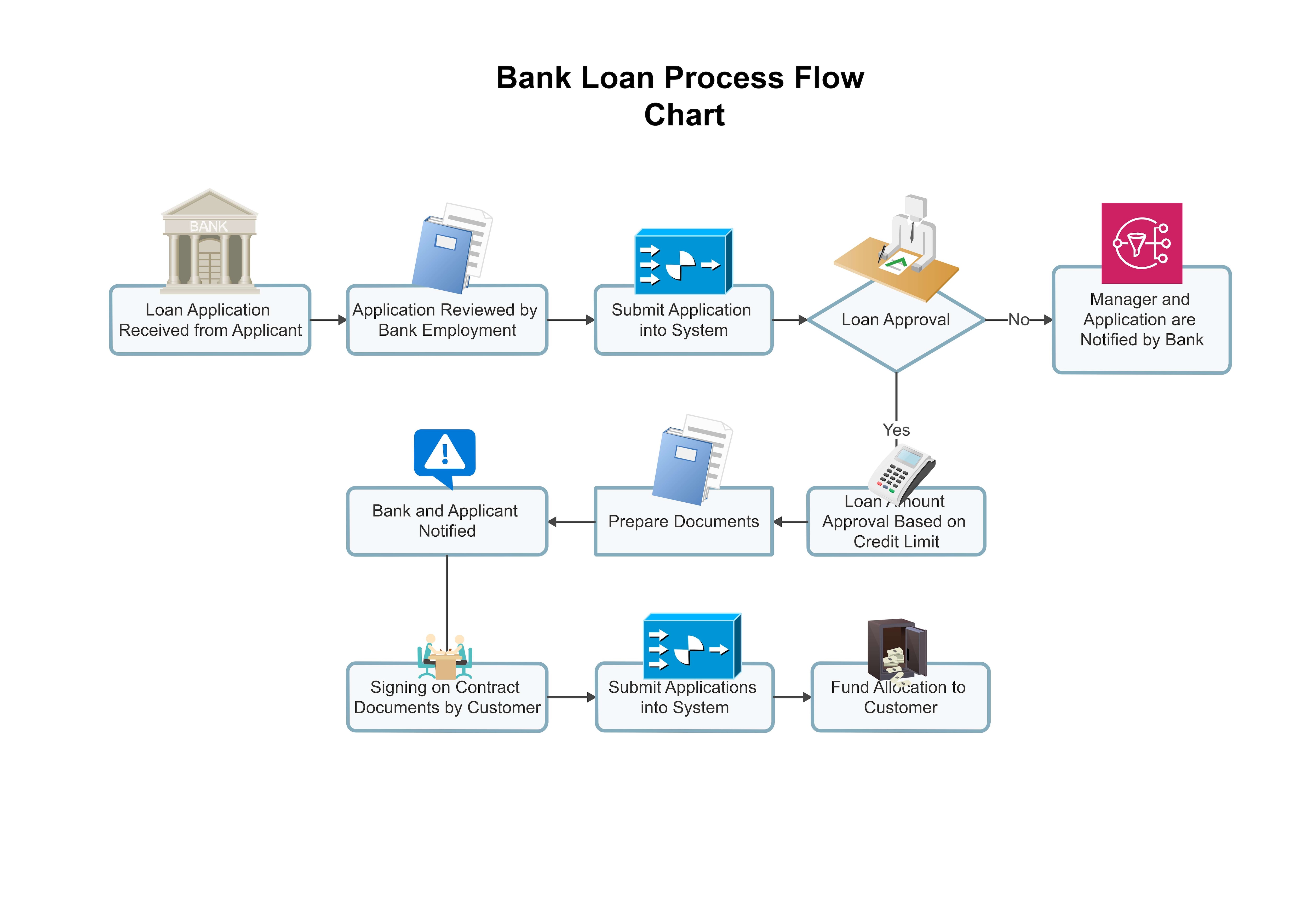

Analysis of The Loan Process Flow Chart Templates

Understand the concept of bank loan processing with these loan process flowchart templates:

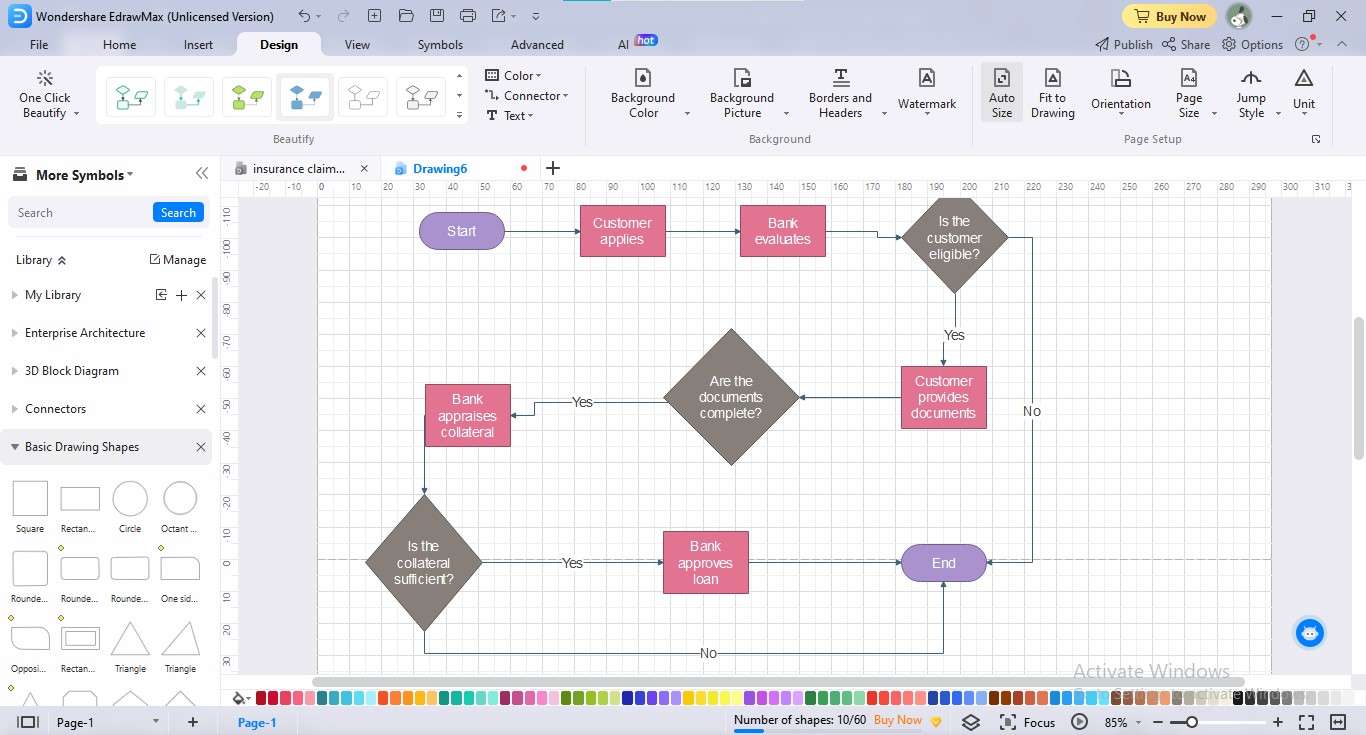

In the bank loan process, the customer first submits a loan request to the bank. The customer also provides the required documents to support his application. Following this, the bank conducts a loan interview. The bank analyzes the customer's financial situation.

If the loan is approved, the bank gives the client the necessary documents. These documents outline the terms and conditions of loan payments. Once the customer carefully reviews and signs the documents, the loan disbursement takes place. The bank provides funds to fulfill their financial needs.

While The eddx file need to be opened in EdrawMax.

If you don't have EdrawMax yet, you could download EdrawMax free from

below.

below. You also can try EdrawMax Online for free from

below.

below.Banks impose interest amounts on the borrowers for the loan disbursement. Interest is a critical component in the bank loan process. It plays a paramount role in determining the overall cost of borrowing for the client. Interest denotes the additional amount borrowers must pay the lender to use their funds. When borrowers take a bank loan, they agree to repay the original loan amount along with the interest.

The interest factor is expressed as an annual percentage rate (APR). It is based on various factors, including the type of loan, prevailing market rates, and client repayment. The interest rate can be fixed or variable.

What Are the Steps in the Bank Loan Application Process?

Understanding the steps involved in loan processing is essential for navigating its complexities. Each step plays a key role from the initial application to the final disbursement. We will shed light on major steps of the loan process that borrowers need to be aware of to secure financial help:

Research and Preparation

The first step is to research and identify the type of loan that best suits your needs. Knowing the specific needs is crucial, whether it's a personal or business loan. Once you have chosen the type of loan, gather all the needed documents.

Application Submission

The next step is submitting the loan application form to the bank of your choice. You can do this by visiting a branch in person. Some banks also allow applying online through their website.

Document Verification

The bank reviews the loan application. It then verifies the supporting documents to ensure all the details are accurate.

Credit Check

The bank conducts a credit check to assess your worthiness. It involves checking your credit history, credit score, and previous loan repayment patterns.

Assessment of Eligibility

Afterwards, the bank assesses your eligibility for the loan. It is based on factors like your income, job stability, and existing debts.

Loan Approval

If your loan application meets the bank's criteria, the bank will approve your loan application. The bank will make a loan offer. This offer will specify the loan amount and interest rate.

Loan Disbursement

Once you have accepted the loan offer, the bank will transfer the loan amount. Depending on the loan type, the funds will arrive. For example, the funds may come all at once or in installments.

Loan Repayment

After the loan payment, you must make regular repayments according to schedule. It may involve monthly or quarterly payments.

Closure and Final Settlement

Upon completing the loan repayment, the loan is considered closed. You will receive the closure form from the bank. Fill out the form and submit it to give your loan closure statement.

Innovation of Creating Loan Processing Flowcharts!

Imagine you are a loan officer at a bustling bank. Your desk is piled high with loan applications from eager individuals. You might not get enough time to review each application. However, you can ensure that your clients and staff understand the intricacies of bank loan applications. For this, we suggest using EdrawMax.

EdrawMax is a reliable flowchart maker for creating visually engaging flowcharts. The tool boasts a myriad of powerful features that make it a top-notch diagramming tool. Here are some of its feature highlights:

| Features | Description |

| Templates Community | The tool has an extensive template library that provides users with a wide range of ready-to-use templates. |

| Symbols Library | Its symbol library offers a vast collection of shapes, icons, and illustrations that can be easily added to diagrams. |

| Multimedia Import | You can add images, audio, and video files to your diagrams to make them more interactive. |

| Export Options | The platform supports exporting diagrams in various formats for easy access. |

| Color Palettes and Themes | You can beautify your flowcharts with its built-in color palettes, themes, and layouts. |

1. How To Design a Bank Loan Process Flowchart Using EdrawMax?

Step 1:

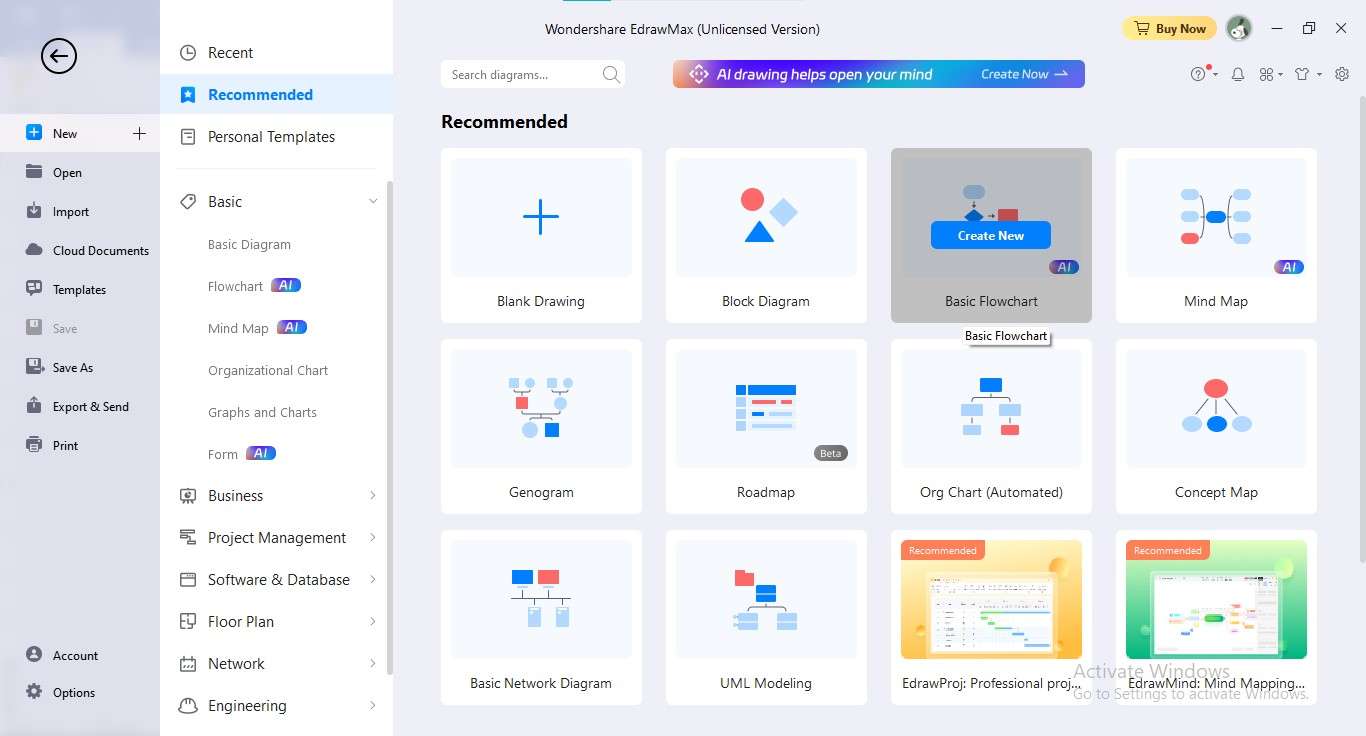

Install the EdrawMax application. Launch it on your device. Sign up to create your bank loan flowchart.

Step 2:

Choose the "New" option from the left panel. Hit the "Basic Flowchart"tab in the main window.

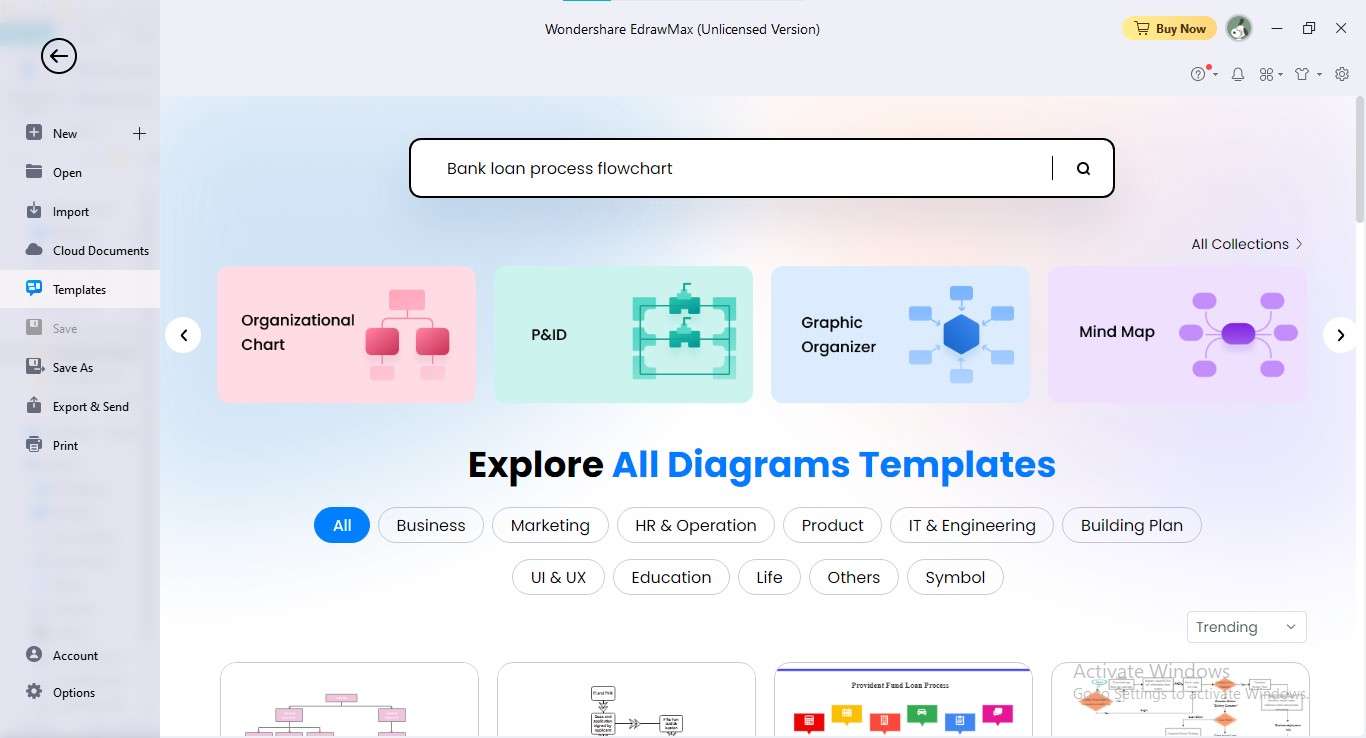

Step 3:

Choose the "Templates" option to start using a prebuilt template. Input "Bank Loan Process Flowchart"n the search bar. Pick your desired loan processing template and proceed.

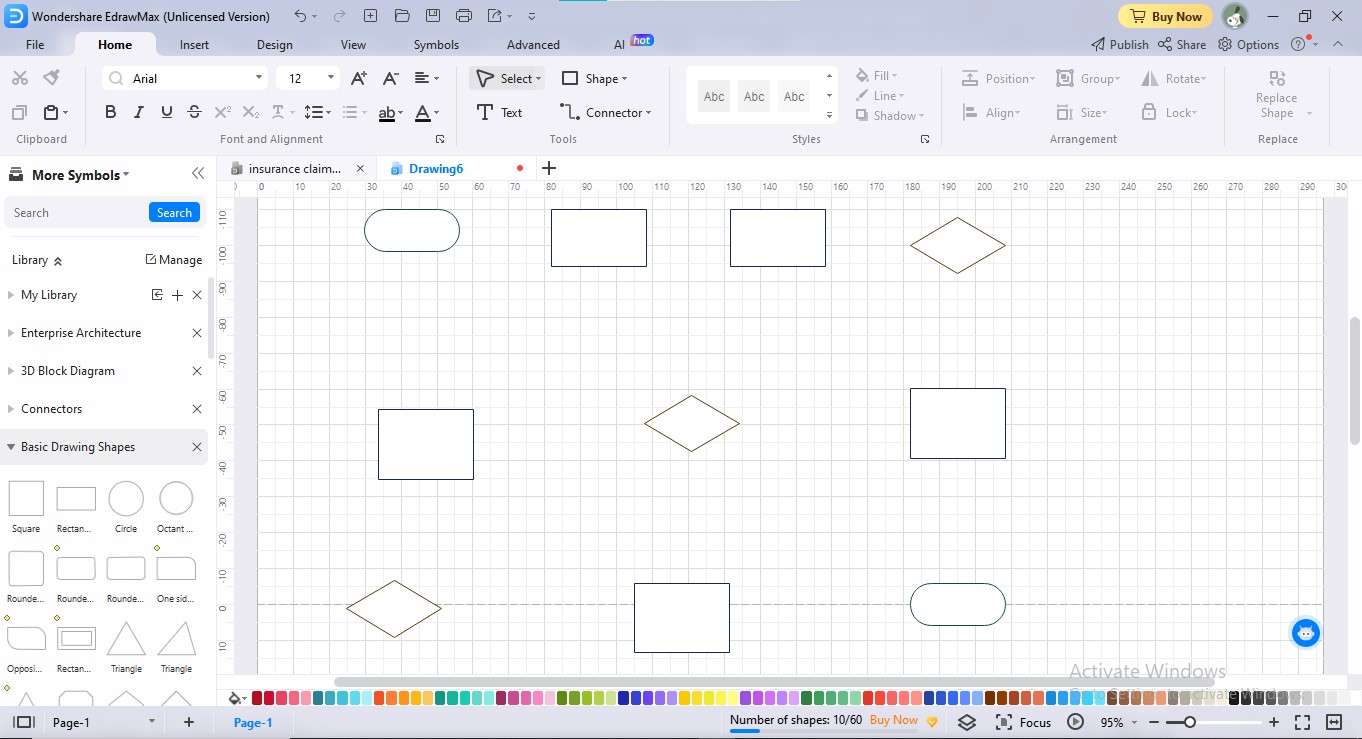

Step 4:

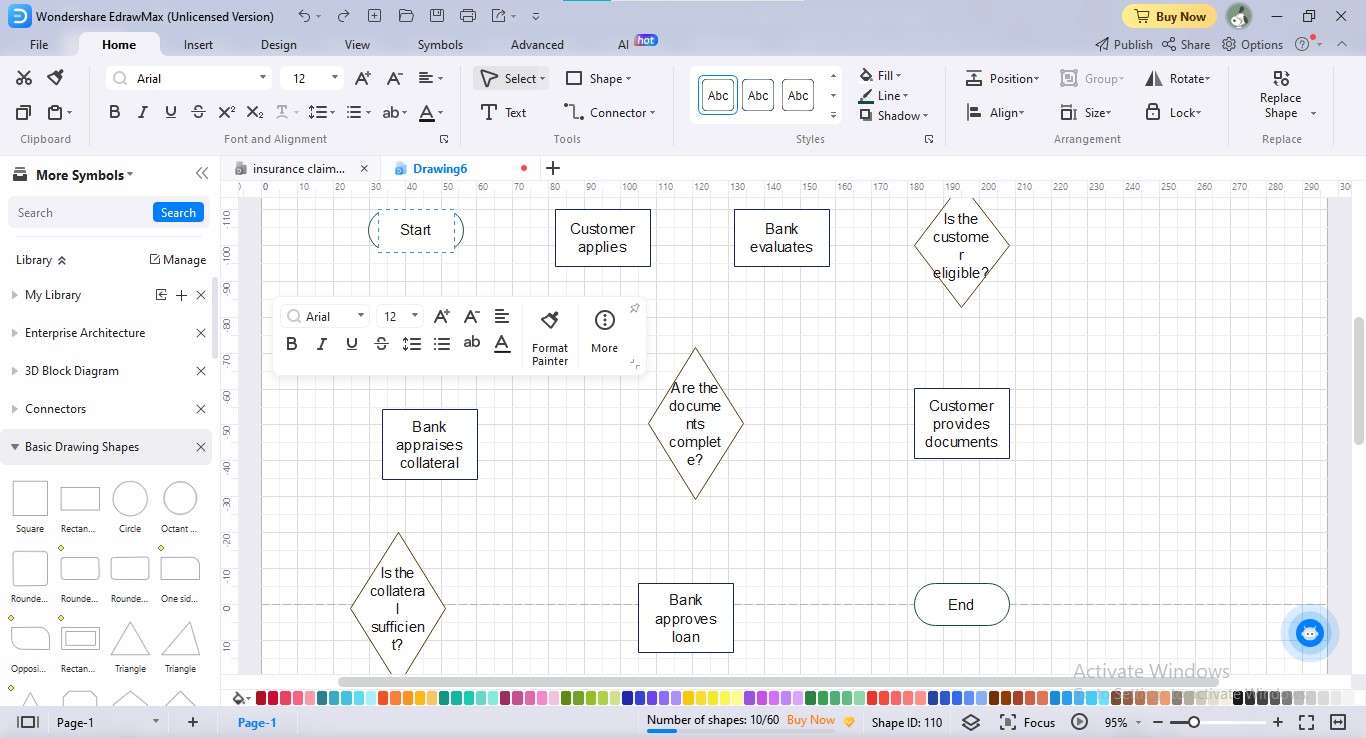

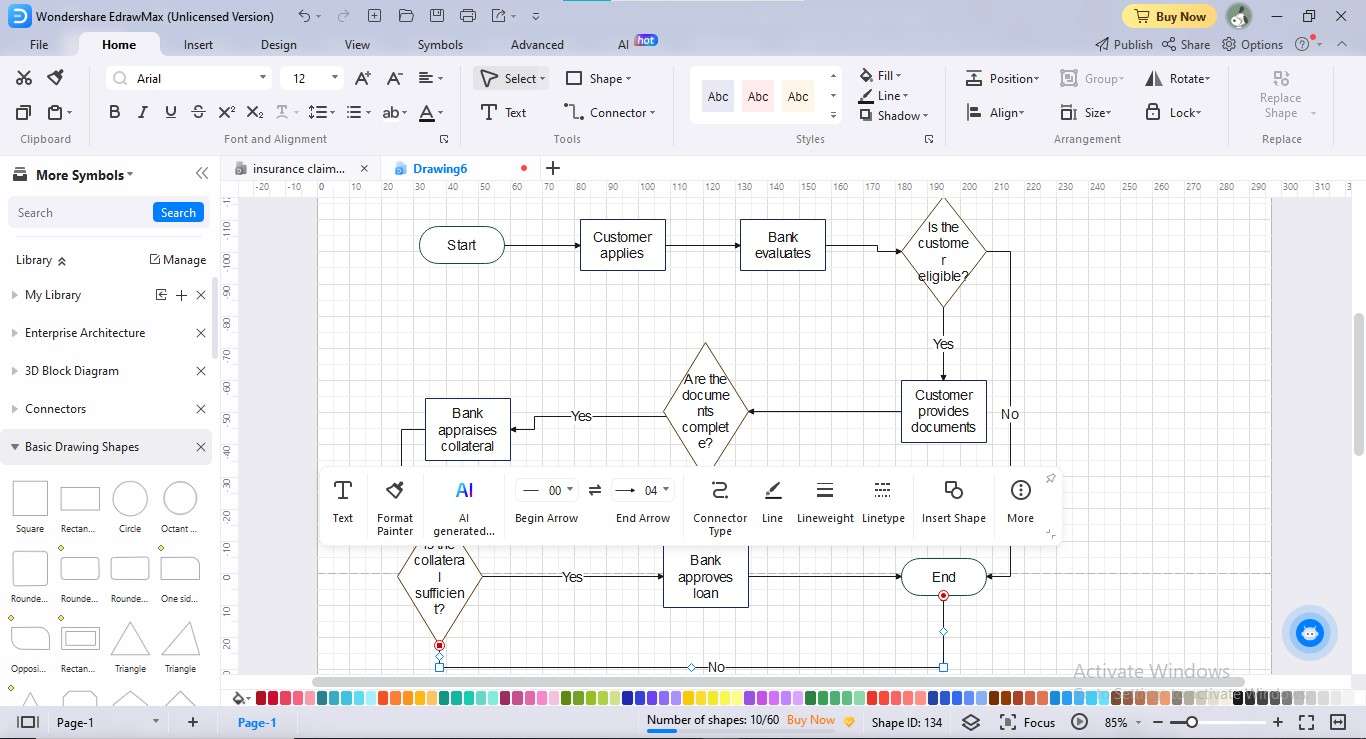

First, draw all the required shapes for your loan process flowchart. Drag and drop the symbols from the left panel.

Step 5:

Add textual information in each shape. To edit the text, click once and choose options from the quick toolbar.

Step 6:

Add connectors to the symbols in an accurate sequence. To draw connectors, click the "Connector" option under the "Home"menu.

Step 7:

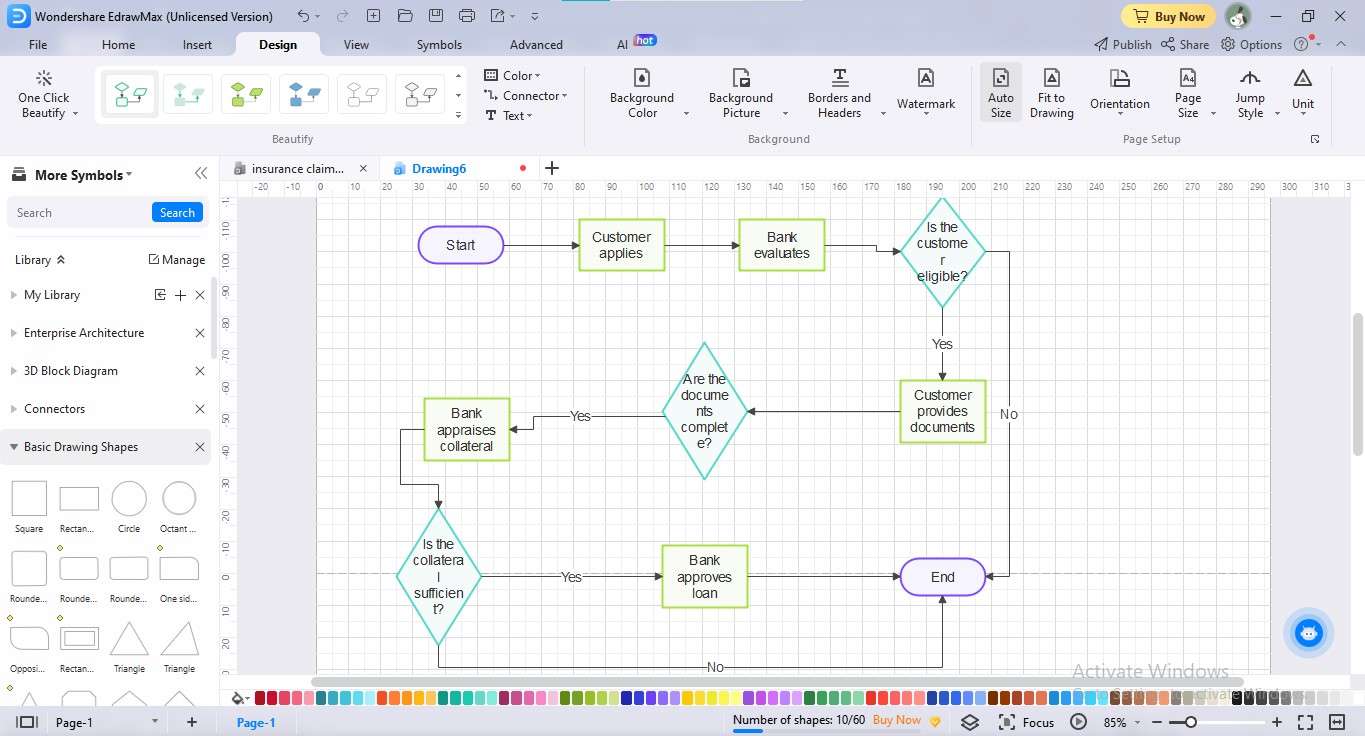

Tailor your flowchart using the desired color combo and layout. Go to the "Design" tab to do manual layout edits.

Step 8:

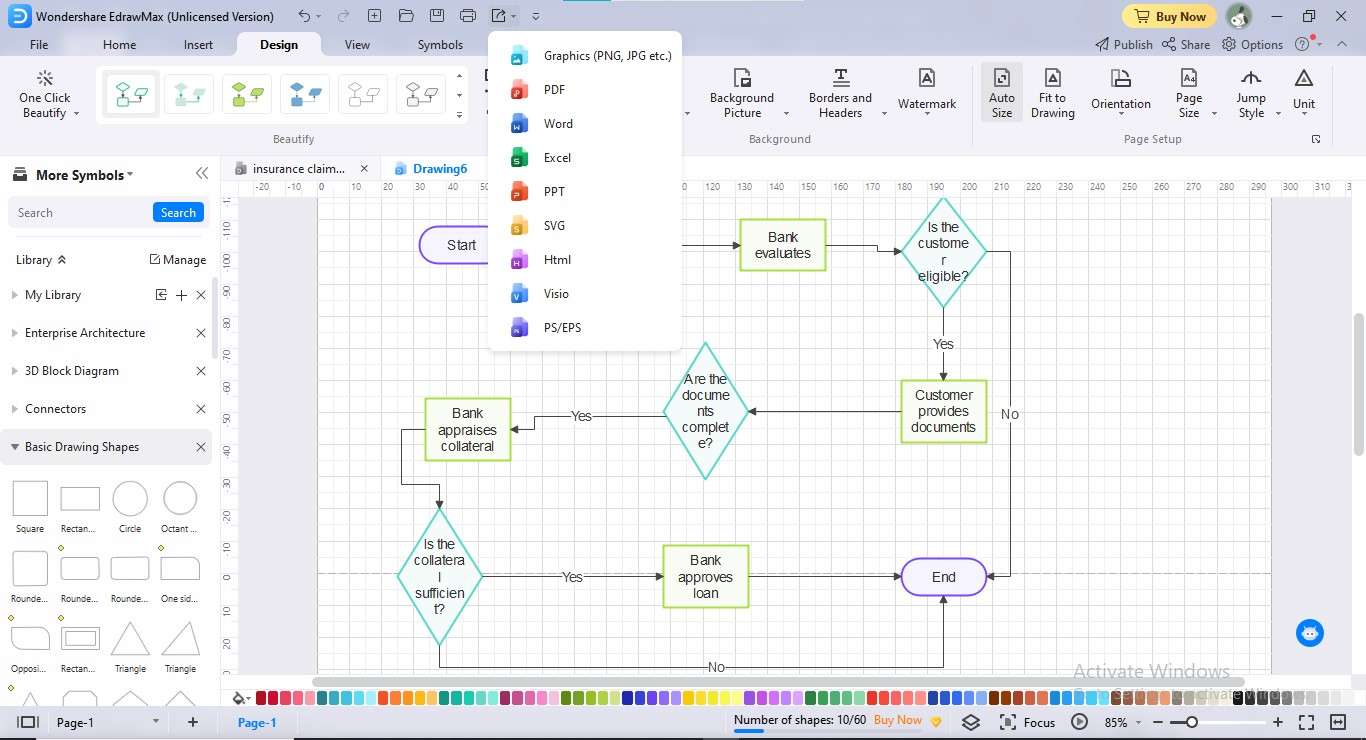

Export your insurance flowchart by clicking the "Export" icon. Pick your desired export option from the dropdown.

Conclusion

Bank loan plays a pivotal role in fulfilling diverse financial needs for borrowers. However, banks follow a standardized process to issue loans. To enhance the loan application experience, bank loan process flowcharts prove indispensable tools. They encourage communication between borrowers and financial institutions. Simultaneously, banks can ensure seamless procedures, risk reduction, and improved client service.

This guide presented details about loan processing flowcharts and their examples. You can create your tailored loan process flowchart using EdrawMax. Welcome the innovative and fast-paced experience of bank loan processing.